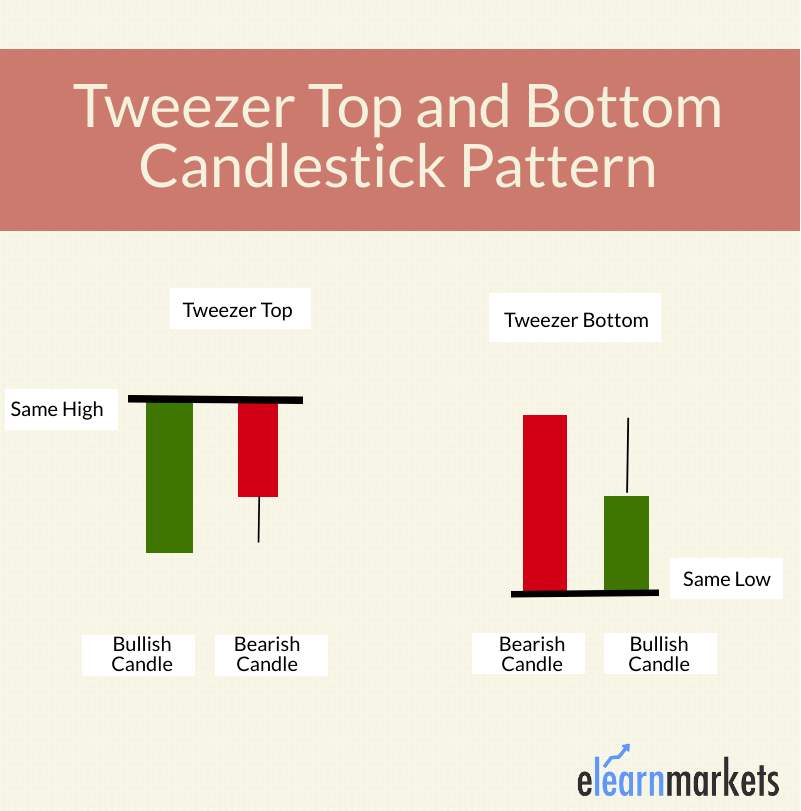

"Tweezer Bottom Pattern," ya "Tweezer Bottom," ek technical analysis pattern hai jo candlestick charts par paya jata hai. Ye pattern market mein possible trend reversal ko darust karta hai, khaas karke downtrend ke baad. Tweezer Bottom ek bullish reversal pattern hai, jise traders trend reversal ka pata lagane ke liye istemal karte hain.

Tweezer Bottom Pattern ke kuch ahem characteristics hain:

- Downtrend ke Baad Aata Hai:

- Tweezer Bottom pattern usually downtrend ke baad aata hai. Iska matlab hai ke market mein pehle sellers ne control kiya tha, lekin ab buyers ne apna dominance dikhaya hai.

- Do Alag-alag Lekin Similar Low Prices:

- Tweezer Bottom pattern mein do alag-alag candlesticks hote hain, jo ke similar low prices par close hote hain.

- Pehla candle bearish hota hai, jiska closing price downtrend ko indicate karta hai.

- Dusra candle bullish hota hai aur iska opening price pehle ke candle ke closing price ke bohat qareeb hota hai.

- Similar Highs:

- Dono candlesticks ke highs bhi aapas mein similar hote hain, jisse ek horizontal line draw karke tweezer shape ban jata hai.

- Volume ka Tafseel:

- Tweezer Bottom pattern ke confirmation ke liye volume ki bhi madad li jaati hai. Agar tweezer bottom ke formation ke samay volume bhi badh jata hai, toh ye trend reversal ko aur bhi strong bana deta hai.

Tweezer Bottom Pattern ka Tafsili Taur par Istemal:

- Confirmation Ke Liye Wait Karein:

- Tweezer Bottom pattern ko confirm karne ke liye, traders ko doji ya bullish candlestick ka aane ka wait karna chahiye, jisse downtrend ka reversal saaf ho sake.

- Stop-Loss aur Target Levels:

- Tweezer Bottom pattern ke baad, traders apne stop-loss levels ko set karte hain taki agar market reversal na ho toh unka nuksan kam ho sake.

- Target levels ko set karke traders apne profits ko maximize karne ka bhi sochte hain.

- Dusre Technical Indicators ke Istemal:

- Tweezer Bottom pattern ke sath, traders ko dusre technical indicators jaise ki RSI, MACD, aur moving averages ka istemal karke confirmatory signals ko dhyan mein rakhna chahiye.

Tweezer Bottom pattern ek powerful reversal signal ho sakta hai, lekin hamesha yaad rahe ke kisi bhi ek indicator par poora bharosa na karein aur doosre analysis tools ka bhi istemal karein trading decisions ke liye.

تبصرہ

Расширенный режим Обычный режим