Introduction to the Rising Three Pattern:

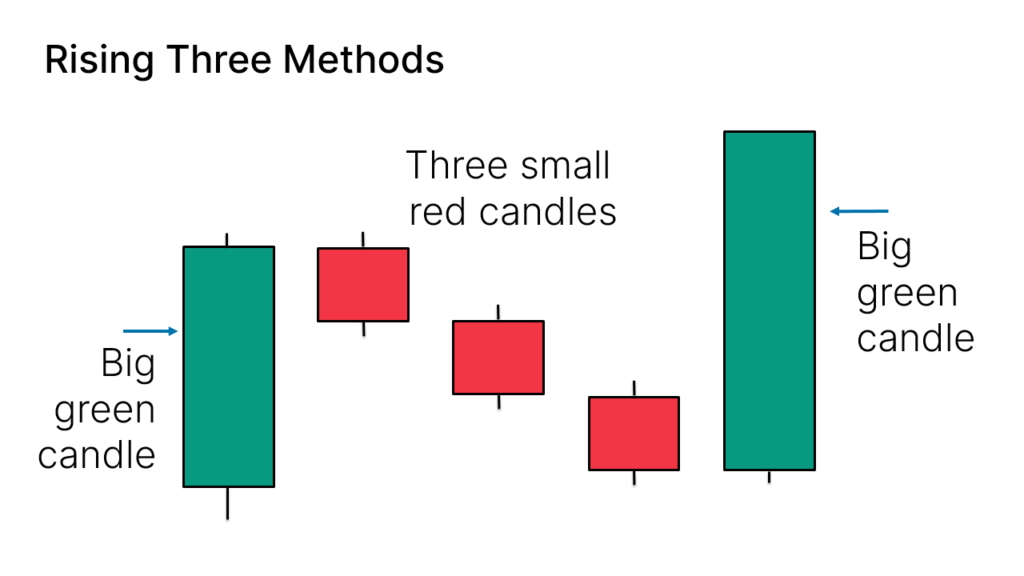

Rising three pattern ek bullish continuation pattern hai jo forex trading mein aksar uptrend ke doran hota hai. Ismein panch candlesticks shamil hote hain.

Identification of the Rising Three Pattern:

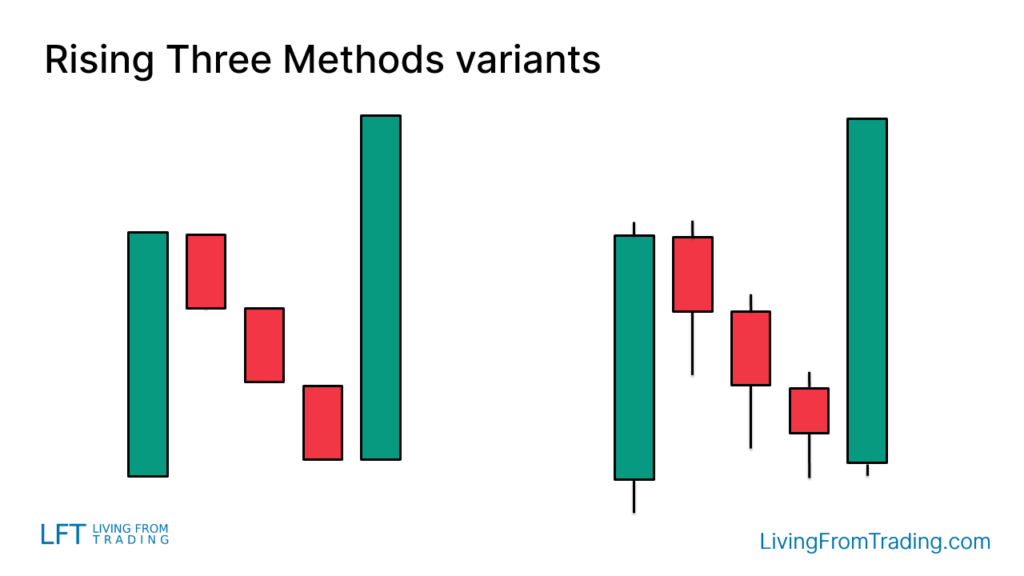

Rising three pattern ka pata lagane ke liye, traders ko forex charts par ek mazboot uptrend ko pehle se observe karna chahiye. Pattern ek lambi bullish candle se shuru hota hai, jise teen chhote bearish candles follow karte hain, aur phir ek aur lambi bullish candle se samapt hota hai. Middle three candles ka high kam hona chahiye aur low zyada hona chahiye, jisse ek pennant ya flag jaisa shape ban jata hai. Ye consolidation pattern bada uptrend ke beech mein ek chhota rukawat ya hichkichaahat ko darshata hai, jab takke bulls phir se control mein aa jaate hain.

