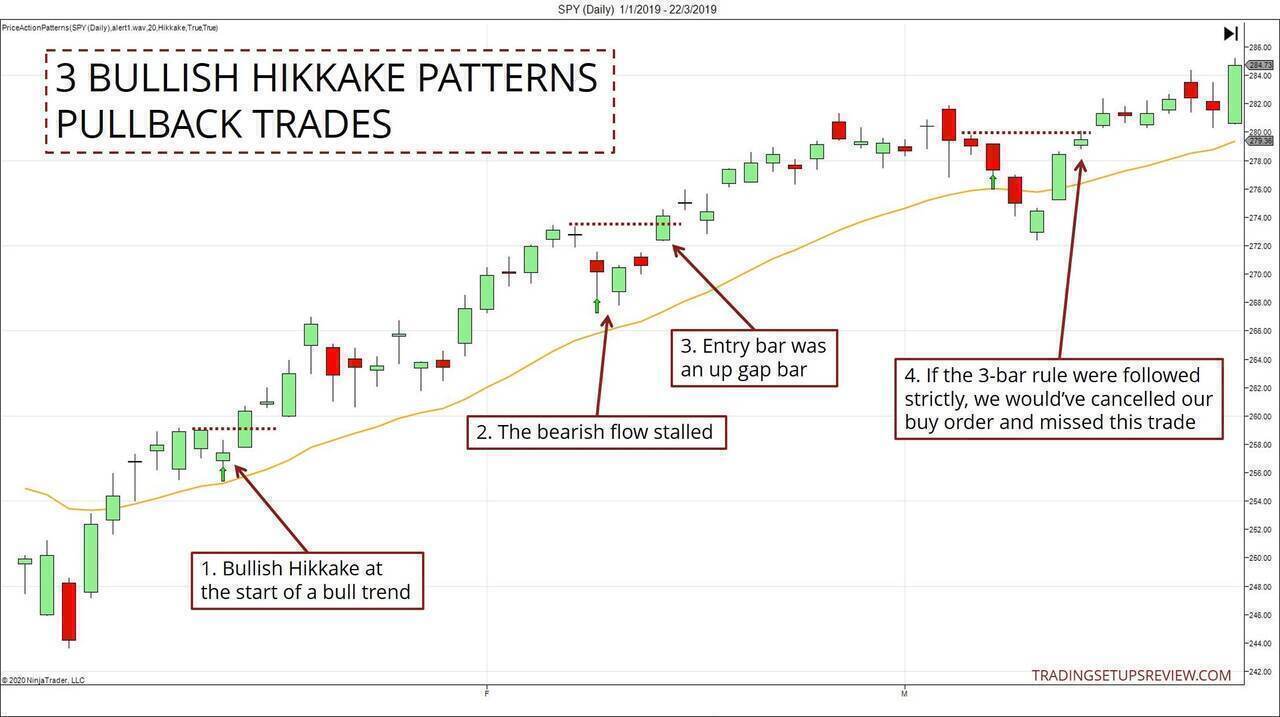

Hikkake pattern ek price action pattern hai jo trend reversal ko identify karne ke liye istemal hota hai. Yeh pattern traders ko confirmations aur risk management ke liye madad karta hai.

Jab hikkake pattern form hota hai, traders ko confirmation ke liye kuch factors consider karne chahiye:

- Pattern Formation: Hikkake pattern mein typically do ya zyada consecutive candles hote hain jinke highs aur lows ek specific range mein hoti hain. Ek initial candle form hoti hai, jo ek small range mein trade karti hai, aur phir ek follow-up candle aati hai jo initial range ko break karti hai lekin phir se uske andar re-enter ho jati hai.

- Candlestick Confirmation: Hikkake pattern ke formation ke saath, traders candlestick patterns ya indicators ka istemal karke confirmation ke liye dekhte hain. Jaise ki bullish ya bearish engulfing patterns, RSI, ya MACD ke signals.

- Volume Analysis: Volume ki bhi analysis ki jati hai, kyun ke hikkake pattern ke formation ke waqt volume ka bhi consideration hota hai. Agar pattern ke formation ke samay volume increase hota hai, toh usse confirm kiya ja sakta hai.

Risk management ke liye, traders hikkake pattern ke baad stop loss aur target levels set karte hain. Stop loss ko usually pattern ke against ke breakout ke thode se points neeche rakha jata hai takay agar trade ulta chala gaya toh loss minimize ho sake. Target levels ko bhi set kiya jata hai pattern ke opposite direction mein.

Hikkake pattern ek helpful tool ho sakta hai, lekin zaroori hai ki traders isse confirm karte hain aur saath hi risk management ko bhi dhyaan mein rakhte hain trade karne se pehle.

تبصرہ

Расширенный режим Обычный режим