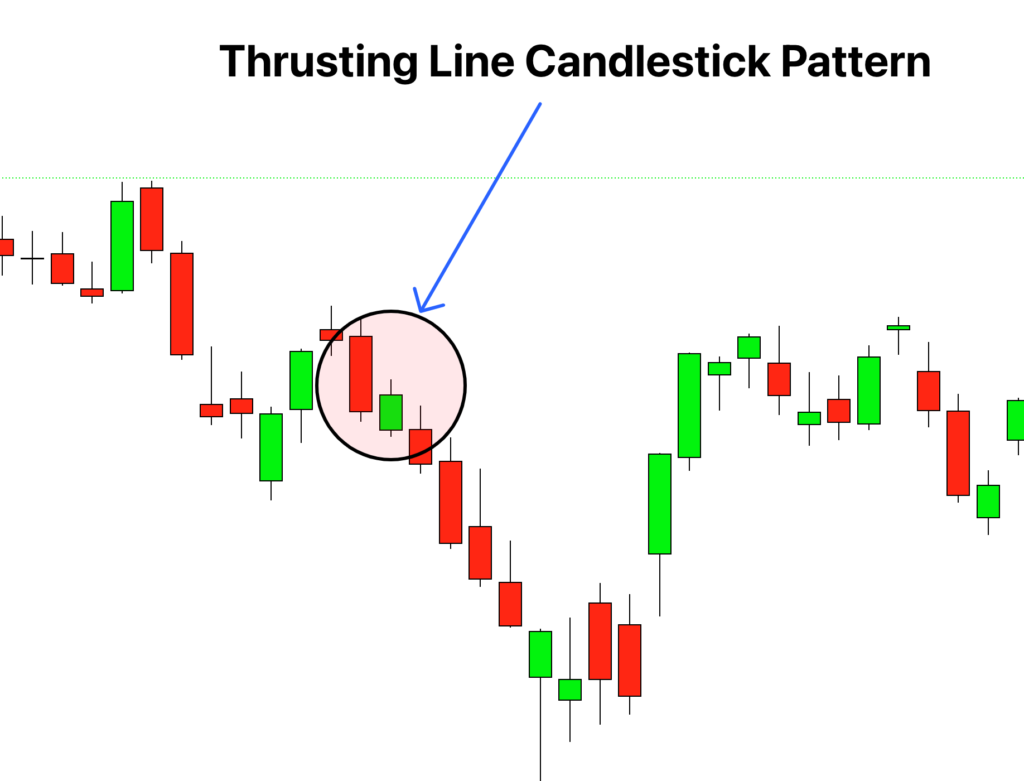

Overview of Thrusting Line Candlestick Pattern:

Thrusting line candlestick pattern forex market mein chal rahe downtrend ke dauran hone wala ek takatwar reversal pattern hota hai. Ye pattern do consecutive candlestickska mil kar banta hai: ek bearish candle, jisme typically bada size aur lamba body hota hai, jo strong selling pressure ko darshata hai, aur ek bullish candle, jo pehle candle ke close se neeche khulta hai, lekin bearish candle ki body ka midpoint se oopar close karta hai. Isse samajh me aata hai ki despite initial selling pressure, buyers ne prices ko upar push kar liya hai.

Interpretation of the Thrusting Line Candlestick Pattern:

Thrusting line pattern yeh dikhata hai ki buyers takatwar ho rahe hai aur current downtrend ko reverse kar sakte hai. Jab yeh pattern banata hai, toh iska matlab hai ki selling pressure khatam hone wala hai aur buyers aa rahe hai. Lekin trading decisions lene se pehle dusre technical indicators aur price action confirmation ko bhi dhyan me rakhna zaroori hai.

Confirmation and Filtering Factors for the Thrusting Line Candlestick Pattern:

Thrusting line pattern ko trade karne se pehle confirmation ka intezar karna zaroori hai. Traders often aur technical tools aur patterns ka istemaal karte hai thrusting line signal ko validate karne ke liye. For example, traders bullish candlestick patterns ko dekh sakte hai, jaise bullish engulfing ya piercing patterns, jo reversal ko confirm karte hai. Additionally, traders technical indicators jaise moving averages aur trendlines ka istemaal karte hai pattern ki validity ko confirm karne ke liye.

Stop Loss Placement and Take Profit Targets for the Thrusting Line Candlestick Pattern:

Thrusting line pattern trade karte waqt sahi risk management measures ko set karna zaroori hai. Aam taur par stop loss order bearish candlestick ki low ke neeche place kiya jata hai, jisse market volatility ke liye ek chota buffer ho. Take profit targets ke liye, traders aksar previous support ya resistance levels ko exit points ke taur par use karte hai. Additionally, traders trailing stops ka istemaal kar sakte hai agar market favorable direction me move karti hai, takay further gains capture kiye ja sake.

Trade Example Using the Thrusting Line Candlestick Pattern:

Chaliye ek example ke through samjhte hai ki thrusting line pattern ko trade kaise kiya jata hai. Sochiye market consistent downtrend me hai aur ek thrusting line pattern ban raha hai. Traders wait kar sakte hai ki agle candle bearish candle ke midpoint ke upar close ho jaane ke baad long trade me enter ho. Vo stop loss order bearish candle ki low ke neeche place karenge aur take profit target pehle resistance level pe set karenge. Traders closely trade ko monitor karenge aur stop loss ya take profit levels ko market progress ke hisaab se adjust karenge. Ye zaroori hai ki proper risk management aur confirmation dusre technical tools se hamesha dhyan me rakha jaaye jab thrusting line pattern trade kiya jaaye.

