Definition of Bearish Belt Hold Pattern:

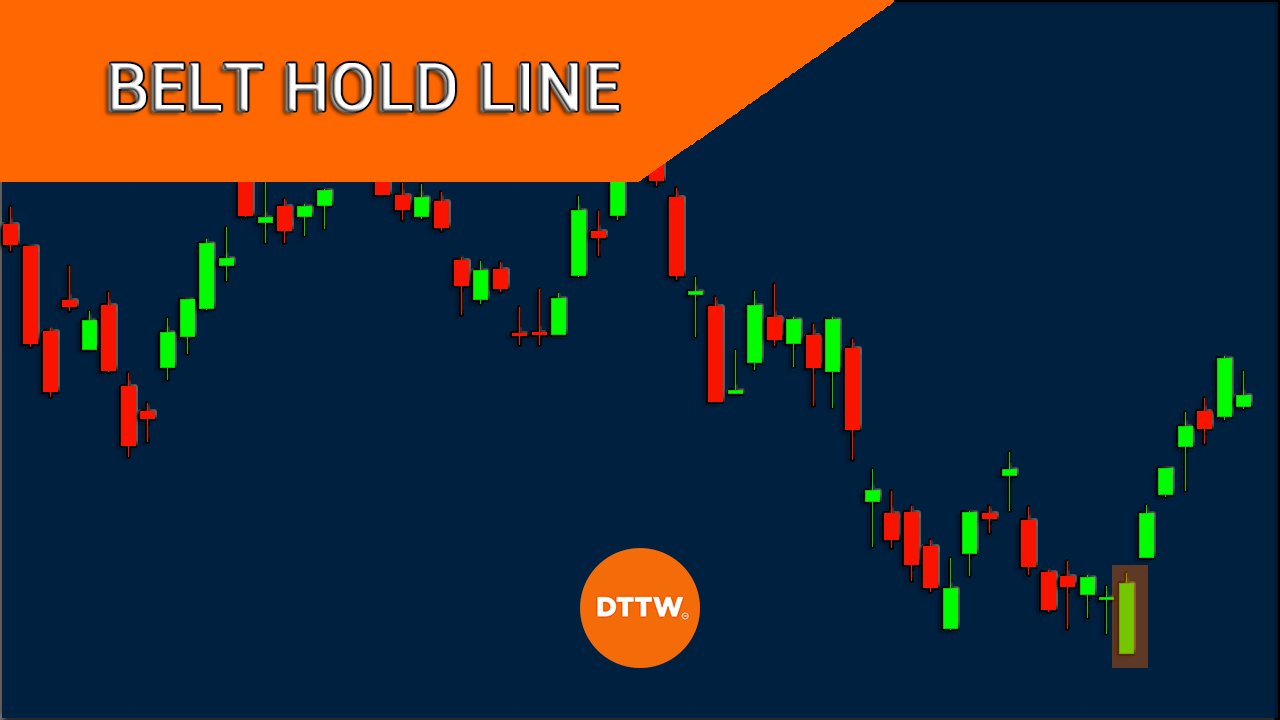

Bearish Belt Hold Pattern forex trading mein dekha jane wala ek ahem technical analysis candlestick formation hai. Ye pattern tab hota hai jab ek lambi bearish candlestick parwa ho aur pehle bullish candlestick ko ghira le, jo ki higher price par open hota hai aur trading range ki low ke qareeb close hota hai. Iski taraf se market sentiment mein ek taiz badalav dikhayi deta hai, bullish se bearish ki taraf, jo price mein neeche ki taraf momentum ki sambhavna darshata hai.

Characteristics of Bearish Belt Hold Pattern:

Bearish Belt Hold Pattern ki khasiyat hai ki isme ek lambi bearish candlestick hoti hai jiske upar ka shadow chhota ya bilkul na hota hai aur neeche ka shadow bhi kam ya bilkul na hota hai. Bearish candlestick ka opening price pehle bullish candlestick ke closing price se upar hota hai, jisse dono ke beech mein ek gap banta hai. Bearish candlestick phir trading session ke dauran girte rahte hain aur apni low ke qareeb close hote hain, jisse significant selling pressure ka pradarshan hota hai.

