INTRODUCTION TO THE TWEEZER BOTTOM PATTERN :

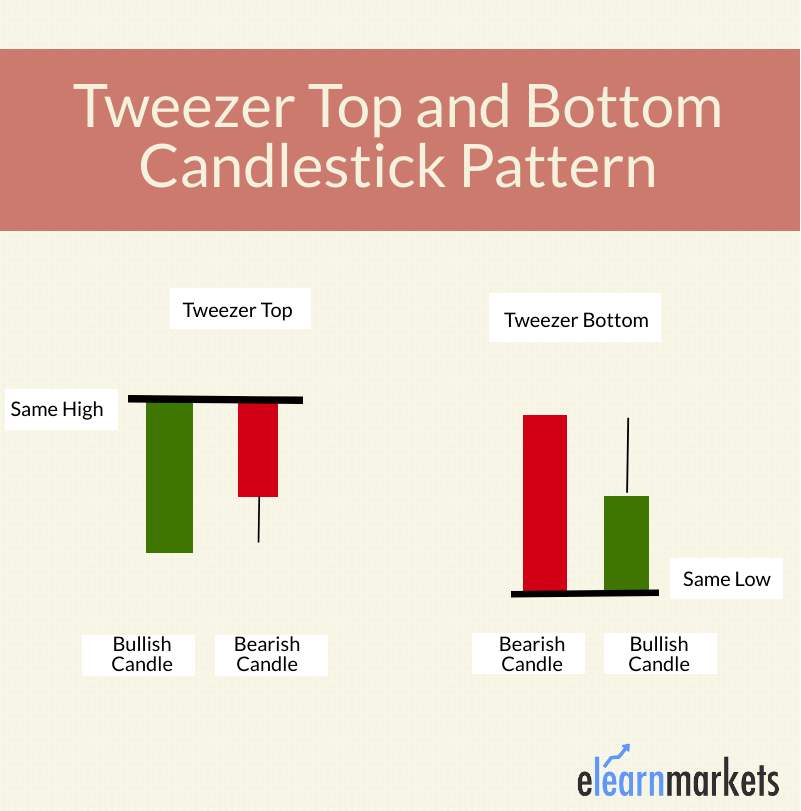

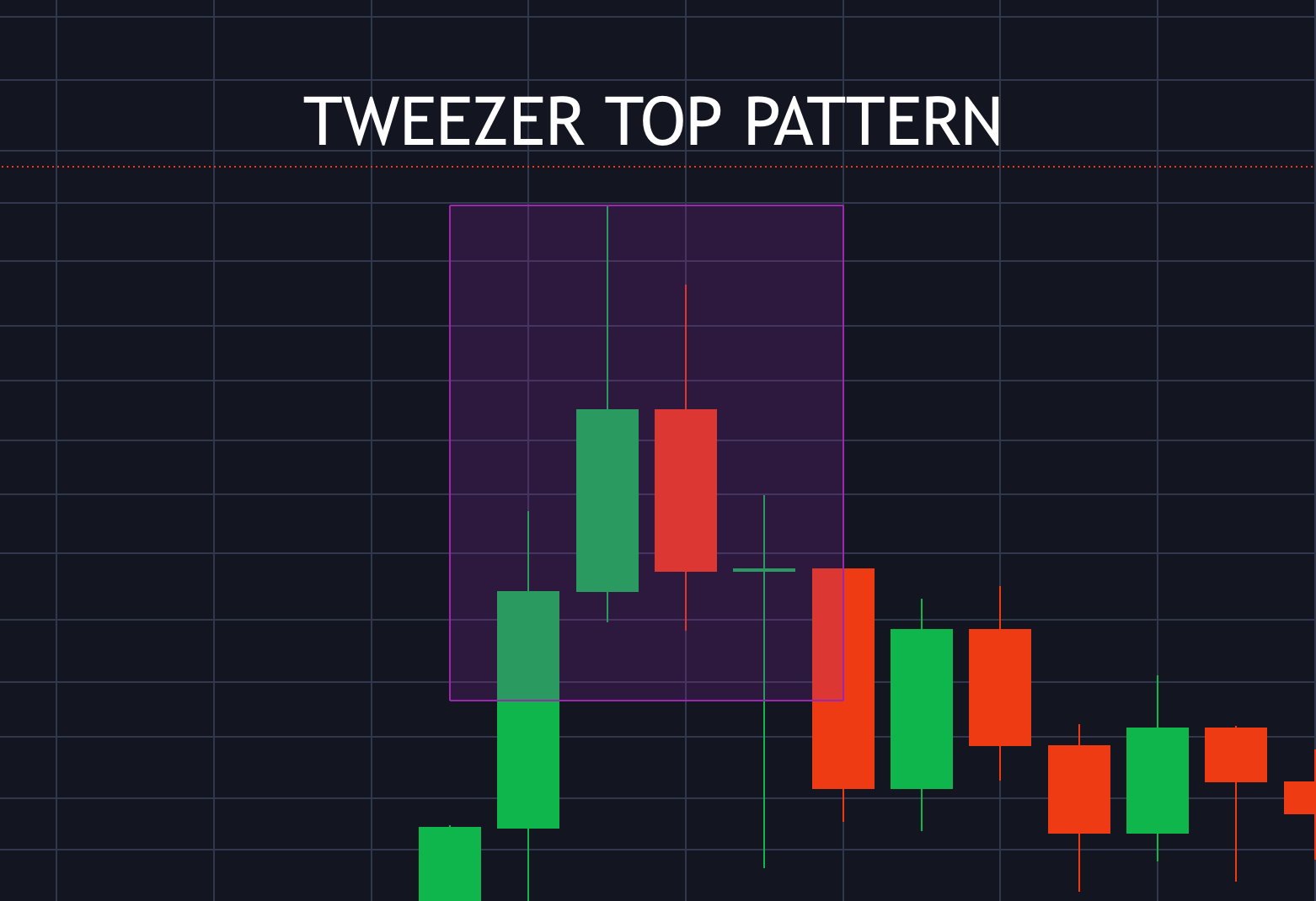

Tweezer Bottom Pattern forex trading charts mein dekhne ko milne wala ek technical analysis pattern hai. Ye pattern bearish aur bullish sentiment ke beach ek mogTweezer Bottom Pattern ek aisa technical analysis pattern hai jo forex trading charts mein dekha ja sakta hai. Ye pattern market ke sentiment mein ek possible shift ko darshata hai, beart se bull ki taraf. Is pattern mein do candlesticks hote hain, ek bullish aur ek bearish, jinki low price level same hoti hai. Tweezer Bottom Pattern aam taur par downtrend ke ant mein paya jata hai aur market mein ek possible reversal ko signal karta hai.

IDENTIFYING THE TWEEZER BOTTOM PATTERN :

Tweezer Bottom Pattern ko pehchanne ke liye traders ko in characteristics par dhyan dena hoga:

1. Do consecutive candlesticks: Ye pattern do consecutive candlesticks se banta hai, ek bullish aur ek bearish, jinki low price level same hoti hai. Candlesticks ki length alag ho sakti hai, lekin unka low same hona zaruri hai.

2. Lambi lower wicks: Dono candlesticks mein lambi lower wicks honi chahiye, jo ye darshate hain ki price temporarily down gayi hai lekin ultimately recover ho gayi hai.

3. Tweezer Bottom Pattern ke baad wala bullish candlestick: Tweezer Bottom Pattern ke baad wala bullish candlestick strong bullish close honi chahiye aur preferably long body honi chahiye, jisse badh gayi buying pressure ka pata chale.

SIGNIFICANCE OF THE TWEEZER BOTTOM PATTERN :

Tweezer Bottom Pattern ka significance isliye hai kyunki ye market sentiment mein ek possible reversal ko darshata hai. Ye darshata hai ki bears ka control kam ho gaya hai aur bulls step in kar rahe hain. Jab ye pattern bearish trend ke ant mein hota hai, to ye ek possible trend reversal ya bullish continuation ko signal karta hai. Traders is pattern ka istemal karke long positions lena ya short positions band karna ke liye istemal kar sakte hain.

