Assalamu Alaikum Dosto!

Investing Vs. Speculating

Forex, stocks ya cryptocurrencies k buying ya selling mein, aik investor aur aik speculator ke kirdar ko pehchan lena aasan ho sakta hai. Lekin, inki market analysis par mabni fikr mein woh kuch farq hai. Forex market trading ki duniya mein enter hone se pehle, investing aur speculation ke darmiyan farq samajhna zaroori hai. Har stock exchange transaction mein mukhtalif log hote hain jin ke apne maqasid, strategies, aur qawaid hote hain, jo sab ko paisa kamane ki koshish karte hain. Is article ka maqsad hai ke investors aur speculators ke darmiyan farq ko roshan karna, in ke mukhtalif tareeqon aur maqsadon ko daryaft karna hai.

Pehle nazar mein, investor aur speculator mein farq karna mushkil ho sakta hai. Lekin, stocks khareedne aur bechne ke amal mein dono ko pehli tajziya ki zarurat hoti hai. Lekin, inn mein farq nature mein hai.

Stock markets ki duniya mein ghusne se pehle, investing aur speculation ke darmiyan farq ko samajhna zaroori hai. Har din stock exchange mein hone wale transactions mein, jo ke maayusi ke nateejay mein muntazim hoti hain, mukhtalif log hote hain, jo apne maqasid, strategies, aur qawaid ke saath kuch paisa kamane ki koshish karte hain. Lekin, unka tajawuz alag hota hai; kuch invest karna chunte hain, jabke doosre tijarat karna pasand karte hain.

Investing

Investing, companies ke hisson ko unki asli price par buy ka kaam hai, long time period mein izafay aur baad mein munafa ki sharah ke saath hota hai. Jaise ke is definition mein hai, sabr ki zarurat hai, kyun ke companies aam taur par sirf hafton mein bade izafay nahi hoti. Yahan par stocks ke portfolios ko saaloon ke liye banaya jata hai. Investors sirf qeemat ka izafah hi nahi, balki sirf price appreciation ke ilawa bhi maayus kar sakte hain. Stocks khareedne wale malik ban ke woh company ke ham-sahib bhi ban jate hain. Woh company ke muqami jalse mein shirkat kar sakte hain aur unko dividends bhi mil sakte hain, jo company ke munafa ka hissa hota hai aur uske investors ke saath baanta jata hai. Is tareeqe se, investors periodic returns hasil kar sakte hain.

Investing, uss company ki comprehensive analysis ko shamil karta hai jiska stock kharida ja raha hai. Maqsad yeh hai ke mojooda asasat ko lambi muddat mein izafay mein izafah kiya jaye. Kisi khaas sector aur company ki imkanat ko tajziya karna, takhliqat parhna, market trends ke baare mein malumat hasil karna, aur maqami malumat ko daftar karne ka hissa hai. Mahir investors woh portfolios banane mein kamyabi hasil kar sakte hain jo saalon tak mustaqil izafay paida karte hain.

Speculation

Ab, speculator kon hai? Inke liye, asal focus sirf munafa kamane par hota hai. Woh khas stocks ko jo bhi company unke peechay ho, uske performance ke baray mein kam fikr karte hain. Sab se zyada ahem cheez qeemat mein buland raftar ka izafah hai jo munafa ka imkan deta hai. Aksar, price movement ka rukh be maayne ho jata hai, kyun ke speculator girte hue prices ka faida utha sakte hain, contracts aur doosre auzar ka istemal kar ke. Jab stocks ki qeemat ghat-ti hai, speculator phir bhi faida utha sakte hain.

Speculator primarily stocks buy hain jinhe jaldi bechne ka irada hota hai. Aik misali waqia trading ka tha Brexit referendum ke baad jab leasing companies ne girte hue stock prices ka jawab diya. Tijaratkar ko mauqa mila ke woh low prices par stocks khareed sakte hain, aur bohot se stocks ne agle dino mein bounce back kiya. Logon ka zyada focus dene ka trend istemal kar ke, kuch dino mein undervalued companies mein invest kar ke bade munafe kamaya ja sakta tha.

