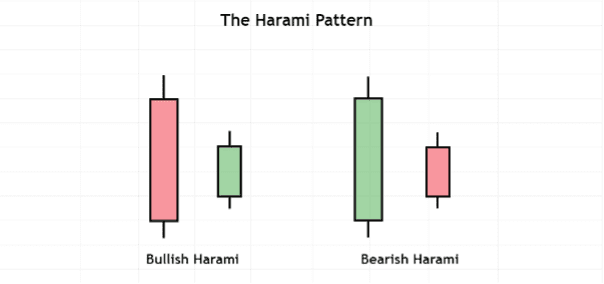

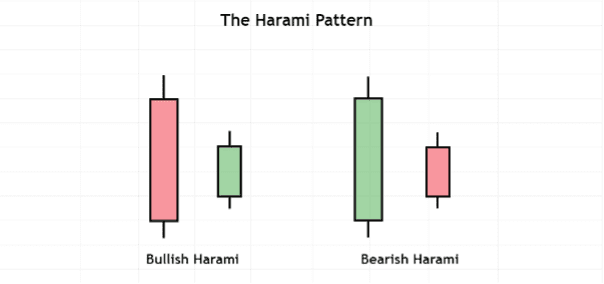

Harami candlestick pattern forex trading mein istemaal hone wala ek technical analysis tool hai jo market mein mukhtalif palatane ki pehchaan karne ke liye istemaal hota hai. Ye do-candle formation hoti hai jo ke downtrend ya uptrend mein nazar aati hai aur ek mumkin price reversal ko signal karti hai. Harami candlestick pattern do candles se bana hota hai, pehli candle lambi laal candle (jo bearish candle bhi kehlati hai) hoti hai jo market mein taqatwar selling pressure ko darust karti hai. Dusri candle, jo choti hoti hai aur iski body purani candle ki body mein puri tarah ghairat hai, ise harami candle kehte hain. Ye dusri candle darust karta hai ke khareedne wale market mein dakhil ho rahe hain aur prices ko upar le ja rahe hain, lekin abhi tak ye kafi taqatwar nahi hain ke bechne wale pressure ko hara sakein.

Formation of Harami Candlestick Pattern

Harami candlestick pattern ko ek mumkin price reversal ke tor par tabeer di jati hai kyun ke isse yeh ishara hota hai ke khareedne wale market mein pehle se kam price level par dakhil ho rahe hain jo ke is price level par support ho sakta hai, aur jab khareedne wale market mein dakhil hote hain, to woh prices ko upar le ja sakte hain. Harami candle ye bhi darust karta hai ke market mein kuch khareedne ki dabawat hai, jo ke ek uptrend ya kam az kam short-term price rally ki taraf ishara kar sakti hai.

Trading Strategies

Limitations of Harami Candlestick Pattern

Formation of Harami Candlestick Pattern

Harami candlestick pattern ko ek mumkin price reversal ke tor par tabeer di jati hai kyun ke isse yeh ishara hota hai ke khareedne wale market mein pehle se kam price level par dakhil ho rahe hain jo ke is price level par support ho sakta hai, aur jab khareedne wale market mein dakhil hote hain, to woh prices ko upar le ja sakte hain. Harami candle ye bhi darust karta hai ke market mein kuch khareedne ki dabawat hai, jo ke ek uptrend ya kam az kam short-term price rally ki taraf ishara kar sakti hai.

Trading Strategies

- Buy Entry: Agar harami candlestick pattern uptrend ke doran nazr aata hai, to ye ek mauqa ho sakta hai ke aap ek buy position mein dakhil ho. Stop-loss order dusri candle (harami candle) ki low ke neeche rakhna chahiye, aur take-profit order dusri candle (harami candle) ki high ke upar rakhna chahiye. Ye strategy harami candlestick pattern ke baad hone wale kisi bhi mumkin price rally se munafa uthane ki taraf maqsad rakhti hai.

- Sell Entry: Agar harami candlestick pattern downtrend ke doran nazr aata hai, to ye ek mauqa ho sakta hai ke aap ek sell position mein dakhil ho. Stop-loss order dusri candle (harami candle) ki high ke upar rakhna chahiye, aur take-profit order dusri candle (harami candle) ki low ke neeche rakhna chahiye. Ye strategy harami candlestick pattern ke baad hone wale kisi bhi mumkin price decline se munafa uthane ki taraf maqsad rakhti hai.

- Wait and See: Ek aur strategy ye hai ke harami candlestick pattern par amal karne se pehle tasdeeq ka intezar karna. Ye tasdeeq mukhtalif shaklon mein aasakti hai, jese ke resistance ya support level ka tootna, ya dusri candle (harami candle) se ek muqarar percentage ke parayayi hone ka pata chalna. Ye strategy harami candlestick pattern par amal karne se pehle tasdeeq ka intezar karke risk ko kam karne ki taraf maqsad rakhti hai.

- Combination with Other Indicators: Harami candlestick pattern ko doosre technical analysis indicators jese ke moving averages, oscillators, aur trend lines ke saath milakar uski fiqar aur etemaad ko barhane ke liye istemaal kiya ja sakta hai. Maslan, agar harami candlestick pattern kisi support ya resistance level ke qareeb ya oscillator par overbought ya oversold level par nazr aata hai, to isse ek zyada taqatwar price reversal hone ka ishara ho sakta hai.

Limitations of Harami Candlestick Pattern

- False Signals: Jese ke tamam technical analysis tools, harami candlestick pattern bhi market ki shor aur ghairat ke asarat ke bais galat signals dene ka imkan rakhta hai. Traders ko hamesha chahiye ke harami candlestick pattern par amal karne se pehle doosre technical analysis tools se kisi bhi mumkin price reversal ko tasdeeq karein.

- Market Conditions: Harami candlestick pattern ki efektivness market ki halat jese ke shorat, liquidity, aur trend ki taqat par mabni hoti hai. Traders ko hamesha ye factors madde nazar rakhne chahiye jab wo is pattern ko apne trading strategies mein istemaal karte hain.

- Timeframe: Forex charts ki tafseel se dakhliyat ke liye istemaal hone wale timeframe ka bhi asar harami candlestick pattern ki itminan ko mutassir kar sakta hai. Traders ko hamesha chahiye ke is pattern ko apne trading style aur maqasid ke liye iski fiqar aur etemaad ko barhane ke liye mukhtalif timeframes par test karein.

تبصرہ

Расширенный режим Обычный режим