INTRODUCTION TO INVERSE HEAD AND SHOULDERS PATTERN:

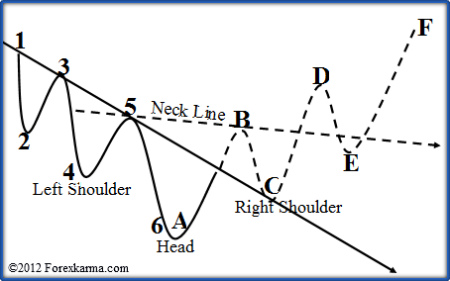

Inverse head and shoulders pattern forex trading charts mein dekha ja sakta hai. Ye ek bullish reversal pattern hai aur isse samjha jata hai ki ek existing downtrend kInverse head and shoulders pattern forex trading charts mein ek technical analysis formation hai. Isay ek bullish reversal pattern ke roop mein maana jaata hai aur iski wajah se samjha jaata hai ki ek maujooda downtrend khatam hone ki taraf ja sakta hai. Is pattern mein teen mukhya components hote hain: left shoulder, head aur right shoulder. Jab price low tak pahunchti hai aur phir temporary bounce hota hai, tab left shoulder ban jaata hai. Jab price pichhle low se bhi niche girti hai aur phir rebound hoti hai, tab head ban jaata hai. Ant mein price fir se upar badhti hai lekin head ki unchai tak nahi pahunchti, tab right shoulder ban jaata hai. Pattern poori hoti hai jab price neckline ke upar breakout karti hai. Neckline left shoulder aur right shoulder ke highs ko jodne wali line hoti hai. Zaruri hai dhyaan dena ki inverse head and shoulders pattern tabhi confirm hota hai jab neckline ko cross kiya jaata hai.

FORMATION AND SIGNIFICANCE OF THE NECKLINE:

Neckline inverse head and shoulders pattern mein ek ahem element hai kyunki ye ek mukhya samarthan star ke roop mein kaam karta hai. Ye left shoulder aur right shoulder ke highs ko jodta hai aur ek seedha ya thoda sa kendrit ho sakta hai. Neckline ka mahatva pattern ko validate karne mein hota hai. Jab price neckline ke upar breakout karti hai, tab ye bullish reversal pattern ko confirm karta hai aur ek potential upward trend ko darshaata hai. Saath hi saath, agar price neckline ke upar breakout na kar paye aur ise todekar niche gir jaaye, tab pattern invalid samjha jaata hai aur price apna downtrend jaari rakh sakti hai. Traders often apne stop-loss orders neckline ke niche hi rakhte hain, taaki false breakouts se bacha ja sake.

VOLUME AND CONFIRMATION:

Volume, inverse head and shoulders pattern ki tasdeeq karne mein ahmiyat ka kaam karta hai. Aam taur par, jab ye pattern ban raha hota hai,Voilem inverse head and shoulders pattern ki tasdeeq karne mein ahmiyat rakhta hai. Aksar, pattern banate waqt voilem kam hoti hai, jo bechnay walon ki kam dilchaspi ko darshata hai. Lekin jab keemat neckline se bahar nikal jati hai, toh voilem mein noticeable izafa hona chahiye, jisse kharidari ki shuruaat aur pattern ki tasdeeq ho. Zyada voilem bullish hokar market ki ehsas ko tasdeeq karta hai. Agar breakout kam ya girte voilem par hota hai, toh yeh ek galat breakout ke signal ho sakte hai aur pichli trend ka chalan jari rakh sakte hai.

MEASURING PRICE TARGET:

Traders aksar inverse head and shoulders pattern tasdeeq hone par uski unchi ko keemat nishan maaqiyat ke liye istemal karte hai. Nishan maaqiyan tayyar karne ke liye, traders neckline se head ka lowest point tak fasla napte hai aur ise breakout point se upar ki taraf istemal karte hai. Yeh nishan maaqiyat pattern dwara muta'alliq mumkin keemat ka andaza deta hai. Lekin yaad rakhein ke yeh sirf taksim hai aur dusre factors, jaise support aur resistance levels, ko bhi madde nazar rakhte hue munafa ka nishan maaqi jama karna chahiye.