Interpretation of Bearish Belt Hold Pattern:

Bearish Belt Hold Pattern ko ek taqatwar bearish reversal signal mana jata hai, jisse bullish se bearish ki taraf ek trend reversal ki sambhavna darshayi jati hai. Iska matlab hai ki bearish traders ne market control le liya hai aur price ko neeche le ja rahe hain. Traders is pattern ko sell karne ya long positions se bahar nikalne ka indication samajhte hain, kyunki yeh ek possible downtrend aur profit-taking opportunities ki sambhavna darshata hai.

Confirmation and Validation of Bearish Belt Hold Pattern:

Bearish Belt Hold Pattern ko tasdeek karne ke liye, traders additional technical indicators ya chart patterns ka istemal karte hain. Isme volume, trend lines, moving averages, ya dusre candlestick patterns ka analysis shaamil ho sakta hai. Tasdeek ki madad se Bearish Belt Hold Pattern ki reliability badh sakti hai aur traders ko strong signal provide kar sakti hai.

Limitations and Considerations of Bearish Belt Hold Pattern:

Jabki Bearish Belt Hold Pattern ek taqatwar reversal signal hai, lekin traders ko trading decision lene se pehle dusre factors jaise ki market context aur overall trend ko bhi dhyan mein rakhna zaroori hai. Ek single candlestick pattern ek trade mein dakhil hone ya nikalne ka mukammal adhaar nahi hona chahiye. Additionally, false signals bhi ho sakte hain, isliye dusre technical indicators ki tasdeek ka intezaar karna mahatvapurna hai. Traders ko sahi risk management techniques ka istemal karna chahiye aur sahi stop-loss levels set karna chahiye, taaki potential losses se bacha ja sake.

Bearish Belt Hold Pattern forex trading mein dekha jane wala ek ahem technical analysis candlestick formation hai. Ye pattern tab hota hai jab ek lambi bearish candlestick parwa ho aur pehle bullish candlestick ko ghira le, jo ki higher price par open hota hai aur trading range ki low ke qareeb close hota hai. Iski taraf se market sentiment mein ek taiz badalav dikhayi deta hai, bullish se bearish ki taraf, jo price mein neeche ki taraf momentum ki sambhavna darshata hai.

Characteristics of Bearish Belt Hold Pattern:

Bearish Belt Hold Pattern ki khasiyat hai ki isme ek lambi bearish candlestick hoti hai jiske upar ka shadow chhota ya bilkul na hota hai aur neeche ka shadow bhi kam ya bilkul na hota hai. Bearish candlestick ka opening price pehle bullish candlestick ke closing price se upar hota hai, jisse dono ke beech mein ek gap banta hai. Bearish candlestick phir trading session ke dauran girte rahte hain aur apni low ke qareeb close hote hain, jisse significant selling pressure ka pradarshan hota hai.

Interpretation of Bearish Belt Hold Pattern:

Bearish Belt Hold Pattern ko ek taqatwar bearish reversal signal mana jata hai, jisse bullish se bearish ki taraf ek trend reversal ki sambhavna darshayi jati hai. Iska matlab hai ki bearish traders ne market control le liya hai aur price ko neeche le ja rahe hain. Traders is pattern ko sell karne ya long positions se bahar nikalne ka indication samajhte hain, kyunki yeh ek possible downtrend aur profit-taking opportunities ki sambhavna darshata hai.

Confirmation and Validation of Bearish Belt Hold Pattern:

Bearish Belt Hold Pattern ko tasdeek karne ke liye, traders additional technical indicators ya chart patterns ka istemal karte hain. Isme volume, trend lines, moving averages, ya dusre candlestick patterns ka analysis shaamil ho sakta hai. Tasdeek ki madad se Bearish Belt Hold Pattern ki reliability badh sakti hai aur traders ko strong signal provide kar sakti hai.

Limitations and Considerations of Bearish Belt Hold Pattern:

Jabki Bearish Belt Hold Pattern ek taqatwar reversal signal hai, lekin traders ko trading decision lene se pehle dusre factors jaise ki market context aur overall trend ko bhi dhyan mein rakhna zaroori hai. Ek single candlestick pattern ek trade mein dakhil hone ya nikalne ka mukammal adhaar nahi hona chahiye. Additionally, false signals bhi ho sakte hain, isliye dusre technical indicators ki tasdeek ka intezaar karna mahatvapurna hai. Traders ko sahi risk management techniques ka istemal karna chahiye aur sahi stop-loss levels set karna chahiye, taaki potential losses se bacha ja sake.

تبصرہ

Расширенный режим Обычный режим