INTRODUCTION TO THE ABC CORRECTION PATTERN:

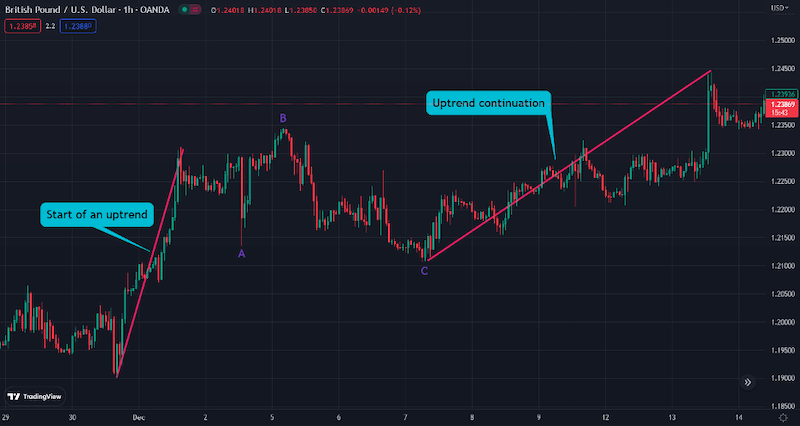

Forex mein ABC correction pattern aik aam dekha jane wala price action pattern hai, jo bari trend ke andar ho jata hai. Isay isi liye ABC patternkaha jata hai kyunki ye teen mukhtalif lehron se bana hota hai jo A, B aur C ke naam se label kiye jate hain. Ye pattern aik corrective pattern samjha jata hai aur amooman pure trend mein a temporary reversal ya pause ke taur par dekha jata hai. Isko traders dwara wasee tadaad mein parha jata hai aur istemal kiya jata hai kyunki ye trading mein munsif prices par dakhil ya nikalne ke mauqe deti hai.

WAVE A IN THE ABC CORRECTION PATTERN:

ABC correction pattern mein pehli wave, wave A, aksar prevailing trend ke khilaf aik majboot harekate hoti hai. Ye wave initial correction ya counter-trend movement ko darsha karti hai. Is mein taqatwar selling ya buying pressure hoti hai, jisme market sentiment ya fundamental factors ka asar hota hai. Wave A ko price charts par mutalia karke aur overall trend ke opposite direction mein significant price movements dhoond kar pehchana jata hai. Traders aksar technical indicators aur analysis tools ka istemal karte hain wave A ke maujoodgi ko tasdeeq karne aur pattern ke baad wale waves ko pehchane ke liye.

WAVE B IN THE ABC CORRECTION PATTERN:

Wave A ke baad, price amooman retraces ya sideways move karta hai, jise wave B kehte hain. Wave B aik counter-trend move hoti hai jo previous wave A ka aik hissa retraces karti hai. Ye zaruri hai ki wave B wave A ke starting point se aage na jaaye. Dusre alfaz mein kaha jaye toh wave B wave A ke originating price level se aage na jaye. Ye retracement traders ke liye support aur resistance levels, sath hi potential reversal patterns pehchane ka mauqa deti hai. Wave B aksar aik complex pattern hoti hai,jisme aksar chote sub-waves shaamil hote hain, jinhe careful analysis aur interpretation ki zarurat hoti hai.

WAVE C IN THE ABC CORRECTION PATTERN:

ABC correction pattern ki antim wave wave C hoti hai. Ye wave overall trend ke resumption ko darsha karti hai wave A ki correction aur wave B ki retracement ke baad. Wave C prevailing trend ke direction mein taqatwar buying ya selling pressure se charha hua hota hai. Ye aksar pattern mein sab se lambi aur taeedh wave hoti hai, kyunki iska maqsad hai pichhle highs ya lows ko extend ya exceed karna. Traders aksar wave C ke direction mein trades enter karte hain, jisme wo trend ki potential continuation ko pakadne ki koshish karte hain. Stop aur profit targets ABC correction pattern se hasil hone wale expected price movements ke hisaab se set kiye ja sakte hain.

FIBONACCI RETRACEMENT AND THE ABC CORRECTION PATTERN:

Fibonacci retracement levels ABC correction pattern ke saath aksar istemal kiye jate hain taaki potential support aur resistance levels dhoondhe ja saken. Fibonacci retracement ratios, jaise ki 38.2%, 50% aur 61.8%, Fibonacci sequence se liye jate hain aur is par yakin rakha jata hai ki ye key levels hai jahan price retrace kar sakti hai, phir trend ke direction mein jari rahi. Traders in levels ko istemal karte hain ABC correction pattern par based trades ke potential entry aur exit points ke liye. ABC pattern ko Fibonacci retracement levels ke saath combine karke, traders apne analysis aur decision-making process mein additional confirmation aur precision prapt kar sakte hai.

