DEFINITION OF DOUBLE BOTTOM PATTERN:

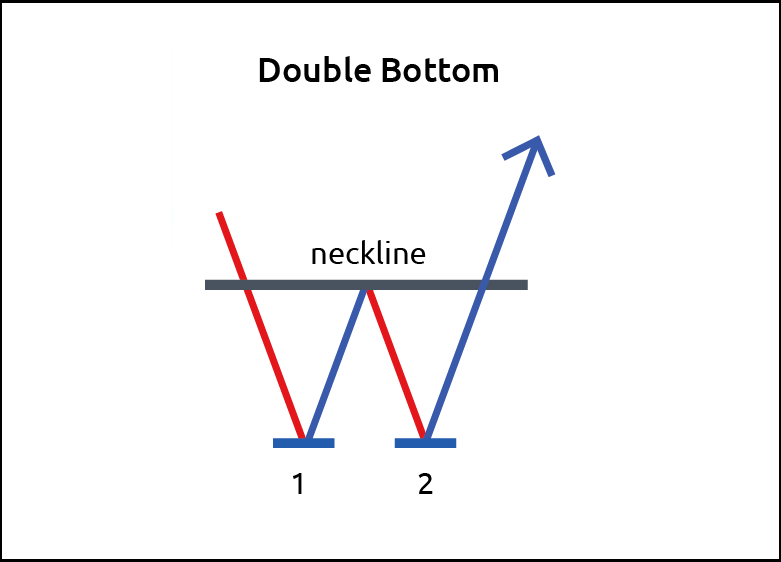

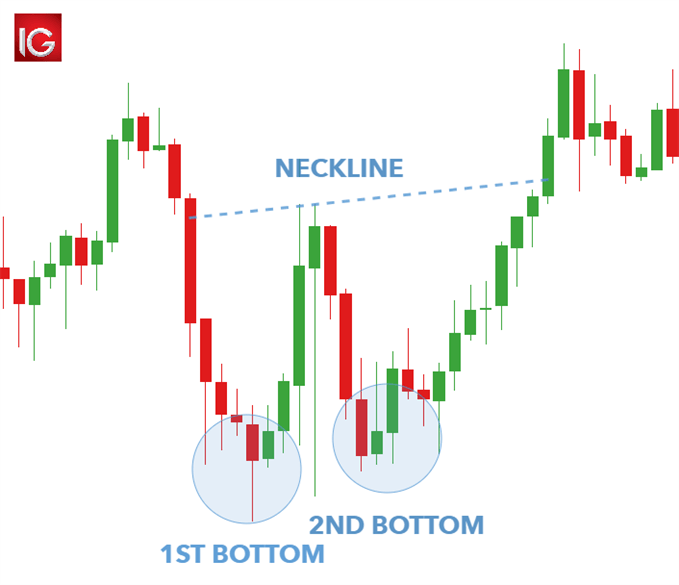

Double bottom pattern ek technical analysis charting pattern hai jise security ke price movement mein potaale ki suraksha ki keemat ke pehchaan karne ke liye aam taur par istemaal kiya jata hai. Ye pattern tab paida hota hai jab ek suraksha keemat ke potaale mein security ke price girata hai. Ye pattern "W" ki shakal mein hota hai, jahan price pehle kam hoti hai, phir ek bottom par pahunchti hai, upar uthati hai, phir girati hai aur doosri bottom banati hai, aur phir ek mahatvapoorna upar ki harkat hoti hai.

Is pattern ke tashkeel ko samajhne ke liye, bazaar mein shamil hone wale vyaktiyon ke manobhavna ka tafsili tajurba karna mahatvapurna hai. Pehla bottom us waqat ki selling pressure aur beargish sentiment ko darshaata hai jo bazaar mein mojood hai. Jab price is kam keemat tak pahunchti hai, khareedne ke iraade wale ise kam keemat samajhne lagte hain, jiski wajah se khareedari mein izafa hota hai. Is khareedari ki dabao wajah se price pehle bottom se upar uthati hai.

Halaanki, ye pehla rally aksar kam samay tak hoti hai aur koora shuru ho jaata hai, jiski wajah se doosra giravat hoti hai aur doosra bottom banata hai. Is waqt bazaar ki bhavishyavaani bearish hai aur bechne wale bazaar par dominent hote hain. Phir se, khareedne wale is suvidha ke level par bazaar mein dakhil hote hain, jiski wajah se price aur bhi unchai tak badhti hai.

