OVERVIEW OF THE ZIGZAG INDICATOR:

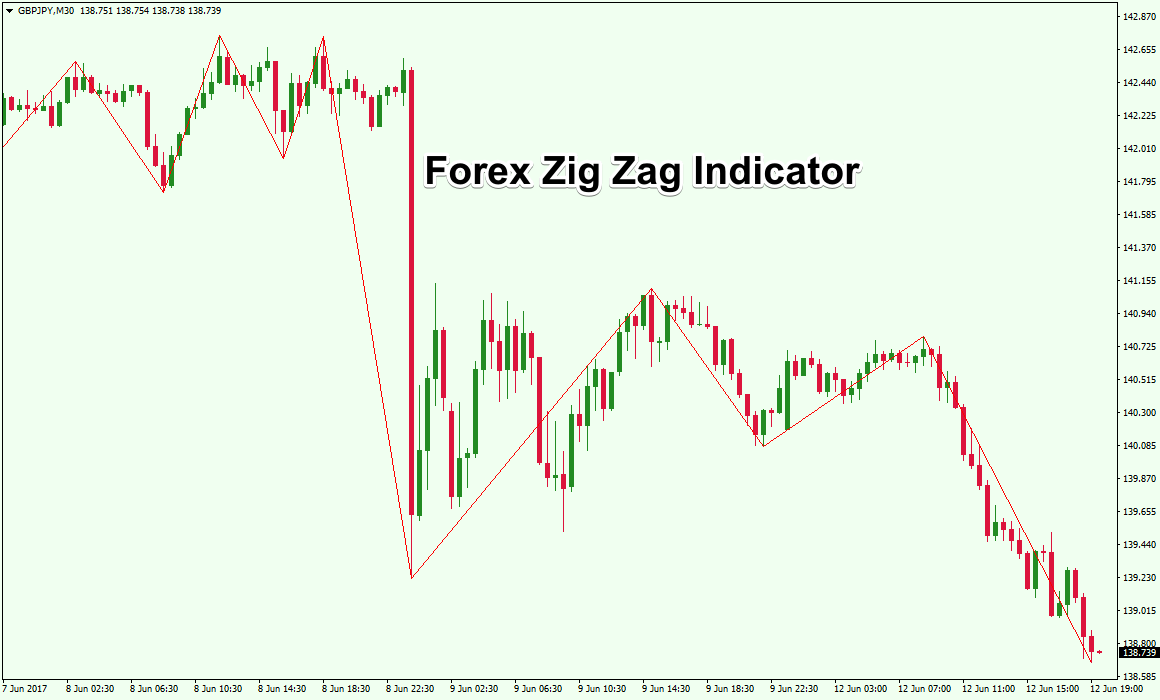

ZigZag Indicator, forex trading mein istemaal hone wala aik popular technical analysis tool hai jo traders ko market mein ahem qeematsaye mudey ki pehchan karne mein madad kar sakta hai. Iska kaam chote price movement ko filter karke badi, ahem price swings ko highlight karna hota hai. Is indicator ki bunyad market ke zigzag pattern par hai, jahan upar neeche ki taraf alternate waves hote hain. Is tarah ke waves ko pehchan karke, traders market ki overall direction ka andaza laga sakte hain aur in trend reversals se faida utha sakte hain.

CALCULATION OF THE ZIGZAG INDICATOR:

