WHAT IS AN INVERSE HEAD AND SHOULDERS PATTERN ?

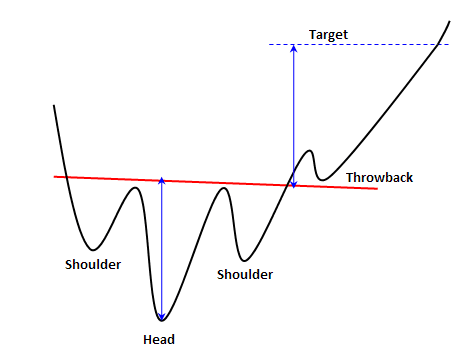

Inverse Head and Shoulders pattern forex trading mein uptrend ki potential reversal ko signal karta hai. Ye ek bullish pattern hai aur iskoInverse Head and Shoulders pattern ek technical chart formation hai jo forex trading mein downtrend ki potential reversal ki possibility ko signal karta hai. Isko identify karne ke liye teen mukhya components hote hain: left shoulder, head aur right shoulder. Left shoulder ek significant downtrend ke baad banega aur price ka ek low point represent karega. Head uske baad banega aur ye pattern ka lowest point hoga. Finally, right shoulder banega jo dusra low point hoga, jiske usually head se upar hoga. Ye teen components mil kar ek aisa pattern banaenge jo ek head aur shoulders jaisa dikhega, par inverted hoga.

KEY CHARACTERISTICS OF AN INVERSE HEAD AND SHOULDERS PATTERN :

Inverse Head and Shoulders pattern ki kuch mukhya khasiyat hoti hain jinhe traders is pattern ko identify karne ke liye dekhte hain. Pehla, ye pattern ek downward trend ke baad banega, jiske through market bottom tak pahunch rahi hai aur reversal ke liye taiyar ho rahi hai. Dusra, neckline, jo ki ek resistance level hota hai, left shoulder, head aur right shoulder ke highs ko connect karke draw kiya ja sakta hai. Teesra, head banane ke time volume shoulder banane ke time volume se kam hona chahiye. Finally, neckline se breakout ko pattern ki confirmation mana jata hai aur ye bullish move ki potential target define karta hai.

TRADING THE INVERSE HEAD AND SHOULDERS PATTERN :

Inverse Head and Shoulders pattern ko trade karte waqt kuch mukhya baatein yaad rakhni chahiye. Pehle, pattern ko puri tarah se banne aur neckline ke upar breakout hone ka intezaar karna zaroori hai trade mein enter hone se pehle. Isse pattern ki validly confirm hoti hai aur false signals ki risk kam hoti hai. Dusra, traders volume ko ek confirmation tool ke taur par istemal kar sakte hain. Ideally, volume neckline ke upar breakout ke time increase hona chahiye, indicating strong buying pressure. Teesra, bullish move ka target head se neckline tak ka distance measure karke breakout point se upward project karke calculate kiya ja sakta hai. Finally, pattern ki failure ke case mein stop-loss order neckline ke niche set karna zaroori hai.

POTENTIAL PITFALLS OF TRADING THE INVERSE HEAD AND SHOULDERS PATTERN :

Inverse Head and Shoulders pattern ek powerful reversal pattern hai, par isme kuch potential pitfalls hote hain jinhe dhyan mein rakhna zaroori hai. Pehla, false breakouts ho sakte hain, jahan price briefly neckline ke upar break karega, par jaldi se pattern mein reverse ho jayega. Ye losses ka reason ban sakta hai agar traders positions prematurally enter karte hain. Dusra, pattern hamesha significant bullish move result nahi karta hai, aur price sirf minor reversal experience kar sakta hai phir se downtrend continue karte hue. Traders ko overall market context assess karna aur pattern ki strength ko gauge karne ke liye other technical indicators ko consider karna zaroori hai. Teesra, risk ko effectively manage karna zaroori hai, appropriate stop-loss orders set karke aur single trade pe excess capital ko risk na karte hue.

COMBINING THE INVERSE HEAD AND SHOULDERS PATTERN WITH OTHER TECHNICAL TOOLS :

Inverse Head and Shoulders pattern ka effectiveness enhance karne ke liye, traders often ise other technical tools aur indicators ke saath combine karte hain. For example, traders ko oscillators jaise Relative Strength Index (RSI) ka istemal bullish momentum ko pattern ke formation ke time confirm karne ke liye kar sakte hain. Additionally, trendlines draw kiya ja sakte hain pattern ke andar potential entry points identify karne ke liye, jaise neckline ke upar breakout ya breakout ke baad neckline ke towards pullback. Fibonacci retracement levels ko bhi use kiya ja sakta hai potential areas of support ya resistance identify karne ke liye jo pattern ke saath coincide kar sakte hain. Multiple technical tools ko combine karke, traders market ka more comprehensive view gain kar sakte hain aur Inverse Head and Shoulders pattern ke use se.