VOLUME ANALYSISIN DOUBLE BOTTOM PATTERN :

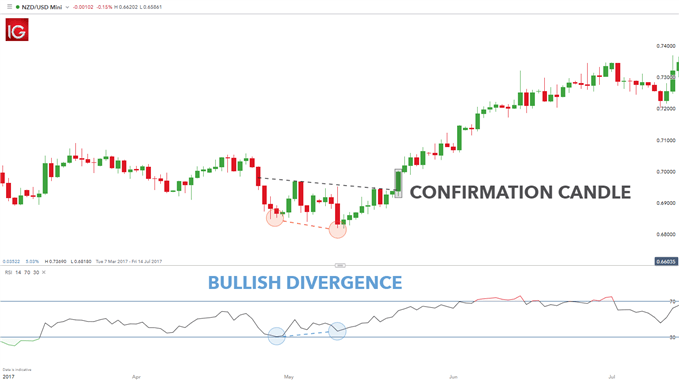

Volume analysis double bottom pattern ko tajurbe karne mein mahatvapurna hai. Is pattern ki tashkeel ke dauran ek aham pehlu to volume hai. Ideal taur par, volume pehli kam ke dauran zyada hona chahiye, jo mazboot selling pressure ki tasdeek karta hai. Jab price upar uthati hai, to volume kam hona chahiye, jo bechna wale dilchaspi ki kami ka afsurda karta hai.

Doosre bottom ki tashkeel ke dauran, volume phir se badhna shuru karna chahiye, jisse naayi bechni ki dabao ki nakaami ki nishani hoti hai. Lekin jab price doosre bottom se upar uthne lagti hai, to volume ka bahav dekhna zaroori hai, jise majboot khareedne ki dilchaspi ki nishani ke taur par samjha jata hai. Doosre bottom se breakout ke dauran zyada volume, pattern ka tasleem karne aur ek sambhav trend ulatne ki janakari dena zaroori hai.

NECKLINE IN DOUBLE BOTTOM PATTERN :

Neckline double bottom pattern mein ek eham ahemiat rakhta hai. Ye ek resistance level ki tarah kaam karta hai jise price ko todna hota hai pattern ko tasleem karane ke liye. Neckline pehle aur doosre bottoms ke baad bana hota hai. Neechey aur neckline ke beech ki fasle bhi tawazun mein rakhne ki eham baat hai.

Ek kam iqtidal wali neckline, taqatwar pattern ko dikhata hai kyunki yeh ishara karta hai ke price ne kam mushkilat ke saath upar jana hai. Aksar barri neckline kamzor pattern ko batati hai, kyunki yeh ishara karta hai ke price ko upar jaane mein zyada takleef hai. Traders neckline ke upar breakout ko tasdeeq ke liye dekhte hain, jiska tasdeeq volume ki barhti hui tadad bhi karta hai.

TARGET PROJECTION IN DOUBLE BOTTOM PATTERN :

Jab price neckline ke upar breakout karta hai, traders aksar potential upar ki harekate ke liye target ka andaaza lagate hain. Aam taur par ek method target ka tayyar karne ke liye pehle bottom se neckline tak ki fasl ko measure karna hai. Phir is fasl ko breakout point par jodkar potential target ka andaaza lagaya ja sakta hai.

Yeh note karna zaroori hai ke target projection ek tajweezah hai aur muqarrar natija nahi hai. Is liye zaroori hai ke dusre technical indicators aur market conditions ko bhi samjh liya jaye target ki kamyabi ke asle maiyar ke taur par. Traders aksar overall market sentiment aur potential resistance levels ko bhi dekh kar apne target projections adjust karte hain jo agay ki upar ki harekate mein rok sakta hai.

FAILURE AND INVALIDATION IN DOUBLR BOTTOM PATTERN :

Double bottom pattern potential trend reversals ke baray mein ahem maloomat faraham karne ki salahiyat rakhta hai, lekin woh halat jahan pattern fail ho jaye ya anisar ho jaye, se waqif rehna bhi zaroori hai. Ek aam fail hone ki soorat mein price neckline ke upar na paar ho kar false breakout paida kar sakta hai.

Doosra scenario ye hai ke price neckline ke upar paar karke upar ki momentum ko sustad nahi kar sakta, jis ki wajah se fori tawalud ki bajaye wapas neeche ki taraf ulat jata hai. Aisi halat mein pattern ke nakami ka matlab hai ke bearish sentiment abhi bhi market par havi hai, isliye traders ko ahtiyat ke sath bullish positions lena chahiye.

False signals ya pattern ke nakami ke risk ko kam karne ke liye mashoor hai ke double bottom pattern ko dusre technical indicators aur tajziati tools ke saath istemal kiya jaye. Yeh market ki poora jaiza farahamy karne mein madadgar ho sakta hai aur pattern ki isharon ko tasdeeq karna mein madad karta hai.

Double bottom pattern ek technical analysis charting pattern hai jise security ke price movement mein potaale ki suraksha ki keemat ke pehchaan karne ke liye aam taur par istemaal kiya jata hai. Ye pattern tab paida hota hai jab ek suraksha keemat ke potaale mein security ke price girata hai. Ye pattern "W" ki shakal mein hota hai, jahan price pehle kam hoti hai, phir ek bottom par pahunchti hai, upar uthati hai, phir girati hai aur doosri bottom banati hai, aur phir ek mahatvapoorna upar ki harkat hoti hai.

