Dear friends, keltner Channel ek technical analysis tool hai jo traders ko market trends aur volatility ke baray mein malumat faraham karta hai. Yeh channel ek range-based indicator hai jo price volatility aur potential trend reversals ko analyze karta hai. Iska istemal traders ko market ki strength aur weakness ka andaza dene mein madad karta hai.

Keltner Channel Kay working features:

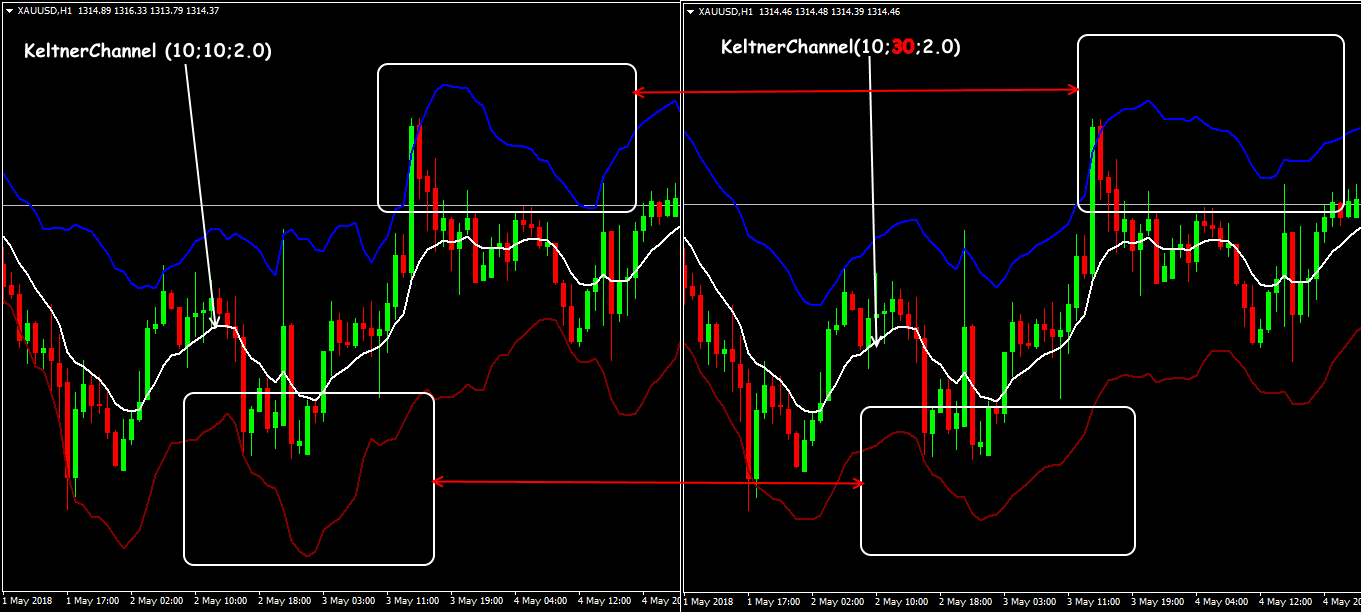

Keltner Channel, ek series of lines hai jo price ke aas paas draw ki jati hain. Yeh lines usually ek middle line, jo ke simple moving average (SMA) ka istemal karke tay ki jati hai, aur do outer bands ko shamil karti hain. Outer bands standard deviation ke zariye tay ki jati hain. Is tarah, Keltner Channel ek price channel banata hai jismein price ki movement ko track kiya ja sakta hai.

Components of Keltner Channel:

1. Middle Line : Yeh line Keltner Channel ka center hai aur iska tajwez shuda istemal simple moving average (SMA) ke zariye hota hai. Markazi rekhta prices ka average dikhata hai aur trend ki samajh ke liye istemal hota hai.