Ikhtitam mein, ABC correction pattern forex trading mein tasleem shuda aur istemal hone wala aik price action pattern hai. Har wave ke khasosiyat aur dynamics ko samajh kar, traders bari trend ke andar potential reversals ya continuation signals ka andaza laga sakte hain. ABC pattern ko Fibonacci retracement levels jaise technical analysis tools ke saath combine karke, traders apni analysis aur trading decisions ki accuracy aur confirmation ko mazeed behtar kar sakte.

Forex mein ABC correction pattern aik aam dekha jane wala price action pattern hai, jo bari trend ke andar ho jata hai. Isay isi liye ABC patternkaha jata hai kyunki ye teen mukhtalif lehron se bana hota hai jo A, B aur C ke naam se label kiye jate hain. Ye pattern aik corrective pattern samjha jata hai aur amooman pure trend mein a temporary reversal ya pause ke taur par dekha jata hai. Isko traders dwara wasee tadaad mein parha jata hai aur istemal kiya jata hai kyunki ye trading mein munsif prices par dakhil ya nikalne ke mauqe deti hai.

WAVE A IN THE ABC CORRECTION PATTERN:

ABC correction pattern mein pehli wave, wave A, aksar prevailing trend ke khilaf aik majboot harekate hoti hai. Ye wave initial correction ya counter-trend movement ko darsha karti hai. Is mein taqatwar selling ya buying pressure hoti hai, jisme market sentiment ya fundamental factors ka asar hota hai. Wave A ko price charts par mutalia karke aur overall trend ke opposite direction mein significant price movements dhoond kar pehchana jata hai. Traders aksar technical indicators aur analysis tools ka istemal karte hain wave A ke maujoodgi ko tasdeeq karne aur pattern ke baad wale waves ko pehchane ke liye.

WAVE B IN THE ABC CORRECTION PATTERN:

Wave A ke baad, price amooman retraces ya sideways move karta hai, jise wave B kehte hain. Wave B aik counter-trend move hoti hai jo previous wave A ka aik hissa retraces karti hai. Ye zaruri hai ki wave B wave A ke starting point se aage na jaaye. Dusre alfaz mein kaha jaye toh wave B wave A ke originating price level se aage na jaye. Ye retracement traders ke liye support aur resistance levels, sath hi potential reversal patterns pehchane ka mauqa deti hai. Wave B aksar aik complex pattern hoti hai,jisme aksar chote sub-waves shaamil hote hain, jinhe careful analysis aur interpretation ki zarurat hoti hai.

WAVE C IN THE ABC CORRECTION PATTERN:

ABC correction pattern ki antim wave wave C hoti hai. Ye wave overall trend ke resumption ko darsha karti hai wave A ki correction aur wave B ki retracement ke baad. Wave C prevailing trend ke direction mein taqatwar buying ya selling pressure se charha hua hota hai. Ye aksar pattern mein sab se lambi aur taeedh wave hoti hai, kyunki iska maqsad hai pichhle highs ya lows ko extend ya exceed karna. Traders aksar wave C ke direction mein trades enter karte hain, jisme wo trend ki potential continuation ko pakadne ki koshish karte hain. Stop aur profit targets ABC correction pattern se hasil hone wale expected price movements ke hisaab se set kiye ja sakte hain.

FIBONACCI RETRACEMENT AND THE ABC CORRECTION PATTERN:

Fibonacci retracement levels ABC correction pattern ke saath aksar istemal kiye jate hain taaki potential support aur resistance levels dhoondhe ja saken. Fibonacci retracement ratios, jaise ki 38.2%, 50% aur 61.8%, Fibonacci sequence se liye jate hain aur is par yakin rakha jata hai ki ye key levels hai jahan price retrace kar sakti hai, phir trend ke direction mein jari rahi. Traders in levels ko istemal karte hain ABC correction pattern par based trades ke potential entry aur exit points ke liye. ABC pattern ko Fibonacci retracement levels ke saath combine karke, traders apne analysis aur decision-making process mein additional confirmation aur precision prapt kar sakte hai.

Ikhtitam mein, ABC correction pattern forex trading mein tasleem shuda aur istemal hone wala aik price action pattern hai. Har wave ke khasosiyat aur dynamics ko samajh kar, traders bari trend ke andar potential reversals ya continuation signals ka andaza laga sakte hain. ABC pattern ko Fibonacci retracement levels jaise technical analysis tools ke saath combine karke, traders apni analysis aur trading decisions ki accuracy aur confirmation ko mazeed behtar kar sakte.

تبصرہ

Расширенный режим Обычный режим