Hook Reversal Pattern: Ek Roman Urdu Mein Tafseeli Tanqeed

Hook reversal pattern ek technical analysis term hai jo ke financial markets, jaise ke stocks ya commodities, mein istemal hoti hai. Yeh pattern market ke price charts par nazar aata hai aur traders ko future price movements ke baray mein malumat farahem karta hai. Is article mein, hum hook reversal pattern ki tafseelat aur iske istemal par baat karenge.

Hook Reversal Pattern Kya Hai?

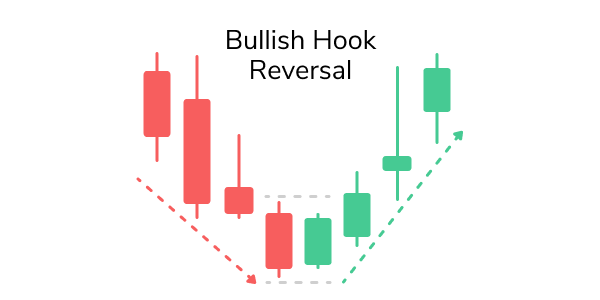

Hook reversal pattern ek candlestick pattern hai jo ke market trend ka indication karta hai. Iska naam iske appearance se aaya hai, jismein ek ya do lambi candles hoti hain jo market trend ko indicate karte hain. Agar market ek certain direction mein move kar rahi hai aur phir ek hook reversal pattern aata hai, to yeh indicate karta hai ke trend mein reversal hone ke chances hain.

Hook Reversal Pattern Ki Pehchan:

Hook reversal pattern ki pehchan karne ke liye traders ko market ke candlestick charts par dhan dena zaroori hai. Is pattern mein kuch key features hote hain:

- Trend Direction: Pehle toh dekha jata hai ke market ka trend kis direction mein hai. Agar uptrend hai toh candles upar ki taraf ja rahi hongi, aur agar downtrend hai toh candles neeche ki taraf ja rahi hongi.

- Hook Candle: Phir traders ko dhyan dena hota hai hook candle par. Hook candle wo hoti hai jo trend direction ke against move karti hai. Agar uptrend hai toh hook candle neeche ja sakti hai aur agar downtrend hai toh hook candle upar ja sakti hai.

- Confirmation Candle: Hook candle ke baad, ek confirmation candle aati hai jo ke hook ki direction mein move karti hai. Yeh candle traders ko is baat ki confirmation deti hai ke trend reversal hone ke chances hain.

Hook Reversal Pattern Ka Istemal:

Hook reversal pattern ka istemal traders ko market ke future movements ke baray mein malumat hasil karne mein madad karta hai. Agar trend reversal hone ke chances hain toh traders apne trading strategies ko adjust kar sakte hain.

Yeh pattern short-term ya long-term trading ke liye istemal kiya ja sakta hai, lekin hamesha yeh zaroori hai ke traders market ke overall context ko bhi samajhein.

Naseehat Aur Khayalat:

- Hook reversal pattern ek tool hai, lekin isay standalone indicator ki tarah na lein. Hamesha doosre technical analysis tools aur market indicators ke saath istemal karein.

- Kabhi bhi puri tarah se rely na karein, hamesha apne analysis aur research par bharosa karein.

- Risk management ko hamesha yaad rakhein aur apne trades ko control mein rakhein.

Is article mein, humne hook reversal pattern ki tafseelat par ghaur kiya. Yeh pattern traders ko market ke trends ko samajhne mein madad karta hai aur unhe future price movements ke baray mein anayat farahem karta hai.

تبصرہ

Расширенный режим Обычный режим