Trading Strategies (Trading Ke Tareeqay)

Forex market mein Stratigies ke bohat sare istemal kie jate hain jin se traders apni trades enter aur exit karte hain.

1. Trend Following

Trend following ek popular trading strategy hai. Is strategy mein trader current market trend ko follow karta hai aur uske sath trade karta hai. Is strategy ko use karne se traders ki chances increase hoti hain ke wo profitable trades kar saken.

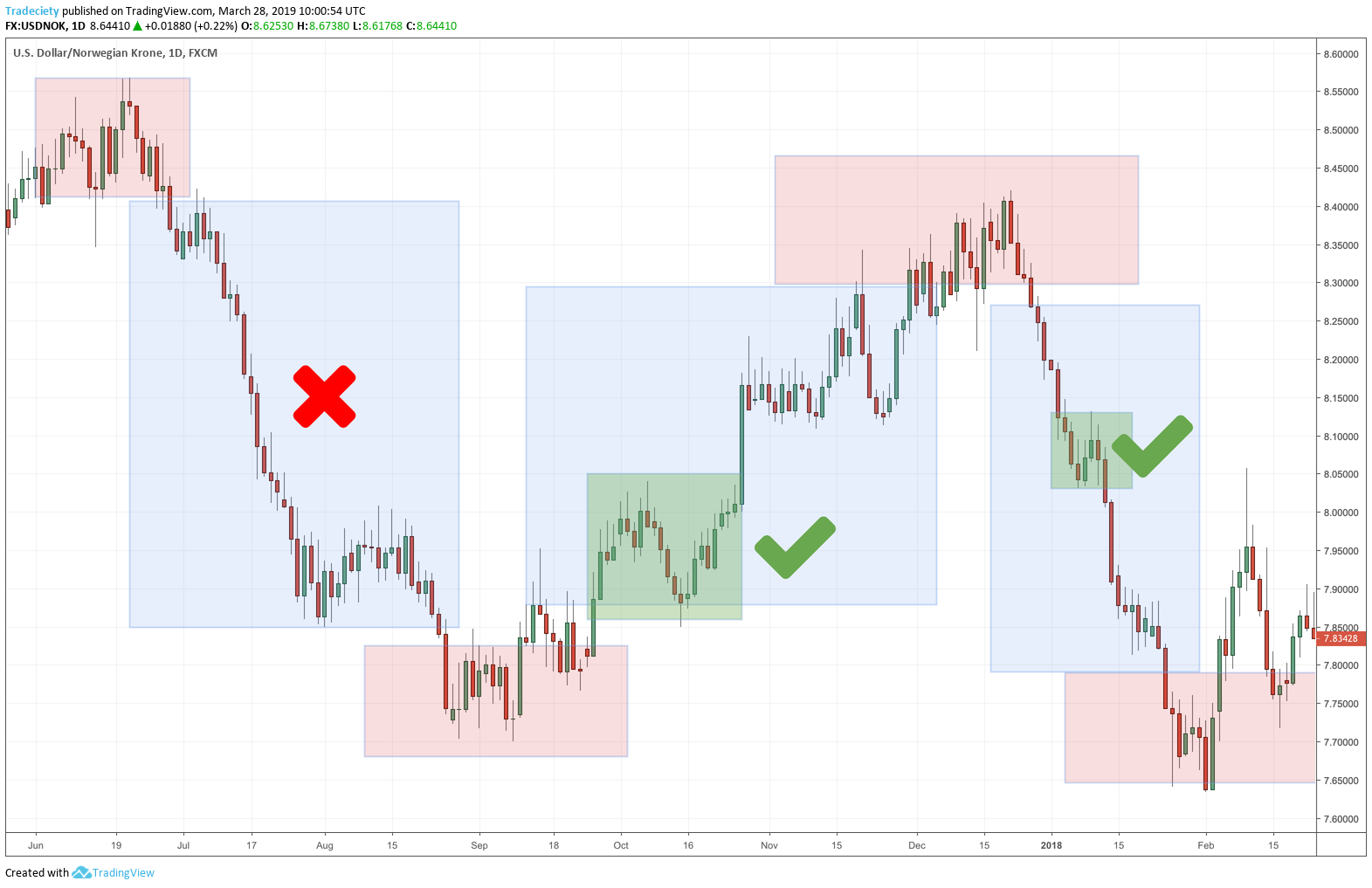

2. Breakout Trading

Breakout trading mein trader ki trades breakout level ko cross karne ke baad enter karta hai. Is strategy mein trader price movement ke sudden change par dhyan deta hai aur us movement ke direction mein trade karta hai.

3. Scalping

Scalping ek short-term trading strategy hai jisme trader trades ko thori dair ke liye hold karta hai. Is strategy mein trader small profits ko accumulate karta hai jin se overall profitability increase hoti hai.

4. Swing Trading

Swing trading mein trader trades ko kuch dino ya hafton tak hold karta hai. Is strategy mein trader price swings par focus karta hai aur un swings ko trade karta hai.

5. Position Trading

Position trading ek long-term trading strategy hai. Is strategy mein trader trades ko weeks ya months tak hold karta hai. Is strategy mein trader macroeconomic factors ko consider karta hai jaise ke interest rates aur GDP growth.

6. News Trading

News trading mein trader market mein aane wali news ko monitor karta hai aur uske according trades ko enter aur exit karta hai. Is strategy mein trader ka focus news par hota hai aur us news ke effect par.

7. Range Trading

Range trading mein trader ki trades ek specific price range ke andar remain karti hain. Is strategy mein trader price range ke limits ko identify karta hai aur uske according trade karta hai.

Forex market mein Stratigies ke bohat sare istemal kie jate hain jin se traders apni trades enter aur exit karte hain.

1. Trend Following

Trend following ek popular trading strategy hai. Is strategy mein trader current market trend ko follow karta hai aur uske sath trade karta hai. Is strategy ko use karne se traders ki chances increase hoti hain ke wo profitable trades kar saken.

2. Breakout Trading

Breakout trading mein trader ki trades breakout level ko cross karne ke baad enter karta hai. Is strategy mein trader price movement ke sudden change par dhyan deta hai aur us movement ke direction mein trade karta hai.

3. Scalping

Scalping ek short-term trading strategy hai jisme trader trades ko thori dair ke liye hold karta hai. Is strategy mein trader small profits ko accumulate karta hai jin se overall profitability increase hoti hai.

4. Swing Trading

Swing trading mein trader trades ko kuch dino ya hafton tak hold karta hai. Is strategy mein trader price swings par focus karta hai aur un swings ko trade karta hai.

5. Position Trading

Position trading ek long-term trading strategy hai. Is strategy mein trader trades ko weeks ya months tak hold karta hai. Is strategy mein trader macroeconomic factors ko consider karta hai jaise ke interest rates aur GDP growth.

6. News Trading

News trading mein trader market mein aane wali news ko monitor karta hai aur uske according trades ko enter aur exit karta hai. Is strategy mein trader ka focus news par hota hai aur us news ke effect par.

7. Range Trading

Range trading mein trader ki trades ek specific price range ke andar remain karti hain. Is strategy mein trader price range ke limits ko identify karta hai aur uske according trade karta hai.

Ye trading strategies ek trader ke liye bohat important hote hain. Ek trader ko apne trading style aur goals ke hisaab se sahi tareeqay se trading strategy choose karna chahiye. Is ke liye trader ko apne risk tolerance aur account size ko consider karna chahiye.

تبصرہ

Расширенный режим Обычный режим