Calculation of Accumulated Swing Index (ASI):

ASI ke calculation mein kai mathematic formulas istematilz hote hain jo price bars, pichle highs aur lows aur volume se mutalliq hote hain. ASI calculate karne ke liye, current bar ki price range ko previous bar ki price range se compare kiya jata hai aur ye tay kiya jata hai ke current bar ki price pichle bar ki high ya low ke nazdeek hai. Iske alawa, ASI har bar ki volume ko bhi mad e nazar rakhta hai, zyada volume wale bars ko zyada weight diya jata hai. Ye calculation ASI ke liye ek value utpann karta hai, jo chart par plot ki ja sakti hai.

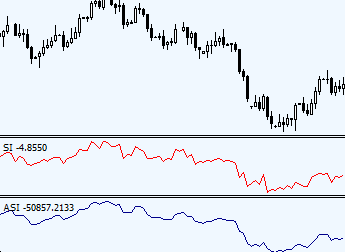

Interpretation of Accumulated Swing Index (ASI):

ASI ke tashreeh par tawajjo deti hai. ASI forex market mein potential trend reversals ko pehchanne ke liye istemal hota hai. Agar ASI barh raha hai to ye bullishness ka ishara hai, jabke agar ASI kam ho raha hai to ye bearishness ka ishara hai. Traders ASI aur price ke beech ka divergence dekh sakte hain trend reversals ko pehchanne ke liye. Misal ke taur par, agar price higher highs banaye jab ASI lower highs banaye, to ye ishara ho sakta hai ke current uptrend kamzor ho raha hai aur trend reversal qareeb hai.

Support and Resistance Levels using Accumulated Swing Index (ASI):

ASI ka istemal kar ke support aur resistance levels ko pehchanna par tawajjo deti hai. ASI market mein ahem levels ko pehchanne mein madad karta hai jahan ASI ke significant values par chart par horizontal lines plot ki jati hain. Jab price in levels ke qareeb ata hai, to ye ek rukawat ki tarah kaam karta hai, jahan price ya to is level se bounce kar ke wapas chala jata hai ya phir is level ko toor kar aage badhta hai. Traders in support aur resistance levels ka istemal kar ke apne trades ke entry aur exit points ka tayyun kar sakte hain.

Divergence Trading with Accumulated Swing Index (ASI):

ASI ka istemal kar ke divergences ke liye tawajjo deti hai. Divergences tab hoti hain jab price ek direction mein move kar raha hota hai aur ASI opposite direction mein move kar raha hota hai. Ye ek potential trend reversal ka ishara hosakta hai, kyun ke is se lagta hai ke momentum badal raha hai. Traders bullish divergences ke liye dekh sakte hain, jahan price lower lows banaye aur ASI higher lows banaye, ya phir bearish divergences ke liye dekh sakte hain, jahan price higher highs banaye aur ASI lower highs banaye. Ye divergences trading signal ke taur par istemal kiye ja sakte hain trades mein dakhil honay aur nikalnay ke liye.

Combining Accumulated Swing Index (ASI) with Other Indicators:

ASI ko dusre technical indicators ke saath mila kar trading signals ko behtar banane par tawajjo deti hai. ASI ko moving averages, trend lines ya oscillators jaisay indicators ke saath istemal kiya ja sakta hai taake trading decisions ko tasdeeq kar sake. Misal ke taur par, agar ASI bullish trend reversal ki taraf ishara de raha hai, to traders dusre indicators jaise moving averages ke bullish crossover ya trend line se breakout ki tasdeeq talash kar sakte hain. Kai indicators ko jorr kar traders trades ki kamiyabi ke imkanaat ko barha sakte hain aur jhootay signals ka khatra kam kar sakte hain.

ASI ke calculation mein kai mathematic formulas istematilz hote hain jo price bars, pichle highs aur lows aur volume se mutalliq hote hain. ASI calculate karne ke liye, current bar ki price range ko previous bar ki price range se compare kiya jata hai aur ye tay kiya jata hai ke current bar ki price pichle bar ki high ya low ke nazdeek hai. Iske alawa, ASI har bar ki volume ko bhi mad e nazar rakhta hai, zyada volume wale bars ko zyada weight diya jata hai. Ye calculation ASI ke liye ek value utpann karta hai, jo chart par plot ki ja sakti hai.

Interpretation of Accumulated Swing Index (ASI):

ASI ke tashreeh par tawajjo deti hai. ASI forex market mein potential trend reversals ko pehchanne ke liye istemal hota hai. Agar ASI barh raha hai to ye bullishness ka ishara hai, jabke agar ASI kam ho raha hai to ye bearishness ka ishara hai. Traders ASI aur price ke beech ka divergence dekh sakte hain trend reversals ko pehchanne ke liye. Misal ke taur par, agar price higher highs banaye jab ASI lower highs banaye, to ye ishara ho sakta hai ke current uptrend kamzor ho raha hai aur trend reversal qareeb hai.

Support and Resistance Levels using Accumulated Swing Index (ASI):

ASI ka istemal kar ke support aur resistance levels ko pehchanna par tawajjo deti hai. ASI market mein ahem levels ko pehchanne mein madad karta hai jahan ASI ke significant values par chart par horizontal lines plot ki jati hain. Jab price in levels ke qareeb ata hai, to ye ek rukawat ki tarah kaam karta hai, jahan price ya to is level se bounce kar ke wapas chala jata hai ya phir is level ko toor kar aage badhta hai. Traders in support aur resistance levels ka istemal kar ke apne trades ke entry aur exit points ka tayyun kar sakte hain.

Divergence Trading with Accumulated Swing Index (ASI):

ASI ka istemal kar ke divergences ke liye tawajjo deti hai. Divergences tab hoti hain jab price ek direction mein move kar raha hota hai aur ASI opposite direction mein move kar raha hota hai. Ye ek potential trend reversal ka ishara hosakta hai, kyun ke is se lagta hai ke momentum badal raha hai. Traders bullish divergences ke liye dekh sakte hain, jahan price lower lows banaye aur ASI higher lows banaye, ya phir bearish divergences ke liye dekh sakte hain, jahan price higher highs banaye aur ASI lower highs banaye. Ye divergences trading signal ke taur par istemal kiye ja sakte hain trades mein dakhil honay aur nikalnay ke liye.

Combining Accumulated Swing Index (ASI) with Other Indicators:

ASI ko dusre technical indicators ke saath mila kar trading signals ko behtar banane par tawajjo deti hai. ASI ko moving averages, trend lines ya oscillators jaisay indicators ke saath istemal kiya ja sakta hai taake trading decisions ko tasdeeq kar sake. Misal ke taur par, agar ASI bullish trend reversal ki taraf ishara de raha hai, to traders dusre indicators jaise moving averages ke bullish crossover ya trend line se breakout ki tasdeeq talash kar sakte hain. Kai indicators ko jorr kar traders trades ki kamiyabi ke imkanaat ko barha sakte hain aur jhootay signals ka khatra kam kar sakte hain.

تبصرہ

Расширенный режим Обычный режим