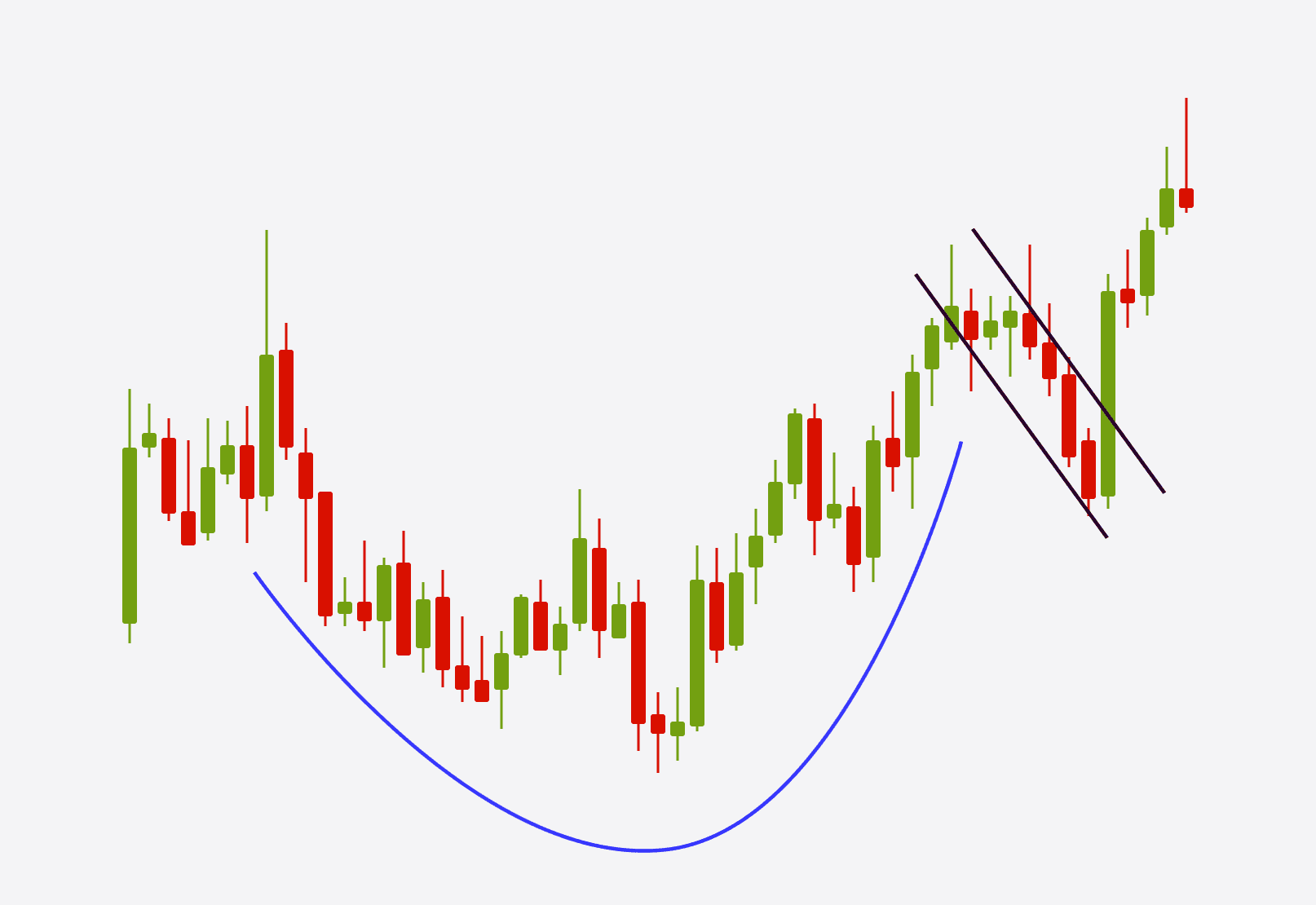

Speculator ke liye, charts aik company ke maali performance ya mulk ki overall halaat se zyada ahemiyat rakhte hain. Market mein jazbat, jese ke khatra jo financial crises ya elections ke aas paas hote hain, far more influential ban jate hain. Speculator tez price swings ka faida uthane mein mahir hote hain, aur unke activities ke liye bohot se mauqay milte hain. Lekin, yeh zaroori hai ke yaad kiya jaye ke significant price fluctuations zyada tanav aur khatra ke saath aate hain.

Time Monitoring Zarori hai

Speculator aur investors ke darmiyan faraq samajhne ka waqat parhne mein aata hai. Stocks mein invest karte waqat, company ke mustaqbil ke baray mein, maali results, aur mumkin dividends par bharosa karke, sabr ki zarurat hoti hai. Company ka izafah aksar saalon tak le leta hai. Kai success stories dikhate hain ke kuch saalon tak intezaar karke substantial izafay hasil karne mein benefits hain, jo ke funds jese instruments ki performance ko bhi peechay chor dete hain.

Speculator, doosri taraf, short-term market sentiment aur reflexive decision-making ka aik thorough understanding par mabni hai. Market ke changes ke liye foran jawab dena zaroori hai, kyun ke stock market significant sell-offs aur potential reversals ki taraf prone hota hai. Successful tijaratkar aksar mauqe ka sabr karte hain aur market ko mojooda funds ke saath nazara karte hain, jabke investors predominantly apne securities mein extended periods ke liye apne funds ko hold karte hain.

Speculator mein ek paradox yeh hai ke uske mukhtalif time frames hote hain: tijarat khud chhoti hoti hai, lekin tijaratkar traders ke mukable mein charts ko observe karne mein ziada time guzarte hain.

Speculator, Investors Aik Dosre ko Rad Nahi Karte

