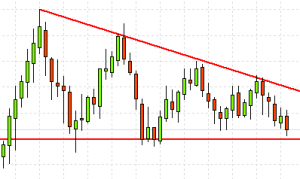

False Breakout Pattern:

False Breakout Pattern, ya "Jhooti Breakout" pattern, market mein aik deceptive move ko describe karta hai jab kisi support ya resistance level ko break karnay ka dawa karta hai lekin phir wapis reverse ho jata hai. Traders ko isse bachne ke liye saavdhan rehna chahiye, kyun ke yeh ek aam market manipulation technique hai.

False Breakout ki Khasoosiyat:

- Breakout Claim:

- False breakout, ek level ko breach hone ka dawa karta hai, jaise ke support level ya resistance level.

- Quick Reversal:

- Phir iske baad, jald hi price wapis reverse ho jati hai aur breach hua level regain ho jata hai.

- Trap for Traders:

- Yeh traders ke liye aik trap ho sakta hai jo breakout par trade karna shuru karte hain.

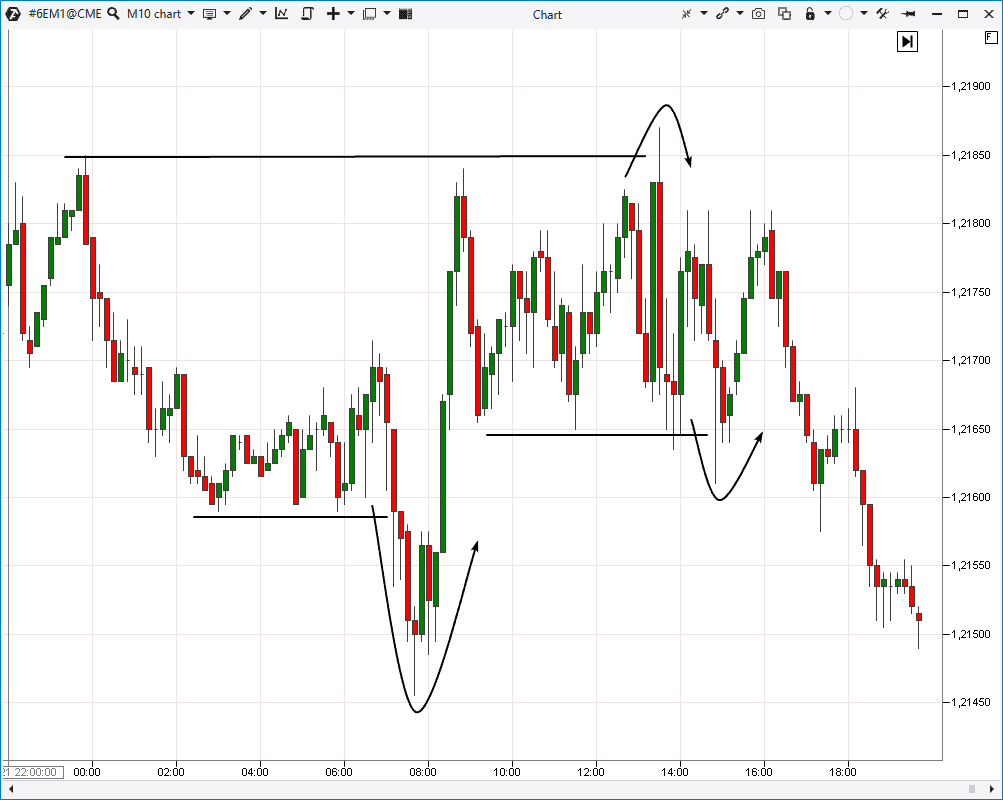

- Volume Analysis:

- False breakout ke doran, traders ko trading volume par nazar rakhni chahiye. Agar breakout volume ke saath nahi hota, toh yeh indication ho sakti hai ke woh asal hai nahi.

False Breakout ka Asar:

- Stop Loss Trigger:

- False breakout ke doran traders apne stop loss orders activate kar sakte hain, jo unko nuksan mein daal sakta hai.

- Confusion Create karna:

- Yeh market participants ko confuse karke unka sentiment manipulate kar sakta hai.

- Liquidity Provide karna:

- False breakout se market makers ko liquidity provide ho sakti hai jab traders apne positions close karte hain.

Trading Strategies to Avoid False Breakouts:

- Volume Confirmation:

- Breakout ko confirm karne ke liye, trading volume ka analysis karna important hai. Agar breakout volume ke saath ho, toh woh zyada valid hota hai.

- Price Confirmation:

- Price action patterns aur doosre technical indicators ka istemal karke breakout ko confirm karna.

- Wait for Retest:

- Agar breakout hota hai, toh wait karna retracement ka aur phir confirm entry karna.

- Use of Multiple Timeframes:

- Multiple timeframes ka istemal karke dekhein ke breakout doosre timeframes par bhi confirm ho raha hai ya nahi.

False Breakout Pattern, ya "Jhooti Breakout" pattern, market mein aik deceptive move ko describe karta hai jab kisi support ya resistance level ko break hone ka dawa karta hai lekin phir woh wapis reverse ho jata hai. Yeh traders ke liye ek trap ho sakta hai, aur isse bachne ke liye volume aur price action ka dhyan rakhna important hai. Trading strategies mein volume confirmation, price confirmation, retracement ka wait karna, aur multiple timeframes ka istemal karna shamil hai.

تبصرہ

Расширенный режим Обычный режим