Introduction to Triple Top Pattern in Forex:

Triple Top pattern forex trading ki technical analysis mein aksar paish aane wala ek reversal pattern hai. Is pattern mein teen milti julti qeemati tin arooj hoti hai, jinke beech do darmiyanweh hote hai, ek resistance line banate hai. Yeh pattern ek uptrend ki potaential reversal ko darshaata hai, kyunki qeemat resistance level ko paar karne mein asafal hojati hai aur istead mein kamzor hojati hai. Tradres is pattern ko bechne ki maukhe dhoondte hai, kyun ki yeh ishara deta hai ki bullish jamnu qamzor ho raha hai aur ek bearish trend shuru ho sakta hai.

Identifying Triple Top Pattern:

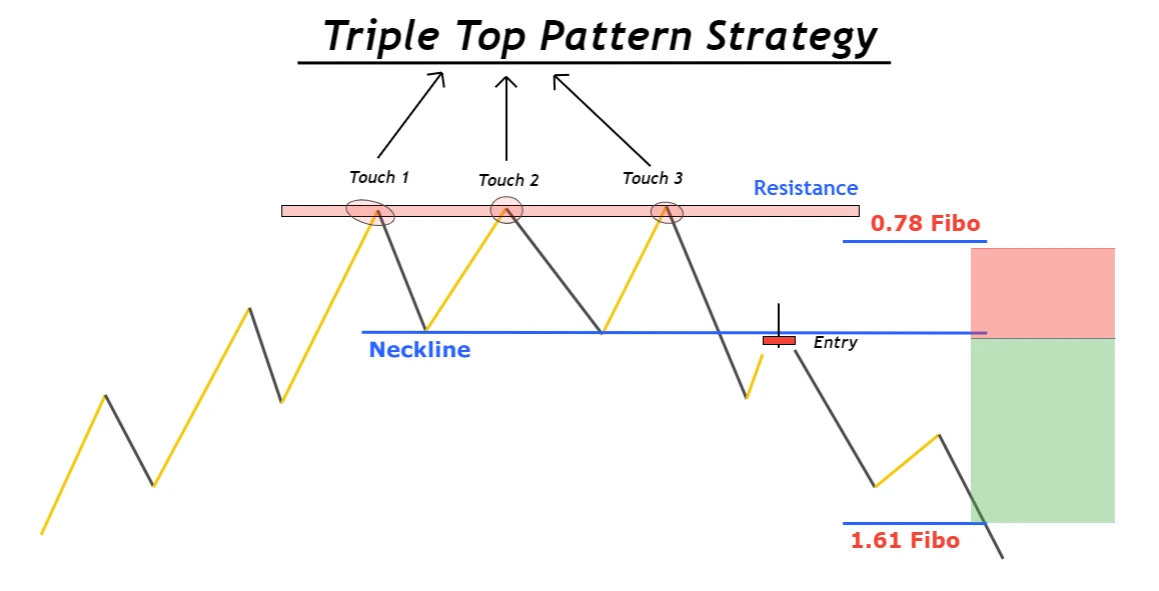

Triple Top pattern ki pehchan karne ke liye, traders teen milti julti qeemati tin arooj dhoondte hai jo qeemat mein kareebi barabari ke hote hai aur ek resistance level banate hai. In arooj ke baad do darmiyanweh hote hai, jo temporary tarah se kharidne wale ke saath qeemat ko support karne ka level darshaate hai. Resistance level paar nahi hona chahiye aur qeemat teesri arooj ke baad kam hona shuru hogi. Traders aksar trend lines ya horizontal lines ka istemal karte hai arooj aur darmiyanweh ko jodne ke liye aur pattern ko zyada saaf dikhane ke liye.

Confirmation of Triple Top Pattern:

Triple Top pattern ki tasdeeq tab hoti hai jab qeemat do darmiyanweh ke dwara banaye gaye support level se paar hoti hai. Is breakout se samjha jata hai ki bechne wale dabav main jitna intezar horaha hai, pichle uptrend ki potaential reversal hone ki disha mein. Traders aam taur par support level se kafi neeche ka breakout ka intezar karte hai, kyunki false breakout ya minor retracement ho sakte hai jab down tren ka jamun tezi se prabal hota hai.

