Harami Candlestick Pattern Introduction:

Harami ek Japanese candlestick pattern hai jo ke potential trend reversal ko signal karta hai. Ismein do candles hote hain, jismein se ek choti candle purani badi candle mein puri tarah se ghus gayi hoti hai.

Harami Candlestick Pattern Samajhna:

Harami pattern market sentiment mein badalne ki nishani deta hai. Pehli candle mojood trend ko darust karti hai, jabke dusri, choti candle indecision ya possible reversal ko darust karti hai.

Harami Patterns Pehchanne Ka Tariqa:

Harami patterns ko pehchanne ke liye, ek badi candle ke baad ek choti ulte rang ki candle dhoondhein. Choti candle ka jism pehle wali candle ke range mein hona chahiye.

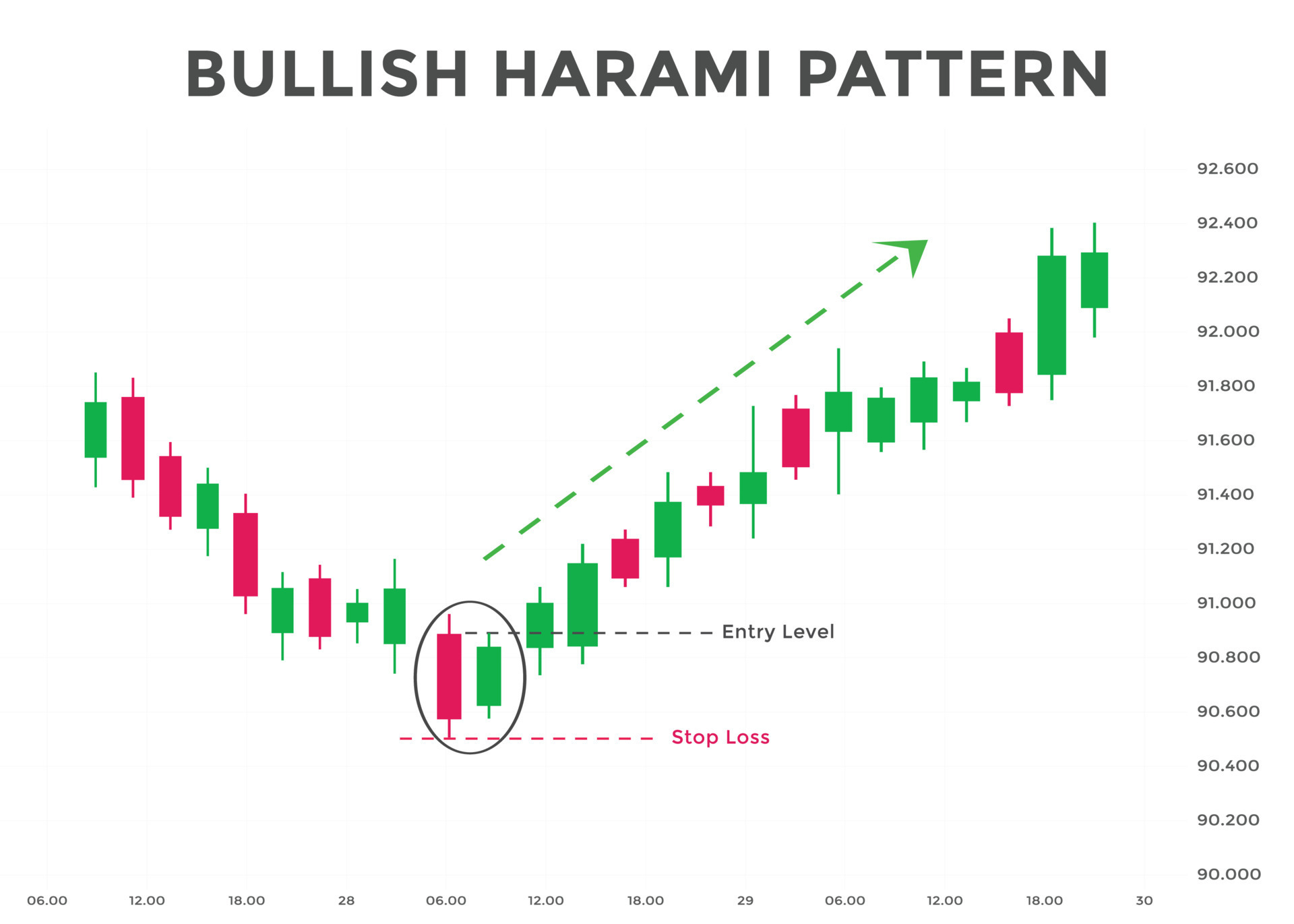

Bullish Harami: Trading Strategy:

Bullish Harami mein, pehli candle bearish hoti hai, jo ke ek choti bullish candle ke baad aati hai. Traders bullish confirmation ke baad khareedai karne ka soch sakte hain taake potential upar ki taraf chalne ko faida utha sakein.

