INTRODUCTION TO THE PARABOLIC SAR INDICATOR:

Parabolic SAR (Stop and Reverse) indicator forex trading mein istemal hone wala aik popular technical analysis tool hai. Ye J. Welles Wilder ne tashkekiya hai, jo dusre aam istemal hone wale technical indicators jaise Relative Strength Index (RSI) aur Average True Range (ATR) ke sath banaye gaye hain. Parabolic SAR khas tor par trend reversals pe pehchan karte hain, kyun ke isse traders ko underlying price action ke basis pe entry aur exit signals milte hain.

UNDERSTANDING THE CALCULATION OF THE PARABOLIC SAR:

Parabolic SAR indicator ek complex mathematical formula pe based hai, jo price data ko account karta hai aur stop loss orders rakhne ke liye optimal positions tay karta hai. Parabolic SAR ki calculation mein do variables hote hain: acceleration factor (AF) aur previous period ki SAR value. AF low value se start hota hai aur har bar jab naya extreme point reach hota hai, woh gradualy increase hota hai. SAR value calculate karne ke liye formula is tarah hota hai:

SAR(i) = SAR(i-1) + (AF * (EP(i-1) - SAR(i-1)))

Yahan:

SAR(i) = current SAR value

SAR(i-1) = previous SAR value

AF = acceleration factor

EP(i-1) = previous period mein reach hui highest ya lowest price.

INTERPRETING THE SIGNALS GENERATED BY THE PARABOLIC SAR:

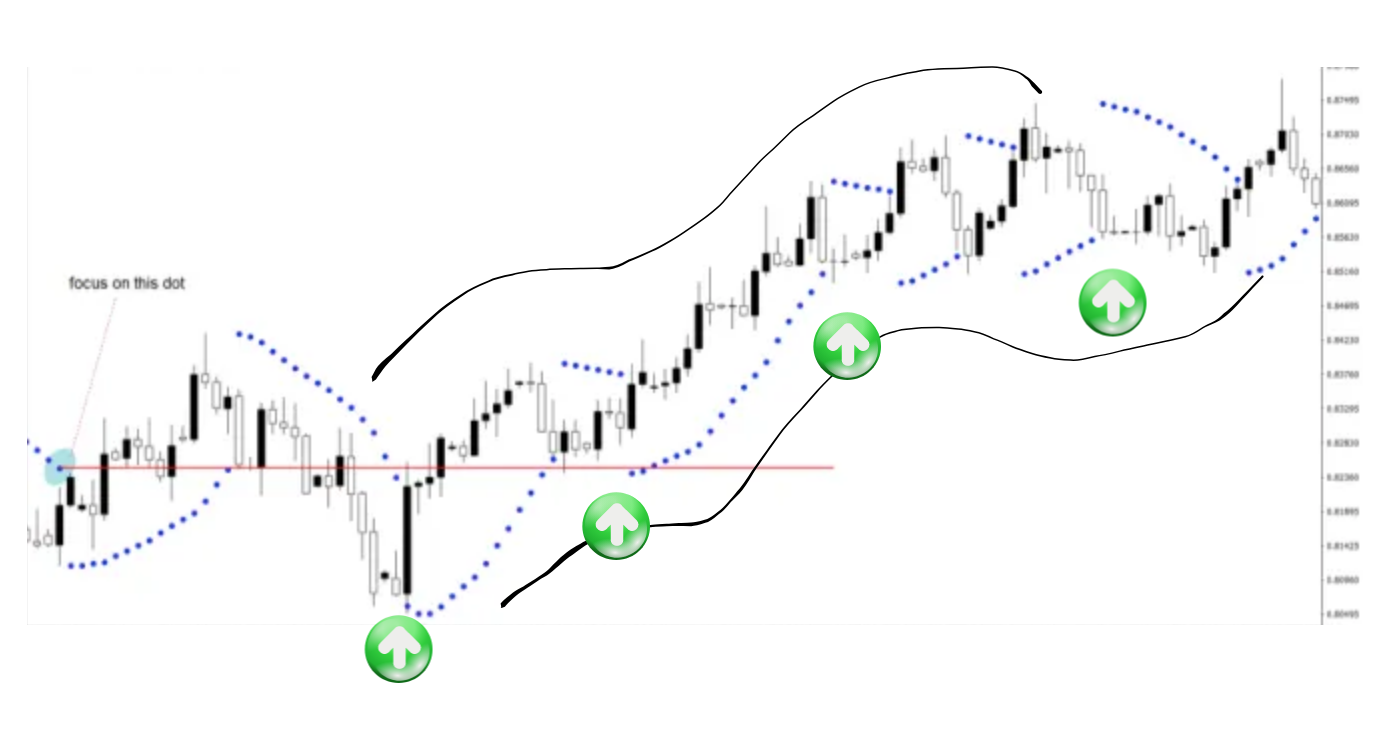

Parabolic SAR indicator do tarah ke signals generate karta hai: bullish signals aur bearish signals. Bullish signal tab paida hota hai jab SAR value price se neeche hota hai, iska matlab hai ke ek potential downtrend se uptrend hone ki possibility hai. Waise hi, bearish signal tab paida hota hai jab SAR value price se upar hota hai, iska matlab hai ke ek potential uptrend se downtrend hone ki possibility hai. Traders typically in signals ka istemal karke positions enter aur exit karte hain, stop loss orders rakh kar.