POTENTIAL PITFALLS AND RECOGNITION:

Inverse head and shoulders pattern bullish reversal pehchanne ke liye powerful tool ho sakta hai, lekin ismein kuch mumkin mashkizaan hai jin par tawajjo dene ki zarurat hai. Galat breakouts ho sakte hai, jahan keemat briefly neckline se upar nikal jati hai, phir se nichle taraf lot kar jati hai. Galat signal se bachne ke liye, traders tasdeeq ka intezar karein aur dusre supporting factors, jaise voilem aur candlestick patterns, ko bhi madde nazar rakhein. Iske alawa, zarahtat market ya khabron ki wajah se trading karte waqt ihtiyat bartana zaruri hai, kyunki yahan tezi se keemat mein tabdeeli inverse pattern ko naaqis kar sakti hai. Inverse head and shoulders pattern pehchanne ke liye mashq aur tajurba zaruri hai. Yeh patterns ko sahi tareeke se pehchanna waqt aur mehnat maangta hai, lekin yeh traders ke liye munafa bakhsha bullish positions mein dakhil hone ke liye aik qeemati hoshiyar ban sakta hai.

Ikhtitam mein, inverse head and shoulders pattern forex trading mein widely recognized bullish reversal pattern hai. Traders is chart pattern ka istemal karke moghey kharidari ki muma'iniyat ki alamat pehchan sakte hai aur keemat nishan maaqi kar sakte hai. Tasdeeq karne ke liye neckline se breakout ki tasdeeq aur dusre factors, jaise voilem, ko madde nazar rakhna zaruri hai. Lekin ehtiyat bartana aur moghey bhol na bhayeh galat breakouts ya tabdeeli aati hui market volatility pe tawajjo rakhte hue jaruri hai. Tajurba aur mashq ke saath, traders inverse pattern ko pehchanne aur istemal karne mein mahir ho sakte hai.

Inverse head and shoulders pattern forex trading charts mein dekha ja sakta hai. Ye ek bullish reversal pattern hai aur isse samjha jata hai ki ek existing downtrend kInverse head and shoulders pattern forex trading charts mein ek technical analysis formation hai. Isay ek bullish reversal pattern ke roop mein maana jaata hai aur iski wajah se samjha jaata hai ki ek maujooda downtrend khatam hone ki taraf ja sakta hai. Is pattern mein teen mukhya components hote hain: left shoulder, head aur right shoulder. Jab price low tak pahunchti hai aur phir temporary bounce hota hai, tab left shoulder ban jaata hai. Jab price pichhle low se bhi niche girti hai aur phir rebound hoti hai, tab head ban jaata hai. Ant mein price fir se upar badhti hai lekin head ki unchai tak nahi pahunchti, tab right shoulder ban jaata hai. Pattern poori hoti hai jab price neckline ke upar breakout karti hai. Neckline left shoulder aur right shoulder ke highs ko jodne wali line hoti hai. Zaruri hai dhyaan dena ki inverse head and shoulders pattern tabhi confirm hota hai jab neckline ko cross kiya jaata hai.

FORMATION AND SIGNIFICANCE OF THE NECKLINE:

Neckline inverse head and shoulders pattern mein ek ahem element hai kyunki ye ek mukhya samarthan star ke roop mein kaam karta hai. Ye left shoulder aur right shoulder ke highs ko jodta hai aur ek seedha ya thoda sa kendrit ho sakta hai. Neckline ka mahatva pattern ko validate karne mein hota hai. Jab price neckline ke upar breakout karti hai, tab ye bullish reversal pattern ko confirm karta hai aur ek potential upward trend ko darshaata hai. Saath hi saath, agar price neckline ke upar breakout na kar paye aur ise todekar niche gir jaaye, tab pattern invalid samjha jaata hai aur price apna downtrend jaari rakh sakti hai. Traders often apne stop-loss orders neckline ke niche hi rakhte hain, taaki false breakouts se bacha ja sake.

