Deliberation Candlestick Pattern:

Deliberation candlestick pattern, jo ke technical analysis mein istemal hota hai, ek makhsoos tijarat ki technique hai. Ye pattern market mein trend reversal ko darust karnay mein madadgar hota hai. Is pattern ki pehchan karna aur samajhna tajaweez hai takay tijarat karne walay apni faislay ko behtareen tor par le saken.

Deliberation Pattern Ki Tafseelat:

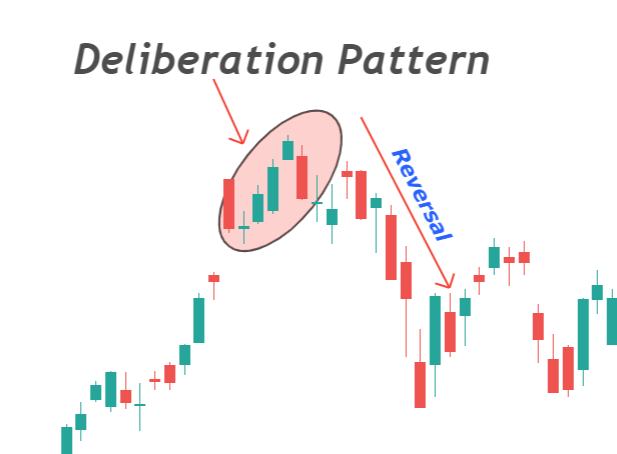

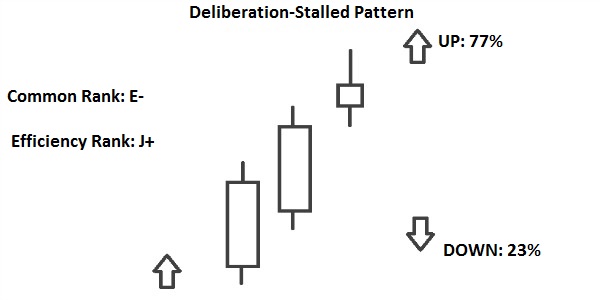

Deliberation pattern mein aik lambi aur do choti candlesticks shamil hoti hain. Lambi candlestick ki closing price, peechli dono choti candlesticks ki opening prices ke darmiyan hoti hai. Ye isharat karta hai ke market mein confusion hai aur trend reversal hone ke imkanat hain.

Deliberation Pattern Ki Tasdiq:

Deliberation pattern ki tasdiq ke liye, doosri technical indicators ka bhi istemal zaroori hai. RSI, MACD, aur moving averages jaise tools se is pattern ko tasdiq karna mumkin hai. Agar doosre indicators bhi trend reversal ko darust karte hain, toh ye deliberation pattern ki tajaweez ko mazbooti deta hai.Deliberation pattern ke sath trading karte waqt, risk management ko ahmiyat di jani chahiye. Stop-loss orders ka istemal karke, traders nuksanat se bach sakte hain. Iske ilawa, position size ko bhi sahi taur par tay karna bohot zaroori hai takay tijarat mein control bana rahe.

Successful Trading Strategies with Deliberation Pattern:

Deliberation pattern ke saath tijarat karne ke liye kuch khaas strategies istemal ki ja sakti hain. Trend lines aur support/resistance levels ka istemal karke entry aur exit points tay karna ek asan tariqa hai. Iske ilawa, risk management ko ahmiyat di jani chahiye takay nuksanat se bacha ja sake.

Deliberation Pattern Aur Economic News Ka Ta'alluq:

Deliberation pattern ke istemal mein economic news ka bhi ahmiyat hota hai. Achaanak tabdeeliyan aane par, deliberation pattern ko tasdiq karne ke liye aur bhi saboot milte hain. Economic calendar ka regular mutala aur is par amal karna tijarat mein kamyabi ki taraf bata sakta hai.Deliberation pattern ka sahi istemal karne ke liye, market sentiment ko bhi samajhna zaroori hai. Is pattern ki pehchan mein market ke mood aur traders ki raayen bhi shamil hoti hain, jo ke overall trading strategy ko mazbooti deti hain.

Deliberation candlestick pattern, jo ke technical analysis mein istemal hota hai, ek makhsoos tijarat ki technique hai. Ye pattern market mein trend reversal ko darust karnay mein madadgar hota hai. Is pattern ki pehchan karna aur samajhna tajaweez hai takay tijarat karne walay apni faislay ko behtareen tor par le saken.

Deliberation Pattern Ki Tafseelat:

Deliberation pattern mein aik lambi aur do choti candlesticks shamil hoti hain. Lambi candlestick ki closing price, peechli dono choti candlesticks ki opening prices ke darmiyan hoti hai. Ye isharat karta hai ke market mein confusion hai aur trend reversal hone ke imkanat hain.

Deliberation Pattern Ki Tasdiq:

Deliberation pattern ki tasdiq ke liye, doosri technical indicators ka bhi istemal zaroori hai. RSI, MACD, aur moving averages jaise tools se is pattern ko tasdiq karna mumkin hai. Agar doosre indicators bhi trend reversal ko darust karte hain, toh ye deliberation pattern ki tajaweez ko mazbooti deta hai.Deliberation pattern ke sath trading karte waqt, risk management ko ahmiyat di jani chahiye. Stop-loss orders ka istemal karke, traders nuksanat se bach sakte hain. Iske ilawa, position size ko bhi sahi taur par tay karna bohot zaroori hai takay tijarat mein control bana rahe.

Successful Trading Strategies with Deliberation Pattern:

Deliberation pattern ke saath tijarat karne ke liye kuch khaas strategies istemal ki ja sakti hain. Trend lines aur support/resistance levels ka istemal karke entry aur exit points tay karna ek asan tariqa hai. Iske ilawa, risk management ko ahmiyat di jani chahiye takay nuksanat se bacha ja sake.

Deliberation Pattern Aur Economic News Ka Ta'alluq:

Deliberation pattern ke istemal mein economic news ka bhi ahmiyat hota hai. Achaanak tabdeeliyan aane par, deliberation pattern ko tasdiq karne ke liye aur bhi saboot milte hain. Economic calendar ka regular mutala aur is par amal karna tijarat mein kamyabi ki taraf bata sakta hai.Deliberation pattern ka sahi istemal karne ke liye, market sentiment ko bhi samajhna zaroori hai. Is pattern ki pehchan mein market ke mood aur traders ki raayen bhi shamil hoti hain, jo ke overall trading strategy ko mazbooti deti hain.

تبصرہ

Расширенный режим Обычный режим