Asal mein, aik ko investing aur speculator mein exclusive taur par faisla nahi karna parta hai. Lekin, aik equity portfolio ko aik speculative portfolio ke saath effectively combine karna challenging hai, jo ke bohot se experience aur waqat ki darkhwast karta hai.

Yeh zaroori hai ke yaad rakha jaye ke speculator investing ke muqable mein significantly zyada khatarnak hoti hai. Aik mahir investor gradually aik chhota sa speculative portfolio bana sakta hai, jabke usko funds ke zyadatar hisse ko stocks mein invest karne ke liye allot karne ka asool paish aata hai aur ek chhota sa hissa tijarati imkaanat ke liye bacha leta hai. Stocks portfolio consistently capital banata hai, jabke speculative portion potential hai ke jab market mein mojooda opportunities paida ho sakte hain.

Investor pursakon hota hai, Jabke speculator rozana price fluctuations se munafa kamane mein masroof hote hain, investors aik mukhtalif tareeqe se amal karte hain. Investors apne portfolios ke liye stocks ko carefuly chunte hain aur sabr se intezaar karte hain, risk control ko istemal karte hain. Yeh tareeqa unko apni peshevar ya karobari zimmedariyon par tawajju dene aur unke bachat ko capital appreciation ke zariye barhne dene mein madad karta hai. Aik mashhoor investor Warren Buffett ka yeh investment strategy ka misali namoona hai.

Buffett ne saalon tak portfolios banane mein mashghool rahe hain, jisme reliable companies ke shares chunte hain jo apne hissedaron ke saath mustaqil profits share karte hain through dividend payments. Yeh seedha tareeqa, decades se istemal hone wala, tijaratkar aur aggressive mutual funds ki performance ko peechay chhod deta hai.

Investing mein kamyabi investor ke ilm aur mojooda market conditions par mabni hai. Jabke doosra factor kisi ke control ke bahar hota hai, toh pehla factor har har trade ke baad hasil hone wale tajurba par mabni hai. Investing aik dheere process hai, aur jab mojooda trade ke har baad ilm jama hota hai, toh musbat nateejay zyada mumkin hai.

