Ask price aur bid price

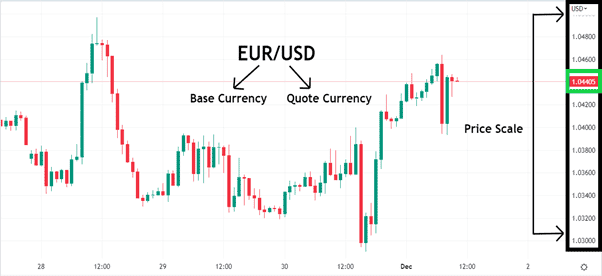

Ask price aur bid price, financial markets mein istemal hone wale do ahem terms hain jo securities trading ke dauran ahamiyat rakhte hain. Ye terms stock market aur forex market mein commonly use hoti hain.

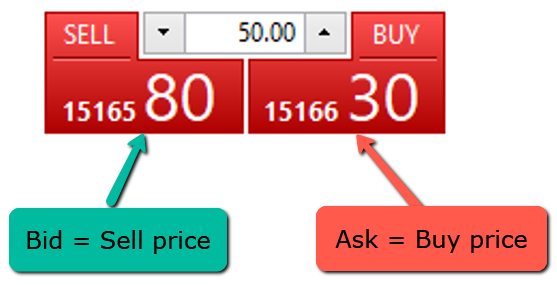

Ask Price: Ask price woh price hoti hai jis par market ya broker willing hota hai kisi security ko sell karne ke liye. Jab aap market mein kisi security ke liye order place karte hain, aapko use purchase karne ke liye ask price par transaction karna padta hai. Ask price hamesha bid price se zyada hoti hai. Yeh difference, bid-ask spread ke roop mein jaana jata hai. Ask price ka determination market conditions, demand-supply dynamics, aur security type par depend karta hai.

Bid Price: Bid price woh price hoti hai jis par market ya buyer willing hota hai kisi security ko khareedne ke liye. Jab aap market mein kisi security ko buy karte hain, aapko use purchase karne ke liye bid price par transaction karna padta hai. Bid price hamesha ask price se kam hoti hai. Isme bhi market conditions, demand-supply, aur security type ka asar hota hai.

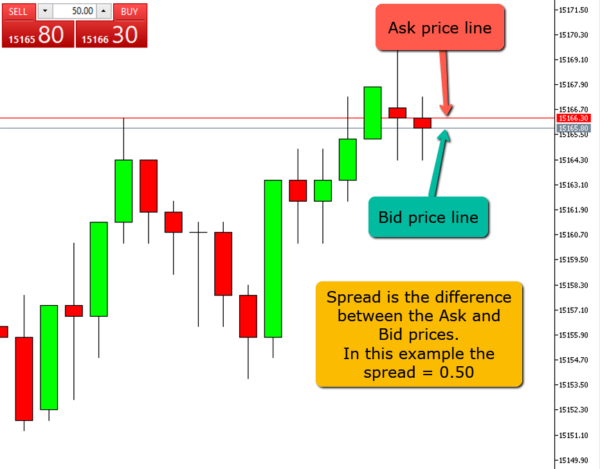

Bid-Ask Spread: Bid-ask spread, bid price aur ask price ke beech ka difference hota hai. Yeh spread market volatility aur liquidity par depend karta hai. High liquidity wale markets mein spread usually kam hota hai, jabki low liquidity wale markets mein spread zyada ho sakta hai. Traders is spread ko monitor karte hain, kyun ki ye unhe market conditions ke baare mein insights deta hai.

Bid price aur ask price ka samajh hona traders ke liye bahut zaroori hai, kyun ki ye unhe sahi waqt par sahi decisions lene mein madad karte hain. In prices ki real-time monitoring, market trends ka pata lagana aur trading strategies banane mein madad karta hai.

Ask price aur bid price, financial markets mein istemal hone wale do ahem terms hain jo securities trading ke dauran ahamiyat rakhte hain. Ye terms stock market aur forex market mein commonly use hoti hain.

Ask Price: Ask price woh price hoti hai jis par market ya broker willing hota hai kisi security ko sell karne ke liye. Jab aap market mein kisi security ke liye order place karte hain, aapko use purchase karne ke liye ask price par transaction karna padta hai. Ask price hamesha bid price se zyada hoti hai. Yeh difference, bid-ask spread ke roop mein jaana jata hai. Ask price ka determination market conditions, demand-supply dynamics, aur security type par depend karta hai.

Bid Price: Bid price woh price hoti hai jis par market ya buyer willing hota hai kisi security ko khareedne ke liye. Jab aap market mein kisi security ko buy karte hain, aapko use purchase karne ke liye bid price par transaction karna padta hai. Bid price hamesha ask price se kam hoti hai. Isme bhi market conditions, demand-supply, aur security type ka asar hota hai.

Bid-Ask Spread: Bid-ask spread, bid price aur ask price ke beech ka difference hota hai. Yeh spread market volatility aur liquidity par depend karta hai. High liquidity wale markets mein spread usually kam hota hai, jabki low liquidity wale markets mein spread zyada ho sakta hai. Traders is spread ko monitor karte hain, kyun ki ye unhe market conditions ke baare mein insights deta hai.

Bid price aur ask price ka samajh hona traders ke liye bahut zaroori hai, kyun ki ye unhe sahi waqt par sahi decisions lene mein madad karte hain. In prices ki real-time monitoring, market trends ka pata lagana aur trading strategies banane mein madad karta hai.

تبصرہ

Расширенный режим Обычный режим