Introduction to Evening Star Candlestick Pattern:

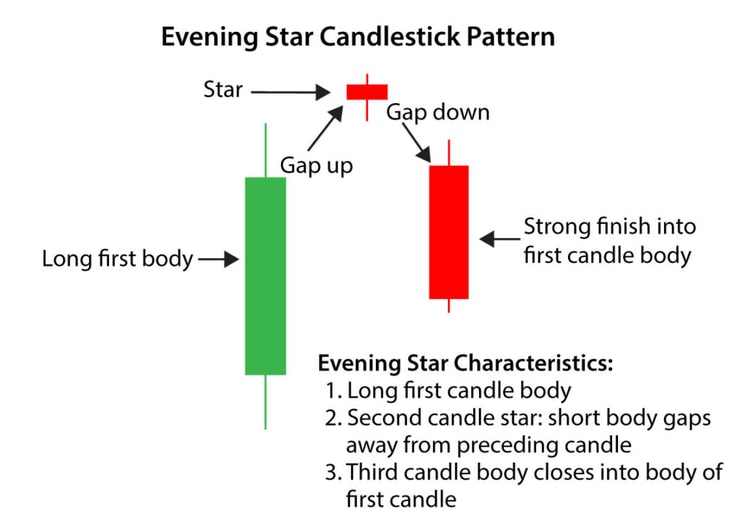

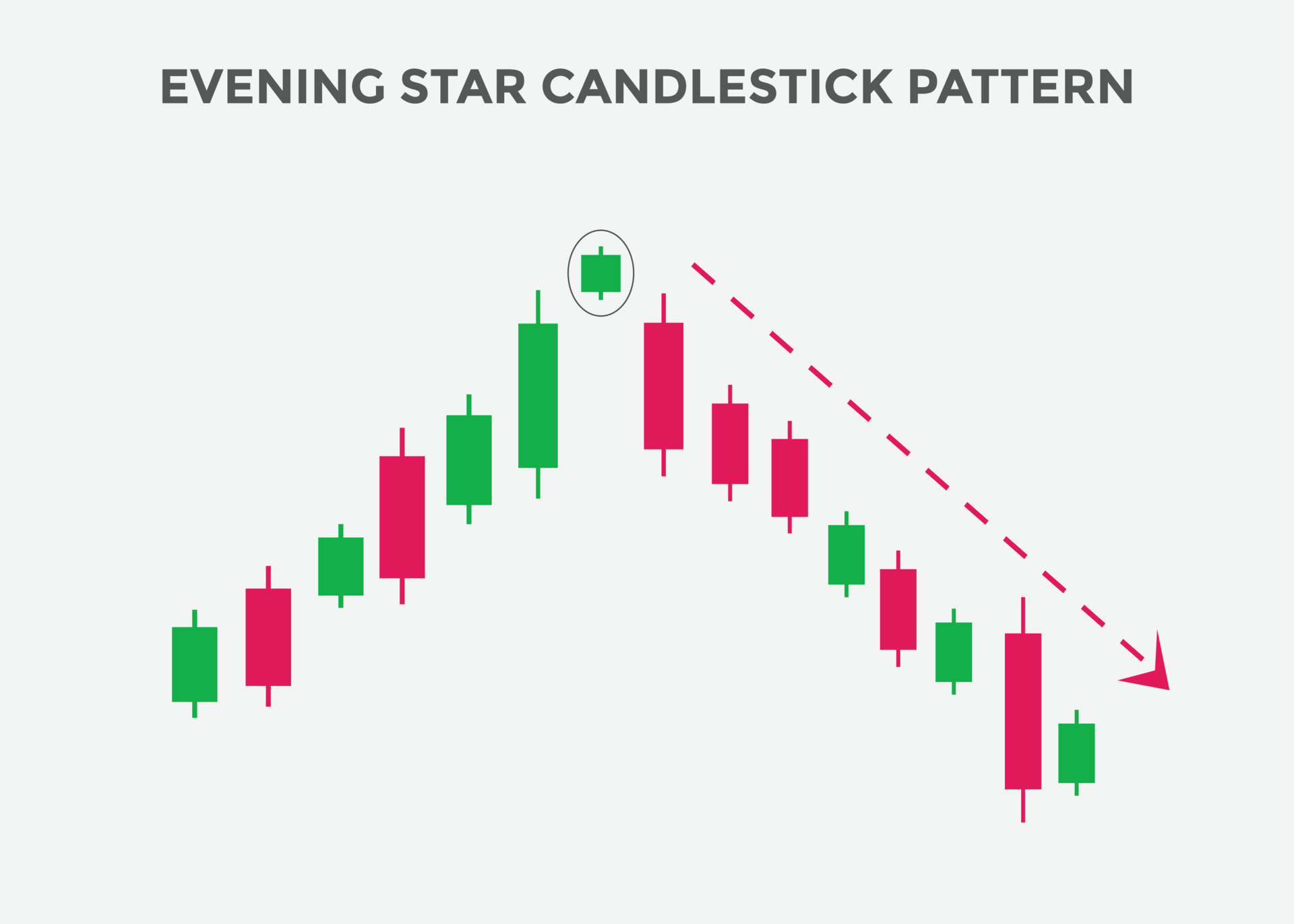

Evening Star forex trading mein aik mashoor aur mukammal candlestick pattern hai. Yeo akhri taraqqi ki aakhir meihai ke yeh uptrend ke akhiri hisse mein paida hota hai aur price mein ulttaqriban tamam users dwara istemal hua hai. Evening Star bearish reversal pattern hai, jis ka matlab hai ke ye uptrend ke akhir mein aur keemat ke ulat hone ki soorat mein paish aata hai. Is pattern mein teen candles shamil hoti hain: pehli candle ek large bullish candle hoti hai, dusri candle small-bodied hoti hai (ya toh bullish ya bearish) jo pehli candle ke close ke qareeb ya close ke qareeb open hoti hai, aur akhir mein, teesri candle bearish hoti hai jo pehli candle ke midpoint se neeche close hoti hai.

Understanding the Psychology behind the Evening Star Pattern:

Evening Star pattern ki ahmiyat samajhne ke liye, iske peeche mojood psychology ka samajhna zaroori hai. Ye pattern ek bullish se bearish ki taraf badalti hui sentiment ki numaindagi karta hai. Pehli candle mein, traders ke darmiyan taqatwar kharidari ka pressure aur umeed hoti hai, jis se keemat buland ho jati hai. Lekin dusri candle mein, maqami rayegan aur tashweesh ki wajah se market indecision aur uncertainty se guzar jati hai, jis se choti-bodied candle ban jati hai. Ye uptrend mein tehran aur kamzori ka ishara karta hai. Akhir mein, teesri candle mein traders ke darmiyan taqatwar farokhtari ka pressure aur mayoosi nazar aati hai, jis se pehli candle ke midpoint se neeche close hoti hai. Ye sentiment ki ulta phir se tasdeeq karta hai aur neechay ki taraf ek movement ke imkanat ko barha deta hai.

