DEFINITION AND CHARACTERISTICS OF DOUBLE BOTTOM PATTERN:

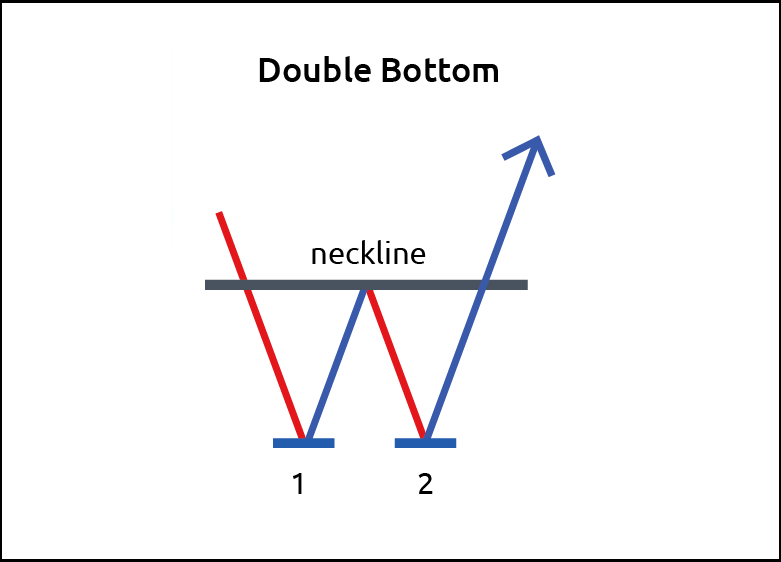

Double bottom pattern forex trading mein sab se zyada istemal hone wale chart patterns mein se ek hai. Jab kisi currency pair ki qeemat ek bottom tak pahunchti hai, phir oopar uthkar wapas wahi ya us se milta julta support level tak girne ke baad doosra bottom banata hai. Is pattern ki tashkeel ka matlab hai ki downtrend mein reversal ki sambhavna hai aur uptrend ki taraf parivartan ho sakta hai.

Double bottom pattern ki mukhya khasiyat hai ki isme do barabar neeche ke price levels, yaani bottoms, ek nishchit samay seema ke andar hote hain. Ye price levels ek doosre ke kareeb hote hain, iska matlab hai ki kharidne wale log price ko support karne ke liye ek hi level par aa rahe hain. Ye bottoms ek peak ya neckline se jude hote hain, ye ek resistance level ka kaam karta hai aur pattern ko confirm karne ke liye break hona zaruri hai.

IDENTIFYING A DOUBLE BOTTOM PATTERN:

Forex chart par double bottom pattern ko pehchanne ke liye, traders ko dhyaan se dekhna hoga ki do bottoms clear tarike se bane hain, jo similar ya equal neeche ke level par hote hain. In bottoms ke baad neckline ya peak se jude hote hain. Bottoms ke baad neckline se break-up hone par pattern ki tasdeek hoti hai.

Traders double bottom pattern ko pehchane ke liye alag-alag technical analysis tools ka istemal kar sakte hain, jaise ki trend lines, support and resistance levels, ya moving averages. Ye tools pattern ke sahi hone ki tasdeek karte hain aur potential trades ke liye aur support aur resistance levels pradan karte hain.

CONFIRMATION AND TRADE ENTRY:

Double bottom pattern ki pehchan ho jane ke baad, traders trade entry se pehle tasdeek ke liye rukte hain. Is tasdeek ka pata is baat se chalta hai ki price neckline se oopar break karke significant volume ke saath aur majboot bullish momentum ke saath aage badhti hai.

Trade entry ke liye, traders neckline ke thoda upar ek buy order rakhte hain ya fir neckline tak pullback ka intezaar karte hain. Stop-loss level second bottom ke neeche rakha ja sakta hai, jisse ki potential false breakouts ke liye cushion ho. Profit target bottom aur neckline ke beech ki doori ka maap karke ussi doori ko neckline se upar projection karke set kiya ja sakta hai.

POTENTIAL PITFALLS AND FALSE SIGNALS:

Double bottom pattern ek vishwasniya reversal pattern ho sakti hai, lekin traders ko sambhavnaatam jhatke aur galat signals ki quandt mein rehna zaroori hai. Ek aam jhatka galati double bottom pattern ko triple bottom pattern ke roop mein samajhna hai, jisme price teen-bottoms instead of do bottom banata hai.

Traders ko false breakouts par bhi satark rehna chahiye, jahan price briefly neckline se oopar break karti hai, lekin upar ka momentum sambhal nahi paata. Agar trades initial breakout par dalkar ki jaati hai, toh ye false breakouts loss ka karan ho sakte hain.

ENHANCING THE PERFORMANCE OF THE DOUBLE BOTTOM PATTERN:

Double bottom pattern ki performance ko badhane ke liye, traders aur technical indicators ya tools ka istemal kar sakte hain. Jaise ki, traders bullish reversal candlestick patterns jaise engulfing ya piercing patterns ko dhundh sakte hain, jo aur tasdeek pradaan karte hain. Wo oscillators, jaise relative strength index (RSI) bhi istemal kar sakte hain, overbought ya oversold conditions aur potential entry points ko pehchane ke liye.

Is ke alawa, traders double bottom pattern trade karne se pehle overall trend ko bhi ghor kar sakte hain. Double bottom pattern jo ek uptrend ke andar hota hai, generally considered more reliable hai kyunki isse larger trend ke saath align hota hai aur ek potential reversal ki strong tasdeeq provide kar sakta hai.

