Introduction to Hook Reversal Pattern:

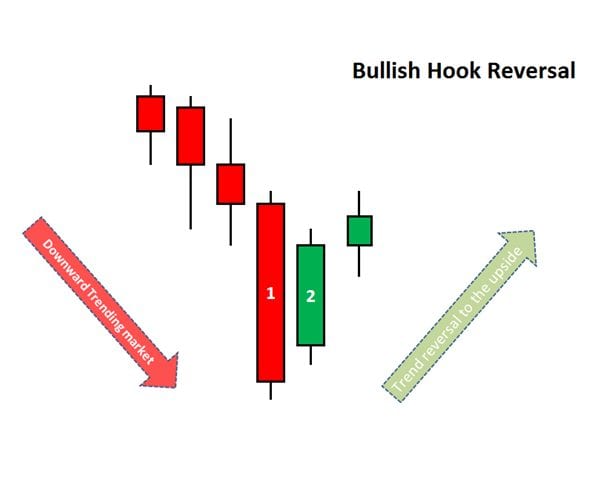

Hook Reversal Pattern forex trading mein aik aam tor par dekhi jane wali chart pattern hai. Isay aam tor par kisi trend ki shadeed aur ghair mut Trend ki taraf sharp aur sudden reversal se Hook Reversal Pattern pehchan kiya jata hai. Yeh pattern aksar market sentiment ka ulta hawala deta hai aur traders ke liye opposite direction mein position lena ka taqatwar signal hai.

Characteristics of a Hook Reversal Pattern:

Hook Reversal Pattern ko pehchanne ke liye traders ko price action mein kuch khas khasiyaton par tawajjuh deni hoti hai. Yeh pattern aam tor par ek taiz upward ya downward trend ke baad achanak aur tezi se palta hai. Palatne ka typically iss trend ke thakne ka indication hota hai. Palatne wala candlestick lambi tail ya wick ka saath hoga, jo hook ki tarah dikhega, aur uska body chota hoga. Candlestick ka body bullish ya bearish ho sakta hai, yeh uss palatne wale ki bullish ya bearish reversal par depend karta hai.

Confirmation and Entry Points:

Jab trader Hook Reversal Pattern ko dekhta hai, to position le lene se pehle confirmation ka intezaar karna zaroori hai. Confirmation doosre candlestick patterns ke roop mein ho sakti hai, jaise engulfing patterns ya doji formations, ya phir kisi key support ya resistance level ka tootna. Jab confirmation mil jaye, tab trader market mein enter kar sakta hai, jahan stop-loss order ko reversal candlestick ki high ya low ke upar ya nichle hisse ke upar lagaya jata hai, palatne ki direction par depend karte hue.

Profit Targets and Risk Management:

Hook Reversal Pattern trades ke liye traders profit targets apne pasandeeda methods par based kar sakte hain. Ek approach swing high ya low ki taraf target karne ki hai, palatne ki direction mein. Doosra approach Fibonacci extensions ka istemal karne ki hai, jahan price palatne ke baad pahunche sambhav support ya resistance levels ko identify karne ke liye. Traders ke liye zaroori hai sahi risk management techniques istemal karke stop-loss orders set karna, taaki agar palatne kaamyaab na ho toh nuksan had se zyada na ho.

Examples and Application:

Hook Reversal Pattern forex trading mein various timeframes aur currency pairs par apply kiya ja sakta hai. Traders technical analysis tools aur indicators, jaise moving averages, trendlines, aur support aur resistance levels ka istemal karke charts analyze kar sakte hain, taki potential Hook Reversal Patterns ko pehchane. Pattern ko trend following ya momentum trading jaisi aur trading strategies ke saath combine karne se traders successful trades ke probability ko badha sakte hain. Live trading mein istemal karne se pehle pattern ko historical data par practice aur backtest karna zaroori hai, taaki uski effectiveness par confidence aur familiarity hasil ki ja sake.

Hook Reversal Pattern forex trading mein aik aam tor par dekhi jane wali chart pattern hai. Isay aam tor par kisi trend ki shadeed aur ghair mut Trend ki taraf sharp aur sudden reversal se Hook Reversal Pattern pehchan kiya jata hai. Yeh pattern aksar market sentiment ka ulta hawala deta hai aur traders ke liye opposite direction mein position lena ka taqatwar signal hai.

Characteristics of a Hook Reversal Pattern:

Hook Reversal Pattern ko pehchanne ke liye traders ko price action mein kuch khas khasiyaton par tawajjuh deni hoti hai. Yeh pattern aam tor par ek taiz upward ya downward trend ke baad achanak aur tezi se palta hai. Palatne ka typically iss trend ke thakne ka indication hota hai. Palatne wala candlestick lambi tail ya wick ka saath hoga, jo hook ki tarah dikhega, aur uska body chota hoga. Candlestick ka body bullish ya bearish ho sakta hai, yeh uss palatne wale ki bullish ya bearish reversal par depend karta hai.

Confirmation and Entry Points:

Jab trader Hook Reversal Pattern ko dekhta hai, to position le lene se pehle confirmation ka intezaar karna zaroori hai. Confirmation doosre candlestick patterns ke roop mein ho sakti hai, jaise engulfing patterns ya doji formations, ya phir kisi key support ya resistance level ka tootna. Jab confirmation mil jaye, tab trader market mein enter kar sakta hai, jahan stop-loss order ko reversal candlestick ki high ya low ke upar ya nichle hisse ke upar lagaya jata hai, palatne ki direction par depend karte hue.

Profit Targets and Risk Management:

Hook Reversal Pattern trades ke liye traders profit targets apne pasandeeda methods par based kar sakte hain. Ek approach swing high ya low ki taraf target karne ki hai, palatne ki direction mein. Doosra approach Fibonacci extensions ka istemal karne ki hai, jahan price palatne ke baad pahunche sambhav support ya resistance levels ko identify karne ke liye. Traders ke liye zaroori hai sahi risk management techniques istemal karke stop-loss orders set karna, taaki agar palatne kaamyaab na ho toh nuksan had se zyada na ho.

Examples and Application:

Hook Reversal Pattern forex trading mein various timeframes aur currency pairs par apply kiya ja sakta hai. Traders technical analysis tools aur indicators, jaise moving averages, trendlines, aur support aur resistance levels ka istemal karke charts analyze kar sakte hain, taki potential Hook Reversal Patterns ko pehchane. Pattern ko trend following ya momentum trading jaisi aur trading strategies ke saath combine karne se traders successful trades ke probability ko badha sakte hain. Live trading mein istemal karne se pehle pattern ko historical data par practice aur backtest karna zaroori hai, taaki uski effectiveness par confidence aur familiarity hasil ki ja sake.

تبصرہ

Расширенный режим Обычный режим