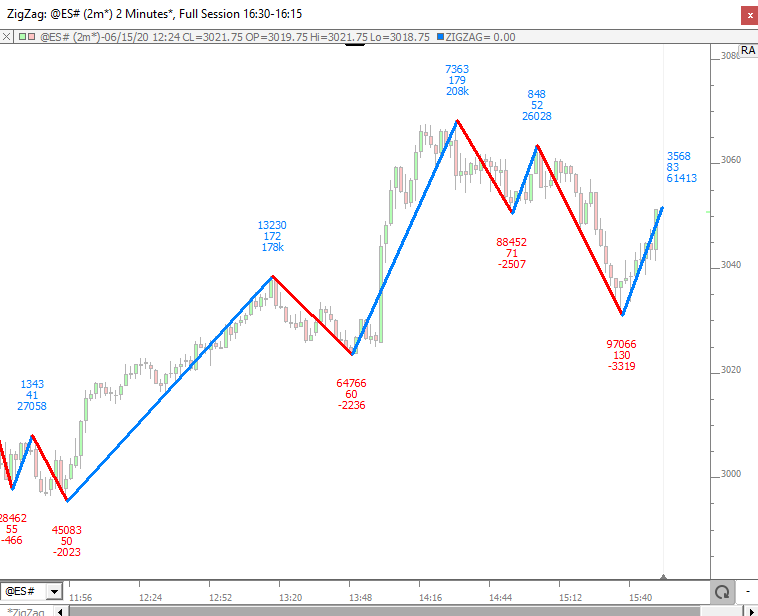

ZigZag Indicator, price movement mein local peaks aur troughs ka tayyun karke unhe trend lines se jodkar calculate kiya jata hai. Indicator noise ko eliminate karne ke liye kisi threshold (aam tor par percentage ya fixed value) se kam price movement ko filter karta hai aur ahem price swings par focus karta hai.

ZigZag indicator ko calculate karne ke liye sab se pehle, indicator threshold se zyada price movement ki talaash karta hai. Jab wo ek ahem move milta hai, to wo point move ki direction par depend karte hue peak ya trough ke roop mein mark kiya jata hai. Phir, indicator price data mein agey scan karti hai aur next ahem move jo threshold se zyada hai ko doosri peak ya trough ki tarah mark karti hai. Ye process tab tak chalti hai jab tak market apni direction change na karde, is waqt nayi trend line draw ki jati hai.

INTERPRETING THE ZIGZAG INDICATOR:

ZigZag Indicator zyada tar trend reversals ko identify aur confirm karne ke liye istemal hota hai. Jab indicator higher peaks ya lower troughs ko jodta hai, to ye ek upward ya downward trend ka ishara deta hai. Bil-khasoos, jab indicator lower highs ya higher lows ko jod kar ek line banti hai, to ye ek potentional trend reversal ki nishandahi karta hai.

Traders ZigZag Indicator ka istemal short-term aur long-term trend reversals ko identify karne ke liye kar sakte hain. Short-term traders bade trend ke andar chote zigzag patterns ki talaash kar sakte hain, taaki unhe apni trading strategies mein entry aur exit points ka pata chal sake. Long-term trend traders ZigZag Indicator ka istemal karke apni analysis ko validate kar sakte hain aur apni positions ke bare mein behtar faislay kar sakte hain.

LIMITATIONS OF THE ZIGZAG INDICATOR:

Zaroori hai ke ZigZag Indicator ke kuch hadood ko samjha jaye, jin par traders ko tawajjoh deni chahiye. Sab se pehle, indicator apne signals ko badal sakta hai jab naye price swings ka pata chalta hai. Iska matlab hai ke indicator ki signals asal maqsad se pehle change ho sakte hain, jisse real-time trading decisions par bharosa karna mushkil ho jata hai.

Dusri baat, ZigZag Indicator kam price volatility ya consolidation wale samay mein kabhi kabar galat signals generate kar sakta hai. Isliye zaroori hai ke ZigZag signals ki sahi tasdeek ke liye dusre technical indicators ya market factors ko bhi consider kiya jaye, tabhi karwai ki jaye.

USING THE ZIGZAG INDICATOR IN TRADING STRATEGIES:

ZigZag Indicator ko trading strategies mein istemal karke decision-making ko behtar banaya ja sakta hai. Aik tareeqa hai ZigZag Indicator ko dusre technical analysis tools jaise moving averages ya support aur resistance levels ke saath combine karna. Isse potential trend reversals ki additional tasdeek milti hai.

Traders ZigZag Indicator ko filter ke roop mein istemal karke high-probability trading setups ko identify kar sakte hain. Maslan, wo sirf wohi trades consider karenge jab ZigZag Indicator crucial Fibonacci level ya significant support/resistance area par trend reversal ki nishandahi kar raha ho.

