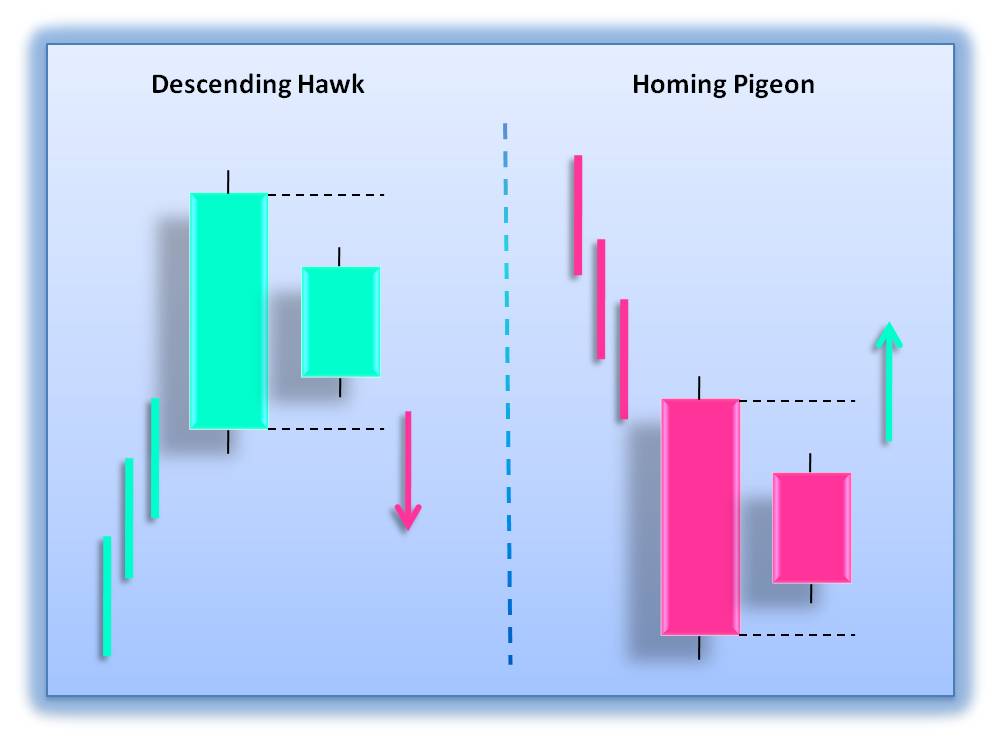

Introduction to the Descending Hawk Pattern:

Descending Hawk Pattern forex trading mein aik technical analysis chart pattern hai. Is pattern ka janam aam taur par lambi uptrend ke baad hota hai. Yah bearish reversal pattern hai. Is pattern ki pehchan hoti hai lower highs aur lower lows ki series, jo price chart par aik descending triangle jaisa structure banati hai. Is pattern ko traders ke liye ek bharosemand signal samjha jata hai, jisse woh short positions enter karke price ki potential downward movement se faida utha sakte hain.

Identifying the Descending Hawk Pattern:

Descending Hawk Pattern ko pehchanne ke liye traders ko in mukhya tathyon par dhyan dena chahiye:

1. Downtrend: Descending Hawk Pattern lambi uptrend ke baad hota hai. Yah potential trend reversal ko darshata hai, jab price lower lows aur lower highs banane lagti hai.

2. Lower highs: Is pattern ko decline kar rahe peaks ki series se vyakt kiya jata hai, jo kam hone wale buying pressure aur bechne wale pressure ki wajah se hota hai.

3. Lower lows: Lower highs ke saath saath, Descending Hawk Pattern price ke levels mein lagatar kami ko darshata hai, jisse show hota hai ki bears market par control hasil kar rahe hain.

4. Support aur resistance levels: Descending Hawk Pattern aam taur par ek well-defined support aur resistance zone ke andar banta hai, aur lower highs support level ko eventually touch karte hain aur ise break kar dete hain, jisse pattern ki bearishness confirm hoti hai.

Trading the Descending Hawk Pattern:

Descending Hawk Pattern ko trade karte waqt, traders aam taur par short positions enter karne ke avsar khojte hain, aur downward price movement ki umeed karte hain. Yahan kuch aam trading strategies hain, jinhe apply kiya ja sakta hai:

1. Breakout strategy: Traders Descending Hawk Pattern ke support level ke neeche price break hone par short position enter kar sakte hain. Yah breakout bearish momentum aur downtrend ki jari rakhne ki pushti karta hai.

2. Retracement strategy: Ek aur tariqa hai ki pattern formation ke baad price ka pullback ya retracement ka wait kiya jaye. Traders price ko key resistance level tak retrace hone par short position enter kar sakte hain, jisse favorable risk-to-reward ratio milta hai.

3. Confirmation indicators: Traders Descending Hawk Pattern ki validity aur strength ko confirm karne ke liye aksar technical indicators ka istemal karte hain. For example, unhe RSI aur MACD jaise oscillators par bearish signals ki talash ho sakti hai, ya volume indicators ko monitor karte hain, jahan bechne wale pressure mein izafa ka pata chalta hai.

