Forex market mein volume spread analysis (VSA) ek technical trading tool hai jo traders ko trading volume aur spreads ka analysis karke potential price movements ko identify karne mein madad karta hai. VSA ka tajaweez ye hai ke jab high volume aur low spreads hote hain, to yeh increased liquidity aur potential price action ko indicate karte hain, jab ke low volume aur high spreads decreased liquidity aur potential reversals ko suggest karte hain. VSA ka bunyadi asool ye hai ke jab ek currency pair high volumes mein trade hota hai, to iska matlab hai ke bohat se market participants pair ko actively buy ya sell kar rahe hain. Is increased activity se buyers aur sellers prices set karne mein muqabla karke price movements ka nasheman ho sakta hai. Jab bid aur ask prices ke darmiyan spread bhi kam hota hai, to ye darust hai ke price movement ke liye kam rukawat hai, jiski wajah se zyada taur par price trend ki taraf move hone ke imkanat barh jate hain.

Dusri taraf jab trading volumes kam hote hain aur spreads zyada hote hain, to iska ishara hai ke currency pair mein kam interest hai, aur prices mein ziada tabdiliyan hone ke imkanat kam hote hain. Ye bhi indicate kar sakta hai ke kisi bhi potential price movement ke liye rukawat hai, jiski wajah se prices ulte ho sakti hain.

VSA analysis mein kuch steps hain:

Benefits of VSA

VSA ka ek faida ye hai ke ye traders ko potential price movements ko pesh hony se pehly identify karne mein madad kar sakta hai. High-volume periods ke doran trading volumes aur spreads ka analysis karke, traders potential price action ko paish kar sakte hain aur is information par buniyad par trading decisions le sakte hain. Ye traders ko ulte ya galat breakouts mein phansne se bachane mein madad kar sakta hai, jo ke significant nuksan ka sabab ho sakte hain. VSA ka doosra faida ye hai ke ye traders ko apne risk ko manage karne mein madad kar sakta hai, support aur resistance levels ko identify karke. Prices ko in levels ke qareeb anay ka intezar karke high-volume periods with low spreads mein, traders apne trades ko mazeed munasib prices aur kam risk levels par dakhil kar sakte hain. Ye traders ko apne munafe ko ziada karnay mein aur nuksanat ko kam karne mein madad kar sakta hai.

Drawbacks of VSA

VSA ko ek trading tool ke tor par istemal karne mein kuch nuksanat bhi hain. Ek main challenge ye hai ke trading volumes aur spreads ko market activity ke ilawa bhi kai factors asar daal sakte hain, jaise ke news events ya brokers ya exchanges ke sath technical issues. Ye real-time trading situations mein VSA signals ko sahi se tabayi karna mushkil bana sakta hai. Ek aur challenge ye hai ke VSA analysis ko effective taur par implement karne ke liye bohat saqt waqt aur mehnat ki zarurat hoti hai. Traders ko high-volume periods ke doran trading volumes aur spreads ko monitor karna ke liye diligent rehna padta hai, sath hi sath market news aur events ko bhi track karna padta hai jo in factors par asar daal sakte hain. Ye khas kar un traders ke liye jo ek sath multiple currency pairs ko manage kar rahe hote hain.

Dusri taraf jab trading volumes kam hote hain aur spreads zyada hote hain, to iska ishara hai ke currency pair mein kam interest hai, aur prices mein ziada tabdiliyan hone ke imkanat kam hote hain. Ye bhi indicate kar sakta hai ke kisi bhi potential price movement ke liye rukawat hai, jiski wajah se prices ulte ho sakti hain.

VSA analysis mein kuch steps hain:

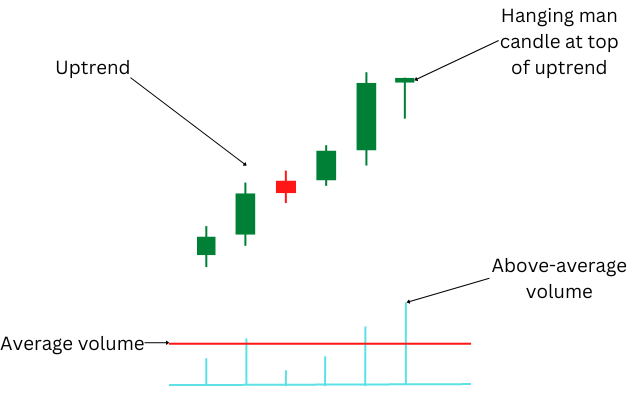

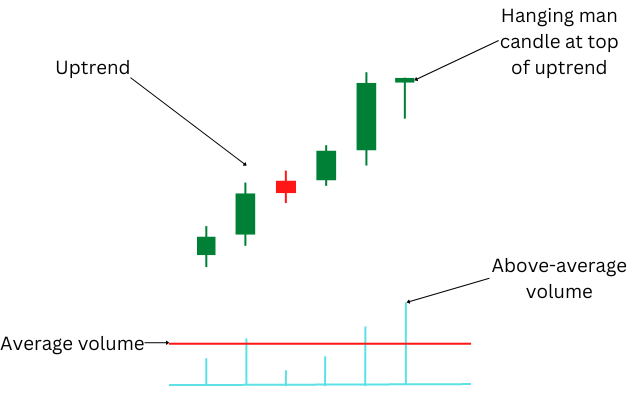

- Identify high-volume periods: Traders ko apne charts par high trading volume ke doran periods dhoondhne chahiye. Isko Average True Range (ATR) ya Money Flow Index (MFI) jaise indicators ka istemal karke kiya ja sakta hai. High-volume periods ko amuman bade candlesticks ke sath ya lambi wicks ya shadows ke sath characterize kiya jata hai, jo significant price action ko darust karte hain.

- Analyze spreads: Traders ko high-volume periods mein bid aur ask prices ke darmiyan spread ka bhi analysis karna chahiye. Kam spreads increased liquidity aur potential price action ko indicate karte hain, jab ke zyada spreads decreased liquidity aur potential reversals ko suggest karte hain.

- Identify support and resistance levels: Traders ko apne charts par support aur resistance areas dhoondhne chahiye. Ye levels price points ko darust karte hain jahan buyers aur sellers market mein dakhil ya nikal sakte hain. High-volume periods with low spreads near support ya resistance levels potential price movements ko is taraf indicate kar sakte hain.

- Monitor market news and events: Traders ko market news aur events par bhi nazar rakhni chahiye jo trading volumes aur spreads par asar daal sakte hain. Maslan, economic data releases ya central bank meetings currency pairs mein izafayi volatility paida kar sakte hain, jiski wajah se trading volumes barh sakte hain aur spreads potentially kam ho sakte hain. Jabke VSA potential price movements ko identify karne mein ek useful tool ho sakti hai, lekin ise isolation mein istemal nahi karna chahiye. Traders ko apne VSA analysis ko confirm karne ke liye doosre technical analysis tools jaise chart patterns, moving averages, aur oscillators ka bhi istemal karna chahiye.

Benefits of VSA

VSA ka ek faida ye hai ke ye traders ko potential price movements ko pesh hony se pehly identify karne mein madad kar sakta hai. High-volume periods ke doran trading volumes aur spreads ka analysis karke, traders potential price action ko paish kar sakte hain aur is information par buniyad par trading decisions le sakte hain. Ye traders ko ulte ya galat breakouts mein phansne se bachane mein madad kar sakta hai, jo ke significant nuksan ka sabab ho sakte hain. VSA ka doosra faida ye hai ke ye traders ko apne risk ko manage karne mein madad kar sakta hai, support aur resistance levels ko identify karke. Prices ko in levels ke qareeb anay ka intezar karke high-volume periods with low spreads mein, traders apne trades ko mazeed munasib prices aur kam risk levels par dakhil kar sakte hain. Ye traders ko apne munafe ko ziada karnay mein aur nuksanat ko kam karne mein madad kar sakta hai.

Drawbacks of VSA

VSA ko ek trading tool ke tor par istemal karne mein kuch nuksanat bhi hain. Ek main challenge ye hai ke trading volumes aur spreads ko market activity ke ilawa bhi kai factors asar daal sakte hain, jaise ke news events ya brokers ya exchanges ke sath technical issues. Ye real-time trading situations mein VSA signals ko sahi se tabayi karna mushkil bana sakta hai. Ek aur challenge ye hai ke VSA analysis ko effective taur par implement karne ke liye bohat saqt waqt aur mehnat ki zarurat hoti hai. Traders ko high-volume periods ke doran trading volumes aur spreads ko monitor karna ke liye diligent rehna padta hai, sath hi sath market news aur events ko bhi track karna padta hai jo in factors par asar daal sakte hain. Ye khas kar un traders ke liye jo ek sath multiple currency pairs ko manage kar rahe hote hain.

تبصرہ

Расширенный режим Обычный режим