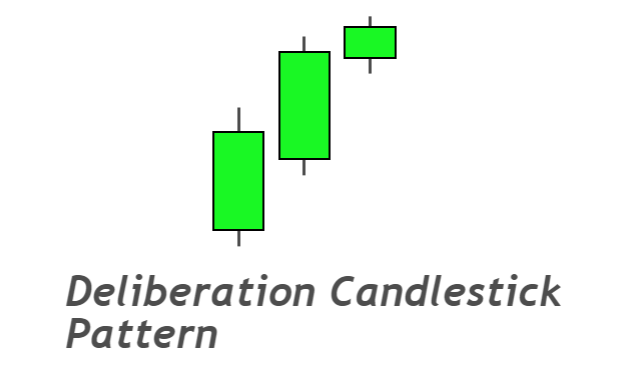

Dear friends, Deliberation Candlestick Pattern ek technical analysis tool hai jo traders ko market trends aur potential trend reversals ke bare mein malumat faraham karta hai. Yeh pattern market mein uncertainty aur indecision ko indicate karta hai aur traders ko ye batata hai ke market mein kisi decisive movement ki kami hai,

Formation of Deliberation Pattern:

Market Mein Indecision:

Deliberation Candlestick Pattern ki formation market mein indecision ya uncertainty ke doraan hota hai. Iske pehle market mein choppy ya range-bound movement hoti hai.

Multiple Small Candles:

Pattern ka pehla step hota hai multiple small candles ka formation, jo indicate karte hain ke market mein price movements kam aur traders ke darmiyan confusion hai.

Doji Candles:

Dusra step hota hai doji candles ka formation, jo ke small bodies ke sath aate hain aur indicate karte hain ke buyers aur sellers ke darmian balance hai.

Deliberation Candlestick Pattern kay characteristics:

Indecision Indicator:

Deliberation Candlestick Pattern ek indecision indicator hai. Iska formation dikhata hai ke market mein kisi decisive movement ki kami hai aur traders unsure hain.

Small Candle Bodies:

Pattern mein small candle bodies ka hona bhi ek khaasiyat hai, jo market ki choppy movement ko reflect karta hai, Deliberation Pattern mein doji candles ka presence bhi ek ahem feature hai, kyun ke ye show karte hain ke opening aur closing prices aapas mein kafi qareeb hain.

Information about Using Deliberation Pattern:

By Wait and Watch Approach:

Deliberation Candlestick Pattern ka istemal karne ka tariqa hota hai wait and watch. Traders ko is pattern ke formation ke baad market ki further confirmation ka intezaar karna chahiye.

Confirmation Ke Liye Doosre Indicators Ka Istemal:

Deliberation Candlestick Pattern ko confirm karne ke liye doosre technical indicators ka bhi sahara lena chahiye. Isse false signals ka khatra kam hota hai.

Conclusion:

Hamesha yaad rahe ke Deliberation Candlestick Pattern ka istemal karte waqt market conditions ka bhi hoshiyari se tawun karna zaroori hai. Kuch situations mein, pattern accurate signals nahi de saktay, Volume analysis bhi ahem hai jab Deliberation Candlestick Pattern ka tawun karte hain. Agar volume pattern ke sath nahi jaa raha, toh ye indicate kar sakta hai ke indecision weak ho sakta hai. Deliberation Candlestick Pattern ek mahine aur cautious approach ko dikhata hai, jab market mein indecision aur uncertainty ka mahol hota hai. Traders ko is pattern ke formation par amal karne se pehle market conditions ka hoshiyari se tawun karna chahiye. Hamesha yaad rahe ke successful trading ke liye, doosre indicators ka bhi saath lena zaroori hai aur market dynamics ko samajhne ke liye diligent approach rakhna chahiy

Formation of Deliberation Pattern:

Market Mein Indecision:

Deliberation Candlestick Pattern ki formation market mein indecision ya uncertainty ke doraan hota hai. Iske pehle market mein choppy ya range-bound movement hoti hai.

Multiple Small Candles:

Pattern ka pehla step hota hai multiple small candles ka formation, jo indicate karte hain ke market mein price movements kam aur traders ke darmiyan confusion hai.

Doji Candles:

Dusra step hota hai doji candles ka formation, jo ke small bodies ke sath aate hain aur indicate karte hain ke buyers aur sellers ke darmian balance hai.

Deliberation Candlestick Pattern kay characteristics:

Indecision Indicator:

Deliberation Candlestick Pattern ek indecision indicator hai. Iska formation dikhata hai ke market mein kisi decisive movement ki kami hai aur traders unsure hain.

Small Candle Bodies:

Pattern mein small candle bodies ka hona bhi ek khaasiyat hai, jo market ki choppy movement ko reflect karta hai, Deliberation Pattern mein doji candles ka presence bhi ek ahem feature hai, kyun ke ye show karte hain ke opening aur closing prices aapas mein kafi qareeb hain.

Information about Using Deliberation Pattern:

By Wait and Watch Approach:

Deliberation Candlestick Pattern ka istemal karne ka tariqa hota hai wait and watch. Traders ko is pattern ke formation ke baad market ki further confirmation ka intezaar karna chahiye.

Confirmation Ke Liye Doosre Indicators Ka Istemal:

Deliberation Candlestick Pattern ko confirm karne ke liye doosre technical indicators ka bhi sahara lena chahiye. Isse false signals ka khatra kam hota hai.

Conclusion:

Hamesha yaad rahe ke Deliberation Candlestick Pattern ka istemal karte waqt market conditions ka bhi hoshiyari se tawun karna zaroori hai. Kuch situations mein, pattern accurate signals nahi de saktay, Volume analysis bhi ahem hai jab Deliberation Candlestick Pattern ka tawun karte hain. Agar volume pattern ke sath nahi jaa raha, toh ye indicate kar sakta hai ke indecision weak ho sakta hai. Deliberation Candlestick Pattern ek mahine aur cautious approach ko dikhata hai, jab market mein indecision aur uncertainty ka mahol hota hai. Traders ko is pattern ke formation par amal karne se pehle market conditions ka hoshiyari se tawun karna chahiye. Hamesha yaad rahe ke successful trading ke liye, doosre indicators ka bhi saath lena zaroori hai aur market dynamics ko samajhne ke liye diligent approach rakhna chahiy

تبصرہ

Расширенный режим Обычный режим