Definition of Stalled Candlestick Pattern:

Stalled Candlestick Pattern forex mein, jo Doji Star ke naam se bhi jaana jaata hai, ek technical analysis pattern hai. Is pattern ka istemal tab hota hai jab ek candlestick bahut chhotay badan ke saath dikhe, isse market mein kam taakat ki baat ho sakti hai aur khareedne walon aur bechne walon ke beech tanav ho sakti hai. Is pattern ki pahchan chhotay ya maujoodnahin honewale badan aur lambi upper aur lower shado se hoti hai, jiski wajah se chart par ek cross ya chhoti taraashah shape ban jati hai. Is pattern se samjha jata hai ki mukhya trend mein ek reversal ya continuation ki sambhavna hai, jo iski puryaani kimatn ke andar hone par nirbhar karti hai.

Interpretation of the Stalled Candlestick Pattern:

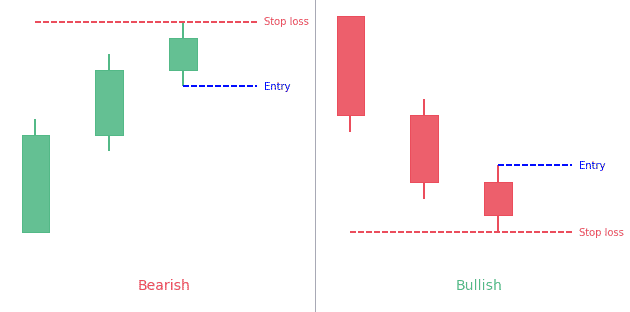

Stalled Candlestick Pattern ek lambe samay tak chalne waale uptrend ke baad dikhe, to yeh batata hai ki khareedne wale tezi kho rahe hain aur ek trend reversal ho sakta hai. Wahi jab yeh pattern ek lambe samay tak chalne waale downtrend ke baad dikhe, to yeh ishara karta hai ki bechne wale control kho rahe hain aur ek tezi ki taraf possible trend reversal ho sakta hai. Traders ko iske saath confirmation signals ki talash karni chahiye, jaise bearish ya bullish engulfing pattern ya trendline break, ek significant reversal ke hone ki pushti karne ke liye.

Recognition of the Stalled Candlestick Pattern:

Stalled Candlestick Pattern ki pehchan karne ke liye, traders ko ek chhotay badan aur lambi upper aur lower shadows wali candlestick ko dhundhna chahiye. Candlestick ka badan pratically mukammal na ho ya bilkul hi chota hona chahiye, isse market mein anishchay ho. Iske alawa, pattern ko ek significant support ya resistance level ya trendline ke pass hona chahiye, jo iske potential mahatv ko aur bhi tasalli deti hai.

The Importance of Volume in the Stalled Candlestick Pattern:

Volume, Stalled Candlestick Pattern ki pushti karne mein mukhya bhumika nibhata hai. Traders ko is pattern ke banne ke samay volume levels ko analyze karna chahiye. Volume ka kam hona batata hai ki traders ki taraf se participation ki kami hai aur market mein anishchay ko aur bhi majboot karta hai. Wahi volume ki wajah se significant increase, ek potential trend reversal ya continuation ki mazboot pushti ho sakti hai.

The Implications of the Stalled Candlestick Pattern in Forex:

Stalled Candlestick Pattern ke dikhne se forex traders ko mahatvapoorna jankari milti hai. Yeh batata hai ki market mein sametan aur anishchay ka samay hai, iska matlab hai ki traders ko badi trading decisions lene se pehle savdhan rehna chahiye. Is pattern ki pehchan aur iski pushti anya technical analysis tools aur indicators ki madad se karke, traders market ke reversals ya continuations ka fayda utha sakte hai aur apni trading strategies ko ussi hisaab se badal sakte hai. Haa yeh zaroor yaad rakhna zaroori hai ki forex trading mein koi bhi ek pattern ya indicator safalta ki gaurantee nahi deta hai, iske liye gehri analysis aur risk management karne se bachengay.

Stalled Candlestick Pattern forex mein, jo Doji Star ke naam se bhi jaana jaata hai, ek technical analysis pattern hai. Is pattern ka istemal tab hota hai jab ek candlestick bahut chhotay badan ke saath dikhe, isse market mein kam taakat ki baat ho sakti hai aur khareedne walon aur bechne walon ke beech tanav ho sakti hai. Is pattern ki pahchan chhotay ya maujoodnahin honewale badan aur lambi upper aur lower shado se hoti hai, jiski wajah se chart par ek cross ya chhoti taraashah shape ban jati hai. Is pattern se samjha jata hai ki mukhya trend mein ek reversal ya continuation ki sambhavna hai, jo iski puryaani kimatn ke andar hone par nirbhar karti hai.

Interpretation of the Stalled Candlestick Pattern:

Stalled Candlestick Pattern ek lambe samay tak chalne waale uptrend ke baad dikhe, to yeh batata hai ki khareedne wale tezi kho rahe hain aur ek trend reversal ho sakta hai. Wahi jab yeh pattern ek lambe samay tak chalne waale downtrend ke baad dikhe, to yeh ishara karta hai ki bechne wale control kho rahe hain aur ek tezi ki taraf possible trend reversal ho sakta hai. Traders ko iske saath confirmation signals ki talash karni chahiye, jaise bearish ya bullish engulfing pattern ya trendline break, ek significant reversal ke hone ki pushti karne ke liye.

Recognition of the Stalled Candlestick Pattern:

Stalled Candlestick Pattern ki pehchan karne ke liye, traders ko ek chhotay badan aur lambi upper aur lower shadows wali candlestick ko dhundhna chahiye. Candlestick ka badan pratically mukammal na ho ya bilkul hi chota hona chahiye, isse market mein anishchay ho. Iske alawa, pattern ko ek significant support ya resistance level ya trendline ke pass hona chahiye, jo iske potential mahatv ko aur bhi tasalli deti hai.

The Importance of Volume in the Stalled Candlestick Pattern:

Volume, Stalled Candlestick Pattern ki pushti karne mein mukhya bhumika nibhata hai. Traders ko is pattern ke banne ke samay volume levels ko analyze karna chahiye. Volume ka kam hona batata hai ki traders ki taraf se participation ki kami hai aur market mein anishchay ko aur bhi majboot karta hai. Wahi volume ki wajah se significant increase, ek potential trend reversal ya continuation ki mazboot pushti ho sakti hai.

The Implications of the Stalled Candlestick Pattern in Forex:

Stalled Candlestick Pattern ke dikhne se forex traders ko mahatvapoorna jankari milti hai. Yeh batata hai ki market mein sametan aur anishchay ka samay hai, iska matlab hai ki traders ko badi trading decisions lene se pehle savdhan rehna chahiye. Is pattern ki pehchan aur iski pushti anya technical analysis tools aur indicators ki madad se karke, traders market ke reversals ya continuations ka fayda utha sakte hai aur apni trading strategies ko ussi hisaab se badal sakte hai. Haa yeh zaroor yaad rakhna zaroori hai ki forex trading mein koi bhi ek pattern ya indicator safalta ki gaurantee nahi deta hai, iske liye gehri analysis aur risk management karne se bachengay.

تبصرہ

Расширенный режим Обычный режим