Introduction to Dumpling Top Pattern:

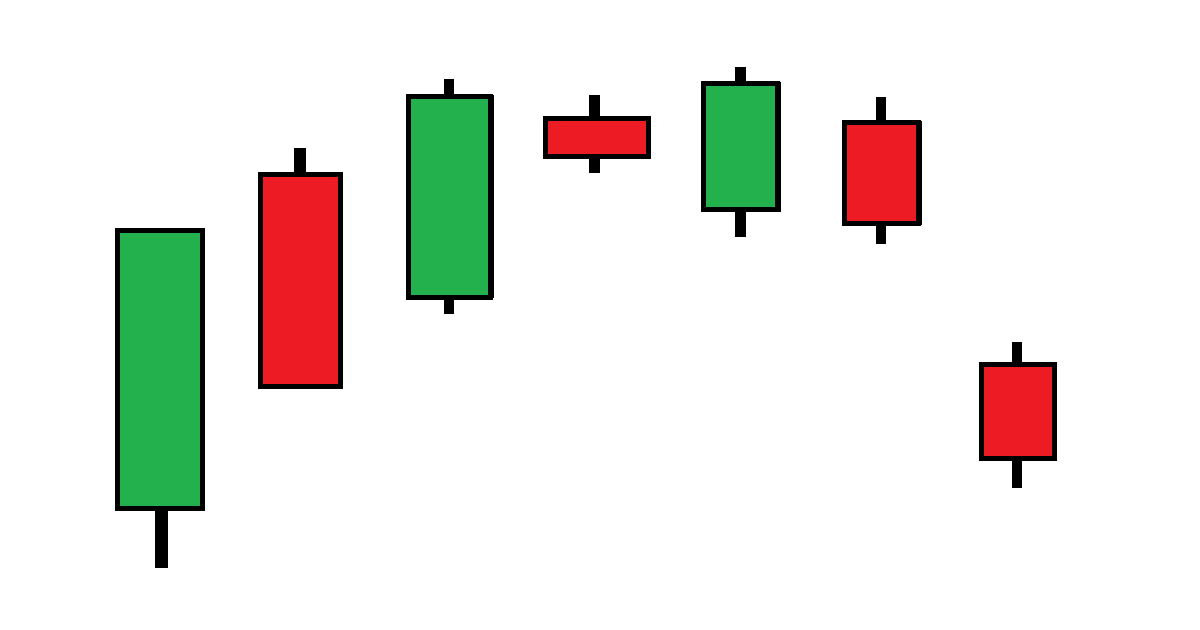

Dumplingchunche par pohanchny k baad temporary pullback hoti hai, jis se dumpling jaisi shakal banti hai. Ye bearish reversal pattern kaha jata hai kyunki ye aam taur par uptrend se downtrend ki potential trend reversal ko signal karta hai.

Dumpling Top Pattern tab banta hai jab price multiple peaks tak pohanchta hai, phir aik pullback hoti hai jo pehle ki peak se upar na nikal sakti hai. Is higher break ki kami bullish momentum ki kamzori aur market sentiment mein potential shift ko indicate karti hai. Traders aksar is pattern ki tasdeeq additional technical indicators aur price action signals ki madad se talash karte hain.

Identifying the Dumpling Top Pattern:

Dumpling Top Pattern ko pehchanne ke liye, traders ko price ke multiple peaks ki taraf dekhna hoga jo lagbhag ek hi level par hote hain aur jo aik horizontal ya thoda sa slope wala resistance line banate hain. Ye peaks ke baad temporary pullback hota hai jo pehle ke peak se upar na ja paye. Traders aksar trendlines ya moving averages ka istemaal karte hain pattern ko pehchanne aur confirm karne ke liye.

Confirmation and Entry Signals for dumpling top pattern:

Dumpling Top Pattern khud mein hi ek potential trend reversal ka strong indication ho sakta hai, lekin traders aksar trade mein dakhil hone se pehle aur confirm karne ke liye additional tasdeek signals talash karte hain. Aik aam tasdeek signal bearish candlestick pattern hai, jaise bearish engulfing ya shooting star, jo Dumpling Top Pattern ke ban jane ke baad banta hai. Dusre technical indicators, jaise Relative Strength Index (RSI) ya Moving Average Convergence Divergence (MACD), bhi bearish sentiment ko tasdeek karne ke liye istemaal kiye ja sakte hain.

Jab Dumpling Top Pattern tasdeek ho jaye, traders short position mein dakhil ho sakte hain aur stop-loss order ko thoda sa highest peak ke upar rakhte hain. Isse traders apna risk had se zyada badhne se bacha sakte hain agar price pattern ke upar break kare aur tezi se aage badhe.

Targets and Exit Strategies for dumpling top pattern:

Dumpling Top Pattern trade karte waqt, traders aksar maqsad set karte hain highest peak aur neckline ke darmiyan ke projected distance par, jo pullback lows ko jodne wala support level hota hai. Ye projection ki madad se traders potential price targets tay kar sakte hain jald hi aanewale downtrend ke liye.

