Introduction to Bollinger Bands:

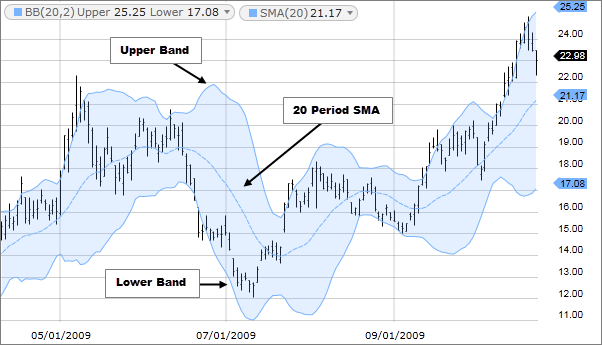

Bollinger Bands forex trading mein istemal hone wala aik popular technical analysis tool hai jismein volatility ko measure kia jata hai aur potential price reversals ko identify ksakte hain. Yeh price chart par teen lines se banayi jati hain: beech mein aik simple moving average (SMA) aur ooper aur neechay wale band jo price volatility ki standard deviation ko show karte hain. Ooper wala band SMA mein ek khas number of standard deviations add kar ke calculate kiya jata hai, jab ke neechay wala band usi number of standard deviations ko subtract kar ke calculate kiya jata hai. Bands ke beech ki width market volatility ke mutabiq dynamically adjust hoti hai, jis se traders ko bands ko alag-alag market conditions mein interpret karne ki suvidha milti hai.

Using Bollinger Bands to Identify Trend:

Bollinger Bands ka aik mukhtasar istemal market trend ka pata lagane aur identify karne ke liye hota hai. Jab price up trend mein hoti hai, to wo ooper wale band ke kareeb rehti hai, jab ke downtrend mein wo neechay wale band ke kareeb rehti hai. Traders price aur bands ke beech ke relationship ko observe kar ke trend ki strength aur sustainability ko determine kar sakte hain. Agar price consistently ooper wale band ko touch karta hai ya usse bahar rehta hai, to yeh overbought condition indicate kar sakta hai, jis se reversal ya correction ka potential hota hai. Waise hi, agar price consistently neechay wale band ko touch karta hai ya usse neechay rehta hai, to yeh oversold condition indicate kar sakta hai, jis se upside ki potential bounce ya reversal point hoti hai.

Bollinger Squeeze and Volatility Breakout:

Bollinger Bands ka ek aur mahatvapurna istemal Bollinger Squeeze aur uske baad wale volatility breakout mein hota hai. Jab market mein volatility low hoti hai, to ooper aur neechay wale bands ke beech ki distance narrow hoti hai, jis se price range contract hoti hai. Isko Bollinger Squeeze kehte hain, jo ek significant price move hone ke potential ko indicate karta hai. Traders often iss squeeze se breakout ki expectation rakhte hain, kyun ke yeh market mein pent-up energy ka release hone ka sanket deta hai. Ooper wale band se breakout ko bullish signal samjha jata hai, jab ke neechay wale band se breakout ko bearish consider kiya jata hai. Traders additional technical analysis tools, jaise candlestick patterns ya momentum indicators, ko use kar ke potential breakouts ko confirm kar sakte hain aur suitable trading positions le sakte hain.

Bollinger Bands and Support/Resistance Levels:

Bollinger Bands ko support aur resistance levels ko identify karne mein bhi istemal kiya ja sakta hai. Jab market uptrend mein hoti hai, to neechay wala band dynamic support level ki tarah kaam karta hai, jahan price ki buying interest expect ki jati hai. Waise hi, jab market downtrend mein hoti hai, to ooper wala band dynamic resistance level ke tarah function karta hai, jahan price ko selling pressure ka samna karna padta hai. Traders in levels ka istemal kar ke trades enter ya exit kar sakte hain aur stop-loss orders set kar sakte hain. Bollinger Bands ko saath mein aur technical tools aur price action analysis ke saath combine karna zaroori hai, taake support aur resistance level identification ki accuracy mein izafa ho.

Bollinger Bands and Price Reversals:

Bollinger Bands achi tarah se potential price reversals ke baare mein interesting jaankari de sakte hain. Price reversals tab hotey hain jab price overbought ya oversold condition se mean ki taraf move karti hai, jo ki middle SMA line dwara represent kiya jata hai. Reversal signals tab pta chalte hain jab price middle SMA se upar ya neeche se cross karti hai, jo market sentiment main badlav ka sanket hai. Traders candlestick patterns ya divergence indicators jaise dusre technical analysis tools ka istemal Bollinger Bands ke saath karke potential reversals ko confirm kar sakte hain aur apni trading strategy ko uske hisaab se adjust kar sakte hain.

Samaapti mein, Bollinger Bands ek versatile technical analysis tool hain jo market conditions ko analyze karne aur informed trading decisions lene ke liye various tareeko se istemal kiya ja sakta hai. Chahe woh trends ko pehchanne ho, breakouts ka anticipation karna ho, support aur resistance levels determine karna ho ya price reversals spot karna ho, Bollinger Bands traders ko valuable information dete hain apni analysis ko enhance karne aur trading success ko badhane ke liye. Halaanki, mahatvapurn hai ki koi indicator foolproof nahi hota, aur traders ko Bollinger Bands ko dusre forms of technical analysis aur risk management techniques ke saath istemal karna chahiye taki forex trading mein consistent profitability achieve ki jaa sake.

