Parabolic SAR (Stop and Reverse) ek technical indicator hai jo forex trading mein istemal hota hai taake mumkinay trend reversals aur trades ke dakhil aur nikalne ke points maloom kiye ja saken. Ye J. Welles Wilder Jr. ne tayar kiya tha, jo ke wohi shakhs hai jo Moving Average Convergence Divergence (MACD) aur Relative Strength Index (RSI) indicators tayar kiye thay. Parabolic SAR ek trend-following indicator hai jo price aur ek dynamic support ya resistance level ke darmiyan faslay ko calculate karke kaam karta hai. Iska calculation ek asaan matnati formula ke zariye hota hai, jisme peechle X bars ki highest high ya lowest low (jahan X ek istemal karne wale parameter hai) ko lete hain, aur isse Average True Range (ATR) ka multiple subtract karte hain.

ATR ek aur technical indicator hai jo kisi asset ki price ki volatility ko ek muddat ke doran napta hai. Iska calculation is doraan true ranges ka average lekar hota hai. True range teen qeematon mein se sab se ziada ka tay kiya jata hai: aaj ki high aur low mein farq, aaj ki high minus kal ki close, ya aaj ki low minus kal ki close.

Parabolic SAR ka formula ye hai:

SAR = High(n) + ATR(n)*Steps(n)

SAR = Low(n) - ATR(n)*Steps(n)

jahan High(n) aur Low(n) peechle n bars ki highest high aur lowest low hain, user-defined Steps(n) SAR ke tezi ya dheere hone ko tay karta hai, aur ATR(n) n bars ki Average True Range hai.