Confirmation and Entry Signals:

Jabki Evening Star pattern khud mein hi ek taqatwar ulte ki taraf hone ki nishani hai, lekin trade mein dakhil hone se pehle mazeed tasdeeqi signals ka intezar zaroori hai. Traders aksar support aur resistance levels, trendline breaks, ya anya technical indicators jaise moving averages ya oscillators ka istemal karte hain. Ye tasdeeqi signals pattern ki qabliyat ko mazeed behtar banate hain aur successful trade ke imkanat ko barha dete hain.

Importance of Volume in Evening Stars:

Volume Evening Star pattern ki tasdeeq ko mazboot karte hue ahmiyat rakhta hai. Behtar hai ke volume teesri bearish candle ke shakal mein barhta hai, jis se taqatwar farokhtari ka pressure nazar aata hai. Buland volume, amli market participants ke maujoodgi ki tasdeeq karta hai aur bearish sentiment ko mazboot karta hai. Lekin ahmiyat hai ke volume akele sufficient nahi hota hai, aur ise anya technical factors ke saath tafseel se tashrih karna chahiye.

Potential Profit Targets and Stop Loss Placement:

Profit targets aur stop-loss levels ka tayyar karna risk ko control aur potential munafa ko ziyada karna ke liye mayne rakhta hai jab Shaam ki Sitara pattern trade karne ki baat aati hai. Traders aksar technical analysis tools jaise Fibonacci retracements, support aur resistance levels, ya peechle swing highs aur lows ka istemal karte hain taqreeban potential profit targets ka pata lagane ke liye. Stop-loss levels teesri bearish candle ki high ke upar rakhe ja sakte hain, agar ulta tasdeeq na ho toh potential nuksan ko kam karne ke liye.

