Introduction to the Triple Top Chart Pattern:

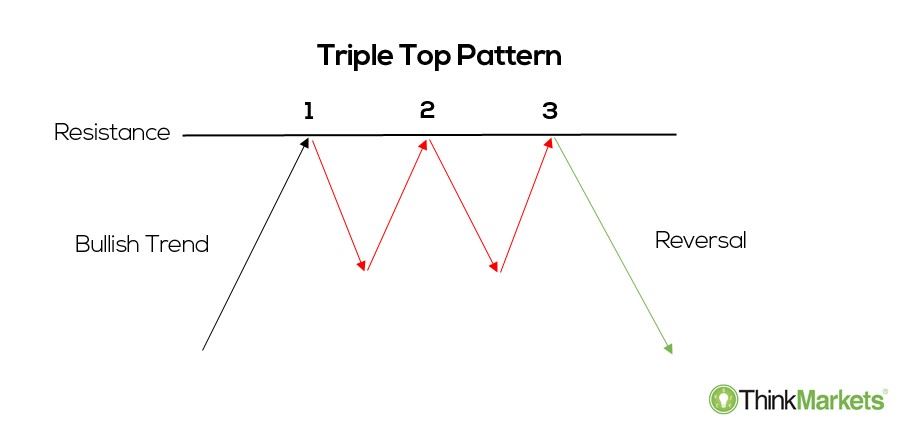

Triple Top Chart Pattern forex markets mein aik aham technical analysis pattern hai. Is pattern mein aam taur par teen mukhtalif chote chote peaks hote hain jo kareebi same price level per ban jate hain, aur is mein do valleys hote hain. Ye pattern aksar reversal pattern ki tarah samjha jata hai jisay uptrend ka aakhir ho jana aur downtrend ki taraf mukammal badalne ki nishani samjha jata hai. Iska matlab hai ke market ne aik ahem resistance level tak pohanch gaya hai aur isko paar karne mein mushkil ho rahi hai. Teen mukhtalif peaks darshate hain ke buyers ne price ko upar oonchay karne mein nakam hokar aur sellers ke samne haari hokar. Traders jo is pattern ko pehchantay hain, amm taur par confirmation signals ki talaash karte hain, jaise support level se neechay break hone ka, phir bearish position lenay se pehlay.

Identifying the Triple Top Chart Pattern:

Triple Top Chart Pattern ko pehchantay waqt, traders teen mukhtalif peaks ko dekh kar same price level per banne wale hote hain. Ye peaks do valleys se tafreeq se banne chahiay, jahan beech ki valley baki do se kam honi chahiay. Pattern is liye tasdeeq ho jata hai jab price do valleys create karke support level se neechay break kar jata hai. Lihaza mahatwah hai ke teen peaks bilkul same price level per na hon, kyunke kuch farq ho sakta hai. Traders aksar trendlines ka istemal karte hain ta ke peaks aur valleys ko jor kar pattern ko zyada wazeh kar saken.

Understanding the Psychology Behind the Triple Top Chart Pattern:

Triple Top Chart Pattern khareedne wale aur bechne wale ke darmiyan market mein jang ka natija hai. Pehli peak taaqatwar bull move ko darshata hai, jahan buyers price ko upar oonchay karne mein jut jate hain. Lekin jab price resistance level ke qareeb pohnchti hai, toh bechne wale aage aate hain aur upar ki taraf mazeed movement roktay hain, jiski wajah se pehli valley ban jati hai. Dusri peak tab ban jati hai jab buyers resistance level ko paar karne ka dobara koshish karte hain, lekin phir bechne wale unki koshish ko roktay hain aur dusri valley banate hain. Teesri peak aksar buyers ki dhaakaa kamzori ki nishani samjhi jati hai, kyunke wo resistance level ko paar karne mein kashmakash karte hain. Aakhir mein, jab price valleys dwaara banaye gaye support level se neechay break karta hai, toh ye trend ka ulta hone aur potential downtrend ki taraf ishara karta hai.

Trade Setup and Entry Point:

Jab trader Triple Top Chart Pattern ko pehchantay hain, toh iska istemal unki entry points aur trade setup tayyar karne ke liye kar sakte hain. Traders aksar price ko support level se neechay break karte hi raunak ki taraf mukammal badalne aur trend ka aksar hone ki tasdeeq ke liye intezaar karte hain. Is break ko bearish position lenay ka trigger samjha jata hai, kyunke iska matlab hota hai ke bechne wale market mein qabza kar chuke hain aur downtrend jari rakhne ki sambhavna hai. Kuch traders is break ke baad hi trade mein shamil hona chunte hain, jabke dusre traders broken support level ki tasdeeq karne ke liye istemal kar sakte hain aur phir short position mein dakhil hone se pehle.