USING THE PARABOLIC SAR WITH OTHER TECHNICAL INDICATORS:

Parabolic SAR indicator ko doosre technical indicators ke sath combine karke trading strategies ko enhance kiya ja sakta hai. For example, traders aksar Parabolic SAR ko moving averages ke sath combine karte hain trend reversals ko confirm karne ke liye. Agar Parabolic SAR bullish signal produce karta hai aur price moving average se upar cross karta hai, toh ye ek strong buying opportunity indicate kar sakta hai. Ussi tarah, agar Parabolic SAR bearish signal produce karta hai aur price moving average se neeche cross karta hai, toh ye ek strong selling opportunity suggest kar sakta hai.

LIMITATIONS AND CONSIDERATIONS:

Parabolic SAR indicator trend reversals ko identify karne ke liye ek valuable tool hai, lekin ye foolproof nahi hai aur isse doosre technical analysis techniques ke sath istemal karna chahiye. Traders ko potential false signals ke bare mein aware hona chahiye, khas karke low volatility ya sideways markets ke samay. Additionally, Parabolic SAR trending markets mein zyada effective hota hai, jab ke choppy ya ranging markets mein less accurate signals provide karta hai. Traders ko apne strategies ko test aur fine-tune karna chahiye Parabolic SAR indicator istemal karne se pehle.

Parabolic SAR (Stop and Reverse) indicator forex trading mein istemal hone wala aik popular technical analysis tool hai. Ye J. Welles Wilder ne tashkekiya hai, jo dusre aam istemal hone wale technical indicators jaise Relative Strength Index (RSI) aur Average True Range (ATR) ke sath banaye gaye hain. Parabolic SAR khas tor par trend reversals pe pehchan karte hain, kyun ke isse traders ko underlying price action ke basis pe entry aur exit signals milte hain.

UNDERSTANDING THE CALCULATION OF THE PARABOLIC SAR:

Parabolic SAR indicator ek complex mathematical formula pe based hai, jo price data ko account karta hai aur stop loss orders rakhne ke liye optimal positions tay karta hai. Parabolic SAR ki calculation mein do variables hote hain: acceleration factor (AF) aur previous period ki SAR value. AF low value se start hota hai aur har bar jab naya extreme point reach hota hai, woh gradualy increase hota hai. SAR value calculate karne ke liye formula is tarah hota hai:

SAR(i) = SAR(i-1) + (AF * (EP(i-1) - SAR(i-1)))

Yahan:

SAR(i) = current SAR value

SAR(i-1) = previous SAR value

AF = acceleration factor

EP(i-1) = previous period mein reach hui highest ya lowest price.

INTERPRETING THE SIGNALS GENERATED BY THE PARABOLIC SAR:

Parabolic SAR indicator do tarah ke signals generate karta hai: bullish signals aur bearish signals. Bullish signal tab paida hota hai jab SAR value price se neeche hota hai, iska matlab hai ke ek potential downtrend se uptrend hone ki possibility hai. Waise hi, bearish signal tab paida hota hai jab SAR value price se upar hota hai, iska matlab hai ke ek potential uptrend se downtrend hone ki possibility hai. Traders typically in signals ka istemal karke positions enter aur exit karte hain, stop loss orders rakh kar.

USING THE PARABOLIC SAR WITH OTHER TECHNICAL INDICATORS:

Parabolic SAR indicator ko doosre technical indicators ke sath combine karke trading strategies ko enhance kiya ja sakta hai. For example, traders aksar Parabolic SAR ko moving averages ke sath combine karte hain trend reversals ko confirm karne ke liye. Agar Parabolic SAR bullish signal produce karta hai aur price moving average se upar cross karta hai, toh ye ek strong buying opportunity indicate kar sakta hai. Ussi tarah, agar Parabolic SAR bearish signal produce karta hai aur price moving average se neeche cross karta hai, toh ye ek strong selling opportunity suggest kar sakta hai.

LIMITATIONS AND CONSIDERATIONS:

Parabolic SAR indicator trend reversals ko identify karne ke liye ek valuable tool hai, lekin ye foolproof nahi hai aur isse doosre technical analysis techniques ke sath istemal karna chahiye. Traders ko potential false signals ke bare mein aware hona chahiye, khas karke low volatility ya sideways markets ke samay. Additionally, Parabolic SAR trending markets mein zyada effective hota hai, jab ke choppy ya ranging markets mein less accurate signals provide karta hai. Traders ko apne strategies ko test aur fine-tune karna chahiye Parabolic SAR indicator istemal karne se pehle.

تبصرہ

Расширенный режим Обычный режим