INTRODUCTION TO THE DUMPLING TOP PATTERN :

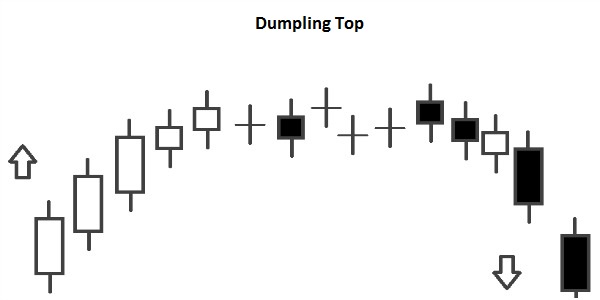

Dumpling Top Pattern forex market mein aam taur par dekha jane wala aik technical chart pattern hai. Ye aik reversal pattern hai jo bull se bulish se bearish trend ki potential trend reversal ki taraf ishara karta hai. Ye pattern lambi tadad mein upar ki taraf jane wali trend ke baad paya jata hai aur is mein higher highs aur higher lows ki series hoti hai. Is pattern ki shakal dumpling ki tarah hoti hai, jis mein aik round top aur flat ya thora sa niche ki taraf jhukne wala bottom hota hai.

FORMATION OF THE DUMPLING TOP PATTERN :

Dumpling Top pattern ka banawat upar jane wali trend se shuru hota hai, jahan par qeematain barhte hue higher highs aur higher lows banati hain. Traders bullish hote hain aur samajhte hain ke upar jane wali trend jari rahegi. Lekin jab market ek resistance level ke qareeb aati hai, tab sellers agay ate hain aur qeematain niche le jate hain. Is se upar jane wali trend mein ek temporary rukawat paida hoti hai, jis se pattern ka round top ban jata hai.

Market phir se rally karne ki koshish karti hai, lekin pehle wale high se upar nahi nikalti. Is incomeletee tareen naye high ki kami market mein kamzori ko tasleem karti hai aur potential trend reversal ki taraf ishara karti hai. Jab qeematain mazeed niche jaati hain aur flat ya thora sa niche jhukte hue bottom banate hain, tab Dumpling Top pattern complete samjha jata hai.

CONFIRMATION AND ENTRY POINTS :

Dumpling Top pattern ki tashkhees us waqt hoti hai jab qeematain flat ya thora sa niche jhukne wale bottom se bhi neeche girte hain. Is break ke waqt amooman selling volume mein izafa hota hai, jo market ki sentiment mein taqat ka tazaad dikhati hai.

Traders is waqt short positions ya apni long positions ko bech sakte hain, mazeed niche movement ki umeed rakhte hue. Stop-loss orders ko recent swing high se upar rakha ja sakta hai, risk ko control karne ke liye. Profit targets ko pattern ki height ka andaza lagakar nichle breakout point se niche ki taraf project karke taeyar kiya jata hai.

POTENTIAL REVERSAL AND TARGET PRICE :

Dumpling Top pattern mazeed bearish trend ki potential trend reversal ko ishara karta hai. Ye sanket deta hai ke khareedne wali taqat kamzor ho chuki hai aur farokht karne wali taqat barh chuki hai, jis se market ki sentiment mein tabdeeli paida hoti hai.

Traders tashkhees ki tasdeeq ke baad market mein mazeed niche movement ka intezar kar sakte hain. Target price pattern ki height ko andaza lagakar nichle breakout point se niche ki taraf project karke estemaal kiya ja sakta hai. Is se traders ko market ki kitni had tak possible girawat ki umeed hoti hai.

Dumpling Top pattern 100% accurate nahi hai aur iska istemal dusre technical indicators aur analysis ke saath ki jana chahiye. False breakouts aur fakeouts ho sakte hain, isliye traders ko hamesha dusre factors jaise trend analysis, support aur resistance levels aur market momentum ka bhi hisaab rakhna chahiye.

POTENTIAL TRADING STRATEGIES AND RISK MANAGEMENT :

Traders Dumpling Top pattern ki trading mein kuch strategies istemal kar sakte hain. Aik strategy ye hai ke breakout point par short position liya jaye, jahan par stop-loss order recent swing high se upar rakha jata hai. Dosri strategy ye hai ke broken support level ki pullback ya retest ka intezar kiya jaye, phir short position liya jaye.

Risk management Dumpling Top pattern ki tijarat karte hue bahut zaroori hai. Traders hamesha munasib position sizing aur stop-loss orders ka istemaal karna chahiye takay potential nuksan ko had se zyada na hone dein. Iske alawa, tijarat ki progress ke saath risk management strategies ko baar baar review aur adjust karna bhi zaroori hai.

