Introduction to Peanut Pattern in Forex:

YeTechnical analysis mai istemal hone wala Peanut Pattern forex market mai aam taur par istemal kiya jata hai. Iska khaas feature yeh hai ki iske price movement ka shape peanut jaisa hota hai. Ye pattern un traders ke liye faydemand hota hai jo trend-following approach ka istemal karte hain. Isse unko pattern ke formation aur uske saath wale price action ke basis par potential entry aur exit points ka pata chalta hai.

Peanut Pattern tab banta hai jab price higher highs aur higher lows ki ek series experience karti hai aur phir uske baad ek tezi se reversal hota hai aur ek subsequent series of lower highs aur lower lows hoti hai. Isse ek peanut jaisa distinctive shape ban jata hai. Traders isko "bullish-to-bearish" ya "bearish-to-bullish" market transition ke roop mai refer karte hain.

Identifying the Peanut Pattern:

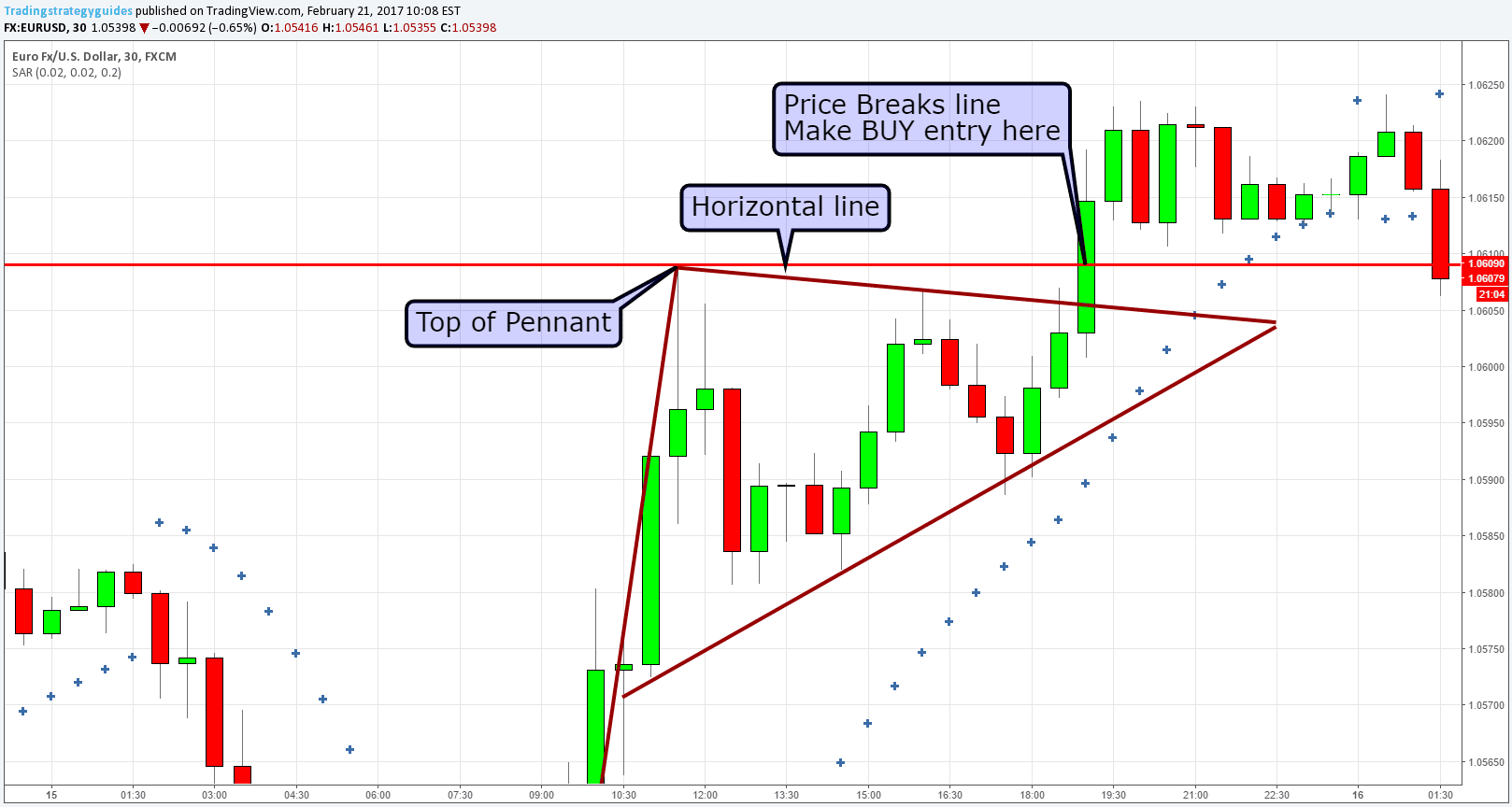

Peanut Pattern ko pehchanne ke liye traders ko price chart observe karna hota hai aur characteristic shape ko dhundhna hota hai. Iske liye higher highs aur higher lows ki series ko connect karne wale trendlines draw kiye jate hain aur phir lower highs aur lower lows ki series ko connect karne wale trendlines bhi draw kiye jate hain. Trendlines ko peanut ke shape banane ke liye converge kiya jata hai. Additionally, traders ko pattern ke formation ke dauran price action ko analyze karna hota hai uski validity ko confirm karne ke liye.

Trading with the Peanut Pattern:

Peanut Pattern ke saath trading karna potential entry aur exit points dhundhne par depend karta hai, jo pattern ke formation aur uske saath wale price action par base hota hai. Jab price pattern ke lower trendline se bahar nikalti hai, yeh ek potential short opportunity signal deti hai aur bearish trend reversal ko indicate karti hai. Vaise hi jab price upper trendline se bahar nikalti hai, yeh ek potential long opportunity signal deti hai aur bullish trend reversal ko indicate karti hai.

Traders apne short trade mai stop-loss orders ko pattern ke recent swing low se neeche place kar sakte hain aur long trade mai stop-loss orders ko pattern ke recent swing high ke upar place kar sakte hain. Isse risk ko manage kiya ja sakta hai aur potential losses ko limit kiya ja sakta hai agar price intended direction ke against reverse hota hai. Profit targets technical levels par set kiye jaa sakte hain, jaise ki previous support aur resistance areas, Fibonacci retracement levels, ya trendline projections.

Confirmation Tools for the Peanut Pattern:

Peanut Pattern ki reliability ko badhane ke liye, traders often additional confirmation tools ka istemal karte hain. Isme oscillators, jaise ki Relative Strength Index (RSI) ya Moving Average Convergence Divergence (MACD) shaamil ho sakte hain, jo overbought ya oversold conditions aur potential trend reversals ke insights provide kar sakte hain.

Additionally, traders candlestick patterns, jaise ki dojis ya engulfing patterns ko incorporate kar sakte hain, Peanut Pattern dwara di gayi reversal signals ko confirm karne ke liye. Yeh candlestick formations market sentiment ke valuable insights provide kar sakte hain aur trade ki chances ko increase kar sakte hain.

Risk Management and Trade Psychology with the Peanut Pattern:

Jaise ki kisi bhi trading strategy mai, risk management aur trade psychology Peanut Pattern ke saath trading karte waqt bahut mahatvapurna hai. Traders ko ek ek saath bahut zyada trading capital risk karne se bachna chahiye. Unko ek well-defined trading plan hona chahiye, jisme entry aur exit criteria, risk-reward ratios aur position sizing guidelines include ho.

Iske alawa, traders ke liye zaroori hai ki ve apne emotions ko control kare aur apne trading plan par qayam rahein, chahe market unke trade ke khilaaf chal raha ho. Ye kaam mushkil ho sakta hai, khaas karke jab trend reversals ki baat ho. Par, discipline aur sabra banaye rakhna traders ko sahi trading decisions lene aur impulsive aur emotional actions se bachne mein madad karti hai, jo nuksaan kar sakte hain.

Ant mein, Peanut Pattern forex market mein potential trend reversals ko pahchanne ke liye istemaal kiya jane wala ek technical analysis pattern hai. Is pattern ki formation ko observe karke aur saath hi saath price action ko analyze karke, traders potential entry aur exit points pahchan sakte hain. Confirmation tools ko shaamil karna aur sahi risk management aur trade psychology ki practice karna, Peanut Pattern ke saath trading karne ki effectiveness ko badha sakti hai. Isliye, traders ko is pattern ko samajhna aur apni trading strategy ka hissa banane ki aavashyakta hai.

YeTechnical analysis mai istemal hone wala Peanut Pattern forex market mai aam taur par istemal kiya jata hai. Iska khaas feature yeh hai ki iske price movement ka shape peanut jaisa hota hai. Ye pattern un traders ke liye faydemand hota hai jo trend-following approach ka istemal karte hain. Isse unko pattern ke formation aur uske saath wale price action ke basis par potential entry aur exit points ka pata chalta hai.