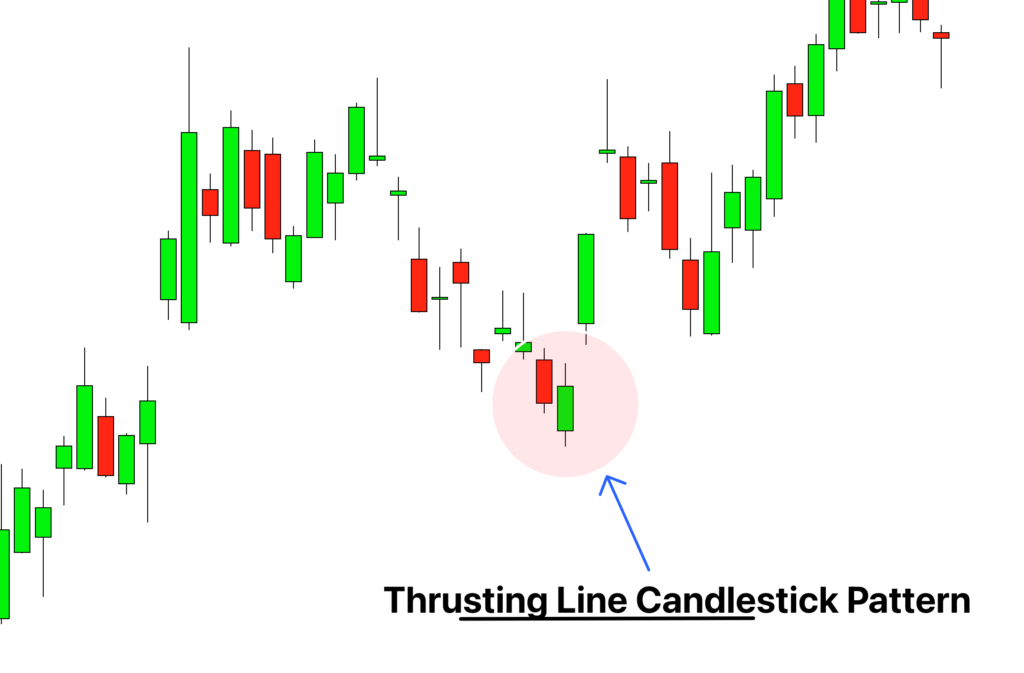

Thrusting line candlestick pattern forex market mein chal rahe downtrend ke dauran hone wala ek takatwar reversal pattern hota hai. Ye pattern do consecutive candlestickska mil kar banta hai: ek bearish candle, jisme typically bada size aur lamba body hota hai, jo strong selling pressure ko darshata hai, aur ek bullish candle, jo pehle candle ke close se neeche khulta hai, lekin bearish candle ki body ka midpoint se oopar close karta hai. Isse samajh me aata hai ki despite initial selling pressure, buyers ne prices ko upar push kar liya hai.

Interpretation of the Thrusting Line Candlestick Pattern:

Thrusting line pattern yeh dikhata hai ki buyers takatwar ho rahe hai aur current downtrend ko reverse kar sakte hai. Jab yeh pattern banata hai, toh iska matlab hai ki selling pressure khatam hone wala hai aur buyers aa rahe hai. Lekin trading decisions lene se pehle dusre technical indicators aur price action confirmation ko bhi dhyan me rakhna zaroori hai.

Confirmation and Filtering Factors for the Thrusting Line Candlestick Pattern:

Thrusting line pattern ko trade karne se pehle confirmation ka intezar karna zaroori hai. Traders often aur technical tools aur patterns ka istemaal karte hai thrusting line signal ko validate karne ke liye. For example, traders bullish candlestick patterns ko dekh sakte hai, jaise bullish engulfing ya piercing patterns, jo reversal ko confirm karte hai. Additionally, traders technical indicators jaise moving averages aur trendlines ka istemaal karte hai pattern ki validity ko confirm karne ke liye.

Stop Loss Placement and Take Profit Targets for the Thrusting Line Candlestick Pattern:

Thrusting line pattern trade karte waqt sahi risk management measures ko set karna zaroori hai. Aam taur par stop loss order bearish candlestick ki low ke neeche place kiya jata hai, jisse market volatility ke liye ek chota buffer ho. Take profit targets ke liye, traders aksar previous support ya resistance levels ko exit points ke taur par use karte hai. Additionally, traders trailing stops ka istemaal kar sakte hai agar market favorable direction me move karti hai, takay further gains capture kiye ja sake.

Trade Example Using the Thrusting Line Candlestick Pattern:

Chaliye ek example ke through samjhte hai ki thrusting line pattern ko trade kaise kiya jata hai. Sochiye market consistent downtrend me hai aur ek thrusting line pattern ban raha hai. Traders wait kar sakte hai ki agle candle bearish candle ke midpoint ke upar close ho jaane ke baad long trade me enter ho. Vo stop loss order bearish candle ki low ke neeche place karenge aur take profit target pehle resistance level pe set karenge. Traders closely trade ko monitor karenge aur stop loss ya take profit levels ko market progress ke hisaab se adjust karenge. Ye zaroori hai ki proper risk management aur confirmation dusre technical tools se hamesha dhyan me rakha jaaye jab thrusting line pattern trade kiya jaaye.

تبصرہ

Расширенный режим Обычный режим