Introduction to Spike Candlestick Pattern:

Spike candlestick pattern forex trading mein istemaal hone wala aik taqatwar technical indicator hai jo market ki mukhtalif reversals ko pehchaanay mein madad deta hai. Is mein aik aise candlestick hoti hai jis ka upper ya lower wick behtareen tor par lambi hoti hai, jo tezi se hone wali price movement ko darshaati hai.

Ye pattern aam taur par market sentiment mein aik significant tabdeeli ka ishara samjha jata hai. Jab kisi spike candlestick ka tashkeel banta hai, to ye ishara deta hai ke traders ne currency pair ko taaqat se kharid ya bech diya hai, jis ki wajah se price mein tashkeel paida hoti hai. Is sudden tabdeeli se mojooda trend ki mukhalif taraf ka rukh ya naya trend shuru ho sakta hai.

Types of Spike Candlestick Patterns:

Spike candlestick patterns ke do qisim hote hain: bullish spike aur bearish spike.

Bullish spike tab paida hoti hai jab tashkeel ki opening price tashkeel ki closing price se kam hoti hai, jis se lamba lower wick banta hai. Ye ishara deta hai ke buyers ne currency pair taaqat se kharida hai, jis se price ko ooper le gayi hai. Bullish spike ek potential reversal ko downtrend se uptrend ki taraf indicate kar sakti hai.

Dosri taraf, bearish spike tab banati hai jab tashkeel ki opening price tashkeel ki closing price se zyada hoti hai, jis se lamba upper wick banta hai. Ye ishara deta hai ke sellers ne currency pair taaqat se becha hai, jis se price ko neeche le gayi hai. Bearish spike ek potential reversal ko uptrend se downtrend ki taraf indicate kar sakti hai.

Importance of Spike Candlestick Patterns:

Spike candlestick patterns forex traders ke liye aham hote hain kyunki ye potential reversals ya trend continuations ke clear aur fori signals provide karte hain. Traders in patterns ka istemaal kar ke informed trading decisions le sakte hain aur apne munafa ko zyada kar sakte hain.

Jab spike candlestick pattern tashkeel banata hai, to ye ishara deta hai ke market sentiment mein aik significant tabdeeli hui hai. Traders is tabdeeli ka faida utha ke us rukh mein trade enter kar sakte hain, umeed karte hue ke price wo hi rukh par chalay ga. Is ke sath hi, traders spike candlestick patterns ko apni existing strategies ya indicators ki tasdeeq ke liye bhi istemaal kar sakte hain.

Identifying and Trading Spike Candlestick Patterns:

Spike candlestick pattern ki pehchan karne ke liye, traders ko candles ko dekh kar lambi upper ya lower wicks ko candle ke body ke hawale se dekhna chahiye. Jitna lamba wick hoga, utni zyada significant price movement hoga.

Jab spike candlestick pattern pehchan jaye, to traders apni pasandeeda trading strategy ke hisaab se trade enter kar sakte hain. Kuch traders tashkeel banne par hi trade enter karna chahenge, jabke kuch wait kar sakte hain dusre technical indicators ya candlestick patterns ki additional tasdeeq ke liye.

Risk management spike candlestick patterns ki trading mein bohat aham hoti hai. Traders ko apni potential nuqsaan ko limit karne ke liye stop-loss orders set karna chahiye, agar price anay wale reversals se ummid se berhawashta ho jaye. Is ke sath hi, overall market conditions ko acchi tarah se analyze karna aur dusre factors ko bhi madde nazar rakhte hue trading decisions lena zaroori hai spike candlestick patterns par hi bharosa kar ke.

