Risk-Reward Ratio

Risk-reward ratio potential profit ko potential loss ke sath muqabla karne ka ek scale hai ek trading strategy mein. Ye traders ko madad karta hai tajwez shuda trade ke risk ke muqablay mein potential faida ka andaza lagane mein. Risk-reward ratio ek mathematical formula hai jo potential profit ko potential loss ke sath muqabla karne ke liye istemal hota hai ek trading strategy mein. Isay potential profit ko potential loss se taqseem karke calculate kiya jata hai. Risk-reward ratio calculate karne ka formula ye hai.

Risk-Reward Ratio = Potential Profit / Potential Loss

For example agar ek trader ka stop loss 50 pips hai aur unka take profit 100 pips hai, to unka potential profit 100 pips hoga aur potential loss 50 pips hoga. Risk-reward ratio hoga.

Risk-Reward Ratio = 100 / 50 = 2:1

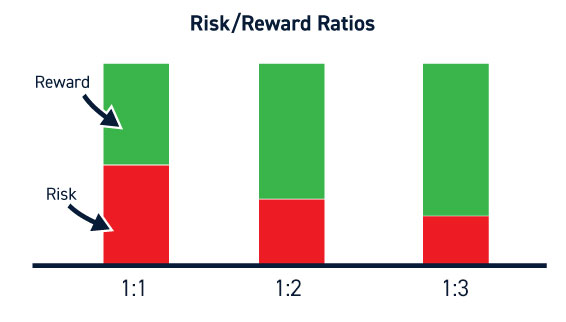

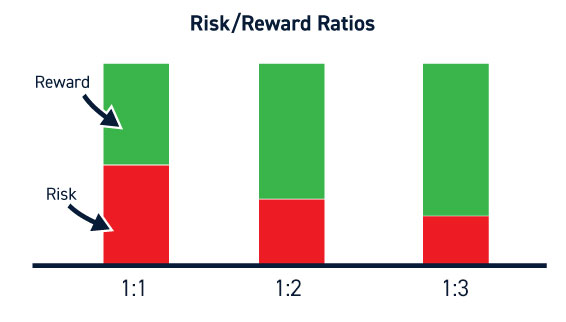

Is case mein risk-reward ratio 2:1 hai, jo ke ye batata hai ke har pip ki nuqsaan ke liye trader ko do pip ka faida ho sakta hai. Zyada risk-reward ratio ye batata hai ke potential loss ke muqablay mein zyada potential profit hai.

Importance of Risk-Reward Ratio in Forex Trading

Risk-reward ratio forex trading mein ahmiyat rakhta hai kyun ke ye traders ko madad karta hai risks ko effectively manage karne mein. Risk-reward ratio calculate karke traders ye tajwez kar sakte hain ke kya ek trading strategy mein risk potential reward ke muqablay mein qubooli hadd mein hai. Zyada risk-reward ratio batata hai ke potential loss ke muqablay mein zyada potential profit hai, jo ke traders ke liye zyada attractive bana sakta hai. Lekin yaad rakha jana chahiye ke pichli karwaien future ke natijon ki guarantee nahi deti. Kam risk-reward ratio batata hai ke potential profit ke muqablay mein kam potential loss hai. Ye pehle nazar mein kam attractive lagta hai, lekin kuch traders ke liye ye ek qubooli strategy ho sakti hai jo kam risk wale trades ko pasand karte hain. Kam risk-reward ratio conservative traders ke liye bhi zyada munasib ho sakta hai jo apne nuqsaan ko kam karna priority banate hain, faida kamana nahi.

Calculating Risk-Reward Ratio in Forex Trading

Forex trading mein risk-reward ratio calculate karna ek trade ke liye stop loss aur take profit levels ko pehchanne ko shamil karta hai. Stop loss level woh point hota hai jahan trader apni position ko nuqsaan mein band karta hai nakhuda price movements ki wajah se. Take profit level woh point hota hai jahan trader apni position ko faida mein band karta hai mufeed price movements ki wajah se. In levels ko calculate karke traders apne trade ke liye potential profit aur loss ko tay kar sakte hain, aur phir apne risk-reward ratio ko mutabiq calculate kar sakte hain.

For example ek trader ne ek mauqa pehchan lia hai ke EUR/USD ko 1.1750 par khareedna hai, jahan unka stop loss 1.1700 aur take profit 1.1800 hai. In do levels ke darmiyan ki doori trader ke liye is trade mein potential profit aur loss ko darust karti hai.

Using Risk-Reward Ratio to Manage Risks Effectively

Forex trading mein risks ko effective taur par manage karne ke liye, traders ko apne potential reward ke muqablay mein ek qubooli hadd mein risk maintain karne ka maqsad rakhna chahiye. Koi sakhti aur taaqatwar qawaneen risk ya faida ko kya mani hai is ke bare mein koi wazeh hukam nahi hain, lekin kuch aam hidayat traders ko malumat hasil karne mein madad karti hain.

