Mass Index candlestick pattern ek technical analysis tool hai jo financial markets, jese ke stock market, forex, aur cryptocurrencies mein istemal hota hai. Yeh pattern traders aur investors ko market ke mood aur potential trend reversals ka andaza lagane mein madad karta hai. Is pattern ki understanding, candlestick charts aur Mass Index indicator ko combine karke ki jati hai.

Mass Index Candlestick Pattern ka mool taur par ek volatility indicator hai, jo market ke fluctuations ko measure karta hai. Iske through, traders ko pata chalta hai ke market mein kitni intensity aur strength hai. Yeh pattern primarily trend reversals ko spot karne mein istemal hota hai, aur iske signals se traders apne trading decisions ko refine karte hain.

Mass Index ka calculation multiple steps par mabni hota hai. Sabse pehle, kuch dinon ke closing prices ka exponential moving average (EMA) nikala jata hai. Phir, EMA ko aik aur EMA se divide kiya jata hai, jise phir kuch dinon ke takatwar closing ranges ki sum se divide kiya jata hai. Yeh calculation, market ki volatility ko reflect karta hai aur ek numeric value produce karta hai, jo Mass Index kehlata hai.

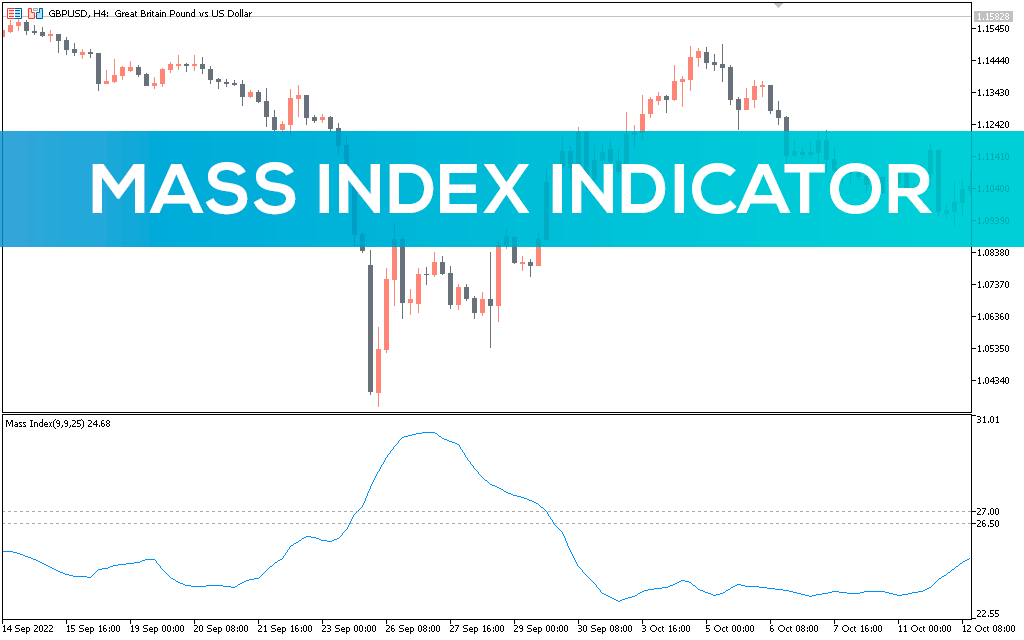

Mass Index ki values ko candlestick charts ke sath combine karke Mass Index Candlestick Pattern create hota hai. Is pattern mein kuch key components hote hain jo traders ko signals provide karte hain. Ek important component, jab Mass Index ki value 27 se zyada hoti hai, to yeh indicate karta hai ke market mein ek potential reversal hone ka chance hai. Isse traders ko pata chalta hai ke market mein extreme bullish ya bearish conditions aa sakti hain.

Jab Mass Index ki value high hoti hai aur phir ek specific level ko cross karti hai, isko "Bulge" kehte hain. Bulge market mein jald hi ek reversal hone ki indication deta hai. Jab yeh bulge peak par hoti hai aur phir ghatne lagti hai, to yeh ek reversal ka signal ban sakti hai.