Inverse Head and Shoulders pattern forex trading mein uptrend ki potential reversal ko signal karta hai. Ye ek bullish pattern hai aur iskoInverse Head and Shoulders pattern ek technical chart formation hai jo forex trading mein downtrend ki potential reversal ki possibility ko signal karta hai. Isko identify karne ke liye teen mukhya components hote hain: left shoulder, head aur right shoulder. Left shoulder ek significant downtrend ke baad banega aur price ka ek low point represent karega. Head uske baad banega aur ye pattern ka lowest point hoga. Finally, right shoulder banega jo dusra low point hoga, jiske usually head se upar hoga. Ye teen components mil kar ek aisa pattern banaenge jo ek head aur shoulders jaisa dikhega, par inverted hoga.

KEY CHARACTERISTICS OF AN INVERSE HEAD AND SHOULDERS PATTERN :

Inverse Head and Shoulders pattern ki kuch mukhya khasiyat hoti hain jinhe traders is pattern ko identify karne ke liye dekhte hain. Pehla, ye pattern ek downward trend ke baad banega, jiske through market bottom tak pahunch rahi hai aur reversal ke liye taiyar ho rahi hai. Dusra, neckline, jo ki ek resistance level hota hai, left shoulder, head aur right shoulder ke highs ko connect karke draw kiya ja sakta hai. Teesra, head banane ke time volume shoulder banane ke time volume se kam hona chahiye. Finally, neckline se breakout ko pattern ki confirmation mana jata hai aur ye bullish move ki potential target define karta hai.

TRADING THE INVERSE HEAD AND SHOULDERS PATTERN :

Inverse Head and Shoulders pattern ko trade karte waqt kuch mukhya baatein yaad rakhni chahiye. Pehle, pattern ko puri tarah se banne aur neckline ke upar breakout hone ka intezaar karna zaroori hai trade mein enter hone se pehle. Isse pattern ki validly confirm hoti hai aur false signals ki risk kam hoti hai. Dusra, traders volume ko ek confirmation tool ke taur par istemal kar sakte hain. Ideally, volume neckline ke upar breakout ke time increase hona chahiye, indicating strong buying pressure. Teesra, bullish move ka target head se neckline tak ka distance measure karke breakout point se upward project karke calculate kiya ja sakta hai. Finally, pattern ki failure ke case mein stop-loss order neckline ke niche set karna zaroori hai.

POTENTIAL PITFALLS OF TRADING THE INVERSE HEAD AND SHOULDERS PATTERN :

Inverse Head and Shoulders pattern ek powerful reversal pattern hai, par isme kuch potential pitfalls hote hain jinhe dhyan mein rakhna zaroori hai. Pehla, false breakouts ho sakte hain, jahan price briefly neckline ke upar break karega, par jaldi se pattern mein reverse ho jayega. Ye losses ka reason ban sakta hai agar traders positions prematurally enter karte hain. Dusra, pattern hamesha significant bullish move result nahi karta hai, aur price sirf minor reversal experience kar sakta hai phir se downtrend continue karte hue. Traders ko overall market context assess karna aur pattern ki strength ko gauge karne ke liye other technical indicators ko consider karna zaroori hai. Teesra, risk ko effectively manage karna zaroori hai, appropriate stop-loss orders set karke aur single trade pe excess capital ko risk na karte hue.

COMBINING THE INVERSE HEAD AND SHOULDERS PATTERN WITH OTHER TECHNICAL TOOLS :

Inverse Head and Shoulders pattern ka effectiveness enhance karne ke liye, traders often ise other technical tools aur indicators ke saath combine karte hain. For example, traders ko oscillators jaise Relative Strength Index (RSI) ka istemal bullish momentum ko pattern ke formation ke time confirm karne ke liye kar sakte hain. Additionally, trendlines draw kiya ja sakte hain pattern ke andar potential entry points identify karne ke liye, jaise neckline ke upar breakout ya breakout ke baad neckline ke towards pullback. Fibonacci retracement levels ko bhi use kiya ja sakta hai potential areas of support ya resistance identify karne ke liye jo pattern ke saath coincide kar sakte hain. Multiple technical tools ko combine karke, traders market ka more comprehensive view gain kar sakte hain aur Inverse Head and Shoulders pattern ke use se.

تبصرہ

Расширенный режим Обычный режим