WHAT IS THE FOUR PRICE DOJI PATTERN?

Four Price Doji Pattern technical analysis mein istemal hone wala ek candlestick pattern hai. Ismein chaar musalsal doji candlesticks hote hain, jo candlesusers include will close ho aur open price mein kafi qareeb hote hain. Is pattern mein, chaar musalsal candles ki bodies bahut choti hoti hain, jo yeh darshate hain ke market mein tashweesh aur kharidari ke dabaav mein barabar balance hai. Pattern tab banta hai jab candles ke open aur close prices kafi qareeb hote hain, jiski wajah se body bahut choti ya bilkul na hoti hai.

IDENTIFYING THE FOUR PRICE DOJI PATTERN:

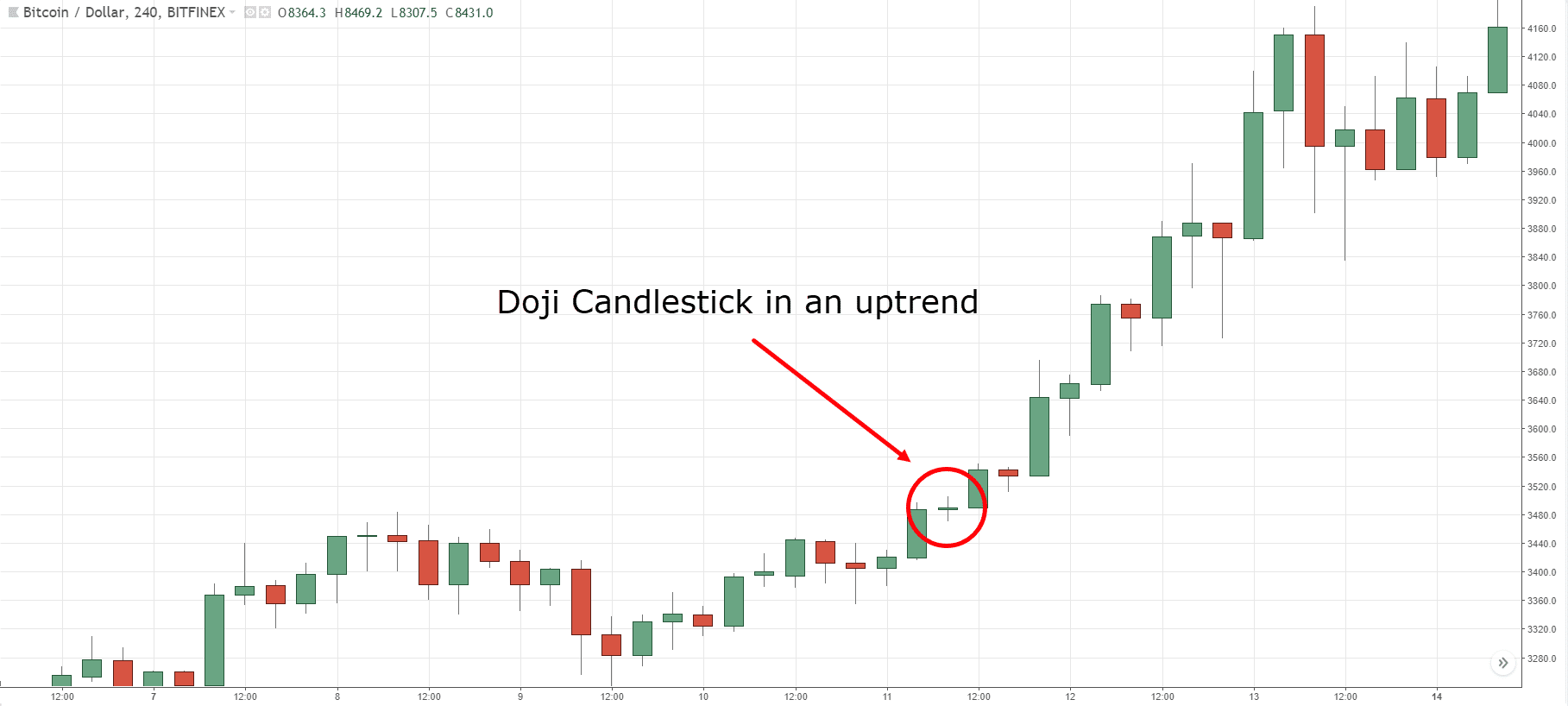

Four Price Doji Pattern ko pehchanne ke liye traders chaar musalsal doji candles ki sequence dhoondte hain. Har doji candle ki body bahut choti ya bilkul na honi chahiye, jisse yeh darshaya ja sake ke open aur close prices qareeb qareeb barabar hain. Pattern uptrend ya downtrend ke andar bhi ho sakta hai, aur yeh market mein ek potential reversal ki nishani hota hai. Traders various charting software ya candlestick pattern recognition tools ka istemal karke pattern ko aasani se pata laga sakte hain aur chart mein usko plot kar sakte hain.

INTERPRETATION AND SIGNIFICANCE OF THE FOUR PRICE DOJI PATTERN:

Four Price Doji Pattern ahmiyat ki wajah se mahtavpurn hai kyunki yeh market mein ek tawazun ki sthiti ko darshata hai. Isse pata chalta hai ke na kharidari wale na bechne wale zyada qabza mein hain, jiski wajah se ek tashweesh ki sthiti ban jati hai. Yeh pattern aksar key support aur resistance levels ke qareeb paya jata hai, jisse ek possible reversal ki nishani ban sakta hai. Jab yeh pattern downtrend ke ant mein banta hai, to yeh ek bullish reversal ki sambhavna darshata hai, jabki yeh uptrend ke ant mein ban sake to yeh bearish reversal ki sambhavna samjha jata hai. Yaad rakhna zaroori hai ke Four Price Doji Pattern ko trading decisions lene se pehle dusre technical indicators aur patterns ke saath confirm kiya jana chahiye.