Conclusion:

Double bottom pattern forex trading mein ek widely followed chart pattern hai. Traders is pattern ko do bottoms ke formation se pehchan sakte hain, jinme similar lows hote hain aur jo neckline se jude hote hain. Ye pattern ek potential reversal ko downtrend mein dikhata hai aur ek shift ko uptrend ki taraf. Traders ko tasdeeq ka intezar karna chahiye, jaise neckline ke breakout ke saath volume aur bullish momentum ke saath, trade mein dakhil hone se pehle. Lekin, traders ko false signals se savdhan rehna chahiye aur pattern ki performance ko behtar banane ke liye aur technical indicators ya tools ka istemal karne ka sochna chahiye.

Double bottom pattern forex trading mein sab se zyada istemal hone wale chart patterns mein se ek hai. Jab kisi currency pair ki qeemat ek bottom tak pahunchti hai, phir oopar uthkar wapas wahi ya us se milta julta support level tak girne ke baad doosra bottom banata hai. Is pattern ki tashkeel ka matlab hai ki downtrend mein reversal ki sambhavna hai aur uptrend ki taraf parivartan ho sakta hai.

Double bottom pattern ki mukhya khasiyat hai ki isme do barabar neeche ke price levels, yaani bottoms, ek nishchit samay seema ke andar hote hain. Ye price levels ek doosre ke kareeb hote hain, iska matlab hai ki kharidne wale log price ko support karne ke liye ek hi level par aa rahe hain. Ye bottoms ek peak ya neckline se jude hote hain, ye ek resistance level ka kaam karta hai aur pattern ko confirm karne ke liye break hona zaruri hai.

IDENTIFYING A DOUBLE BOTTOM PATTERN:

Forex chart par double bottom pattern ko pehchanne ke liye, traders ko dhyaan se dekhna hoga ki do bottoms clear tarike se bane hain, jo similar ya equal neeche ke level par hote hain. In bottoms ke baad neckline ya peak se jude hote hain. Bottoms ke baad neckline se break-up hone par pattern ki tasdeek hoti hai.

Traders double bottom pattern ko pehchane ke liye alag-alag technical analysis tools ka istemal kar sakte hain, jaise ki trend lines, support and resistance levels, ya moving averages. Ye tools pattern ke sahi hone ki tasdeek karte hain aur potential trades ke liye aur support aur resistance levels pradan karte hain.

CONFIRMATION AND TRADE ENTRY:

Double bottom pattern ki pehchan ho jane ke baad, traders trade entry se pehle tasdeek ke liye rukte hain. Is tasdeek ka pata is baat se chalta hai ki price neckline se oopar break karke significant volume ke saath aur majboot bullish momentum ke saath aage badhti hai.

Trade entry ke liye, traders neckline ke thoda upar ek buy order rakhte hain ya fir neckline tak pullback ka intezaar karte hain. Stop-loss level second bottom ke neeche rakha ja sakta hai, jisse ki potential false breakouts ke liye cushion ho. Profit target bottom aur neckline ke beech ki doori ka maap karke ussi doori ko neckline se upar projection karke set kiya ja sakta hai.

POTENTIAL PITFALLS AND FALSE SIGNALS:

Double bottom pattern ek vishwasniya reversal pattern ho sakti hai, lekin traders ko sambhavnaatam jhatke aur galat signals ki quandt mein rehna zaroori hai. Ek aam jhatka galati double bottom pattern ko triple bottom pattern ke roop mein samajhna hai, jisme price teen-bottoms instead of do bottom banata hai.

Traders ko false breakouts par bhi satark rehna chahiye, jahan price briefly neckline se oopar break karti hai, lekin upar ka momentum sambhal nahi paata. Agar trades initial breakout par dalkar ki jaati hai, toh ye false breakouts loss ka karan ho sakte hain.

ENHANCING THE PERFORMANCE OF THE DOUBLE BOTTOM PATTERN:

Double bottom pattern ki performance ko badhane ke liye, traders aur technical indicators ya tools ka istemal kar sakte hain. Jaise ki, traders bullish reversal candlestick patterns jaise engulfing ya piercing patterns ko dhundh sakte hain, jo aur tasdeek pradaan karte hain. Wo oscillators, jaise relative strength index (RSI) bhi istemal kar sakte hain, overbought ya oversold conditions aur potential entry points ko pehchane ke liye.

Is ke alawa, traders double bottom pattern trade karne se pehle overall trend ko bhi ghor kar sakte hain. Double bottom pattern jo ek uptrend ke andar hota hai, generally considered more reliable hai kyunki isse larger trend ke saath align hota hai aur ek potential reversal ki strong tasdeeq provide kar sakta hai.

Conclusion:

Double bottom pattern forex trading mein ek widely followed chart pattern hai. Traders is pattern ko do bottoms ke formation se pehchan sakte hain, jinme similar lows hote hain aur jo neckline se jude hote hain. Ye pattern ek potential reversal ko downtrend mein dikhata hai aur ek shift ko uptrend ki taraf. Traders ko tasdeeq ka intezar karna chahiye, jaise neckline ke breakout ke saath volume aur bullish momentum ke saath, trade mein dakhil hone se pehle. Lekin, traders ko false signals se savdhan rehna chahiye aur pattern ki performance ko behtar banane ke liye aur technical indicators ya tools ka istemal karne ka sochna chahiye.

تبصرہ

Расширенный режим Обычный режим