Plotting Parabolic SAR

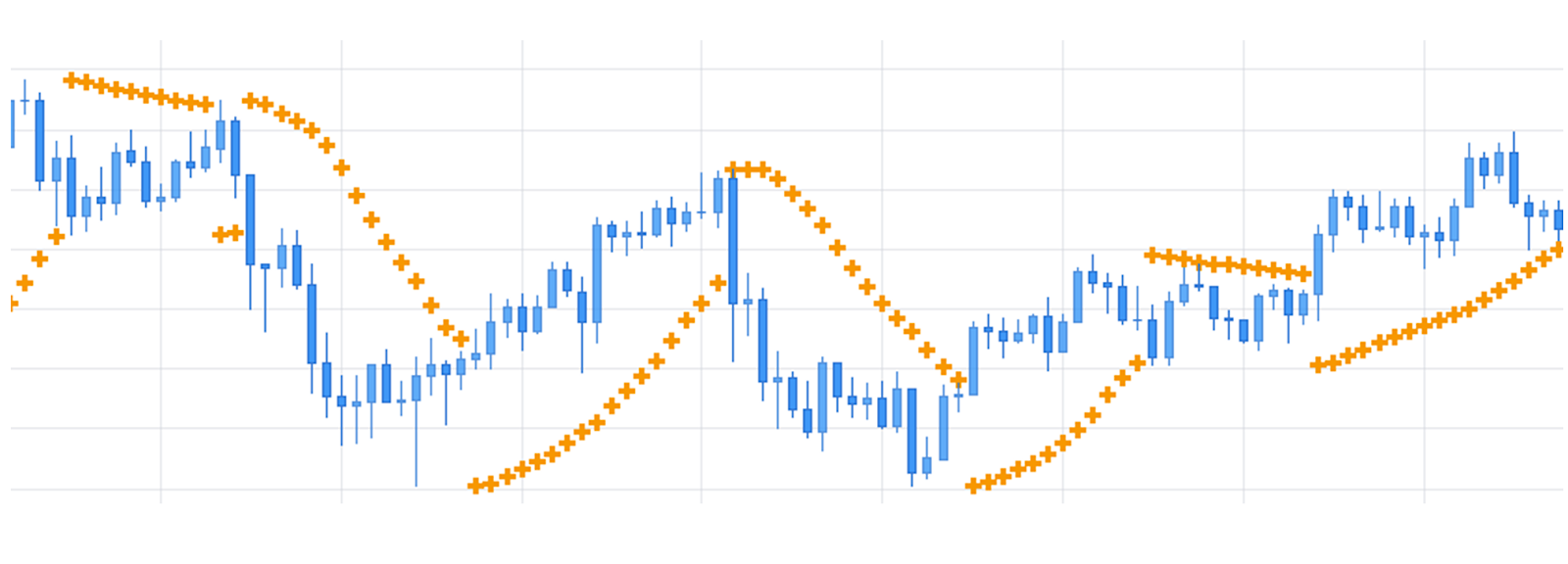

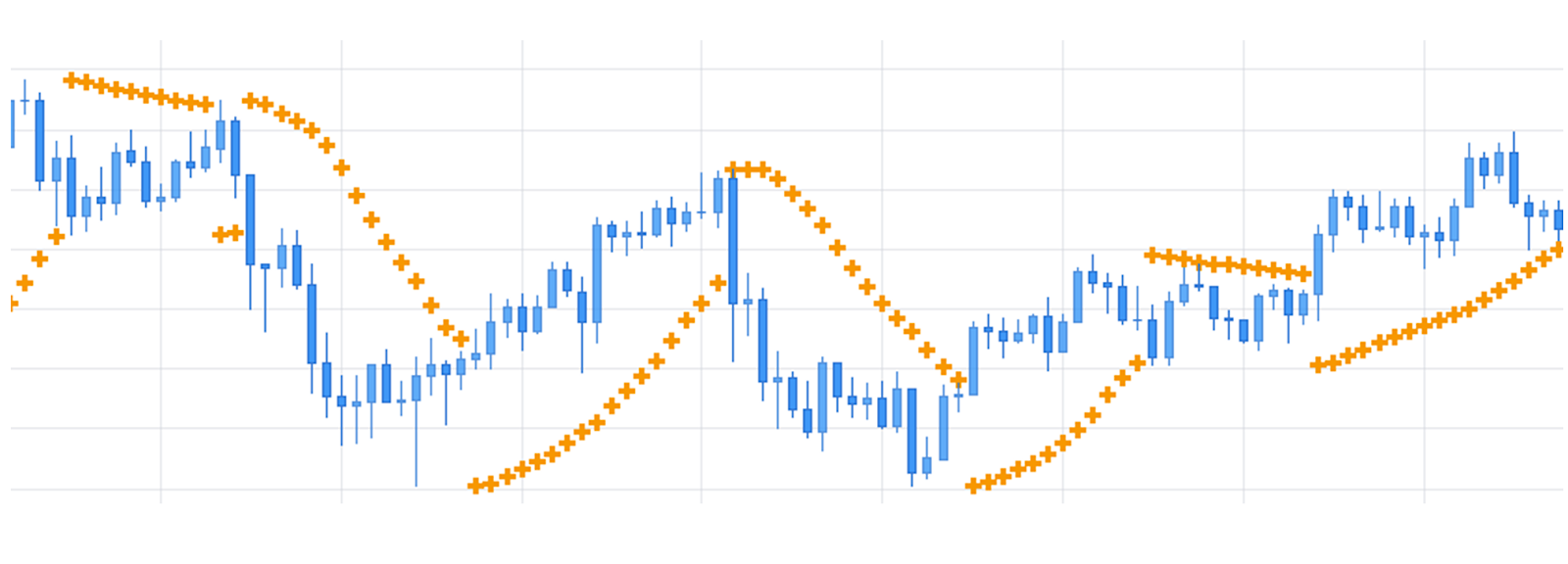

Parabolic SAR ko price chart ke upar ya neeche dots ya points ke tor par plot kiya jata hai, ye is par depend karta hai ke High(n) ya Low(n) ka istemal kiya gaya hai. Jab price High(n) ke upar hoti hai, to SAR dots uske neeche hote hain, jo support ko darust kartay hain. Jab price Low(n) ke neeche hoti hai, to SAR dots uske upar hote hain, jo resistance ko darust kartay hain. Jab price High(n) se guzar jati hai ya Low(n) se neeche jati hai, to ye mumkin hai ke trend reversal ho raha hai, kyun ke SAR dots apne maqam ko mutabiq badal jatay hain. Parabolic SAR ko forex trading mein mukhtalif tareeqon se istemal kiya ja sakta hai