Confirmation and Entry Points:

Traders aksar rising three pattern par trade karne se pehle confirmation ka intezar karte hain. Confirmation unko mil sakta hai jab price pattern ke last bullish candle ka high todein. Ye consolidation range ke upar breakout bullish momentum ke jaari rahne ka ishara deta hai. Traders jab ye breakout hota hai, tab long position mein enter ho sakte hain, stop-loss order ko pattern ke low ke neeche lagate hue risk management ki taraf se.

Profit Targets and Stop-Loss Levels:

Rising three pattern par trade karte samay, potential profit targets aur stop-loss levels ka pata lagana zaroori hai. Profit targets technical analysis tools jaise Fibonacci retracement levels ya pehle ke swing highs ko reference points ke taur par use karke set kiye ja sakte hain. Aam taur par profit targets ko 2:1 ya 3:1 jaise risk-to-reward ratio wale levels par rakha jata hai. Stop-loss levels pattern ke low ke neeche ya key support levels ke neeche rakhe ja sakte hain, taaki trade expectations ke khilaaf jaane par potential nuksaan kam ho sake.

Potential Reversals and False Signals:

Jabki rising three pattern aam taur par bullish continuation pattern hota hai, potential reversals aur false signals ki taraf dhyan dena zaroori hai. Traders ko dusre technical indicators ya patterns ko bhi consider karna chahiye, jo market sentiment mein badlav ki sambhavna ko darshane ke liye ho sakte hain. Jaise ki agar rising three pattern significant resistance level ke paas ho ya oscillators par bearish divergence ho, to ye reversal ki higher probability darsha sakte hain. Risk management strategies jaise trailing stop-loss orders ko implement karna, asaami ke nuksaan hone par profits ko bachane mein madad karta hai. Trade ki regular monitoring aur price action ke basis par stop-loss levels ko adjust karna bhi mahatvapurna hai.

Rising three pattern ek bullish continuation pattern hai jo forex trading mein aksar uptrend ke doran hota hai. Ismein panch candlesticks shamil hote hain.

Identification of the Rising Three Pattern:

Rising three pattern ka pata lagane ke liye, traders ko forex charts par ek mazboot uptrend ko pehle se observe karna chahiye. Pattern ek lambi bullish candle se shuru hota hai, jise teen chhote bearish candles follow karte hain, aur phir ek aur lambi bullish candle se samapt hota hai. Middle three candles ka high kam hona chahiye aur low zyada hona chahiye, jisse ek pennant ya flag jaisa shape ban jata hai. Ye consolidation pattern bada uptrend ke beech mein ek chhota rukawat ya hichkichaahat ko darshata hai, jab takke bulls phir se control mein aa jaate hain.

Confirmation and Entry Points:

Traders aksar rising three pattern par trade karne se pehle confirmation ka intezar karte hain. Confirmation unko mil sakta hai jab price pattern ke last bullish candle ka high todein. Ye consolidation range ke upar breakout bullish momentum ke jaari rahne ka ishara deta hai. Traders jab ye breakout hota hai, tab long position mein enter ho sakte hain, stop-loss order ko pattern ke low ke neeche lagate hue risk management ki taraf se.

Profit Targets and Stop-Loss Levels:

Rising three pattern par trade karte samay, potential profit targets aur stop-loss levels ka pata lagana zaroori hai. Profit targets technical analysis tools jaise Fibonacci retracement levels ya pehle ke swing highs ko reference points ke taur par use karke set kiye ja sakte hain. Aam taur par profit targets ko 2:1 ya 3:1 jaise risk-to-reward ratio wale levels par rakha jata hai. Stop-loss levels pattern ke low ke neeche ya key support levels ke neeche rakhe ja sakte hain, taaki trade expectations ke khilaaf jaane par potential nuksaan kam ho sake.

Potential Reversals and False Signals:

Jabki rising three pattern aam taur par bullish continuation pattern hota hai, potential reversals aur false signals ki taraf dhyan dena zaroori hai. Traders ko dusre technical indicators ya patterns ko bhi consider karna chahiye, jo market sentiment mein badlav ki sambhavna ko darshane ke liye ho sakte hain. Jaise ki agar rising three pattern significant resistance level ke paas ho ya oscillators par bearish divergence ho, to ye reversal ki higher probability darsha sakte hain. Risk management strategies jaise trailing stop-loss orders ko implement karna, asaami ke nuksaan hone par profits ko bachane mein madad karta hai. Trade ki regular monitoring aur price action ke basis par stop-loss levels ko adjust karna bhi mahatvapurna hai.

تبصرہ

Расширенный режим Обычный режим