Tweezer Bottom Pattern ka significance aur badhaya ja sakta hai additional technical indicators ya confirmation signals ke saath. For example, traders oversold conditions ki taraf dekh sakte hain oscillators jaise ki Relative Strength Index (RSI) ya Stochastic Oscillator mein. Iske alawa, traders confirmation signals ka wait kar sakte hain, jaise ki bullish engulfing pattern ya trendline resistance ko break karne ka signal.

TRADING STRATEGIES WITH THE TWEEZER BOTTOM PATTERN :

Tweezer Bottom Pattern ko spot karne par traders kuch trading strategies istemal kar sakte hain:

1. Trend reversal strategy: Jab Tweezer Bottom Pattern downtrend ke ant mein forms hota hai, traders contrarian approach lekar long positions le sakte hain jab bullish candlestick pattern ke baad close ho jaye. Stop-loss orders pattern ki low ke neeche place kar sakte hain aur profit targets previous resistance levels ya other technical indicators ke basis par set kar sakte hain.

2. Continuation strategy: Kuch cases mein, Tweezer Bottom Pattern existing bullish trend ki continuation ko signal karta hai. Traders iska fayda utha sakte hain, jab Tweezer Bottom Pattern confirm ho jata hai, aur stop-loss orders pattern ki low ke neeche place kar sakte hain. Profit targets previous resistance levels ya other technical indicators ke basis par set kar sakte hain.

LIMITATIONS OF THE TWEEZER BOTTOM PATTERN :

Tweezer Bottom Pattern ke kuch limitations bhi hain. Sabse pehle, overall market context ko consider karna zaruri hai aur sirf is pattern par rely nahi karna chahiye. Ye pattern sabse reliable hota hai jab ye significant support levels par ya prolonged downtrend ke baad hota hai.