ZigZag Indicator, forex trading mein istemaal hone wala aik popular technical analysis tool hai jo traders ko market mein ahem qeematsaye mudey ki pehchan karne mein madad kar sakta hai. Iska kaam chote price movement ko filter karke badi, ahem price swings ko highlight karna hota hai. Is indicator ki bunyad market ke zigzag pattern par hai, jahan upar neeche ki taraf alternate waves hote hain. Is tarah ke waves ko pehchan karke, traders market ki overall direction ka andaza laga sakte hain aur in trend reversals se faida utha sakte hain.

CALCULATION OF THE ZIGZAG INDICATOR:

ZigZag Indicator, price movement mein local peaks aur troughs ka tayyun karke unhe trend lines se jodkar calculate kiya jata hai. Indicator noise ko eliminate karne ke liye kisi threshold (aam tor par percentage ya fixed value) se kam price movement ko filter karta hai aur ahem price swings par focus karta hai.

ZigZag indicator ko calculate karne ke liye sab se pehle, indicator threshold se zyada price movement ki talaash karta hai. Jab wo ek ahem move milta hai, to wo point move ki direction par depend karte hue peak ya trough ke roop mein mark kiya jata hai. Phir, indicator price data mein agey scan karti hai aur next ahem move jo threshold se zyada hai ko doosri peak ya trough ki tarah mark karti hai. Ye process tab tak chalti hai jab tak market apni direction change na karde, is waqt nayi trend line draw ki jati hai.

INTERPRETING THE ZIGZAG INDICATOR:

ZigZag Indicator zyada tar trend reversals ko identify aur confirm karne ke liye istemal hota hai. Jab indicator higher peaks ya lower troughs ko jodta hai, to ye ek upward ya downward trend ka ishara deta hai. Bil-khasoos, jab indicator lower highs ya higher lows ko jod kar ek line banti hai, to ye ek potentional trend reversal ki nishandahi karta hai.

Traders ZigZag Indicator ka istemal short-term aur long-term trend reversals ko identify karne ke liye kar sakte hain. Short-term traders bade trend ke andar chote zigzag patterns ki talaash kar sakte hain, taaki unhe apni trading strategies mein entry aur exit points ka pata chal sake. Long-term trend traders ZigZag Indicator ka istemal karke apni analysis ko validate kar sakte hain aur apni positions ke bare mein behtar faislay kar sakte hain.

LIMITATIONS OF THE ZIGZAG INDICATOR:

Zaroori hai ke ZigZag Indicator ke kuch hadood ko samjha jaye, jin par traders ko tawajjoh deni chahiye. Sab se pehle, indicator apne signals ko badal sakta hai jab naye price swings ka pata chalta hai. Iska matlab hai ke indicator ki signals asal maqsad se pehle change ho sakte hain, jisse real-time trading decisions par bharosa karna mushkil ho jata hai.

Dusri baat, ZigZag Indicator kam price volatility ya consolidation wale samay mein kabhi kabar galat signals generate kar sakta hai. Isliye zaroori hai ke ZigZag signals ki sahi tasdeek ke liye dusre technical indicators ya market factors ko bhi consider kiya jaye, tabhi karwai ki jaye.

USING THE ZIGZAG INDICATOR IN TRADING STRATEGIES:

ZigZag Indicator ko trading strategies mein istemal karke decision-making ko behtar banaya ja sakta hai. Aik tareeqa hai ZigZag Indicator ko dusre technical analysis tools jaise moving averages ya support aur resistance levels ke saath combine karna. Isse potential trend reversals ki additional tasdeek milti hai.

Traders ZigZag Indicator ko filter ke roop mein istemal karke high-probability trading setups ko identify kar sakte hain. Maslan, wo sirf wohi trades consider karenge jab ZigZag Indicator crucial Fibonacci level ya significant support/resistance area par trend reversal ki nishandahi kar raha ho.

:max_bytes(150000):strip_icc()/ZigZag-5c643b96c9e77c0001566e88.png)

تبصرہ

Расширенный режим Обычный режим