Introduction to the Hook Reversal Pattern:

Hook Reversal Pattern forex trading mein ek technical chart pattern hai jo current trend mein mukhtalifat ka aasar dikhata hai. Iski pehchaan ekAssistant: Hook Reversal Pattern forex trading mein ek technical chart pattern hai jo current trend mein mukhtalifat ka aasar dikhata hai. Isko "hook" ki shakal mein phechana jata hai, jo baqi trend mein temporary pullback ya rukawat ka ishara hai. Ye pattern aam tor par taizi se bdhne ya ghatne ke baad dikhta hai aur market ki sentiment mein tabdeeli ka ishara deta hai. Traders is pattern ko istemal karke khareedne ya bechne ke potenital mauqe pehchan sakte hain.

Identification and Characteristics of a Hook Reversal Pattern:

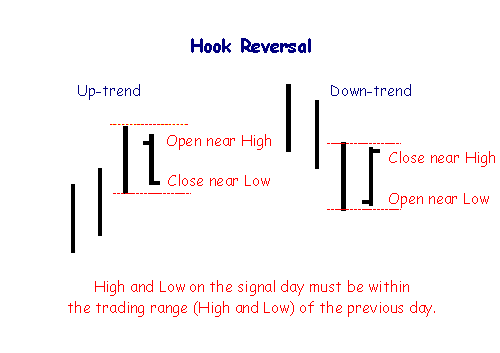

Hook Reversal Pattern ki pehchan karne ke liye traders price chart pe khasosiyat dekhte hain. Pehle toh, pattern mein ek clear aur defined hook shape hona chahiye, jo tez pullback ke baad chhote bounce ya consolidation se banta hai. Dusra, ye pattern ek significant price move ke baad dikhe, jo current trend mein thakan ka ishara karta hai. Tesra, ye pattern dusre technical indicators jaise moving averages ya support aur resistance levels ke saath milta hona chahiye. In khasosiyaton ko analyze karke traders sahi Hook Reversal Pattern ki maujoodgi ko confirm kar sakte hain.

Types of Hook Reversal Patterns:

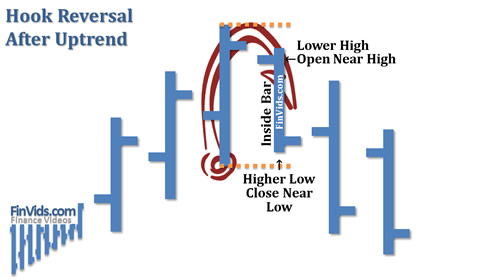

Hook Reversal Pattern ke do mukhya types hote hain: bullish aur bearish. Bullish hook reversal pattern ek downtrend ke baad dikhta hai aur ek potential reversal ko uptrend ki taraf ishara karta hai. Ismein neeche ki taraf movement hoti hai, jise chhote bounce ya consolidation follow karta hai aur phir upar ki taraf breakout hota hai. Dusri taraf, bearish hook reversal pattern ek uptrend ke baad dikhta hai aur ek potential reversal ko downtrend ki taraf ishara karta hai. Ismein upar ki taraf movement hoti hai, jise chhote pullback ya consolidation follow karta hai aur phir niche ki taraf breakout hota hai. Traders ko dono patterns se parichit hona chahiye takay woh potential trading opportunities ko pehchan sakein.

Confirmation and Entry Points:

Ek safal trade ki sambhavna ko bdhane ke liye, traders Hook Reversal Pattern pe based trade mein daakhil hone se pehle tasdeek ke signals dekhna pasand karte hain. Ye tasdeek ke signals technical indicators, candlestick patterns ya trendline breaks mein se ho sakte hain. Maslan, traders bullish Hook Reversal Pattern ke baad ek bullish tasdeek ki candlestick pattern jaise bullish engulfing ya hammer ka intezar kar sakte hain. Ye reversal ko tasdeek karta hai aur lambi trade mein taqatwar ishara deta hai. Usi tarah, bearish Hook Reversal Pattern ke case mein, traders bearish tasdeek ki candlestick pattern jaise bearish engulfing ya shooting star ka intezar kar sakte hain, phir short trade mein daakhil ho sakte hain. Tasdeek ka intezar karke, traders ghair haqiqi signals ki ehtiyat kar sakte hain aur apni trading performance ko behtar kar sakte hain.