Dusri baat, jaise ki koi bhi technical analysis pattern, Tweezer Bottom Pattern bhi foolproof nahi hai aur false signals produce kar sakta hai. Traders ko additional confirmation signals ya indicators ka istemal karke pattern ki accuracy ko badhana hai.

Akhir mein, risk management ko consider karna zaruri hai aur appropriate stop-loss orders set karna chahiye, potential losses se bachne ke liye. Ye traders ko unki risk manage karne aur potential losses se bachne mein madad karta hai, agar pattern hold na ho.

Tweezer Bottom Pattern forex trading charts mein dekhne ko milne wala ek technical analysis pattern hai. Ye pattern bearish aur bullish sentiment ke beach ek mogTweezer Bottom Pattern ek aisa technical analysis pattern hai jo forex trading charts mein dekha ja sakta hai. Ye pattern market ke sentiment mein ek possible shift ko darshata hai, beart se bull ki taraf. Is pattern mein do candlesticks hote hain, ek bullish aur ek bearish, jinki low price level same hoti hai. Tweezer Bottom Pattern aam taur par downtrend ke ant mein paya jata hai aur market mein ek possible reversal ko signal karta hai.

IDENTIFYING THE TWEEZER BOTTOM PATTERN :

Tweezer Bottom Pattern ko pehchanne ke liye traders ko in characteristics par dhyan dena hoga:

1. Do consecutive candlesticks: Ye pattern do consecutive candlesticks se banta hai, ek bullish aur ek bearish, jinki low price level same hoti hai. Candlesticks ki length alag ho sakti hai, lekin unka low same hona zaruri hai.

2. Lambi lower wicks: Dono candlesticks mein lambi lower wicks honi chahiye, jo ye darshate hain ki price temporarily down gayi hai lekin ultimately recover ho gayi hai.

3. Tweezer Bottom Pattern ke baad wala bullish candlestick: Tweezer Bottom Pattern ke baad wala bullish candlestick strong bullish close honi chahiye aur preferably long body honi chahiye, jisse badh gayi buying pressure ka pata chale.

SIGNIFICANCE OF THE TWEEZER BOTTOM PATTERN :

Tweezer Bottom Pattern ka significance isliye hai kyunki ye market sentiment mein ek possible reversal ko darshata hai. Ye darshata hai ki bears ka control kam ho gaya hai aur bulls step in kar rahe hain. Jab ye pattern bearish trend ke ant mein hota hai, to ye ek possible trend reversal ya bullish continuation ko signal karta hai. Traders is pattern ka istemal karke long positions lena ya short positions band karna ke liye istemal kar sakte hain.

Tweezer Bottom Pattern ka significance aur badhaya ja sakta hai additional technical indicators ya confirmation signals ke saath. For example, traders oversold conditions ki taraf dekh sakte hain oscillators jaise ki Relative Strength Index (RSI) ya Stochastic Oscillator mein. Iske alawa, traders confirmation signals ka wait kar sakte hain, jaise ki bullish engulfing pattern ya trendline resistance ko break karne ka signal.

TRADING STRATEGIES WITH THE TWEEZER BOTTOM PATTERN :

Tweezer Bottom Pattern ko spot karne par traders kuch trading strategies istemal kar sakte hain:

1. Trend reversal strategy: Jab Tweezer Bottom Pattern downtrend ke ant mein forms hota hai, traders contrarian approach lekar long positions le sakte hain jab bullish candlestick pattern ke baad close ho jaye. Stop-loss orders pattern ki low ke neeche place kar sakte hain aur profit targets previous resistance levels ya other technical indicators ke basis par set kar sakte hain.

2. Continuation strategy: Kuch cases mein, Tweezer Bottom Pattern existing bullish trend ki continuation ko signal karta hai. Traders iska fayda utha sakte hain, jab Tweezer Bottom Pattern confirm ho jata hai, aur stop-loss orders pattern ki low ke neeche place kar sakte hain. Profit targets previous resistance levels ya other technical indicators ke basis par set kar sakte hain.

LIMITATIONS OF THE TWEEZER BOTTOM PATTERN :

Tweezer Bottom Pattern ke kuch limitations bhi hain. Sabse pehle, overall market context ko consider karna zaruri hai aur sirf is pattern par rely nahi karna chahiye. Ye pattern sabse reliable hota hai jab ye significant support levels par ya prolonged downtrend ke baad hota hai.

Dusri baat, jaise ki koi bhi technical analysis pattern, Tweezer Bottom Pattern bhi foolproof nahi hai aur false signals produce kar sakta hai. Traders ko additional confirmation signals ya indicators ka istemal karke pattern ki accuracy ko badhana hai.

Akhir mein, risk management ko consider karna zaruri hai aur appropriate stop-loss orders set karna chahiye, potential losses se bachne ke liye. Ye traders ko unki risk manage karne aur potential losses se bachne mein madad karta hai, agar pattern hold na ho.

تبصرہ

Расширенный режим Обычный режим