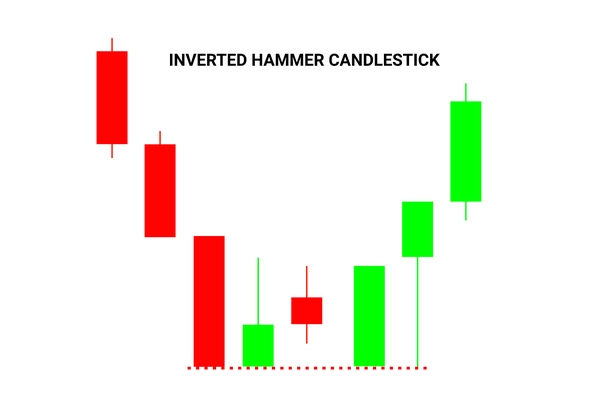

"Inverted Hammer" ek candlestick pattern hai jo technical analysis mein use hota hai. Yeh ek reversal pattern hai jo market ke trend ko indicate karta hai. Is pattern ka naam isliye hai kyunki iski shape ek hammer ki tarah hoti hai, lekin ulta hota hai. Yani, wick upper side par hota hai aur body lower side par hoti hai.

Inverted Hammer Ki Key Characteristics:

- Shape:

- Is pattern ki sabse pehchan woh hai ki iski shape ek chhota sa body aur ek lambi upper wick hoti hai. Body chhota hota hai aur lower side par hota hai.

- Upper Wick:

- Inverted Hammer ke upper wick ka size body ke comparison mein zyada hota hai. Iska matlab hai ki price ne trading session ke dauran ek higher level tak gaya tha, lekin session ke end tak woh level sustain nahi kiya.

- Lower Shadow (Body):

- Lower shadow ya body chhoti hoti hai aur woh pattern ke bottom par hoti hai. Yeh indicate karta hai ki selling pressure tha, lekin buyers ne session ke end mein control le liya.

- Color:

- Inverted Hammer ka color kuch bhi ho sakta hai. Green (bullish) ya red (bearish) iski significance par depend karta hai.

Inverted Hammer Ka Trading Signal:

- Inverted Hammer bearish trend ke end ya reversal ko suggest karta hai. Is pattern ke appearance ke baad, traders expect karte hain ki market mein bullish reversal hone ke chances hain.

- Agar Inverted Hammer ek downtrend ke baad aata hai, toh yeh indicate karta hai ki selling pressure kamzor ho rahi hai aur buyers control mein aa rahe hain.

- Confirmation ke liye, traders doosre indicators aur patterns ka istemal karte hain. Agar doosre bullish signals bhi present hain, toh Inverted Hammer ka impact zyada hota hai.

Inverted Hammer Ka Example:

- Suppose, ek downtrend chal raha hai aur ek din market Inverted Hammer pattern dikhata hai. Iske baad, next trading session mein price upward move karta hai, confirming the reversal.

- Is example mein, traders ko yeh signal mil raha hai ki bearish trend khatam ho sakta hai aur ab bullish trend shuru ho sakta hai.

Yeh important hai ke Inverted Hammer ko isolated form mein dekha jaye aur doosre technical analysis tools ke saath combine kiya jaye trading decisions lene se pehle.

تبصرہ

Расширенный режим Обычный режим