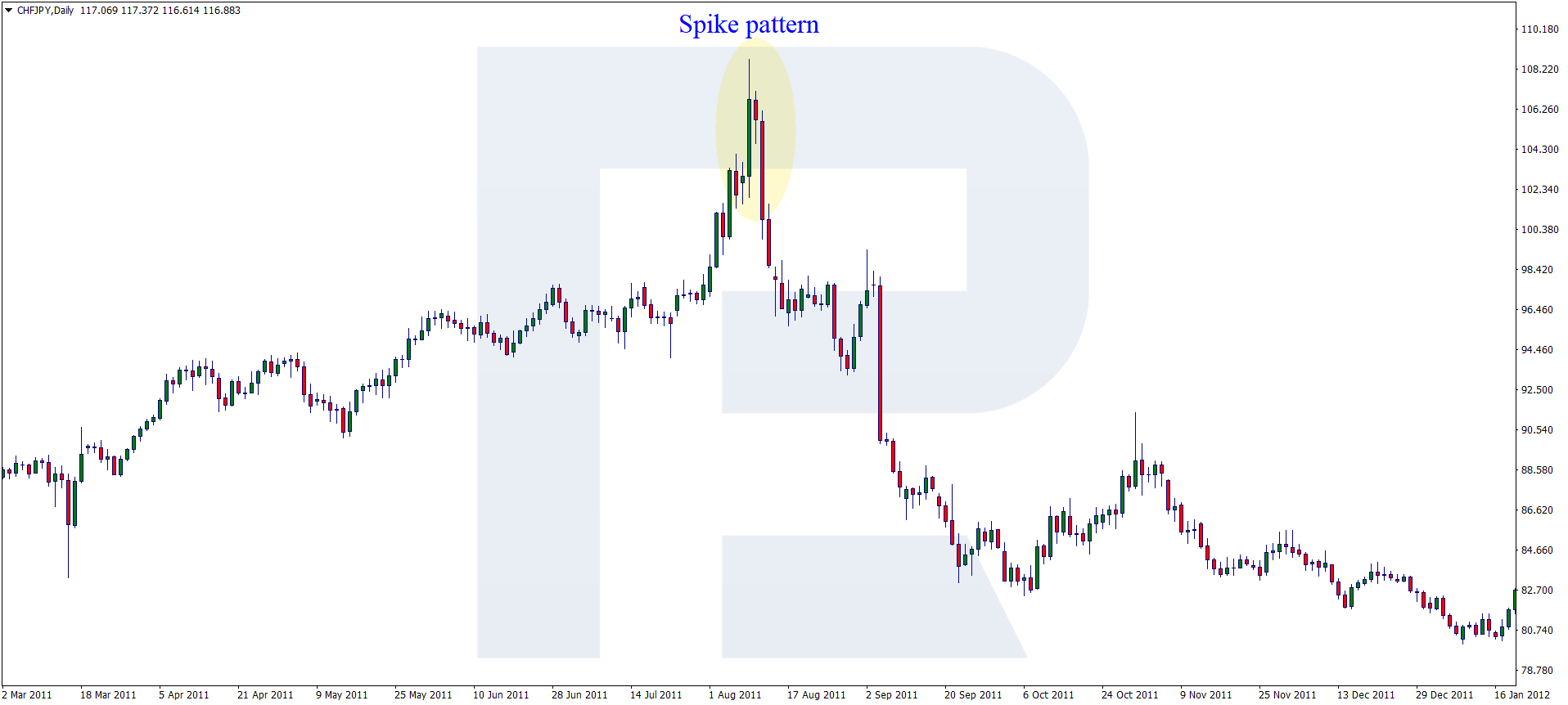

Examples of Spike Candlestick Patterns:

Yahan spike candlestick patterns ke misalain hain:

1. Bullish Spike: Lambi lower wick aur chota jism wala candlestickhai. Ye ishara karta hai ke khareedne wale ne qeemat ko tezi se badhaya hai, jis se yeh ishara hota hai ke market ka trend neechay se upar jane ki sambhavna hai.

2. Bearish Spike: Lambi upper wick aur chota jism wala candlestick hai. Iska matlab hai ke bechna chahte wale ne qeemat ko tezi se kam kar diya hai, jis se yeh ishara hota hai ke market ka trend upar se neechay jane ki sambhavna hai.

Ye dono patterns forex traders dwara potential trend reversals ya fir continuations ki pehchan karne aur munafa-dene wale trading decisions lene ke liye istemal kiye ja sakte hain. Trading signals ki accuracy badhane ke liye spike candlestick patterns ko dusre technical indicators aur analysis ke saath combine karna mahatvapurna hai.

Spike candlestick pattern forex trading mein istemaal hone wala aik taqatwar technical indicator hai jo market ki mukhtalif reversals ko pehchaanay mein madad deta hai. Is mein aik aise candlestick hoti hai jis ka upper ya lower wick behtareen tor par lambi hoti hai, jo tezi se hone wali price movement ko darshaati hai.

