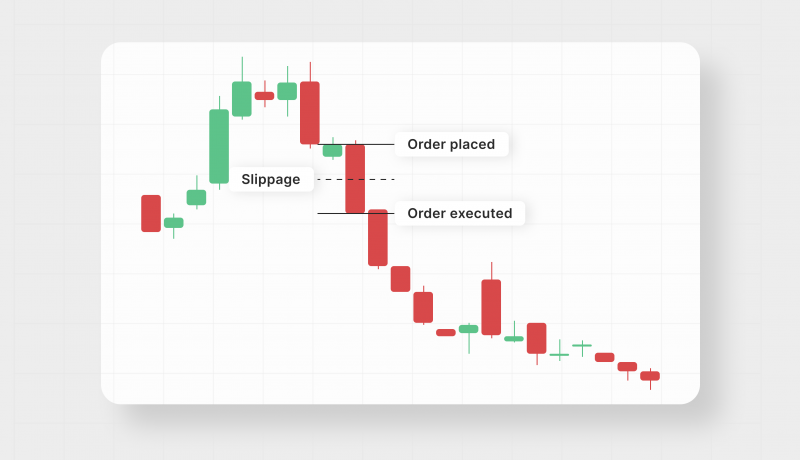

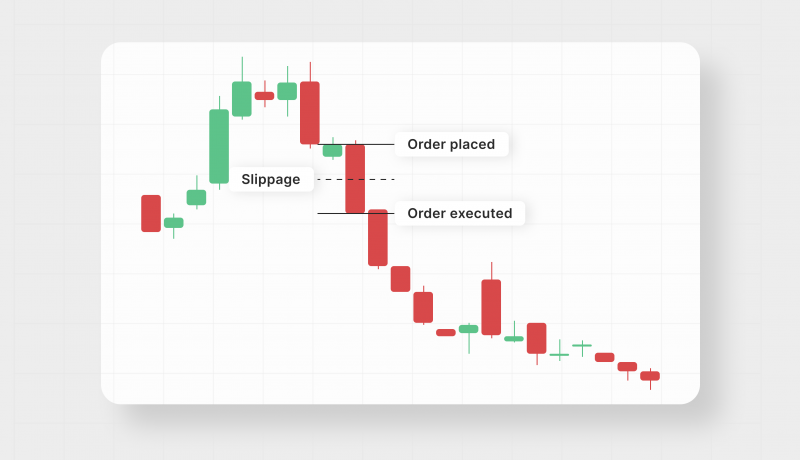

Slippage forex market mein ek term hai jo istemaal hoti hai, jo ek currency pair ki muntazir keemat aur trade execute hone wale keemat ke darmiyan farq ko bayan karne ke liye istemaal hoti hai. Slippage musbat ya manfi ho sakta hai, aur yeh forex traders ke liye ahem hai, kyun ke yeh unke munafa aur nuksan ko kisi had tak asar daal sakta hai.

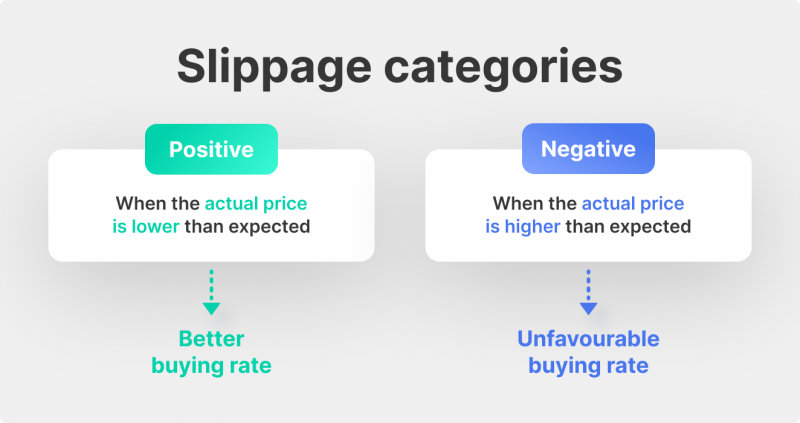

Positive Slippage

Positive slippage, jo ke favorable slippage bhi kehlati hai, tab hoti hai jab currency pair ki keemat trader ke position ke favur mein chali jati hai. Iska matlab hai ke trade execute hone wale keemat muntazir keemat se behtar hai. For example, agar ek trader EUR/USD mein 1.1750 par buy order lagata hai aur keemat turant 1.1800 par chali jati hai pehle se pehle order fill hone se, to iska natija musbat slippage hoga jiska maqamiati izafah 50 pips hoga.