VOLUME AND CONFIRMATION:

Volume, inverse head and shoulders pattern ki tasdeeq karne mein ahmiyat ka kaam karta hai. Aam taur par, jab ye pattern ban raha hota hai,Voilem inverse head and shoulders pattern ki tasdeeq karne mein ahmiyat rakhta hai. Aksar, pattern banate waqt voilem kam hoti hai, jo bechnay walon ki kam dilchaspi ko darshata hai. Lekin jab keemat neckline se bahar nikal jati hai, toh voilem mein noticeable izafa hona chahiye, jisse kharidari ki shuruaat aur pattern ki tasdeeq ho. Zyada voilem bullish hokar market ki ehsas ko tasdeeq karta hai. Agar breakout kam ya girte voilem par hota hai, toh yeh ek galat breakout ke signal ho sakte hai aur pichli trend ka chalan jari rakh sakte hai.

MEASURING PRICE TARGET:

Traders aksar inverse head and shoulders pattern tasdeeq hone par uski unchi ko keemat nishan maaqiyat ke liye istemal karte hai. Nishan maaqiyan tayyar karne ke liye, traders neckline se head ka lowest point tak fasla napte hai aur ise breakout point se upar ki taraf istemal karte hai. Yeh nishan maaqiyat pattern dwara muta'alliq mumkin keemat ka andaza deta hai. Lekin yaad rakhein ke yeh sirf taksim hai aur dusre factors, jaise support aur resistance levels, ko bhi madde nazar rakhte hue munafa ka nishan maaqi jama karna chahiye.

POTENTIAL PITFALLS AND RECOGNITION:

Inverse head and shoulders pattern bullish reversal pehchanne ke liye powerful tool ho sakta hai, lekin ismein kuch mumkin mashkizaan hai jin par tawajjo dene ki zarurat hai. Galat breakouts ho sakte hai, jahan keemat briefly neckline se upar nikal jati hai, phir se nichle taraf lot kar jati hai. Galat signal se bachne ke liye, traders tasdeeq ka intezar karein aur dusre supporting factors, jaise voilem aur candlestick patterns, ko bhi madde nazar rakhein. Iske alawa, zarahtat market ya khabron ki wajah se trading karte waqt ihtiyat bartana zaruri hai, kyunki yahan tezi se keemat mein tabdeeli inverse pattern ko naaqis kar sakti hai. Inverse head and shoulders pattern pehchanne ke liye mashq aur tajurba zaruri hai. Yeh patterns ko sahi tareeke se pehchanna waqt aur mehnat maangta hai, lekin yeh traders ke liye munafa bakhsha bullish positions mein dakhil hone ke liye aik qeemati hoshiyar ban sakta hai.

Ikhtitam mein, inverse head and shoulders pattern forex trading mein widely recognized bullish reversal pattern hai. Traders is chart pattern ka istemal karke moghey kharidari ki muma'iniyat ki alamat pehchan sakte hai aur keemat nishan maaqi kar sakte hai. Tasdeeq karne ke liye neckline se breakout ki tasdeeq aur dusre factors, jaise voilem, ko madde nazar rakhna zaruri hai. Lekin ehtiyat bartana aur moghey bhol na bhayeh galat breakouts ya tabdeeli aati hui market volatility pe tawajjo rakhte hue jaruri hai. Tajurba aur mashq ke saath, traders inverse pattern ko pehchanne aur istemal karne mein mahir ho sakte hai.

'%20x='0'%20y='0'%20height='100%25'%20width='100%25'%20xlink%3Ahref='data%3Aimage/jpeg;base64,/9j/4AAQSkZJRgABAQAAAQABAAD/2wBDABALDA4MChAODQ4SERATGCgaGBYWGDEjJR0oOjM9PDkzODdASFxOQERXRTc4UG1RV19iZ2hnPk1xeXBkeFxlZ2P/2wBDARESEhgVGC8aGi9jQjhCY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2P/wAARCAAGAAgDASIAAhEBAxEB/8QAFQABAQAAAAAAAAAAAAAAAAAAAAb/xAAYEAADAQEAAAAAAAAAAAAAAAAAARECEv/EABQBAQAAAAAAAAAAAAAAAAAAAAD/xAAUEQEAAAAAAAAAAAAAAAAAAAAA/9oADAMBAAIRAxEAPwC84mqtOgAD/9k='%3E%3C/image%3E%3C/svg%3E)

تبصرہ

Расширенный режим Обычный режим