Trade se bahar aane ki strategies mein, traders maqsad tak price pohanche ya agar strong bullish reversal signal ho jo pattern ko nakar deta hai, to trade se bahar nikal sakte hain. Trailing stop-loss orders bhi istemaal kiye ja sakte hain profit ko bachane aur agar downtrend jari rahe to mazeed faiday hasil karne ke liye.

Limitations and Considerations:

Dumpling Top Pattern potential trend reversal ki pehchan karne mein kisi bhi pattern ya indicator ki koi guarantee nahi hoti hai, isliye yeh zaroori hai ke traders hamesha dusre factors ko bhi dhyan mein rakhen, jaise market conditions, fundamental analysis aur overall risk management strategies, jab trading decisions le rahe hote hain.

Iske alawa, kisi bhi pattern ko trading strategy mein shaamil karne se pehle usko ache se backtest aur verify karna crucial hai. Alag alag market conditions alag alag results de sakte hain aur false signals bhi ho sakte hain. Traders ko multiple timeframes monitor karna chahiye aur dusre technical indicators ke saath cross-reference karke apne trading decisions ki accuracy ko behtar banane ki koshish karni chahiye.

Dumplingchunche par pohanchny k baad temporary pullback hoti hai, jis se dumpling jaisi shakal banti hai. Ye bearish reversal pattern kaha jata hai kyunki ye aam taur par uptrend se downtrend ki potential trend reversal ko signal karta hai.

Dumpling Top Pattern tab banta hai jab price multiple peaks tak pohanchta hai, phir aik pullback hoti hai jo pehle ki peak se upar na nikal sakti hai. Is higher break ki kami bullish momentum ki kamzori aur market sentiment mein potential shift ko indicate karti hai. Traders aksar is pattern ki tasdeeq additional technical indicators aur price action signals ki madad se talash karte hain.

Identifying the Dumpling Top Pattern:

Dumpling Top Pattern ko pehchanne ke liye, traders ko price ke multiple peaks ki taraf dekhna hoga jo lagbhag ek hi level par hote hain aur jo aik horizontal ya thoda sa slope wala resistance line banate hain. Ye peaks ke baad temporary pullback hota hai jo pehle ke peak se upar na ja paye. Traders aksar trendlines ya moving averages ka istemaal karte hain pattern ko pehchanne aur confirm karne ke liye.

Confirmation and Entry Signals for dumpling top pattern:

Dumpling Top Pattern khud mein hi ek potential trend reversal ka strong indication ho sakta hai, lekin traders aksar trade mein dakhil hone se pehle aur confirm karne ke liye additional tasdeek signals talash karte hain. Aik aam tasdeek signal bearish candlestick pattern hai, jaise bearish engulfing ya shooting star, jo Dumpling Top Pattern ke ban jane ke baad banta hai. Dusre technical indicators, jaise Relative Strength Index (RSI) ya Moving Average Convergence Divergence (MACD), bhi bearish sentiment ko tasdeek karne ke liye istemaal kiye ja sakte hain.

Jab Dumpling Top Pattern tasdeek ho jaye, traders short position mein dakhil ho sakte hain aur stop-loss order ko thoda sa highest peak ke upar rakhte hain. Isse traders apna risk had se zyada badhne se bacha sakte hain agar price pattern ke upar break kare aur tezi se aage badhe.

Targets and Exit Strategies for dumpling top pattern:

Dumpling Top Pattern trade karte waqt, traders aksar maqsad set karte hain highest peak aur neckline ke darmiyan ke projected distance par, jo pullback lows ko jodne wala support level hota hai. Ye projection ki madad se traders potential price targets tay kar sakte hain jald hi aanewale downtrend ke liye.

Trade se bahar aane ki strategies mein, traders maqsad tak price pohanche ya agar strong bullish reversal signal ho jo pattern ko nakar deta hai, to trade se bahar nikal sakte hain. Trailing stop-loss orders bhi istemaal kiye ja sakte hain profit ko bachane aur agar downtrend jari rahe to mazeed faiday hasil karne ke liye.

Limitations and Considerations:

Dumpling Top Pattern potential trend reversal ki pehchan karne mein kisi bhi pattern ya indicator ki koi guarantee nahi hoti hai, isliye yeh zaroori hai ke traders hamesha dusre factors ko bhi dhyan mein rakhen, jaise market conditions, fundamental analysis aur overall risk management strategies, jab trading decisions le rahe hote hain.

Iske alawa, kisi bhi pattern ko trading strategy mein shaamil karne se pehle usko ache se backtest aur verify karna crucial hai. Alag alag market conditions alag alag results de sakte hain aur false signals bhi ho sakte hain. Traders ko multiple timeframes monitor karna chahiye aur dusre technical indicators ke saath cross-reference karke apne trading decisions ki accuracy ko behtar banane ki koshish karni chahiye.

تبصرہ

Расширенный режим Обычный режим