Candlestick patterns, market mein aam taur par istemal hone wale technical analysis ka aham hissa hain. In patterns mein se ek jo khaas ahmiyat rakhta hai, woh hai "Double Bottom Candlestick Pattern." Is pattern ki samajh, tijarat mein kamiyabi hasil karne mein madadgar sabit ho sakti hai.

Double Bottom Pattern Kya Hai?

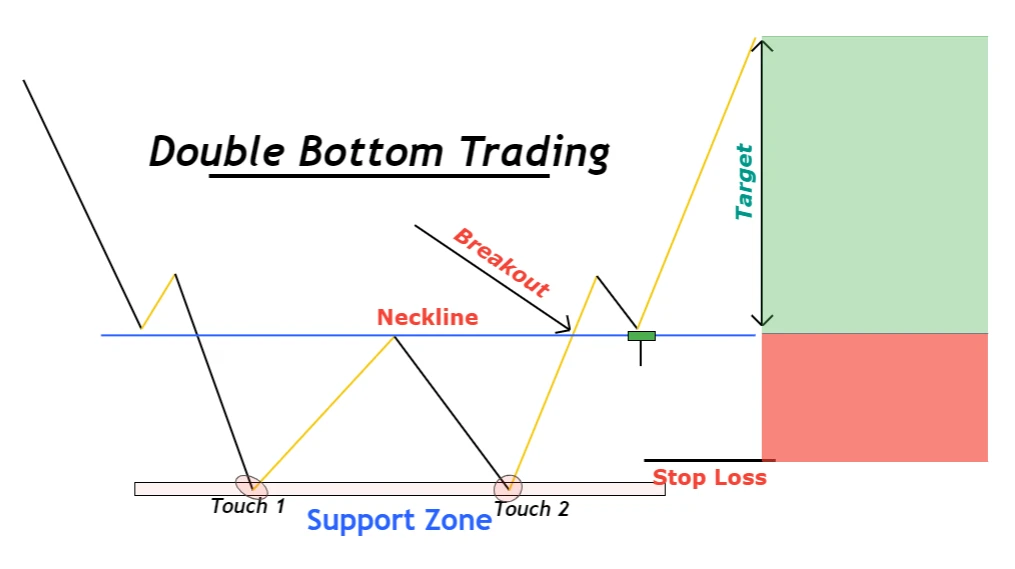

"Double Bottom" ek aisa chart pattern hai jo market mein trend reversal ko darust karti hai. Yeh pattern do neechay girne wale price levels ko darust karta hai, lekin phir dobara se usay tezi se upar le aata hai. Is pattern ka naam isliye hai kyunki chart par yeh do neechay ki taraf koode ki tarah dikhayi deta hai.

Double Bottom Ki Pechan:

1. Pehli Girawat (First Bottom): Sab se pehle, market mein ek downtrend hota hai, jismein prices neeche ja rahe hote hain. Is downtrend ke baad, ek bottom ban jata hai, jo indicate karta hai ke sellers ki control kamzor ho rahi hai.

2. Recovery: Dusri step mein, prices mein izafah hota hai aur market mein kuch stability aati hai. Yeh indicate karta hai ke buyers ne control haasil kiya hai aur trend reversal ho sakta hai.

3. Dobara Girawat (Second Bottom): Fir se prices thodi neeche ja sakti hain, lekin pehli girawat se kam nahi honi chahiye. Agar prices pehle girawat ke neeche nahi jaati, to yeh confirmatory signal hota hai.

4. Confirmation of Reversal: Double Bottom pattern tab complete hota hai jab prices dobara se tezi se upar chale jaate hain aur pehle bottom ke level ko cross karte hain. Yeh confirmation hoti hai ke market trend reversal kar chuki hai aur ab uptrend shuru ho gaya hai.

Double Bottom Ka Istemal Tijarat Mein:

Double Bottom pattern ka sahi taur par istemal karne ke liye kuch zaroori points hain:

1. Volume Analysis: Pattern ke confirm hone par, trader ko volume ki bhi madad leni chahiye. Agar uptrend ke doran volume bhi barh raha hai, to yeh confirm karta hai ke market mein asli tezi aayi hai.