Peanut Pattern tab banta hai jab price higher highs aur higher lows ki ek series experience karti hai aur phir uske baad ek tezi se reversal hota hai aur ek subsequent series of lower highs aur lower lows hoti hai. Isse ek peanut jaisa distinctive shape ban jata hai. Traders isko "bullish-to-bearish" ya "bearish-to-bullish" market transition ke roop mai refer karte hain.

Identifying the Peanut Pattern:

Peanut Pattern ko pehchanne ke liye traders ko price chart observe karna hota hai aur characteristic shape ko dhundhna hota hai. Iske liye higher highs aur higher lows ki series ko connect karne wale trendlines draw kiye jate hain aur phir lower highs aur lower lows ki series ko connect karne wale trendlines bhi draw kiye jate hain. Trendlines ko peanut ke shape banane ke liye converge kiya jata hai. Additionally, traders ko pattern ke formation ke dauran price action ko analyze karna hota hai uski validity ko confirm karne ke liye.

Trading with the Peanut Pattern:

Peanut Pattern ke saath trading karna potential entry aur exit points dhundhne par depend karta hai, jo pattern ke formation aur uske saath wale price action par base hota hai. Jab price pattern ke lower trendline se bahar nikalti hai, yeh ek potential short opportunity signal deti hai aur bearish trend reversal ko indicate karti hai. Vaise hi jab price upper trendline se bahar nikalti hai, yeh ek potential long opportunity signal deti hai aur bullish trend reversal ko indicate karti hai.

Traders apne short trade mai stop-loss orders ko pattern ke recent swing low se neeche place kar sakte hain aur long trade mai stop-loss orders ko pattern ke recent swing high ke upar place kar sakte hain. Isse risk ko manage kiya ja sakta hai aur potential losses ko limit kiya ja sakta hai agar price intended direction ke against reverse hota hai. Profit targets technical levels par set kiye jaa sakte hain, jaise ki previous support aur resistance areas, Fibonacci retracement levels, ya trendline projections.

Confirmation Tools for the Peanut Pattern:

Peanut Pattern ki reliability ko badhane ke liye, traders often additional confirmation tools ka istemal karte hain. Isme oscillators, jaise ki Relative Strength Index (RSI) ya Moving Average Convergence Divergence (MACD) shaamil ho sakte hain, jo overbought ya oversold conditions aur potential trend reversals ke insights provide kar sakte hain.

Additionally, traders candlestick patterns, jaise ki dojis ya engulfing patterns ko incorporate kar sakte hain, Peanut Pattern dwara di gayi reversal signals ko confirm karne ke liye. Yeh candlestick formations market sentiment ke valuable insights provide kar sakte hain aur trade ki chances ko increase kar sakte hain.

Risk Management and Trade Psychology with the Peanut Pattern:

Jaise ki kisi bhi trading strategy mai, risk management aur trade psychology Peanut Pattern ke saath trading karte waqt bahut mahatvapurna hai. Traders ko ek ek saath bahut zyada trading capital risk karne se bachna chahiye. Unko ek well-defined trading plan hona chahiye, jisme entry aur exit criteria, risk-reward ratios aur position sizing guidelines include ho.

Iske alawa, traders ke liye zaroori hai ki ve apne emotions ko control kare aur apne trading plan par qayam rahein, chahe market unke trade ke khilaaf chal raha ho. Ye kaam mushkil ho sakta hai, khaas karke jab trend reversals ki baat ho. Par, discipline aur sabra banaye rakhna traders ko sahi trading decisions lene aur impulsive aur emotional actions se bachne mein madad karti hai, jo nuksaan kar sakte hain.

Ant mein, Peanut Pattern forex market mein potential trend reversals ko pahchanne ke liye istemaal kiya jane wala ek technical analysis pattern hai. Is pattern ki formation ko observe karke aur saath hi saath price action ko analyze karke, traders potential entry aur exit points pahchan sakte hain. Confirmation tools ko shaamil karna aur sahi risk management aur trade psychology ki practice karna, Peanut Pattern ke saath trading karne ki effectiveness ko badha sakti hai. Isliye, traders ko is pattern ko samajhna aur apni trading strategy ka hissa banane ki aavashyakta hai.

تبصرہ

Расширенный режим Обычный режим