Scoop Candlestick Pattern Kia Hai:

Scoop candlestick pattern ek aham technical analysis tool hai jo tijarat mein istemal hota hai. Is pattern ka istemal karke aap market mein mawafiq mauqe par tajaweezat bana sakte hain.

Scoop Candlestick Pattern Ki Formation:

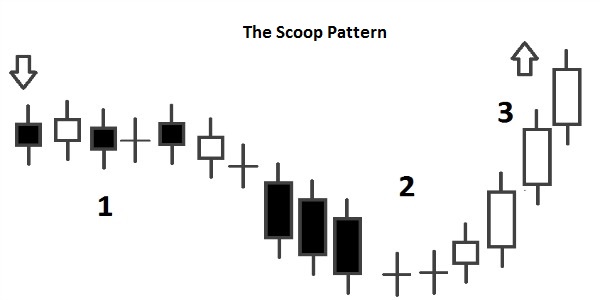

Scoop pattern mein candlesticks ka khaas tarika hota hai. Ismein market mein ek choti si girawat ya dip hoti hai, phir ek lambi candlestick aati hai jo market mein tezi ko darust karti hai. Yeh dip aur phir tezi ka mizaaj Scoop pattern ko banata hai.

Scoop Candlestick Pattern Ki Pehchan:

Scoop pattern ko pehchan'ne ke liye aapko market ki price chart par tawajjuh deni hogi. Scoop pattern ka pehla hissa chhota dip hota hai jo market mein kamzori ko darust karta hai. Phir aata hai ek lamba candlestick jo is dip ko tezi mein tabdeel karta hai. Yeh pattern tab banta hai jab market mein pehle ek choti si girawat hoti hai, phir ek lambi candlestick aati hai jo us girawat ko tezi mein tabdeel kar deti hai. Scoop pattern ki pehchan karne ke liye traders ko market ki trend aur candlestick formations par tawajjuh deni chahiye.

Scoop Pattern Ka Istemal:

Jab aap Scoop pattern ko pehchantay hain, toh aap is par amal karne ka faisla kar saktay hain. Agar aapko lagta hai ke market mein tezi aayegi, toh aap long position le saktay hain. Scoop pattern ki tezi ko madde nazar rakhtay hue, aap apni trading strategy banayein.

Risk Aur Reward Ka Tafseelati Jaiza:

Her tijarat mein risk aur reward ka acha jaiza lena zaruri hai. Scoop pattern par amal karte waqt, aapko apne risk aur reward ko tawajjuh se dekhna chahiye. Ismein apne stop-loss aur target levels ko mukarar karna bhi ahem hai.Har tijarat mein risk ka muhimaam karna ahem hai. Scoop pattern par amal karte waqt, traders ko apne stop-loss aur target levels ko tay karna chahiye. Yeh madad karta hai tijarat mein mawafiqat aur nuksanat ko control mein rakhne mein.

Trading Strategy:

Scoop candlestick pattern ek powerful tool hai, lekin yeh kehna bhi zaruri hai ke har tijarat mein khatra hota hai. Is liye, aapko hamesha apne tijarat ki strateegi ko barqarar rakhna chahiye aur market ki tabdiliyon par tawajjuh deni chahiye.Scoop pattern ka istemal karke traders market mein tezi ya girawat ka pata lagakar apni trading strategy banate hain. Agar Scoop pattern market mein tezi darust karti hai, toh traders long position le sakte hain. Iske liye market ki mawafiq tijarat ka intezar karna zaroori hai.

Scoop candlestick pattern ek aham technical analysis tool hai jo tijarat mein istemal hota hai. Is pattern ka istemal karke aap market mein mawafiq mauqe par tajaweezat bana sakte hain.

Scoop Candlestick Pattern Ki Formation:

Scoop pattern mein candlesticks ka khaas tarika hota hai. Ismein market mein ek choti si girawat ya dip hoti hai, phir ek lambi candlestick aati hai jo market mein tezi ko darust karti hai. Yeh dip aur phir tezi ka mizaaj Scoop pattern ko banata hai.

Scoop Candlestick Pattern Ki Pehchan:

Scoop pattern ko pehchan'ne ke liye aapko market ki price chart par tawajjuh deni hogi. Scoop pattern ka pehla hissa chhota dip hota hai jo market mein kamzori ko darust karta hai. Phir aata hai ek lamba candlestick jo is dip ko tezi mein tabdeel karta hai. Yeh pattern tab banta hai jab market mein pehle ek choti si girawat hoti hai, phir ek lambi candlestick aati hai jo us girawat ko tezi mein tabdeel kar deti hai. Scoop pattern ki pehchan karne ke liye traders ko market ki trend aur candlestick formations par tawajjuh deni chahiye.

Scoop Pattern Ka Istemal:

Jab aap Scoop pattern ko pehchantay hain, toh aap is par amal karne ka faisla kar saktay hain. Agar aapko lagta hai ke market mein tezi aayegi, toh aap long position le saktay hain. Scoop pattern ki tezi ko madde nazar rakhtay hue, aap apni trading strategy banayein.

Risk Aur Reward Ka Tafseelati Jaiza:

Her tijarat mein risk aur reward ka acha jaiza lena zaruri hai. Scoop pattern par amal karte waqt, aapko apne risk aur reward ko tawajjuh se dekhna chahiye. Ismein apne stop-loss aur target levels ko mukarar karna bhi ahem hai.Har tijarat mein risk ka muhimaam karna ahem hai. Scoop pattern par amal karte waqt, traders ko apne stop-loss aur target levels ko tay karna chahiye. Yeh madad karta hai tijarat mein mawafiqat aur nuksanat ko control mein rakhne mein.

Trading Strategy:

Scoop candlestick pattern ek powerful tool hai, lekin yeh kehna bhi zaruri hai ke har tijarat mein khatra hota hai. Is liye, aapko hamesha apne tijarat ki strateegi ko barqarar rakhna chahiye aur market ki tabdiliyon par tawajjuh deni chahiye.Scoop pattern ka istemal karke traders market mein tezi ya girawat ka pata lagakar apni trading strategy banate hain. Agar Scoop pattern market mein tezi darust karti hai, toh traders long position le sakte hain. Iske liye market ki mawafiq tijarat ka intezar karna zaroori hai.

تبصرہ

Расширенный режим Обычный режим