Bollinger Bands forex trading mein istemal hone wala aik popular technical analysis tool hai jismein volatility ko measure kia jata hai aur potential price reversals ko identify ksakte hain. Yeh price chart par teen lines se banayi jati hain: beech mein aik simple moving average (SMA) aur ooper aur neechay wale band jo price volatility ki standard deviation ko show karte hain. Ooper wala band SMA mein ek khas number of standard deviations add kar ke calculate kiya jata hai, jab ke neechay wala band usi number of standard deviations ko subtract kar ke calculate kiya jata hai. Bands ke beech ki width market volatility ke mutabiq dynamically adjust hoti hai, jis se traders ko bands ko alag-alag market conditions mein interpret karne ki suvidha milti hai.

Using Bollinger Bands to Identify Trend:

Bollinger Bands ka aik mukhtasar istemal market trend ka pata lagane aur identify karne ke liye hota hai. Jab price up trend mein hoti hai, to wo ooper wale band ke kareeb rehti hai, jab ke downtrend mein wo neechay wale band ke kareeb rehti hai. Traders price aur bands ke beech ke relationship ko observe kar ke trend ki strength aur sustainability ko determine kar sakte hain. Agar price consistently ooper wale band ko touch karta hai ya usse bahar rehta hai, to yeh overbought condition indicate kar sakta hai, jis se reversal ya correction ka potential hota hai. Waise hi, agar price consistently neechay wale band ko touch karta hai ya usse neechay rehta hai, to yeh oversold condition indicate kar sakta hai, jis se upside ki potential bounce ya reversal point hoti hai.

Bollinger Squeeze and Volatility Breakout:

Bollinger Bands ka ek aur mahatvapurna istemal Bollinger Squeeze aur uske baad wale volatility breakout mein hota hai. Jab market mein volatility low hoti hai, to ooper aur neechay wale bands ke beech ki distance narrow hoti hai, jis se price range contract hoti hai. Isko Bollinger Squeeze kehte hain, jo ek significant price move hone ke potential ko indicate karta hai. Traders often iss squeeze se breakout ki expectation rakhte hain, kyun ke yeh market mein pent-up energy ka release hone ka sanket deta hai. Ooper wale band se breakout ko bullish signal samjha jata hai, jab ke neechay wale band se breakout ko bearish consider kiya jata hai. Traders additional technical analysis tools, jaise candlestick patterns ya momentum indicators, ko use kar ke potential breakouts ko confirm kar sakte hain aur suitable trading positions le sakte hain.

Bollinger Bands and Support/Resistance Levels:

Bollinger Bands ko support aur resistance levels ko identify karne mein bhi istemal kiya ja sakta hai. Jab market uptrend mein hoti hai, to neechay wala band dynamic support level ki tarah kaam karta hai, jahan price ki buying interest expect ki jati hai. Waise hi, jab market downtrend mein hoti hai, to ooper wala band dynamic resistance level ke tarah function karta hai, jahan price ko selling pressure ka samna karna padta hai. Traders in levels ka istemal kar ke trades enter ya exit kar sakte hain aur stop-loss orders set kar sakte hain. Bollinger Bands ko saath mein aur technical tools aur price action analysis ke saath combine karna zaroori hai, taake support aur resistance level identification ki accuracy mein izafa ho.

Bollinger Bands and Price Reversals:

Bollinger Bands achi tarah se potential price reversals ke baare mein interesting jaankari de sakte hain. Price reversals tab hotey hain jab price overbought ya oversold condition se mean ki taraf move karti hai, jo ki middle SMA line dwara represent kiya jata hai. Reversal signals tab pta chalte hain jab price middle SMA se upar ya neeche se cross karti hai, jo market sentiment main badlav ka sanket hai. Traders candlestick patterns ya divergence indicators jaise dusre technical analysis tools ka istemal Bollinger Bands ke saath karke potential reversals ko confirm kar sakte hain aur apni trading strategy ko uske hisaab se adjust kar sakte hain.

Samaapti mein, Bollinger Bands ek versatile technical analysis tool hain jo market conditions ko analyze karne aur informed trading decisions lene ke liye various tareeko se istemal kiya ja sakta hai. Chahe woh trends ko pehchanne ho, breakouts ka anticipation karna ho, support aur resistance levels determine karna ho ya price reversals spot karna ho, Bollinger Bands traders ko valuable information dete hain apni analysis ko enhance karne aur trading success ko badhane ke liye. Halaanki, mahatvapurn hai ki koi indicator foolproof nahi hota, aur traders ko Bollinger Bands ko dusre forms of technical analysis aur risk management techniques ke saath istemal karna chahiye taki forex trading mein consistent profitability achieve ki jaa sake.

تبصرہ

Расширенный режим Обычный режим