Definition and Purpose of the Envelope Indicator in Forex:

Forex mein Envelope Indicator istemaal hota hai takay market mein entry aur exit points ka pehchaan kiya ja sake. Yeh do parallel lines hai jo price chart par moving average line ke upar aur neeche banaye jate hain. Envelope Indicator ka maqsad currency pair ke expected range ke andar price ka visual representation dene ka hai.

Upper band Envelope Indicator overbought zone ko represent karta hai jis se samjha jata hai ke price upper extreme of its expected range mein trade ho rahi hai. Waise hi lower band oversold zone ko represent karta hai jis se samjhaya jata hai ke price lower end of its expected range par trade ho rahi hai. Price aur Envelope bands ke beech ke interaction ko observe kar ke traders potential trend reversals aur entry/exit points ka pehchaan kar sakte hain.

Calculation of the Envelope Indicator:

Envelope Indicator simple moving average (SMA) par base karta hai jo price data se calculate hota hai. Trader moving average mein use hone wale periods aur upper aur lower bands plot karne ke liye percentage deviation ka parameter set kar sakta hai. For example, trader 20-period SMA aur 2% deviation level ka use kar sakta hai.

Upper band calculate karne ke liye, SMA ko percentage deviation ke sath multiply kiya jata hai, aur lower band ke liye, use 1 minus the percentage deviation. Iss tarah ke calculations se result values price chart par plot karke Envelope Indicator banaya jata hai.

Interpretation and Use of the Envelope Indicator:

Envelope Indicator primarily forex market mein overbought aur oversold conditions ka pehchaan karne ke liye istemaal hota hai. Jab price upper band approach karti hai ya use breach karti hai, yeh suggest karta hai ke currency pair overbought hai aur downward correction ka time aa gaya hai. Waise hi, jab price lower band ke aas paas hoti hai ya neeche gir jati hai, yeh indicate karta hai ke pair oversold hai aur upwards rebound hone ki possibility hai.

Traders price Envelope bands cross karne par potential trend reversals ki talash karte hain. For example, agar price upper band ko break kar leti hai, yeh bearish to bullish sentiment ka change signify kar sakta hai, jo ek buy signal provide karta hai. Waise hi, lower band ko break karna bullish to bearish sentiment ka change indicate kar sakta hai, jo sell signal provide karta hai.

Importance of Confirmation and Risk Management:

Although Envelope Indicator forex trading mein ek valuable tool hai, lekin important hai ke ise dusre technical indicators aur tools ke sath istemaal karke signals ko confirm kiya jaye aur risk ko manage kiya jaye. Traders additional indicators jaise oscillators aur trend-following tools ko analyze kar sakte hain, Envelope Indicator ke provide kiye gaye signals ko validate karne ke liye.

Mazeed, risk management Envelope Indicator ya kisi bhi dusre technical analysis tool ka istemaal karte waqt crucial hai. Traders ko apni positions ke khilaaf market ki movement ki possibility ko limit karne ke liye appropriate stop-loss orders set karna chahiye. Woh position sizing aur money management techniques bhi consider karna chahiye, takay unka trading capital protect ho sake.

Limitations and Considerations of the Envelope Indicator:

Jaise ki kisi bhi aur technical analysis tool ki tarah, Envelope Indicator ki bhi limitations hoti hain. Traders ke liye zaroori hai samajhna ke yeh infallible nahi hai aur ise dusre tools aur analysis techniques ke sath istemaal karna chahiye.

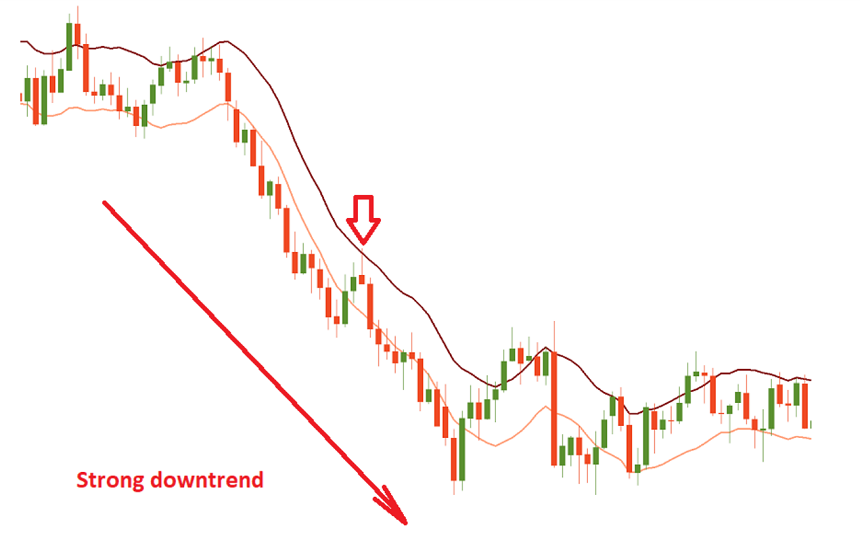

Additionally, Envelope Indicator trending markets mein acche performance nahi kar sakta hai, jahan price consistently upper aur lower bands ke upar ya neeche rehta hai. Iss liye zaroori hai ke Envelope Indicator ka istemaal prevailing market conditions ke mutabiq adapt kiya jaye.