Ikhtitami tor par, Shaam ki Sitara candlestick pattern ki samajh forex traders ke liye ahmiyat rakhti hai kyun ke isse potential trend reversals ke baare mein qeemti wazahat milti hai. Pattern ke peeche psychology ka tajziya karte hue, iski tasdeeq karte hue.

Evening Star forex trading mein aik mashoor aur mukammal candlestick pattern hai. Yeo akhri taraqqi ki aakhir meihai ke yeh uptrend ke akhiri hisse mein paida hota hai aur price mein ulttaqriban tamam users dwara istemal hua hai. Evening Star bearish reversal pattern hai, jis ka matlab hai ke ye uptrend ke akhir mein aur keemat ke ulat hone ki soorat mein paish aata hai. Is pattern mein teen candles shamil hoti hain: pehli candle ek large bullish candle hoti hai, dusri candle small-bodied hoti hai (ya toh bullish ya bearish) jo pehli candle ke close ke qareeb ya close ke qareeb open hoti hai, aur akhir mein, teesri candle bearish hoti hai jo pehli candle ke midpoint se neeche close hoti hai.

Understanding the Psychology behind the Evening Star Pattern:

Evening Star pattern ki ahmiyat samajhne ke liye, iske peeche mojood psychology ka samajhna zaroori hai. Ye pattern ek bullish se bearish ki taraf badalti hui sentiment ki numaindagi karta hai. Pehli candle mein, traders ke darmiyan taqatwar kharidari ka pressure aur umeed hoti hai, jis se keemat buland ho jati hai. Lekin dusri candle mein, maqami rayegan aur tashweesh ki wajah se market indecision aur uncertainty se guzar jati hai, jis se choti-bodied candle ban jati hai. Ye uptrend mein tehran aur kamzori ka ishara karta hai. Akhir mein, teesri candle mein traders ke darmiyan taqatwar farokhtari ka pressure aur mayoosi nazar aati hai, jis se pehli candle ke midpoint se neeche close hoti hai. Ye sentiment ki ulta phir se tasdeeq karta hai aur neechay ki taraf ek movement ke imkanat ko barha deta hai.

Confirmation and Entry Signals:

Jabki Evening Star pattern khud mein hi ek taqatwar ulte ki taraf hone ki nishani hai, lekin trade mein dakhil hone se pehle mazeed tasdeeqi signals ka intezar zaroori hai. Traders aksar support aur resistance levels, trendline breaks, ya anya technical indicators jaise moving averages ya oscillators ka istemal karte hain. Ye tasdeeqi signals pattern ki qabliyat ko mazeed behtar banate hain aur successful trade ke imkanat ko barha dete hain.

Importance of Volume in Evening Stars:

Volume Evening Star pattern ki tasdeeq ko mazboot karte hue ahmiyat rakhta hai. Behtar hai ke volume teesri bearish candle ke shakal mein barhta hai, jis se taqatwar farokhtari ka pressure nazar aata hai. Buland volume, amli market participants ke maujoodgi ki tasdeeq karta hai aur bearish sentiment ko mazboot karta hai. Lekin ahmiyat hai ke volume akele sufficient nahi hota hai, aur ise anya technical factors ke saath tafseel se tashrih karna chahiye.

Potential Profit Targets and Stop Loss Placement:

Profit targets aur stop-loss levels ka tayyar karna risk ko control aur potential munafa ko ziyada karna ke liye mayne rakhta hai jab Shaam ki Sitara pattern trade karne ki baat aati hai. Traders aksar technical analysis tools jaise Fibonacci retracements, support aur resistance levels, ya peechle swing highs aur lows ka istemal karte hain taqreeban potential profit targets ka pata lagane ke liye. Stop-loss levels teesri bearish candle ki high ke upar rakhe ja sakte hain, agar ulta tasdeeq na ho toh potential nuksan ko kam karne ke liye.

Ikhtitami tor par, Shaam ki Sitara candlestick pattern ki samajh forex traders ke liye ahmiyat rakhti hai kyun ke isse potential trend reversals ke baare mein qeemti wazahat milti hai. Pattern ke peeche psychology ka tajziya karte hue, iski tasdeeq karte hue.

تبصرہ

Расширенный режим Обычный режим