Positive slippage traders ke liye faida mand ho sakti hai kyun ke iska natija unki tawakul se zyada munafa ho sakta hai. Lekin, yeh hamesha acha nahi hota kyun ke is se overtrading aur zyada risk lena bhi ho sakta hai. Traders apni qabliyat mein itna yaqeen karenge ke woh keemat ki harkaton ko peshgoi kar sakte hain aur zyada positions le sakte hain, jo agar market unke khilaf chali jaye to bari nuksan ka bai's ban sakti hai.

Negative Slippage

Negative slippage, jo ke unfavorable slippage bhi kehlati hai, tab hoti hai jab currency pair ki keemat trader ke position ke khilaf chali jati hai. Iska matlab hai ke trade execute hone wale keemat muntazir keemat se bura hai. For example, agar ek trader EUR/USD mein 1.1750 par buy order lagata hai aur keemat turant 1.1700 par chali jati hai pehle se pehle order fill hone se, to iska natija manfi slippage hoga jiska maqamiati kamzori 50 pips hoga.

Negative slippage traders ke liye nuksan deh ho sakta hai kyun ke iska natija muntazir munafa se kam ho sakta hai ya phir nuksan bhi ho sakta hai. Is se mahsusi trading aur ghalat faislay karne ka khatra bhi hota hai kyun ke traders mayusi ka shikar ho sakte hain aur khauf ya hirs se mabni fazool faislay kar sakte hain. Traders ko manfi slippage ko efektive taur par manage karna seekhna chahiye stop-loss orders istemal kar ke aur haqeeqi munafa maqasid tay kar ke.

Factors that make Slippage

Managing Slippage

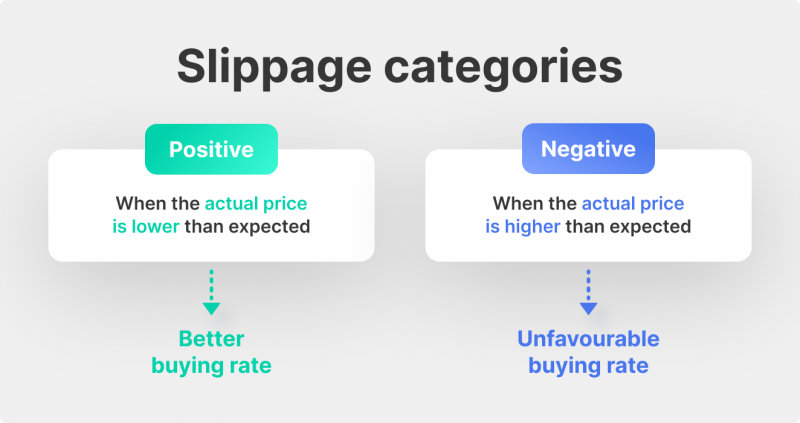

Positive Slippage

Positive slippage, jo ke favorable slippage bhi kehlati hai, tab hoti hai jab currency pair ki keemat trader ke position ke favur mein chali jati hai. Iska matlab hai ke trade execute hone wale keemat muntazir keemat se behtar hai. For example, agar ek trader EUR/USD mein 1.1750 par buy order lagata hai aur keemat turant 1.1800 par chali jati hai pehle se pehle order fill hone se, to iska natija musbat slippage hoga jiska maqamiati izafah 50 pips hoga.

Positive slippage traders ke liye faida mand ho sakti hai kyun ke iska natija unki tawakul se zyada munafa ho sakta hai. Lekin, yeh hamesha acha nahi hota kyun ke is se overtrading aur zyada risk lena bhi ho sakta hai. Traders apni qabliyat mein itna yaqeen karenge ke woh keemat ki harkaton ko peshgoi kar sakte hain aur zyada positions le sakte hain, jo agar market unke khilaf chali jaye to bari nuksan ka bai's ban sakti hai.