Is pattern ke tashkeel ko samajhne ke liye, bazaar mein shamil hone wale vyaktiyon ke manobhavna ka tafsili tajurba karna mahatvapurna hai. Pehla bottom us waqat ki selling pressure aur beargish sentiment ko darshaata hai jo bazaar mein mojood hai. Jab price is kam keemat tak pahunchti hai, khareedne ke iraade wale ise kam keemat samajhne lagte hain, jiski wajah se khareedari mein izafa hota hai. Is khareedari ki dabao wajah se price pehle bottom se upar uthati hai.

Halaanki, ye pehla rally aksar kam samay tak hoti hai aur koora shuru ho jaata hai, jiski wajah se doosra giravat hoti hai aur doosra bottom banata hai. Is waqt bazaar ki bhavishyavaani bearish hai aur bechne wale bazaar par dominent hote hain. Phir se, khareedne wale is suvidha ke level par bazaar mein dakhil hote hain, jiski wajah se price aur bhi unchai tak badhti hai.

VOLUME ANALYSISIN DOUBLE BOTTOM PATTERN :

Volume analysis double bottom pattern ko tajurbe karne mein mahatvapurna hai. Is pattern ki tashkeel ke dauran ek aham pehlu to volume hai. Ideal taur par, volume pehli kam ke dauran zyada hona chahiye, jo mazboot selling pressure ki tasdeek karta hai. Jab price upar uthati hai, to volume kam hona chahiye, jo bechna wale dilchaspi ki kami ka afsurda karta hai.

Doosre bottom ki tashkeel ke dauran, volume phir se badhna shuru karna chahiye, jisse naayi bechni ki dabao ki nakaami ki nishani hoti hai. Lekin jab price doosre bottom se upar uthne lagti hai, to volume ka bahav dekhna zaroori hai, jise majboot khareedne ki dilchaspi ki nishani ke taur par samjha jata hai. Doosre bottom se breakout ke dauran zyada volume, pattern ka tasleem karne aur ek sambhav trend ulatne ki janakari dena zaroori hai.

NECKLINE IN DOUBLE BOTTOM PATTERN :

Neckline double bottom pattern mein ek eham ahemiat rakhta hai. Ye ek resistance level ki tarah kaam karta hai jise price ko todna hota hai pattern ko tasleem karane ke liye. Neckline pehle aur doosre bottoms ke baad bana hota hai. Neechey aur neckline ke beech ki fasle bhi tawazun mein rakhne ki eham baat hai.

Ek kam iqtidal wali neckline, taqatwar pattern ko dikhata hai kyunki yeh ishara karta hai ke price ne kam mushkilat ke saath upar jana hai. Aksar barri neckline kamzor pattern ko batati hai, kyunki yeh ishara karta hai ke price ko upar jaane mein zyada takleef hai. Traders neckline ke upar breakout ko tasdeeq ke liye dekhte hain, jiska tasdeeq volume ki barhti hui tadad bhi karta hai.

TARGET PROJECTION IN DOUBLE BOTTOM PATTERN :

Jab price neckline ke upar breakout karta hai, traders aksar potential upar ki harekate ke liye target ka andaaza lagate hain. Aam taur par ek method target ka tayyar karne ke liye pehle bottom se neckline tak ki fasl ko measure karna hai. Phir is fasl ko breakout point par jodkar potential target ka andaaza lagaya ja sakta hai.

Yeh note karna zaroori hai ke target projection ek tajweezah hai aur muqarrar natija nahi hai. Is liye zaroori hai ke dusre technical indicators aur market conditions ko bhi samjh liya jaye target ki kamyabi ke asle maiyar ke taur par. Traders aksar overall market sentiment aur potential resistance levels ko bhi dekh kar apne target projections adjust karte hain jo agay ki upar ki harekate mein rok sakta hai.

FAILURE AND INVALIDATION IN DOUBLR BOTTOM PATTERN :

Double bottom pattern potential trend reversals ke baray mein ahem maloomat faraham karne ki salahiyat rakhta hai, lekin woh halat jahan pattern fail ho jaye ya anisar ho jaye, se waqif rehna bhi zaroori hai. Ek aam fail hone ki soorat mein price neckline ke upar na paar ho kar false breakout paida kar sakta hai.

Doosra scenario ye hai ke price neckline ke upar paar karke upar ki momentum ko sustad nahi kar sakta, jis ki wajah se fori tawalud ki bajaye wapas neeche ki taraf ulat jata hai. Aisi halat mein pattern ke nakami ka matlab hai ke bearish sentiment abhi bhi market par havi hai, isliye traders ko ahtiyat ke sath bullish positions lena chahiye.

False signals ya pattern ke nakami ke risk ko kam karne ke liye mashoor hai ke double bottom pattern ko dusre technical indicators aur tajziati tools ke saath istemal kiya jaye. Yeh market ki poora jaiza farahamy karne mein madadgar ho sakta hai aur pattern ki isharon ko tasdeeq karna mein madad karta hai.

تبصرہ

Расширенный режим Обычный режим