Trading Strategies for Triple Top Pattern:

Triple Top pattern ke liye kuch trading strategies hai jinhe traders apna sakte hai. Ek strategy hai pattern ki tasdeeq ka intezar karna aur jab qeemat support level se paar hoti hai to ek short position enter karna. Ek aur approach hai, jahan traders additional technical indicators, jaise oscillators ya moving averages ka istemal karte hai, reversal signal ko tasdeeq karne aur entry aur exit points ko fine-tune karne ke liye. Traders stop-loss orders bhi consider kar sakte hai resistance level se upar place karke, takay koi nuksaan ho toh use limit kar sake agar pattern fail hojaye.

Potential Pitfalls and Limitations of Triple Top Pattern:

Triple Top pattern ek prasiddh reversal pattern hai, lekin ye hamesha par bharosa karne layak nahi hota aur false signals bhi de sakta hai. Traders ko savdhaan rehna chahiye aur apne trading decisions ko sirf is pattern par adharit karne se pehle dusri technical aur moolbhoot factors ko bhi madhya mein rakna chahiye. Sath hi, is pattern ki kamiyabi dar bazar ke mahol aur analyze kiye ja rahe timeframe par depend karti hai. Poori tarah se market ke context ko sanket aur sahi risk management strategies ka upyog karke nuksaan ko kam karne ke liye mahtavapun hai.

Triple Top pattern forex trading ki technical analysis mein aksar paish aane wala ek reversal pattern hai. Is pattern mein teen milti julti qeemati tin arooj hoti hai, jinke beech do darmiyanweh hote hai, ek resistance line banate hai. Yeh pattern ek uptrend ki potaential reversal ko darshaata hai, kyunki qeemat resistance level ko paar karne mein asafal hojati hai aur istead mein kamzor hojati hai. Tradres is pattern ko bechne ki maukhe dhoondte hai, kyun ki yeh ishara deta hai ki bullish jamnu qamzor ho raha hai aur ek bearish trend shuru ho sakta hai.

Identifying Triple Top Pattern:

Triple Top pattern ki pehchan karne ke liye, traders teen milti julti qeemati tin arooj dhoondte hai jo qeemat mein kareebi barabari ke hote hai aur ek resistance level banate hai. In arooj ke baad do darmiyanweh hote hai, jo temporary tarah se kharidne wale ke saath qeemat ko support karne ka level darshaate hai. Resistance level paar nahi hona chahiye aur qeemat teesri arooj ke baad kam hona shuru hogi. Traders aksar trend lines ya horizontal lines ka istemal karte hai arooj aur darmiyanweh ko jodne ke liye aur pattern ko zyada saaf dikhane ke liye.

Confirmation of Triple Top Pattern:

Triple Top pattern ki tasdeeq tab hoti hai jab qeemat do darmiyanweh ke dwara banaye gaye support level se paar hoti hai. Is breakout se samjha jata hai ki bechne wale dabav main jitna intezar horaha hai, pichle uptrend ki potaential reversal hone ki disha mein. Traders aam taur par support level se kafi neeche ka breakout ka intezar karte hai, kyunki false breakout ya minor retracement ho sakte hai jab down tren ka jamun tezi se prabal hota hai.

Trading Strategies for Triple Top Pattern:

Triple Top pattern ke liye kuch trading strategies hai jinhe traders apna sakte hai. Ek strategy hai pattern ki tasdeeq ka intezar karna aur jab qeemat support level se paar hoti hai to ek short position enter karna. Ek aur approach hai, jahan traders additional technical indicators, jaise oscillators ya moving averages ka istemal karte hai, reversal signal ko tasdeeq karne aur entry aur exit points ko fine-tune karne ke liye. Traders stop-loss orders bhi consider kar sakte hai resistance level se upar place karke, takay koi nuksaan ho toh use limit kar sake agar pattern fail hojaye.

Potential Pitfalls and Limitations of Triple Top Pattern:

Triple Top pattern ek prasiddh reversal pattern hai, lekin ye hamesha par bharosa karne layak nahi hota aur false signals bhi de sakta hai. Traders ko savdhaan rehna chahiye aur apne trading decisions ko sirf is pattern par adharit karne se pehle dusri technical aur moolbhoot factors ko bhi madhya mein rakna chahiye. Sath hi, is pattern ki kamiyabi dar bazar ke mahol aur analyze kiye ja rahe timeframe par depend karti hai. Poori tarah se market ke context ko sanket aur sahi risk management strategies ka upyog karke nuksaan ko kam karne ke liye mahtavapun hai.

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Triple_Top_Dec_2020-01-78a37beca8574d169c2cccd1fc18279d.jpg)

تبصرہ

Расширенный режим Обычный режим