Ye pattern aam taur par market sentiment mein aik significant tabdeeli ka ishara samjha jata hai. Jab kisi spike candlestick ka tashkeel banta hai, to ye ishara deta hai ke traders ne currency pair ko taaqat se kharid ya bech diya hai, jis ki wajah se price mein tashkeel paida hoti hai. Is sudden tabdeeli se mojooda trend ki mukhalif taraf ka rukh ya naya trend shuru ho sakta hai.

Types of Spike Candlestick Patterns:

Spike candlestick patterns ke do qisim hote hain: bullish spike aur bearish spike.

Bullish spike tab paida hoti hai jab tashkeel ki opening price tashkeel ki closing price se kam hoti hai, jis se lamba lower wick banta hai. Ye ishara deta hai ke buyers ne currency pair taaqat se kharida hai, jis se price ko ooper le gayi hai. Bullish spike ek potential reversal ko downtrend se uptrend ki taraf indicate kar sakti hai.

Dosri taraf, bearish spike tab banati hai jab tashkeel ki opening price tashkeel ki closing price se zyada hoti hai, jis se lamba upper wick banta hai. Ye ishara deta hai ke sellers ne currency pair taaqat se becha hai, jis se price ko neeche le gayi hai. Bearish spike ek potential reversal ko uptrend se downtrend ki taraf indicate kar sakti hai.

Importance of Spike Candlestick Patterns:

Spike candlestick patterns forex traders ke liye aham hote hain kyunki ye potential reversals ya trend continuations ke clear aur fori signals provide karte hain. Traders in patterns ka istemaal kar ke informed trading decisions le sakte hain aur apne munafa ko zyada kar sakte hain.

Jab spike candlestick pattern tashkeel banata hai, to ye ishara deta hai ke market sentiment mein aik significant tabdeeli hui hai. Traders is tabdeeli ka faida utha ke us rukh mein trade enter kar sakte hain, umeed karte hue ke price wo hi rukh par chalay ga. Is ke sath hi, traders spike candlestick patterns ko apni existing strategies ya indicators ki tasdeeq ke liye bhi istemaal kar sakte hain.

Identifying and Trading Spike Candlestick Patterns:

Spike candlestick pattern ki pehchan karne ke liye, traders ko candles ko dekh kar lambi upper ya lower wicks ko candle ke body ke hawale se dekhna chahiye. Jitna lamba wick hoga, utni zyada significant price movement hoga.

Jab spike candlestick pattern pehchan jaye, to traders apni pasandeeda trading strategy ke hisaab se trade enter kar sakte hain. Kuch traders tashkeel banne par hi trade enter karna chahenge, jabke kuch wait kar sakte hain dusre technical indicators ya candlestick patterns ki additional tasdeeq ke liye.

Risk management spike candlestick patterns ki trading mein bohat aham hoti hai. Traders ko apni potential nuqsaan ko limit karne ke liye stop-loss orders set karna chahiye, agar price anay wale reversals se ummid se berhawashta ho jaye. Is ke sath hi, overall market conditions ko acchi tarah se analyze karna aur dusre factors ko bhi madde nazar rakhte hue trading decisions lena zaroori hai spike candlestick patterns par hi bharosa kar ke.

Examples of Spike Candlestick Patterns:

Yahan spike candlestick patterns ke misalain hain:

1. Bullish Spike: Lambi lower wick aur chota jism wala candlestickhai. Ye ishara karta hai ke khareedne wale ne qeemat ko tezi se badhaya hai, jis se yeh ishara hota hai ke market ka trend neechay se upar jane ki sambhavna hai.

2. Bearish Spike: Lambi upper wick aur chota jism wala candlestick hai. Iska matlab hai ke bechna chahte wale ne qeemat ko tezi se kam kar diya hai, jis se yeh ishara hota hai ke market ka trend upar se neechay jane ki sambhavna hai.

Ye dono patterns forex traders dwara potential trend reversals ya fir continuations ki pehchan karne aur munafa-dene wale trading decisions lene ke liye istemal kiye ja sakte hain. Trading signals ki accuracy badhane ke liye spike candlestick patterns ko dusre technical indicators aur analysis ke saath combine karna mahatvapurna hai.

تبصرہ

Расширенный режим Обычный режим