Negative Slippage

Negative slippage, jo ke unfavorable slippage bhi kehlati hai, tab hoti hai jab currency pair ki keemat trader ke position ke khilaf chali jati hai. Iska matlab hai ke trade execute hone wale keemat muntazir keemat se bura hai. For example, agar ek trader EUR/USD mein 1.1750 par buy order lagata hai aur keemat turant 1.1700 par chali jati hai pehle se pehle order fill hone se, to iska natija manfi slippage hoga jiska maqamiati kamzori 50 pips hoga.

Negative slippage traders ke liye nuksan deh ho sakta hai kyun ke iska natija muntazir munafa se kam ho sakta hai ya phir nuksan bhi ho sakta hai. Is se mahsusi trading aur ghalat faislay karne ka khatra bhi hota hai kyun ke traders mayusi ka shikar ho sakte hain aur khauf ya hirs se mabni fazool faislay kar sakte hain. Traders ko manfi slippage ko efektive taur par manage karna seekhna chahiye stop-loss orders istemal kar ke aur haqeeqi munafa maqasid tay kar ke.

Factors that make Slippage

- Market volatility: Ziadah volatile markets slippage ke liye zyada prone hoti hain kyun ke keematein tezi se aur anjaane mein move ho sakti hain. Traders ko zyada volatile douron mein savdhan rehna chahiye aur apni khatra exposure ko had mein rakhne ke liye stop-loss orders ka istemal karna chahiye.

- Market news: Bari khabron ki events, jaise ke central bank meetings ya economic data releases, significant keemat ki harkaton ka sabab ban sakti hain aur traders jo tayyar nahi hote unke liye slippage ka sabab ban sakti hain. Traders ko ane wale news events ke baare mein malumat hasil rakhni chahiye aur apni trading strategies ko is ke mutabiq adjust karna chahiye.

- Broker execution: Broker execution ki tezi aur durustgi bhi slippage par asar daal sakti hai. Jo brokers market execution ka istemal karte hain, woh zyada volatile ya kam liquidity ke doron mein zyada slippage ka samna kar sakte hain, jabke instant execution istemal karne wale brokers ki slippage kam hoti hai lekin spreads zyada hote hain. Traders ko aisa broker chunna chahiye jo durust execution aur shaffaf pricing offer karta hai.

- Order size: Bade order sizes market impact ki wajah se zyada slippage ka sabab bana sakti hain, jo hota hai jab ek bada order prices ko trader ke position ke khilaf move karne ka sabab banata hai. Traders ko apne bade orders ko chhote hisson mein todna ya limit orders ka istemal karke market impact se bachna aur slippage ko kam karna chahiye.

Managing Slippage

- Use stop-loss orders: Stop-loss orders nuksan ko had mein rakhne mein madad karte hain kyun ke woh apne aap hi position ko band kar dete hain jab woh kisi muqarar keemat tak pohanchti hai. Traders ko apne risk tolerance aur market analysis ke mutabiq haqeeqi stop-loss levels tay karna chahiye.

- Use limit orders: Limit orders traders ko apne order ko execute hone wale kisi muqarar keemat par set karne ki ijazat dete hain, market execution par ittehad karna nahi padta. Is se zyada volatile ya kam liquidity ke doron mein slippage ko kam karne mein madad milti hai.

- Manage risk: Traders ko hamesha apne risk exposure ko manage karna chahiye, sahi money management techniques ka istemal karte hue, jaise ke stop-loss levels set karna aur apni leverage istemal ko had mein rakhna. Yeh manfi slippage ya doosre nuksan dah market events se bachane mein madad karega.

- Stay informed: Traders ko apne brokers ya doosre moatabar sources ki taraf se di gayi economic calendars aur news feeds ke zariye ane wale news events aur market ki halat ke baare mein malumat hasil karte rehna chahiye. Is se unhe market ke halat aur muntazir risks aur rewards ke mutabiq trading mein dana dan faislay karne mein madad milti hai.

تبصرہ

Расширенный режим Обычный режим