Ek Technical Tijarat Ki Raushan Chamak

Tijarat aur hissa bazaar mein safalta haasil karne ke liye, investors ko market trends ko samajhna aur sahi waqt par sahi faislay lene ki zarurat hoti hai. Technical analysis, jisme chart patterns ka istemal hota hai, ek aham hissa hai is tajwez mein. "Subah Ki Taara Pattern" (Morning Star Pattern) ek aisa chart pattern hai jo aksar bullish reversal signal deta hai.

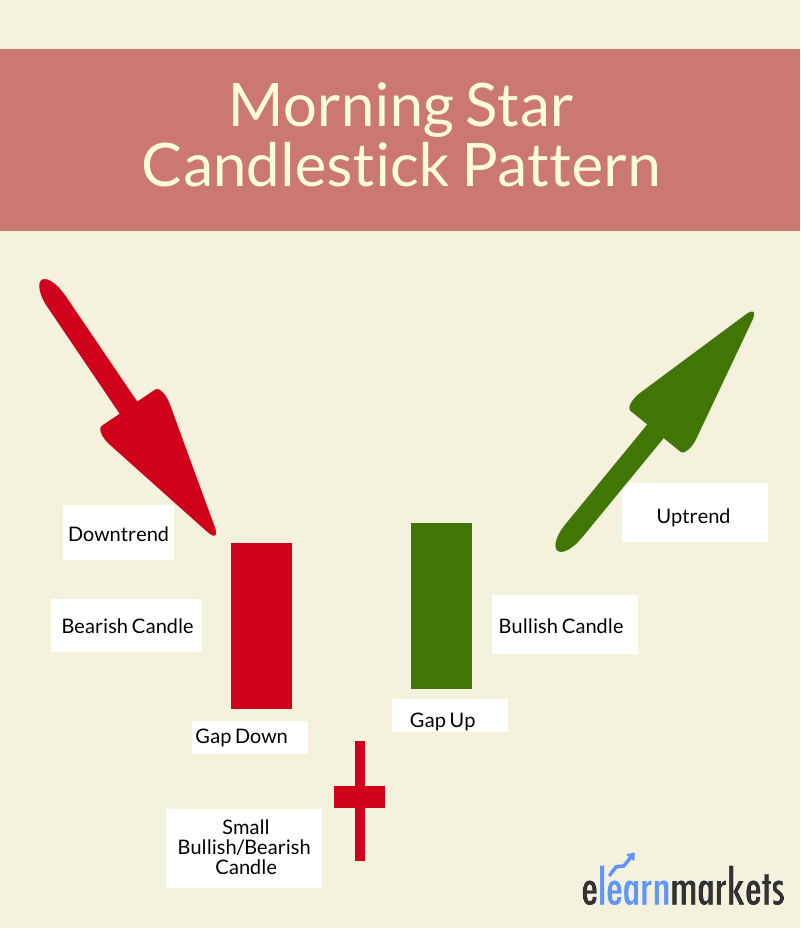

Subah Ki Taara Pattern, teji (bullish) aur mandi (bearish) phases ke darmiyan hone wale trend ko modificate karne ki salahiyat rakhta hai. Yeh pattern teen alag-alag candlesticks se bana hota hai aur aam taur par bearish trend ke baad aakar tezi ki shuruaat ko darust karta hai.

Pattern Ki Tashkeel:

Subah Ki Taara Pattern teen mukhtalif candlesticks se mil kar banta hai:

- Pehla Candlestick (Bearish): Subah Ki Taara Pattern ka pehla hissa ek lambi bearish candlestick hoti hai, jo dikhai dene wale trend ko represent karti hai.

- Dusra Candlestick (Indecision): Dusra candlestick chhota hota hai aur shayad doji ya spinning top ki shakal mein hota hai. Yeh candlestick market mein indecision ya uncertainty ko darust karta hai.

- Teesra Candlestick (Bullish): Teesra candlestick pehle do candlesticks ki taraf se aane wale pressure ko dikha kar bullish trend ko shuru karta hai. Yeh candlestick pehli candlestick ke neeche close ho sakta hai.

Trading Strategy:

Subah Ki Taara Pattern ko sahi dhang se pehchanna aur iska istemal karne ke liye kuch important points hain:

- Confirmation: Pattern ki tasdeek ke liye, traders ko intezaar karna chahiye ke teesra candlestick pehle do candlesticks ki range mein close ho.

- Volume: Trading volume ka bhi khayal rakhna important hai. Agar teesra candlestick high volume ke saath aata hai, toh yeh pattern aur bhi majboot hota hai.

- Dusre Indicators ke Saath Istemal: Subah Ki Taara Pattern ki tasdeek ke liye, dusre technical indicators jaise ki RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence) ka istemal bhi kiya ja sakta hai.

- Stop Loss Aur Target: Har trading strategy mein stop loss aur target levels ka tay karna zaroori hai taake nuksan ko control mein rakha ja sake aur faida hasil kiya ja sake.

Subah Ki Taara Pattern ek powerful reversal signal ho sakta hai, lekin har pattern ki tarah, iski bhi kuch limitations hain. Market mein hamesha risk hota hai, isliye har trading decision ko samajhdaari aur taawun se lena chahiye.

In conclusion, Subah Ki Taara Pattern ek aham technical indicator hai jo traders ko market trends mein hone wale changes ka pata lagane mein madad karta hai. Iska istemal sahi tarah se karne ke liye, traders ko market conditions ko dhyan se dekhna aur dusre indicators ka bhi istemal karna chahiye.

تبصرہ

Расширенный режим Обычный режим