Risk-reward ratio potential profit ko potential loss ke sath muqabla karne ka ek scale hai ek trading strategy mein. Ye traders ko madad karta hai tajwez shuda trade ke risk ke muqablay mein potential faida ka andaza lagane mein. Risk-reward ratio ek mathematical formula hai jo potential profit ko potential loss ke sath muqabla karne ke liye istemal hota hai ek trading strategy mein. Isay potential profit ko potential loss se taqseem karke calculate kiya jata hai. Risk-reward ratio calculate karne ka formula ye hai.

Risk-Reward Ratio = Potential Profit / Potential Loss

For example agar ek trader ka stop loss 50 pips hai aur unka take profit 100 pips hai, to unka potential profit 100 pips hoga aur potential loss 50 pips hoga. Risk-reward ratio hoga.

Risk-Reward Ratio = 100 / 50 = 2:1

Is case mein risk-reward ratio 2:1 hai, jo ke ye batata hai ke har pip ki nuqsaan ke liye trader ko do pip ka faida ho sakta hai. Zyada risk-reward ratio ye batata hai ke potential loss ke muqablay mein zyada potential profit hai.

Importance of Risk-Reward Ratio in Forex Trading

Risk-reward ratio forex trading mein ahmiyat rakhta hai kyun ke ye traders ko madad karta hai risks ko effectively manage karne mein. Risk-reward ratio calculate karke traders ye tajwez kar sakte hain ke kya ek trading strategy mein risk potential reward ke muqablay mein qubooli hadd mein hai. Zyada risk-reward ratio batata hai ke potential loss ke muqablay mein zyada potential profit hai, jo ke traders ke liye zyada attractive bana sakta hai. Lekin yaad rakha jana chahiye ke pichli karwaien future ke natijon ki guarantee nahi deti. Kam risk-reward ratio batata hai ke potential profit ke muqablay mein kam potential loss hai. Ye pehle nazar mein kam attractive lagta hai, lekin kuch traders ke liye ye ek qubooli strategy ho sakti hai jo kam risk wale trades ko pasand karte hain. Kam risk-reward ratio conservative traders ke liye bhi zyada munasib ho sakta hai jo apne nuqsaan ko kam karna priority banate hain, faida kamana nahi.

Calculating Risk-Reward Ratio in Forex Trading

Forex trading mein risk-reward ratio calculate karna ek trade ke liye stop loss aur take profit levels ko pehchanne ko shamil karta hai. Stop loss level woh point hota hai jahan trader apni position ko nuqsaan mein band karta hai nakhuda price movements ki wajah se. Take profit level woh point hota hai jahan trader apni position ko faida mein band karta hai mufeed price movements ki wajah se. In levels ko calculate karke traders apne trade ke liye potential profit aur loss ko tay kar sakte hain, aur phir apne risk-reward ratio ko mutabiq calculate kar sakte hain.

For example ek trader ne ek mauqa pehchan lia hai ke EUR/USD ko 1.1750 par khareedna hai, jahan unka stop loss 1.1700 aur take profit 1.1800 hai. In do levels ke darmiyan ki doori trader ke liye is trade mein potential profit aur loss ko darust karti hai.

- Potential Profit = Take Profit - Entry Price = 1.1800 - 1.1750 = 50 pips

- Potential Loss = Entry Price - Stop Loss = 1.1750 - 1.1700 = 50 pips

- Risk-Reward Ratio = Potential Profit / Potential Loss = 50 / 50 = 1:1

Using Risk-Reward Ratio to Manage Risks Effectively

Forex trading mein risks ko effective taur par manage karne ke liye, traders ko apne potential reward ke muqablay mein ek qubooli hadd mein risk maintain karne ka maqsad rakhna chahiye. Koi sakhti aur taaqatwar qawaneen risk ya faida ko kya mani hai is ke bare mein koi wazeh hukam nahi hain, lekin kuch aam hidayat traders ko malumat hasil karne mein madad karti hain.

- Aim for a minimum risk-reward ratio of 1:2 or higher: Is ka matlub hai ke her pip ki nuqsaan ke liye kam az kam do pip ka faida ya zyada ho. Ye adverse price movements ke liye thoda sa pesh karta hai aur traders ko waqt ke sath ziada nuqsaan se bachane mein madad karta hai.

- Use stop losses and take profits: Stop losses traders ko apni positions ko kisi makhsoos level par pohnchne par khud-ba-khud band karne mein madad karte hain, jabke take profits unko apni positions ko mufeed price movements par band karne mein madad karte hain. Stop losses aur take profits ko istemal karke traders risks ko effectively manage kar sakte hain aur waqt ke sath ziada nuqsaan se bach sakte hain.

- Monitor leverage carefully: Leverage forex trading mein faida ya nuqsaan ko dono ko barha sakta hai, is liye isay hoshiyarana aur mutasuban istemal karna ahem hai. Traders ko apni tajwezat ke mutabiq apne tajruba aur trading strategy ke asasi hadood mein leverage istemal karna chahiye.

تبصرہ

Расширенный режим Обычный режим