Dragonfly Doji, forex trading mein aik ahem candlestick pattern hai jo traders ko market sentiment aur possible reversals ke baray mein malumat farahem karta hai. Ye pattern market mein hone wale changes ko samajhne mein madad karta hai aur traders ko potential entry ya exit points talaashne mein istemal hota hai.

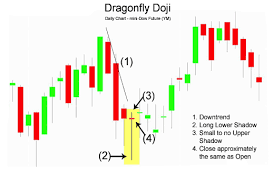

Dragonfly Doji candlestick ek specific price action pattern hai jo market mein uncertainty aur indecision ko darust karta hai. Iski pehchan, ek lambi lower shadow aur kisi bhi upper shadow ke baghair ek chhota sa body se hoti hai. Iska matlab hai ke opening price aur closing price aik dosre ke bohat qareeb hote hain, jisse candle ki body almost non-existent hoti hai. Lambi lower shadow yeh darust karta hai ke market mein buyers ne control liya hua hai, jab ke upper shadow ki absence uncertainty aur lack of selling pressure ko indicate karti hai.

Dragonfly Doji ka zikar hota hai jab market mein bearish trend ke baad ye candle appear hota hai. Is situation mein, ye pattern indicate karta hai ke sellers ne control khoya hai aur buyers market mein wapas entry kar rahe hain. Lambi lower shadow, market mein support ka level darust karti hai, jabke candle ki body ka size buyers aur sellers ke darmiyan barabar ki larai ko show karta hai.

Traders ko Dragonfly Doji ko samajhne ke liye market context aur surrounding candlesticks ka bhi tajzia karna zaroori hai. Agar ye pattern strong support level ke qareeb appear hota hai aur uske baad ek bullish candle follow hoti hai, to ye indicate karta hai ke market mein reversal hone ke chances hain. Is situation mein, traders ko long position le lene chahiye.

Lekin, yaad rahe ke har trading signal ki tarah, Dragonfly Doji bhi 100% confirm nahi hota aur market conditions ka dhyan rakhna zaroori hai. Kabhi-kabhi ye pattern false signals bhi de sakta hai, is liye iska istemal karne se pehle dusre technical indicators aur analysis tools ka bhi istemal karna behtar hota hai.

In conclusion, Dragonfly Doji candlestick pattern traders ko market dynamics ko samajhne mein madad karta hai, lekin iska istemal saavdhani aur doosre confirmation signals ke saath karna hamesha behtar hota hai.

Dragonfly Doji candlestick ek specific price action pattern hai jo market mein uncertainty aur indecision ko darust karta hai. Iski pehchan, ek lambi lower shadow aur kisi bhi upper shadow ke baghair ek chhota sa body se hoti hai. Iska matlab hai ke opening price aur closing price aik dosre ke bohat qareeb hote hain, jisse candle ki body almost non-existent hoti hai. Lambi lower shadow yeh darust karta hai ke market mein buyers ne control liya hua hai, jab ke upper shadow ki absence uncertainty aur lack of selling pressure ko indicate karti hai.

Dragonfly Doji ka zikar hota hai jab market mein bearish trend ke baad ye candle appear hota hai. Is situation mein, ye pattern indicate karta hai ke sellers ne control khoya hai aur buyers market mein wapas entry kar rahe hain. Lambi lower shadow, market mein support ka level darust karti hai, jabke candle ki body ka size buyers aur sellers ke darmiyan barabar ki larai ko show karta hai.

Traders ko Dragonfly Doji ko samajhne ke liye market context aur surrounding candlesticks ka bhi tajzia karna zaroori hai. Agar ye pattern strong support level ke qareeb appear hota hai aur uske baad ek bullish candle follow hoti hai, to ye indicate karta hai ke market mein reversal hone ke chances hain. Is situation mein, traders ko long position le lene chahiye.

Lekin, yaad rahe ke har trading signal ki tarah, Dragonfly Doji bhi 100% confirm nahi hota aur market conditions ka dhyan rakhna zaroori hai. Kabhi-kabhi ye pattern false signals bhi de sakta hai, is liye iska istemal karne se pehle dusre technical indicators aur analysis tools ka bhi istemal karna behtar hota hai.

In conclusion, Dragonfly Doji candlestick pattern traders ko market dynamics ko samajhne mein madad karta hai, lekin iska istemal saavdhani aur doosre confirmation signals ke saath karna hamesha behtar hota hai.

تبصرہ

Расширенный режим Обычный режим