Bearish Harami: Trading Approach:

Bearish Harami mein, pehli candle bullish hoti hai, jise ek choti bearish candle follow karti hai. Traders confirmation ke baad bechne ka soch sakte hain, umid hai ke potential neeche ka trend aayega.

Harami Patterns ke Confirmation Signals:

Harami patterns pe trade karne mein confirmation bahut zaroori hai. Traders aksar reversal ke confirmation ke liye teesri candle ka intezaar karte hain phir trade execute karte hain.

Harami Patterns ke Saath Risk Management:

Harami patterns ke basis par trade karte waqt sahi risk management bahut zaroori hai. Potential nuksan ko rokne ke liye stop-loss orders set karein.

Timeframe Considerations:

Harami patterns alag alag timeframes par dikhai dete hain. Traders ko ye assess karna chahiye ke unka trade ka timeframe kya hai aur pattern us par kitna significant hai.

Harami ko Other Indicators ke Saath Combine Karna:

Harami patterns ko doosre technical indicators ke saath combine karke trading decisions ko aur bhi behtar banaya ja sakta hai. Ye additional confirmation provide kar sakte hain aur successful trades ki probability ko bhi badha sakte hain.

Conclusion:

Harami candlestick patterns par trade karne ke liye pattern, confirmation signals, aur risk management ka gehra understanding hona zaroori hai. Ye tamaam factors milake informed aur strategic trading decisions mein madad karte hain.

Harami ek Japanese candlestick pattern hai jo ke potential trend reversal ko signal karta hai. Ismein do candles hote hain, jismein se ek choti candle purani badi candle mein puri tarah se ghus gayi hoti hai.

Harami Candlestick Pattern Samajhna:

Harami pattern market sentiment mein badalne ki nishani deta hai. Pehli candle mojood trend ko darust karti hai, jabke dusri, choti candle indecision ya possible reversal ko darust karti hai.

Harami Patterns Pehchanne Ka Tariqa:

Harami patterns ko pehchanne ke liye, ek badi candle ke baad ek choti ulte rang ki candle dhoondhein. Choti candle ka jism pehle wali candle ke range mein hona chahiye.

Bullish Harami: Trading Strategy:

Bullish Harami mein, pehli candle bearish hoti hai, jo ke ek choti bullish candle ke baad aati hai. Traders bullish confirmation ke baad khareedai karne ka soch sakte hain taake potential upar ki taraf chalne ko faida utha sakein.

Bearish Harami: Trading Approach:

Bearish Harami mein, pehli candle bullish hoti hai, jise ek choti bearish candle follow karti hai. Traders confirmation ke baad bechne ka soch sakte hain, umid hai ke potential neeche ka trend aayega.

Harami Patterns ke Confirmation Signals:

Harami patterns pe trade karne mein confirmation bahut zaroori hai. Traders aksar reversal ke confirmation ke liye teesri candle ka intezaar karte hain phir trade execute karte hain.

Harami Patterns ke Saath Risk Management:

Harami patterns ke basis par trade karte waqt sahi risk management bahut zaroori hai. Potential nuksan ko rokne ke liye stop-loss orders set karein.

Timeframe Considerations:

Harami patterns alag alag timeframes par dikhai dete hain. Traders ko ye assess karna chahiye ke unka trade ka timeframe kya hai aur pattern us par kitna significant hai.

Harami ko Other Indicators ke Saath Combine Karna:

Harami patterns ko doosre technical indicators ke saath combine karke trading decisions ko aur bhi behtar banaya ja sakta hai. Ye additional confirmation provide kar sakte hain aur successful trades ki probability ko bhi badha sakte hain.

Conclusion:

Harami candlestick patterns par trade karne ke liye pattern, confirmation signals, aur risk management ka gehra understanding hona zaroori hai. Ye tamaam factors milake informed aur strategic trading decisions mein madad karte hain.

:max_bytes(150000):strip_icc()/HaramiCross2-ef9838326287403e945931251cc6c05e.png)

تبصرہ

Расширенный режим Обычный режим