Ikhtitam mein, Dumpling Top pattern ek reversal pattern hai jo bullish se bearish ki taraf mogheera hone ki nishani deti hai. Traders is pattern ka istemaal karke samjh sakte hain ke market mein aur neeche ki taraf movement hogi aur iske mutabik apni entry aur exit points banasakte hain. Halaanki, yaad rakhein ke koi bhi tijarat pattern 100% sahi nahi hota aur traders ko hamesha dusre technical indicators aur analysis ka bhi tawazun rakhna chahiye tijarat ke faislay karne se pehle.

Dumpling Top Pattern forex market mein aam taur par dekha jane wala aik technical chart pattern hai. Ye aik reversal pattern hai jo bull se bulish se bearish trend ki potential trend reversal ki taraf ishara karta hai. Ye pattern lambi tadad mein upar ki taraf jane wali trend ke baad paya jata hai aur is mein higher highs aur higher lows ki series hoti hai. Is pattern ki shakal dumpling ki tarah hoti hai, jis mein aik round top aur flat ya thora sa niche ki taraf jhukne wala bottom hota hai.

FORMATION OF THE DUMPLING TOP PATTERN :

Dumpling Top pattern ka banawat upar jane wali trend se shuru hota hai, jahan par qeematain barhte hue higher highs aur higher lows banati hain. Traders bullish hote hain aur samajhte hain ke upar jane wali trend jari rahegi. Lekin jab market ek resistance level ke qareeb aati hai, tab sellers agay ate hain aur qeematain niche le jate hain. Is se upar jane wali trend mein ek temporary rukawat paida hoti hai, jis se pattern ka round top ban jata hai.

Market phir se rally karne ki koshish karti hai, lekin pehle wale high se upar nahi nikalti. Is incomeletee tareen naye high ki kami market mein kamzori ko tasleem karti hai aur potential trend reversal ki taraf ishara karti hai. Jab qeematain mazeed niche jaati hain aur flat ya thora sa niche jhukte hue bottom banate hain, tab Dumpling Top pattern complete samjha jata hai.

CONFIRMATION AND ENTRY POINTS :

Dumpling Top pattern ki tashkhees us waqt hoti hai jab qeematain flat ya thora sa niche jhukne wale bottom se bhi neeche girte hain. Is break ke waqt amooman selling volume mein izafa hota hai, jo market ki sentiment mein taqat ka tazaad dikhati hai.

Traders is waqt short positions ya apni long positions ko bech sakte hain, mazeed niche movement ki umeed rakhte hue. Stop-loss orders ko recent swing high se upar rakha ja sakta hai, risk ko control karne ke liye. Profit targets ko pattern ki height ka andaza lagakar nichle breakout point se niche ki taraf project karke taeyar kiya jata hai.

POTENTIAL REVERSAL AND TARGET PRICE :

Dumpling Top pattern mazeed bearish trend ki potential trend reversal ko ishara karta hai. Ye sanket deta hai ke khareedne wali taqat kamzor ho chuki hai aur farokht karne wali taqat barh chuki hai, jis se market ki sentiment mein tabdeeli paida hoti hai.

Traders tashkhees ki tasdeeq ke baad market mein mazeed niche movement ka intezar kar sakte hain. Target price pattern ki height ko andaza lagakar nichle breakout point se niche ki taraf project karke estemaal kiya ja sakta hai. Is se traders ko market ki kitni had tak possible girawat ki umeed hoti hai.

Dumpling Top pattern 100% accurate nahi hai aur iska istemal dusre technical indicators aur analysis ke saath ki jana chahiye. False breakouts aur fakeouts ho sakte hain, isliye traders ko hamesha dusre factors jaise trend analysis, support aur resistance levels aur market momentum ka bhi hisaab rakhna chahiye.

POTENTIAL TRADING STRATEGIES AND RISK MANAGEMENT :

Traders Dumpling Top pattern ki trading mein kuch strategies istemal kar sakte hain. Aik strategy ye hai ke breakout point par short position liya jaye, jahan par stop-loss order recent swing high se upar rakha jata hai. Dosri strategy ye hai ke broken support level ki pullback ya retest ka intezar kiya jaye, phir short position liya jaye.

Risk management Dumpling Top pattern ki tijarat karte hue bahut zaroori hai. Traders hamesha munasib position sizing aur stop-loss orders ka istemaal karna chahiye takay potential nuksan ko had se zyada na hone dein. Iske alawa, tijarat ki progress ke saath risk management strategies ko baar baar review aur adjust karna bhi zaroori hai.

Ikhtitam mein, Dumpling Top pattern ek reversal pattern hai jo bullish se bearish ki taraf mogheera hone ki nishani deti hai. Traders is pattern ka istemaal karke samjh sakte hain ke market mein aur neeche ki taraf movement hogi aur iske mutabik apni entry aur exit points banasakte hain. Halaanki, yaad rakhein ke koi bhi tijarat pattern 100% sahi nahi hota aur traders ko hamesha dusre technical indicators aur analysis ka bhi tawazun rakhna chahiye tijarat ke faislay karne se pehle.

تبصرہ

Расширенный режим Обычный режим