Aakhir mein, Envelope Indicator forex trading mein ek qeemti tool hai jis se traders ko market mein potential entry aur exit points ke bare mein maloom hota hai. Is ke calculation, interpretation aur limitations ko samajh kar, traders iss indicator ko apni trading strategy ka hissa banakar asar andaz kar sakte hain.

Forex mein Envelope Indicator istemaal hota hai takay market mein entry aur exit points ka pehchaan kiya ja sake. Yeh do parallel lines hai jo price chart par moving average line ke upar aur neeche banaye jate hain. Envelope Indicator ka maqsad currency pair ke expected range ke andar price ka visual representation dene ka hai.

Upper band Envelope Indicator overbought zone ko represent karta hai jis se samjha jata hai ke price upper extreme of its expected range mein trade ho rahi hai. Waise hi lower band oversold zone ko represent karta hai jis se samjhaya jata hai ke price lower end of its expected range par trade ho rahi hai. Price aur Envelope bands ke beech ke interaction ko observe kar ke traders potential trend reversals aur entry/exit points ka pehchaan kar sakte hain.

Calculation of the Envelope Indicator:

Envelope Indicator simple moving average (SMA) par base karta hai jo price data se calculate hota hai. Trader moving average mein use hone wale periods aur upper aur lower bands plot karne ke liye percentage deviation ka parameter set kar sakta hai. For example, trader 20-period SMA aur 2% deviation level ka use kar sakta hai.

Upper band calculate karne ke liye, SMA ko percentage deviation ke sath multiply kiya jata hai, aur lower band ke liye, use 1 minus the percentage deviation. Iss tarah ke calculations se result values price chart par plot karke Envelope Indicator banaya jata hai.

Interpretation and Use of the Envelope Indicator:

Envelope Indicator primarily forex market mein overbought aur oversold conditions ka pehchaan karne ke liye istemaal hota hai. Jab price upper band approach karti hai ya use breach karti hai, yeh suggest karta hai ke currency pair overbought hai aur downward correction ka time aa gaya hai. Waise hi, jab price lower band ke aas paas hoti hai ya neeche gir jati hai, yeh indicate karta hai ke pair oversold hai aur upwards rebound hone ki possibility hai.

Traders price Envelope bands cross karne par potential trend reversals ki talash karte hain. For example, agar price upper band ko break kar leti hai, yeh bearish to bullish sentiment ka change signify kar sakta hai, jo ek buy signal provide karta hai. Waise hi, lower band ko break karna bullish to bearish sentiment ka change indicate kar sakta hai, jo sell signal provide karta hai.

Importance of Confirmation and Risk Management:

Although Envelope Indicator forex trading mein ek valuable tool hai, lekin important hai ke ise dusre technical indicators aur tools ke sath istemaal karke signals ko confirm kiya jaye aur risk ko manage kiya jaye. Traders additional indicators jaise oscillators aur trend-following tools ko analyze kar sakte hain, Envelope Indicator ke provide kiye gaye signals ko validate karne ke liye.

Mazeed, risk management Envelope Indicator ya kisi bhi dusre technical analysis tool ka istemaal karte waqt crucial hai. Traders ko apni positions ke khilaaf market ki movement ki possibility ko limit karne ke liye appropriate stop-loss orders set karna chahiye. Woh position sizing aur money management techniques bhi consider karna chahiye, takay unka trading capital protect ho sake.

Limitations and Considerations of the Envelope Indicator:

Jaise ki kisi bhi aur technical analysis tool ki tarah, Envelope Indicator ki bhi limitations hoti hain. Traders ke liye zaroori hai samajhna ke yeh infallible nahi hai aur ise dusre tools aur analysis techniques ke sath istemaal karna chahiye.

Additionally, Envelope Indicator trending markets mein acche performance nahi kar sakta hai, jahan price consistently upper aur lower bands ke upar ya neeche rehta hai. Iss liye zaroori hai ke Envelope Indicator ka istemaal prevailing market conditions ke mutabiq adapt kiya jaye.

Aakhir mein, Envelope Indicator forex trading mein ek qeemti tool hai jis se traders ko market mein potential entry aur exit points ke bare mein maloom hota hai. Is ke calculation, interpretation aur limitations ko samajh kar, traders iss indicator ko apni trading strategy ka hissa banakar asar andaz kar sakte hain.

تبصرہ

Расширенный режим Обычный режим