Definition;

Wolfe Wave, jo ke technical analysis ka hissa hai, ek specific pattern hai jo price action ko identify karne ke liye istemal hota hai. Yeh pattern market trends aur reversals ko anticipate karne mein madad karta hai.

Explanation

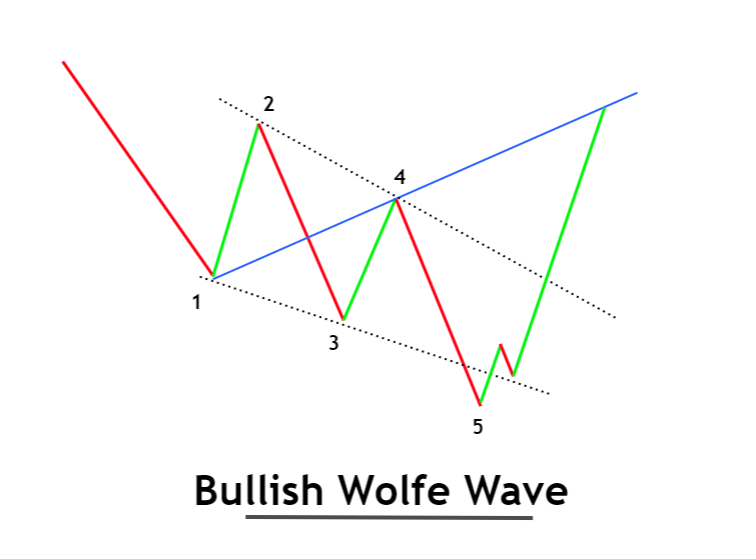

Wolfe Wave candlestick pattern ek geometric shape ko represent karta hai jo price chart par banta hai. Is pattern mein usually 5 waves hote hain, jinmein se 3 up waves aur 2 down waves hote hain. Yeh waves ek symmetric shape banate hain, jismein 4th wave usually smaller hoti hai aur 5th wave, 1st wave ke opposite direction mein move karta hai.Is pattern ko identify karne ke liye, traders ko price chart ko closely observe karna padta hai, aur specific guidelines follow karni parti hain jo Wolfe Wave pattern ke liye set ki gayi hain. Jab yeh pattern complete ho jata hai, traders expect karte hain ke market mein reversal hone ke chances hai.

Significance

Wolfe Wave candlestick pattern ki popularity is liye hai kyunki yeh ek visual method hai jise traders price action analysis mein istemal kar sakte hain. Iske through, market trends aur reversals ko identify karna relatively easier ho jata hai.Yeh important hai ke traders apne analysis ke liye multiple indicators aur tools ka istemal karein, aur Wolfe Wave pattern ko confirmatory signals ke sath dekhein, taake unki trading decisions mein confidence bani rahe.

Wolfe Wave, jo ke technical analysis ka hissa hai, ek specific pattern hai jo price action ko identify karne ke liye istemal hota hai. Yeh pattern market trends aur reversals ko anticipate karne mein madad karta hai.

Explanation

Wolfe Wave candlestick pattern ek geometric shape ko represent karta hai jo price chart par banta hai. Is pattern mein usually 5 waves hote hain, jinmein se 3 up waves aur 2 down waves hote hain. Yeh waves ek symmetric shape banate hain, jismein 4th wave usually smaller hoti hai aur 5th wave, 1st wave ke opposite direction mein move karta hai.Is pattern ko identify karne ke liye, traders ko price chart ko closely observe karna padta hai, aur specific guidelines follow karni parti hain jo Wolfe Wave pattern ke liye set ki gayi hain. Jab yeh pattern complete ho jata hai, traders expect karte hain ke market mein reversal hone ke chances hai.

Significance

Wolfe Wave candlestick pattern ki popularity is liye hai kyunki yeh ek visual method hai jise traders price action analysis mein istemal kar sakte hain. Iske through, market trends aur reversals ko identify karna relatively easier ho jata hai.Yeh important hai ke traders apne analysis ke liye multiple indicators aur tools ka istemal karein, aur Wolfe Wave pattern ko confirmatory signals ke sath dekhein, taake unki trading decisions mein confidence bani rahe.

تبصرہ

Расширенный режим Обычный режим