Mass Index Candlestick Pattern ka istemal trend reversals ke sath sath overbought ya oversold conditions identify karne mein bhi hota hai. Agar Mass Index ki value high hoti hai aur phir ghatne lagti hai, to yeh suggest karta hai ke market mein excessive bullish momentum tha jo ab kam ho raha hai, aur aane wale bearish trend ka indication ho sakta hai. Isi tarah, agar Mass Index ki value low hoti hai aur phir barhne lagti hai, to yeh indicate karta hai ke market mein potential uptrend ka signal hai.

Mass Index Candlestick Pattern ka istemal market analysis mein ek dynamic approach provide karta hai. Traders is pattern ki madad se market trends aur reversals ko samajh kar apne trading strategies ko optimize kar sakte hain. Lekin, hamesha yaad rahe ke koi bhi technical indicator ya pattern 100% guarantee nahi deta, aur market mein risk ka factor hamesha mojood hota hai.

Is tarah, Mass Index Candlestick Pattern ek powerful tool hai jo market volatility ko analyze karta hai aur traders ko potential trend reversals ke bare mein inform karta hai. Yeh pattern, apne calculation aur candlestick charts ke through, market ke complex dynamics ko samajhne mein madad karta hai aur traders ko informed decisions lene mein support karta hai.

Mass Index Candlestick Pattern ka mool taur par ek volatility indicator hai, jo market ke fluctuations ko measure karta hai. Iske through, traders ko pata chalta hai ke market mein kitni intensity aur strength hai. Yeh pattern primarily trend reversals ko spot karne mein istemal hota hai, aur iske signals se traders apne trading decisions ko refine karte hain.

Mass Index ka calculation multiple steps par mabni hota hai. Sabse pehle, kuch dinon ke closing prices ka exponential moving average (EMA) nikala jata hai. Phir, EMA ko aik aur EMA se divide kiya jata hai, jise phir kuch dinon ke takatwar closing ranges ki sum se divide kiya jata hai. Yeh calculation, market ki volatility ko reflect karta hai aur ek numeric value produce karta hai, jo Mass Index kehlata hai.

Mass Index ki values ko candlestick charts ke sath combine karke Mass Index Candlestick Pattern create hota hai. Is pattern mein kuch key components hote hain jo traders ko signals provide karte hain. Ek important component, jab Mass Index ki value 27 se zyada hoti hai, to yeh indicate karta hai ke market mein ek potential reversal hone ka chance hai. Isse traders ko pata chalta hai ke market mein extreme bullish ya bearish conditions aa sakti hain.

Jab Mass Index ki value high hoti hai aur phir ek specific level ko cross karti hai, isko "Bulge" kehte hain. Bulge market mein jald hi ek reversal hone ki indication deta hai. Jab yeh bulge peak par hoti hai aur phir ghatne lagti hai, to yeh ek reversal ka signal ban sakti hai.

Mass Index Candlestick Pattern ka istemal trend reversals ke sath sath overbought ya oversold conditions identify karne mein bhi hota hai. Agar Mass Index ki value high hoti hai aur phir ghatne lagti hai, to yeh suggest karta hai ke market mein excessive bullish momentum tha jo ab kam ho raha hai, aur aane wale bearish trend ka indication ho sakta hai. Isi tarah, agar Mass Index ki value low hoti hai aur phir barhne lagti hai, to yeh indicate karta hai ke market mein potential uptrend ka signal hai.

Mass Index Candlestick Pattern ka istemal market analysis mein ek dynamic approach provide karta hai. Traders is pattern ki madad se market trends aur reversals ko samajh kar apne trading strategies ko optimize kar sakte hain. Lekin, hamesha yaad rahe ke koi bhi technical indicator ya pattern 100% guarantee nahi deta, aur market mein risk ka factor hamesha mojood hota hai.

Is tarah, Mass Index Candlestick Pattern ek powerful tool hai jo market volatility ko analyze karta hai aur traders ko potential trend reversals ke bare mein inform karta hai. Yeh pattern, apne calculation aur candlestick charts ke through, market ke complex dynamics ko samajhne mein madad karta hai aur traders ko informed decisions lene mein support karta hai.

تبصرہ

Расширенный режим Обычный режим