Kaunsa Best Hai – Invest Karna, Ya Speculate Karna?

Toh, kya aapko invest karna chahiye ya trading karna chahiye? Yeh faisla aakhir mein aapke maqasid, risk bardasht, aur muddat par mabni hota hai. Invest karna aik lambi muddat ki trading hai jo companies ke hisson ko unki qeemat par khareedne par mabni hai, jisme lambi muddat mein izafay aur munafa ki tawakul hoti hai. Investors sabrmand hote hain aur aksar saalon tak hisson ko pakar rakhte hain, company ke mustaqbil ko analysis karte hain, aur tehqiqati malumat aur market ki malumat par mabni faislay karte hain. Unhein company ke malik ke taur par faida hasil ho sakta hai, jo steady aamdani ki roshni mein mufeed hota hai. Invest karna tafseeli analysis aur systematic izafay paida karne ka aik muratab tareeqa hai.

Dusri taraf, trading ek short-term investment hai jo jaldi munafa kamane ki khuwahish par mabni hai. Trading mein log amooman munafa kamane ki khatir stocks ki qeemat mein buland raftar ka faida uthate hain. Unka focus zaroori nahi hai ke company ki maaliyat ya mulk ki halaat par focus di jaye. Trading mein market ke tabdiliyon ka tez jawab dena, qeemat mein izafay ka faida uthana, aur aksar zyada tanaav aur khatra shamil hota hai. Trading karte hue log chandani aur giranay wali qeematon se faida utha sakte hain aur unka kamyabi chhoti muddaton mein market ki jazbat ko samajhne par mabni hai.

Jabke invest karna aur tijarat karna dono apni ehmiyat rakhte hain, toh yeh zaroori hai ke tijarat amooman zyada riski hoti hai aur is mein market dynamics ko samajhne ki gehra zarurat hoti hai. Aik equity portfolio ko tijarati positions ke saath milana mushkil aur waqt consuming ho sakta hai. Ziyadatar investors lambi muddat ke izafay aur mustaqil panap ke liye stocks mein invest karna pasand karte hain jabke thori si raqam ko trading imkaanat ke liye allot karte hain.

Aakhir mein, investors amooman ziada dilchaspi aur sabr ke saath kaam karte hain jabke woh apne portfolio ke liye stocks chunte hain aur unke invest mein izafay hone ka sabr karte hain. Yeh tareeqa investors ko apne doosre zimmedariyon par tawajju dene aur phir bhi capital ki izafat se faida uthane ki ejazat deta hai. Warren Buffett, aik mashhoor investor, is tareeqe ko dikhate hain ke woh mustaqil izafay deti hui reliable companies ke portfolios banate hain. Invest karna aik mustaqil seekhne ka process hai aur kamyabi investors ke ilm, tajurba, aur market ki halat mein tarteeb deti hai.

Conclusion

Financialk duniya mein, invest karna aur trading karna ka faisla shakhsiyat ke maqasid, risk bardasht, aur peroid par mabni hota hai. Jabke investors aik sabrmand, lambi muddat ki trading par focus dete hain jo dheere izafay aur mustaqil munafa par mabni hoti hai, toh trading karne wale log jald munafa kamane ki khuwahish se mabni short-term trading par focus dete hain. Dono tareeqon ko milana maharat, waqt, aur experience ka tawun talab karta hai. Lekin, yeh zaroori hai ke tijarat amooman ziada khatarnak hoti hai. Investors apne funds ka aik chhota hissa trading imkaanat ke liye allot kar sakte hain jabke asal mein stocks mein invest karte hain long timeframes ke liye. Jo rasta bhi chunen, woh soch samajh aur nazam se bhara hona zaroori hai long time period ki finance kamyabi ke liye hota hai.

تبصرہ

Расширенный режим Обычный режим