TRADING STRATEGIES USING THE FOUR PRICE DOJI PATTERN:

Traders Four Price Doji Pattern ka istemal karke trading signals generate kar sakte hain. Jab pattern key support levels par banega, to traders khareed kar ya long position le sakte hain, bullish reversal ki umeed mein. Aur jab pattern key resistance levels par banega, to traders bech kar ya short position le sakte hain, bearish reversal ki umeed mein. Iske saath confirmation signals jaise trendline break, momentum indicator divergence, ya volume spike ka intezaar karna zaroori hai, jisse success ki probability ko badhaya ja sake. Stop-loss orders aur profit targets ko set karna zaroori hai risk ko manage karne aur potential profits ko capture karne ke liye.

LIMITATIONS OF THE FOUR PRICE DOJI PATTERN:

Chahe Four Price Doji Pattern technical analysis mein ek usefel tool ho, lekin iski hadiyan ko tasleem karna zaroori hai. Pehle toh yeh pattern baazari ghair mustahkam mausam mein kafi baar ban sakta hai, jisse yeh kam reliable ho jata hai. Dusri baat, is pattern ko confirm karne ke liye dusre technical indicators aur patterns ke saath istemal karna chahiye. Sirf Four Price Doji Pattern par bharosa kar ke false signals aur kharab trading decisions ho sakti hain. Isliye, zaroori hai ke yeh pattern ek mukammal trading strategy ka hissa banaye jaye, jo dusre tools aur techniques ko combine karti ho, jisse success ki probability ko badhaya ja sake.

Four Price Doji Pattern technical analysis mein istemal hone wala ek candlestick pattern hai. Ismein chaar musalsal doji candlesticks hote hain, jo candlesusers include will close ho aur open price mein kafi qareeb hote hain. Is pattern mein, chaar musalsal candles ki bodies bahut choti hoti hain, jo yeh darshate hain ke market mein tashweesh aur kharidari ke dabaav mein barabar balance hai. Pattern tab banta hai jab candles ke open aur close prices kafi qareeb hote hain, jiski wajah se body bahut choti ya bilkul na hoti hai.

IDENTIFYING THE FOUR PRICE DOJI PATTERN:

Four Price Doji Pattern ko pehchanne ke liye traders chaar musalsal doji candles ki sequence dhoondte hain. Har doji candle ki body bahut choti ya bilkul na honi chahiye, jisse yeh darshaya ja sake ke open aur close prices qareeb qareeb barabar hain. Pattern uptrend ya downtrend ke andar bhi ho sakta hai, aur yeh market mein ek potential reversal ki nishani hota hai. Traders various charting software ya candlestick pattern recognition tools ka istemal karke pattern ko aasani se pata laga sakte hain aur chart mein usko plot kar sakte hain.

INTERPRETATION AND SIGNIFICANCE OF THE FOUR PRICE DOJI PATTERN:

Four Price Doji Pattern ahmiyat ki wajah se mahtavpurn hai kyunki yeh market mein ek tawazun ki sthiti ko darshata hai. Isse pata chalta hai ke na kharidari wale na bechne wale zyada qabza mein hain, jiski wajah se ek tashweesh ki sthiti ban jati hai. Yeh pattern aksar key support aur resistance levels ke qareeb paya jata hai, jisse ek possible reversal ki nishani ban sakta hai. Jab yeh pattern downtrend ke ant mein banta hai, to yeh ek bullish reversal ki sambhavna darshata hai, jabki yeh uptrend ke ant mein ban sake to yeh bearish reversal ki sambhavna samjha jata hai. Yaad rakhna zaroori hai ke Four Price Doji Pattern ko trading decisions lene se pehle dusre technical indicators aur patterns ke saath confirm kiya jana chahiye.

TRADING STRATEGIES USING THE FOUR PRICE DOJI PATTERN:

Traders Four Price Doji Pattern ka istemal karke trading signals generate kar sakte hain. Jab pattern key support levels par banega, to traders khareed kar ya long position le sakte hain, bullish reversal ki umeed mein. Aur jab pattern key resistance levels par banega, to traders bech kar ya short position le sakte hain, bearish reversal ki umeed mein. Iske saath confirmation signals jaise trendline break, momentum indicator divergence, ya volume spike ka intezaar karna zaroori hai, jisse success ki probability ko badhaya ja sake. Stop-loss orders aur profit targets ko set karna zaroori hai risk ko manage karne aur potential profits ko capture karne ke liye.

LIMITATIONS OF THE FOUR PRICE DOJI PATTERN:

Chahe Four Price Doji Pattern technical analysis mein ek usefel tool ho, lekin iski hadiyan ko tasleem karna zaroori hai. Pehle toh yeh pattern baazari ghair mustahkam mausam mein kafi baar ban sakta hai, jisse yeh kam reliable ho jata hai. Dusri baat, is pattern ko confirm karne ke liye dusre technical indicators aur patterns ke saath istemal karna chahiye. Sirf Four Price Doji Pattern par bharosa kar ke false signals aur kharab trading decisions ho sakti hain. Isliye, zaroori hai ke yeh pattern ek mukammal trading strategy ka hissa banaye jaye, jo dusre tools aur techniques ko combine karti ho, jisse success ki probability ko badhaya ja sake.

تبصرہ

Расширенный режим Обычный режим