Bull flag chart pattern ek bullish trend continuation pattern hota hai jo market mein uptrend ke dauran dikhai deta hai. Yeh ek price action pattern hai jo market ke momentum aur trend ko reflect karta hai. Bull flag pattern typically price consolidation ke baad uptrend mein hota hai, suggesting a brief pause before the uptrend resumes.

Yeh pattern usually do parts mein hota hai:

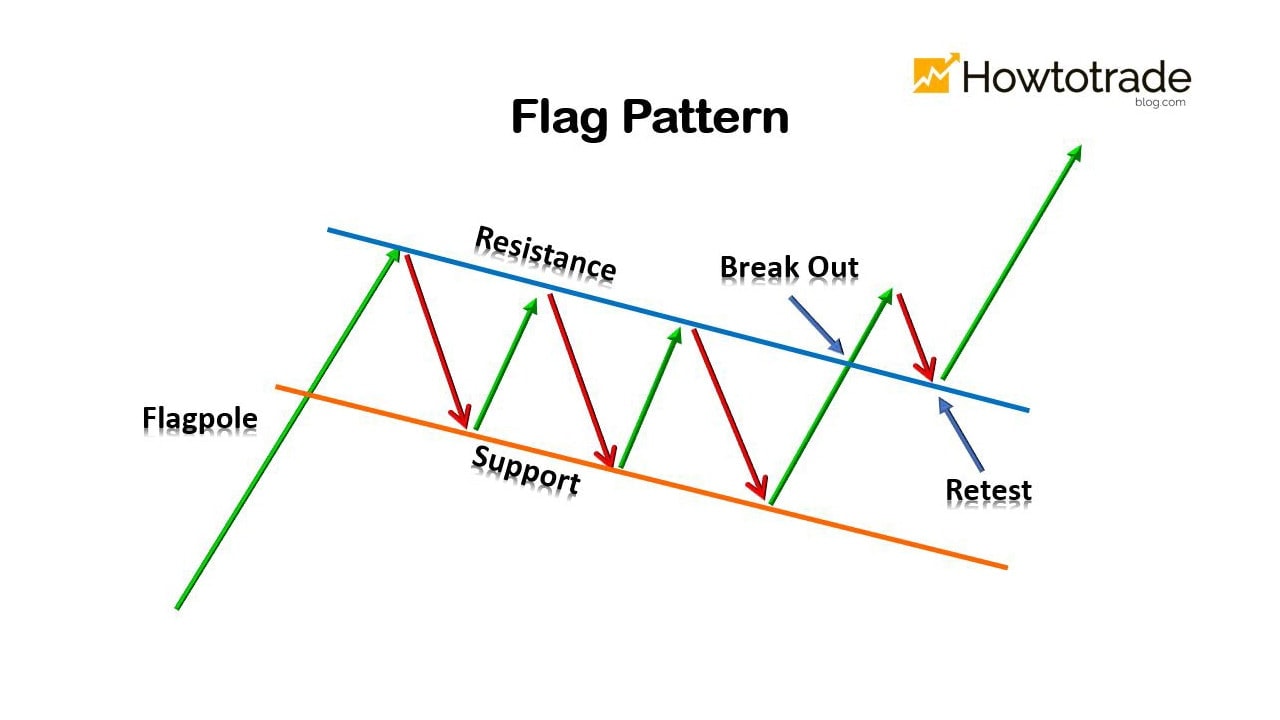

- Pole (Upar ki Raish): Bull flag pattern ki shuruaat ek steep price increase se hoti hai, jo ek pole ki tarah dikhta hai. Is pole mein price mein sudden significant increase hota hai jo flag pattern ki formation ko shuru karta hai.

- Flag (Jhanda): Pole ke baad, price mein consolidation hoti hai jo ek downward sloping trend line ke saath hoti hai, creating a flag-like pattern. Yeh trend line typically parallel hoti hai, price ke sath slope karke neeche ki taraf jaati hai. Volume is phase mein usually kam hota hai, indicating a temporary pause in the market before the next potential upward move.

Bull flag pattern ki pehchaan kaise hoti hai aur kyun yeh important hai:

- Price Action: Bull flag pattern mein pole ke baad price consolidation hoti hai, jise trend line se represent kiya jata hai. Is consolidation phase mein price stable hoti hai aur trend line ke andar rehti hai.

- Volume: Is phase mein usually volume kam hota hai jo indicate karta hai ke market mein activity slow ho gayi hai. Yeh price ke temporary pause ka indication hai.

- Continuation Pattern: Bull flag pattern ek trend continuation pattern hota hai, iska matlab hai ke jab trend upward hota hai aur bull flag pattern form hota hai, toh woh indicate karta hai ke uptrend continue hone ki possibility hai.

Bull flag pattern ko samajhna aur trade karna trading mein beneficial ho sakta hai, lekin isko accurately identify karna aur false signals ko avoid karna important hai. Always confirm the pattern with other technical indicators aur current market conditions ke saath.

تبصرہ

Расширенный режим Обычный режим