2. Upper Band : Uper wala band middle line ke upar draw kiya jata hai aur ismein standard deviation ka istemal hota hai. Ye band volatility ko darust karta hai aur traders ko ye batata hai ke market mein tezi ya mandi kitni had tak ja sakti hai

3. Lower Band : Neechay wala band bhi middle line ke neeche draw kiya jata hai aur ismein standard deviation ka istemal hota hai. Ye band bhi volatility ko measure karta hai aur traders ko ye dikhata hai ke market mein neeche jaane ki kitni sambhavna hai.

Keltner Channel Ka Istemal:

Keltner Channel ek versatile tool hai jo traders ko market trends aur volatility ke bare mein malumat faraham karta hai. Iska istemal karke, traders behtar trading decisions le sakte hain aur market ki dynamics ko samajh sakte hain. Lekin, hamesha yaad rahe ke successful trading ke liye, doosre indicators ka bhi saath lena zaroori hai aur market conditions ka hoshiyari se tawun karna chahiye.

Keltner Channel Kay working features:

Keltner Channel, ek series of lines hai jo price ke aas paas draw ki jati hain. Yeh lines usually ek middle line, jo ke simple moving average (SMA) ka istemal karke tay ki jati hai, aur do outer bands ko shamil karti hain. Outer bands standard deviation ke zariye tay ki jati hain. Is tarah, Keltner Channel ek price channel banata hai jismein price ki movement ko track kiya ja sakta hai.

Components of Keltner Channel:

1. Middle Line : Yeh line Keltner Channel ka center hai aur iska tajwez shuda istemal simple moving average (SMA) ke zariye hota hai. Markazi rekhta prices ka average dikhata hai aur trend ki samajh ke liye istemal hota hai.

2. Upper Band : Uper wala band middle line ke upar draw kiya jata hai aur ismein standard deviation ka istemal hota hai. Ye band volatility ko darust karta hai aur traders ko ye batata hai ke market mein tezi ya mandi kitni had tak ja sakti hai

3. Lower Band : Neechay wala band bhi middle line ke neeche draw kiya jata hai aur ismein standard deviation ka istemal hota hai. Ye band bhi volatility ko measure karta hai aur traders ko ye dikhata hai ke market mein neeche jaane ki kitni sambhavna hai.

Keltner Channel Ka Istemal:

- Trend Ka Pehchan (Identifying Trends): Keltner Channel ka istemal karke traders market mein hone wale trends ko identify kar sakte hain. Agar prices middle line ke upar hain, toh ye bullish trend ko indicate karta hai, aur agar prices middle line ke neeche hain, toh ye bearish trend ko indicate karta hai

- Estimating Volatility: Keltner Channel traders ko market ki volatility ka andaza dene mein madad karta hai. Agar price upper aur lower bands ke beech mein move kar rahi hai, toh ye dikhata hai ke market mein volatility kam hai. Jab prices bands ke bahar jaate hain, toh ye indicate karta hai ke volatility barh sakti hai.

- Creating Breakout Points: Keltner Channel ka istemal breakout points tay karne mein bhi kiya jata hai. Jab prices upper band ko cross karte hain, toh ye breakout ko indicate karta hai, aur jab prices lower band ko cross karte hain, toh ye bearish breakout ko dikhata hai.

- Confirmation Ke Liye Doosre Indicators Ka Istemal: Keltner Channel ko confirm karne ke liye doosre technical indicators ka bhi sahara lena chahiye. Isse false signals ka khatra kam hota hai.

- Market Conditions Ka Tawun: Hamesha yaad rahe ke market conditions ka bhi tawun dekha jaye. Kuch situations mein, Keltner Channel false signals generate kar sakta hai, isliye market conditions ka hoshiyari se tawun lena zaroori hai.

Keltner Channel ek versatile tool hai jo traders ko market trends aur volatility ke bare mein malumat faraham karta hai. Iska istemal karke, traders behtar trading decisions le sakte hain aur market ki dynamics ko samajh sakte hain. Lekin, hamesha yaad rahe ke successful trading ke liye, doosre indicators ka bhi saath lena zaroori hai aur market conditions ka hoshiyari se tawun karna chahiye.

تبصرہ

Расширенный режим Обычный режим