Stop Loss and Take Profit Levels:

Hook Reversal Patterns pe trade karte waqt sahi risk management bahut zaroori hai. Traders ko hamesha stop loss levels set karna chahiye takay wo apni nuqsanat ko had se zyada na hone dein agar trade unke khilaf chal jati hai. Stop loss levels bullish hook reversal pattern ke breakout candle ki low ke neeche rakhe ja sakte hain aur bearish hook reversal pattern ke breakout candle ki high ke upar rakhe ja sakte hain. Take profit levels mein traders agle major support ya resistance level ko target kar sakte hain ya trailing stop orders istemal karke trade ke taraqqi pe munafa hasil kar sakte hain. Market conditions aur specific currency pair ke hisab se stop loss aur take profit levels.

Hook Reversal Pattern forex trading mein ek technical chart pattern hai jo current trend mein mukhtalifat ka aasar dikhata hai. Iski pehchaan ekAssistant: Hook Reversal Pattern forex trading mein ek technical chart pattern hai jo current trend mein mukhtalifat ka aasar dikhata hai. Isko "hook" ki shakal mein phechana jata hai, jo baqi trend mein temporary pullback ya rukawat ka ishara hai. Ye pattern aam tor par taizi se bdhne ya ghatne ke baad dikhta hai aur market ki sentiment mein tabdeeli ka ishara deta hai. Traders is pattern ko istemal karke khareedne ya bechne ke potenital mauqe pehchan sakte hain.

Identification and Characteristics of a Hook Reversal Pattern:

Hook Reversal Pattern ki pehchan karne ke liye traders price chart pe khasosiyat dekhte hain. Pehle toh, pattern mein ek clear aur defined hook shape hona chahiye, jo tez pullback ke baad chhote bounce ya consolidation se banta hai. Dusra, ye pattern ek significant price move ke baad dikhe, jo current trend mein thakan ka ishara karta hai. Tesra, ye pattern dusre technical indicators jaise moving averages ya support aur resistance levels ke saath milta hona chahiye. In khasosiyaton ko analyze karke traders sahi Hook Reversal Pattern ki maujoodgi ko confirm kar sakte hain.

Types of Hook Reversal Patterns:

Hook Reversal Pattern ke do mukhya types hote hain: bullish aur bearish. Bullish hook reversal pattern ek downtrend ke baad dikhta hai aur ek potential reversal ko uptrend ki taraf ishara karta hai. Ismein neeche ki taraf movement hoti hai, jise chhote bounce ya consolidation follow karta hai aur phir upar ki taraf breakout hota hai. Dusri taraf, bearish hook reversal pattern ek uptrend ke baad dikhta hai aur ek potential reversal ko downtrend ki taraf ishara karta hai. Ismein upar ki taraf movement hoti hai, jise chhote pullback ya consolidation follow karta hai aur phir niche ki taraf breakout hota hai. Traders ko dono patterns se parichit hona chahiye takay woh potential trading opportunities ko pehchan sakein.

Confirmation and Entry Points:

Ek safal trade ki sambhavna ko bdhane ke liye, traders Hook Reversal Pattern pe based trade mein daakhil hone se pehle tasdeek ke signals dekhna pasand karte hain. Ye tasdeek ke signals technical indicators, candlestick patterns ya trendline breaks mein se ho sakte hain. Maslan, traders bullish Hook Reversal Pattern ke baad ek bullish tasdeek ki candlestick pattern jaise bullish engulfing ya hammer ka intezar kar sakte hain. Ye reversal ko tasdeek karta hai aur lambi trade mein taqatwar ishara deta hai. Usi tarah, bearish Hook Reversal Pattern ke case mein, traders bearish tasdeek ki candlestick pattern jaise bearish engulfing ya shooting star ka intezar kar sakte hain, phir short trade mein daakhil ho sakte hain. Tasdeek ka intezar karke, traders ghair haqiqi signals ki ehtiyat kar sakte hain aur apni trading performance ko behtar kar sakte hain.

Stop Loss and Take Profit Levels:

Hook Reversal Patterns pe trade karte waqt sahi risk management bahut zaroori hai. Traders ko hamesha stop loss levels set karna chahiye takay wo apni nuqsanat ko had se zyada na hone dein agar trade unke khilaf chal jati hai. Stop loss levels bullish hook reversal pattern ke breakout candle ki low ke neeche rakhe ja sakte hain aur bearish hook reversal pattern ke breakout candle ki high ke upar rakhe ja sakte hain. Take profit levels mein traders agle major support ya resistance level ko target kar sakte hain ya trailing stop orders istemal karke trade ke taraqqi pe munafa hasil kar sakte hain. Market conditions aur specific currency pair ke hisab se stop loss aur take profit levels.

تبصرہ

Расширенный режим Обычный режим