Stop loss and take profit levels:

Risk ko effectively manage karne ke liye traders ko Descending Hawk Pattern trade karte waqt munasib stop loss aur take profit levels tay karna chahiye. Stop loss level ko descending trendline ya sabse haal hi mein hue swing high ke upar rakha jana chahiye, kyunki yeh potential resistance zones ki tarah kaam karte hain. Take profit level pichle downward move ki projected distance par ya key support level par set kiya ja sakta hai.

Limitations and considerations:

Descending Hawk Pattern bharosemand bearish reversal pattern ho sakta hai, lekin traders ko iske limitation aur aur factors ko apni analysis mein dhyan mein rakhna chahiye. Maslan, maujooda trend, volatility aur price ko prabhavit karne wale moolbhoot factors jaise market conditions ko account mein lene ka mahatva hai. Iske alawa, traders ko Descending Hawk Pattern ko dusre technical analysis tools aur indicators ke saath istemal karne se sahi bhavishyavani karne ki sambhavna ko badhane ke liye bhi sujhav diya jata hai.

Descending Hawk Pattern forex trading mein aik technical analysis chart pattern hai. Is pattern ka janam aam taur par lambi uptrend ke baad hota hai. Yah bearish reversal pattern hai. Is pattern ki pehchan hoti hai lower highs aur lower lows ki series, jo price chart par aik descending triangle jaisa structure banati hai. Is pattern ko traders ke liye ek bharosemand signal samjha jata hai, jisse woh short positions enter karke price ki potential downward movement se faida utha sakte hain.

Identifying the Descending Hawk Pattern:

Descending Hawk Pattern ko pehchanne ke liye traders ko in mukhya tathyon par dhyan dena chahiye:

1. Downtrend: Descending Hawk Pattern lambi uptrend ke baad hota hai. Yah potential trend reversal ko darshata hai, jab price lower lows aur lower highs banane lagti hai.

2. Lower highs: Is pattern ko decline kar rahe peaks ki series se vyakt kiya jata hai, jo kam hone wale buying pressure aur bechne wale pressure ki wajah se hota hai.

3. Lower lows: Lower highs ke saath saath, Descending Hawk Pattern price ke levels mein lagatar kami ko darshata hai, jisse show hota hai ki bears market par control hasil kar rahe hain.

4. Support aur resistance levels: Descending Hawk Pattern aam taur par ek well-defined support aur resistance zone ke andar banta hai, aur lower highs support level ko eventually touch karte hain aur ise break kar dete hain, jisse pattern ki bearishness confirm hoti hai.

Trading the Descending Hawk Pattern:

Descending Hawk Pattern ko trade karte waqt, traders aam taur par short positions enter karne ke avsar khojte hain, aur downward price movement ki umeed karte hain. Yahan kuch aam trading strategies hain, jinhe apply kiya ja sakta hai:

1. Breakout strategy: Traders Descending Hawk Pattern ke support level ke neeche price break hone par short position enter kar sakte hain. Yah breakout bearish momentum aur downtrend ki jari rakhne ki pushti karta hai.

2. Retracement strategy: Ek aur tariqa hai ki pattern formation ke baad price ka pullback ya retracement ka wait kiya jaye. Traders price ko key resistance level tak retrace hone par short position enter kar sakte hain, jisse favorable risk-to-reward ratio milta hai.

3. Confirmation indicators: Traders Descending Hawk Pattern ki validity aur strength ko confirm karne ke liye aksar technical indicators ka istemal karte hain. For example, unhe RSI aur MACD jaise oscillators par bearish signals ki talash ho sakti hai, ya volume indicators ko monitor karte hain, jahan bechne wale pressure mein izafa ka pata chalta hai.

Stop loss and take profit levels:

Risk ko effectively manage karne ke liye traders ko Descending Hawk Pattern trade karte waqt munasib stop loss aur take profit levels tay karna chahiye. Stop loss level ko descending trendline ya sabse haal hi mein hue swing high ke upar rakha jana chahiye, kyunki yeh potential resistance zones ki tarah kaam karte hain. Take profit level pichle downward move ki projected distance par ya key support level par set kiya ja sakta hai.

Limitations and considerations:

Descending Hawk Pattern bharosemand bearish reversal pattern ho sakta hai, lekin traders ko iske limitation aur aur factors ko apni analysis mein dhyan mein rakhna chahiye. Maslan, maujooda trend, volatility aur price ko prabhavit karne wale moolbhoot factors jaise market conditions ko account mein lene ka mahatva hai. Iske alawa, traders ko Descending Hawk Pattern ko dusre technical analysis tools aur indicators ke saath istemal karne se sahi bhavishyavani karne ki sambhavna ko badhane ke liye bhi sujhav diya jata hai.

تبصرہ

Расширенный режим Обычный режим