Target and Exit Strategies:

Triple Top Chart Pattern ko trade karne par, traders aksar apne targets ko resistance level aur support level ke beech ki doori par trakhte hain. Woh resistance level se support level tak ka diyaan rakhte hain aur support level ko todne ke baad is doori ko neeche tak project karte hain. Isse unhe apne trade ke liye ek anumati prapt hoti hai. Haan lekin, jab target tay karte samay dusre takneeki factors ko bhi dhyan dene ka zaroori hai, jaise pas ke support levels ka maujood hona ya market ke overall conditions. Traders apne target level par trade se bahar nikal sakte hain yaad ki agar daam aur kam hota hai to unhon ne huch upar liverage lena chahiye aur stop-loss order chalane ke liye profit lock kortane chahiye agar daam or kam kartaa rahe.

Triple Top Chart Pattern forex markets mein aik aham technical analysis pattern hai. Is pattern mein aam taur par teen mukhtalif chote chote peaks hote hain jo kareebi same price level per ban jate hain, aur is mein do valleys hote hain. Ye pattern aksar reversal pattern ki tarah samjha jata hai jisay uptrend ka aakhir ho jana aur downtrend ki taraf mukammal badalne ki nishani samjha jata hai. Iska matlab hai ke market ne aik ahem resistance level tak pohanch gaya hai aur isko paar karne mein mushkil ho rahi hai. Teen mukhtalif peaks darshate hain ke buyers ne price ko upar oonchay karne mein nakam hokar aur sellers ke samne haari hokar. Traders jo is pattern ko pehchantay hain, amm taur par confirmation signals ki talaash karte hain, jaise support level se neechay break hone ka, phir bearish position lenay se pehlay.

Identifying the Triple Top Chart Pattern:

Triple Top Chart Pattern ko pehchantay waqt, traders teen mukhtalif peaks ko dekh kar same price level per banne wale hote hain. Ye peaks do valleys se tafreeq se banne chahiay, jahan beech ki valley baki do se kam honi chahiay. Pattern is liye tasdeeq ho jata hai jab price do valleys create karke support level se neechay break kar jata hai. Lihaza mahatwah hai ke teen peaks bilkul same price level per na hon, kyunke kuch farq ho sakta hai. Traders aksar trendlines ka istemal karte hain ta ke peaks aur valleys ko jor kar pattern ko zyada wazeh kar saken.

Understanding the Psychology Behind the Triple Top Chart Pattern:

Triple Top Chart Pattern khareedne wale aur bechne wale ke darmiyan market mein jang ka natija hai. Pehli peak taaqatwar bull move ko darshata hai, jahan buyers price ko upar oonchay karne mein jut jate hain. Lekin jab price resistance level ke qareeb pohnchti hai, toh bechne wale aage aate hain aur upar ki taraf mazeed movement roktay hain, jiski wajah se pehli valley ban jati hai. Dusri peak tab ban jati hai jab buyers resistance level ko paar karne ka dobara koshish karte hain, lekin phir bechne wale unki koshish ko roktay hain aur dusri valley banate hain. Teesri peak aksar buyers ki dhaakaa kamzori ki nishani samjhi jati hai, kyunke wo resistance level ko paar karne mein kashmakash karte hain. Aakhir mein, jab price valleys dwaara banaye gaye support level se neechay break karta hai, toh ye trend ka ulta hone aur potential downtrend ki taraf ishara karta hai.

Trade Setup and Entry Point:

Jab trader Triple Top Chart Pattern ko pehchantay hain, toh iska istemal unki entry points aur trade setup tayyar karne ke liye kar sakte hain. Traders aksar price ko support level se neechay break karte hi raunak ki taraf mukammal badalne aur trend ka aksar hone ki tasdeeq ke liye intezaar karte hain. Is break ko bearish position lenay ka trigger samjha jata hai, kyunke iska matlab hota hai ke bechne wale market mein qabza kar chuke hain aur downtrend jari rakhne ki sambhavna hai. Kuch traders is break ke baad hi trade mein shamil hona chunte hain, jabke dusre traders broken support level ki tasdeeq karne ke liye istemal kar sakte hain aur phir short position mein dakhil hone se pehle.

Target and Exit Strategies:

Triple Top Chart Pattern ko trade karne par, traders aksar apne targets ko resistance level aur support level ke beech ki doori par trakhte hain. Woh resistance level se support level tak ka diyaan rakhte hain aur support level ko todne ke baad is doori ko neeche tak project karte hain. Isse unhe apne trade ke liye ek anumati prapt hoti hai. Haan lekin, jab target tay karte samay dusre takneeki factors ko bhi dhyan dene ka zaroori hai, jaise pas ke support levels ka maujood hona ya market ke overall conditions. Traders apne target level par trade se bahar nikal sakte hain yaad ki agar daam aur kam hota hai to unhon ne huch upar liverage lena chahiye aur stop-loss order chalane ke liye profit lock kortane chahiye agar daam or kam kartaa rahe.

تبصرہ

Расширенный режим Обычный режим