ATR ek aur technical indicator hai jo kisi asset ki price ki volatility ko ek muddat ke doran napta hai. Iska calculation is doraan true ranges ka average lekar hota hai. True range teen qeematon mein se sab se ziada ka tay kiya jata hai: aaj ki high aur low mein farq, aaj ki high minus kal ki close, ya aaj ki low minus kal ki close.

Parabolic SAR ka formula ye hai:

SAR = High(n) + ATR(n)*Steps(n)

SAR = Low(n) - ATR(n)*Steps(n)

jahan High(n) aur Low(n) peechle n bars ki highest high aur lowest low hain, user-defined Steps(n) SAR ke tezi ya dheere hone ko tay karta hai, aur ATR(n) n bars ki Average True Range hai.

Plotting Parabolic SAR

Parabolic SAR ko price chart ke upar ya neeche dots ya points ke tor par plot kiya jata hai, ye is par depend karta hai ke High(n) ya Low(n) ka istemal kiya gaya hai. Jab price High(n) ke upar hoti hai, to SAR dots uske neeche hote hain, jo support ko darust kartay hain. Jab price Low(n) ke neeche hoti hai, to SAR dots uske upar hote hain, jo resistance ko darust kartay hain. Jab price High(n) se guzar jati hai ya Low(n) se neeche jati hai, to ye mumkin hai ke trend reversal ho raha hai, kyun ke SAR dots apne maqam ko mutabiq badal jatay hain. Parabolic SAR ko forex trading mein mukhtalif tareeqon se istemal kiya ja sakta hai

- Determining trend direction: Jab price High(n) ke upar hoti hai ya Low(n) ke neeche hoti hai, to ye ek uptrend ya downtrend ko darust karti hai. Jab price High(n) se guzar jati hai ya Low(n) se neeche jati hai, to ye mumkin hai ke trend reversal ho raha hai. Traders is malumat ka istemal karke long ya short positions mein dakhil ho sakte hain.

- Identifying potential entry and exit points: Jab price SAR dots ko choo jati hai ya inke qareeb pohanchti hai, to ye mumkin support ya resistance levels ko darust karta hai. Traders is malumat ka istemal karke long positions mein dakhil ho sakte hain jab price support levels se murne lagti hai, ya short positions mein dakhil ho sakte hain jab price resistance levels se murne lagti hai. Is malumat ka istemal karke woh apne nuksan ko had se zyada nahi hone dene ke liye stop-loss orders bhi tay kar sakte hain.

- Managing open positions: Traders Parabolic SAR ka istemal karke apne open positions ko manage kar sakte hain, jab price SAR dots se aik mukhtalif janib pohanchti hai to woh apni munafa ke maqamat tay kar sakte hain. Is malumat ka istemal karke woh apne open positions ke peeche trailing stop-loss orders bhi laga sakte hain takay unki munafa ko lock karte hue risk ko kam kar sakein.

- Confirming other technical indicators: Parabolic SAR ko digar technical indicators jaise ke moving averages, oscillators, aur candlestick patterns ke sath istemal karke trend ki taraf aur mumkinay reversals ki tasdeeq karni mein madad mil sakti hai. Ye traders ko mazeed malumaton ke asalat par mabni trading faislay karne mein madad karta hai.

- Adjusting parameters for different market conditions: Traders Steps(n) ki qeemat ko mukhtalif market shiraeet jaise ke tez ya stable doron, tezi ya dheere trends, aur mazboot ya kamzor trends ke liye mutabiq kar sakte hain. Ye unko apni trading strategies ko tabdeel hone wale market shiraeet ke mutabiq aanay mein madadgar sabit ho sakti hai, aur unko apne nuksan ko kam aur munafa ko zyada karne mein madad karegi.

تبصرہ

Расширенный режим Обычный режим