2. Target Price: Trader ko yeh bhi decide karna hoga ke kitna target price set karna hai. Iske liye pehle bottom se le kar pattern ke height ko measure kiya jata hai.

3. Stop Loss: Hamesha risk management ka khayal rakhna zaroori hai. Stop loss lagana important hai taki nuksan se bacha ja sake.

Double Bottom Pattern Ka Faida:

Is pattern se traders ko early trend reversal ka pata chalta hai, jisse unhe behtar entry point milta hai.

Market sentiment mein badlav aane par is pattern ki madad se faida uthaya ja sakta hai.

Properly istemal karne par, yeh ek mufeed tijarat ka tareeqa sabit ho sakta hai.

Conclusion:

Double Bottom Candlestick Pattern, market analysis mein ek powerful tool hai jo traders ko trend reversal ka pata lagane mein madad karta hai. Isko samajhna aur sahi taur par istemal karna, tijarat mein kamiyabi hasil karne mein ek ahem kadam ho sakta hai.

Double Bottom Pattern Kya Hai?

"Double Bottom" ek aisa chart pattern hai jo market mein trend reversal ko darust karti hai. Yeh pattern do neechay girne wale price levels ko darust karta hai, lekin phir dobara se usay tezi se upar le aata hai. Is pattern ka naam isliye hai kyunki chart par yeh do neechay ki taraf koode ki tarah dikhayi deta hai.

Double Bottom Ki Pechan:

1. Pehli Girawat (First Bottom): Sab se pehle, market mein ek downtrend hota hai, jismein prices neeche ja rahe hote hain. Is downtrend ke baad, ek bottom ban jata hai, jo indicate karta hai ke sellers ki control kamzor ho rahi hai.

2. Recovery: Dusri step mein, prices mein izafah hota hai aur market mein kuch stability aati hai. Yeh indicate karta hai ke buyers ne control haasil kiya hai aur trend reversal ho sakta hai.

3. Dobara Girawat (Second Bottom): Fir se prices thodi neeche ja sakti hain, lekin pehli girawat se kam nahi honi chahiye. Agar prices pehle girawat ke neeche nahi jaati, to yeh confirmatory signal hota hai.

4. Confirmation of Reversal: Double Bottom pattern tab complete hota hai jab prices dobara se tezi se upar chale jaate hain aur pehle bottom ke level ko cross karte hain. Yeh confirmation hoti hai ke market trend reversal kar chuki hai aur ab uptrend shuru ho gaya hai.

Double Bottom Ka Istemal Tijarat Mein:

Double Bottom pattern ka sahi taur par istemal karne ke liye kuch zaroori points hain:

1. Volume Analysis: Pattern ke confirm hone par, trader ko volume ki bhi madad leni chahiye. Agar uptrend ke doran volume bhi barh raha hai, to yeh confirm karta hai ke market mein asli tezi aayi hai.

2. Target Price: Trader ko yeh bhi decide karna hoga ke kitna target price set karna hai. Iske liye pehle bottom se le kar pattern ke height ko measure kiya jata hai.

3. Stop Loss: Hamesha risk management ka khayal rakhna zaroori hai. Stop loss lagana important hai taki nuksan se bacha ja sake.

Double Bottom Pattern Ka Faida:

Is pattern se traders ko early trend reversal ka pata chalta hai, jisse unhe behtar entry point milta hai.

Market sentiment mein badlav aane par is pattern ki madad se faida uthaya ja sakta hai.

Properly istemal karne par, yeh ek mufeed tijarat ka tareeqa sabit ho sakta hai.

Conclusion:

Double Bottom Candlestick Pattern, market analysis mein ek powerful tool hai jo traders ko trend reversal ka pata lagane mein madad karta hai. Isko samajhna aur sahi taur par istemal karna, tijarat mein kamiyabi hasil karne mein ek ahem kadam ho sakta hai.

تبصرہ

Расширенный режим Обычный режим